Stablecoins generate massive value, but the economics are now shifting from issuers to apps and chains that own their distribution.

Hyperliquid's USDH launch marks this shift.

They had $5.5 billion in stablecoins that generated roughly $220 million annually for external issuers.

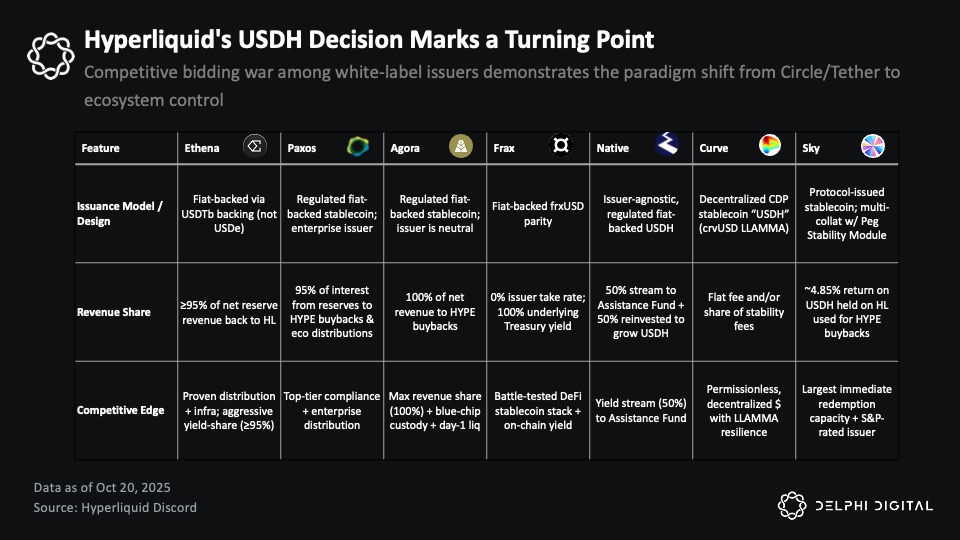

To capture this back, Hyperliquid ran a competitive bidding process where major stablecoin providers like Native Markets, Paxos, and Ethena competed for the USDH ticker.

Native won by offering 50% of reserve yield directly to Hyperliquid's Assistance Fund, with the other 50% reinvested into USDH liquidity.

Other protocols are following. Jupiter is launching JupUSD to internalize yield across its product stack. MegaETH is using stablecoin revenue to subsidize sequencer costs.

Many major chains now have to choose between outsourcing this revenue or bringing it in house.

Ecosystems could redirect this yield toward buybacks or ecosystem incentives, and native tokens can capture these flows directly.

The next wave of stablecoin economics belong to whoever controls distribution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。