Bitcoin November 1

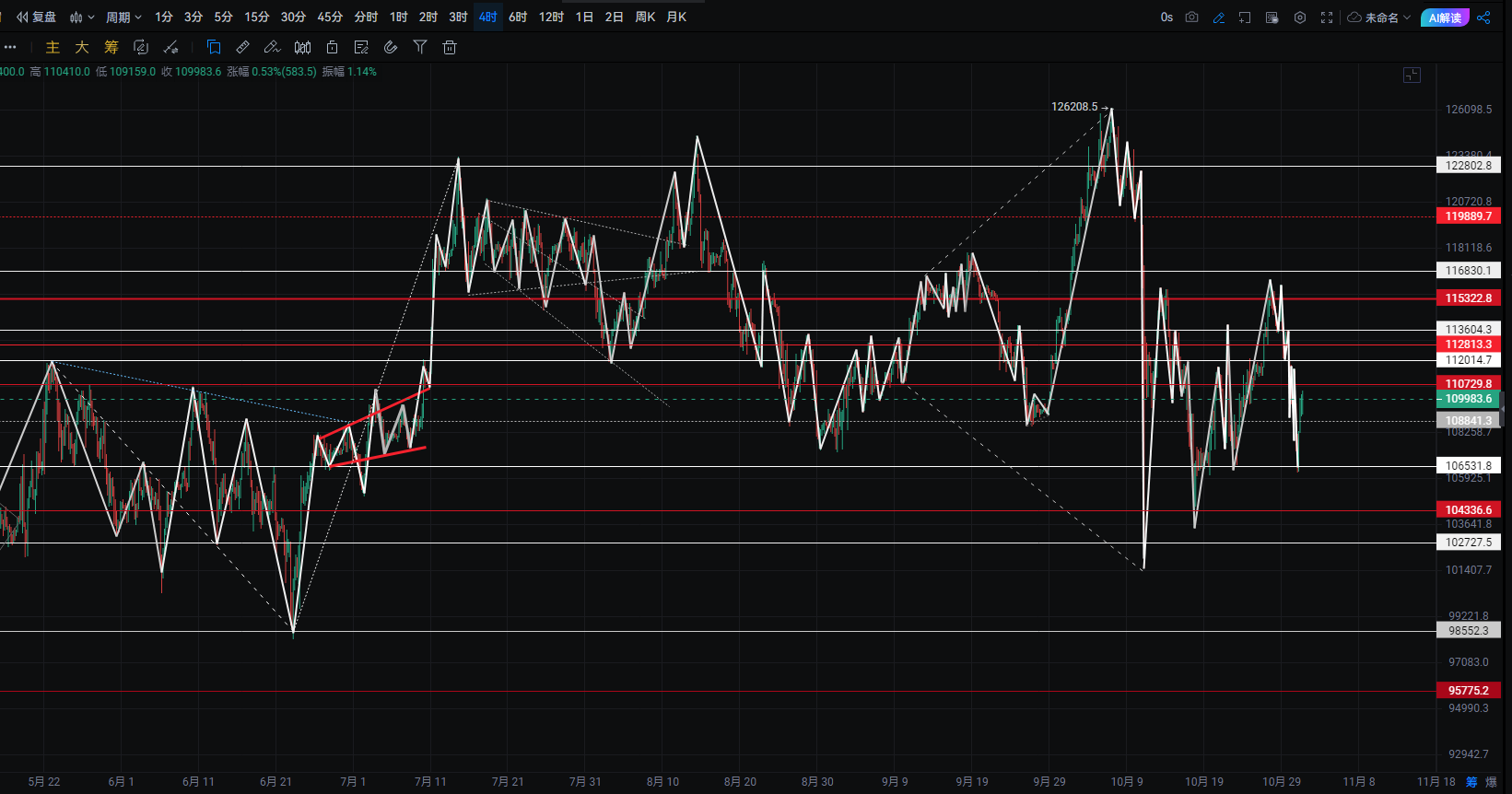

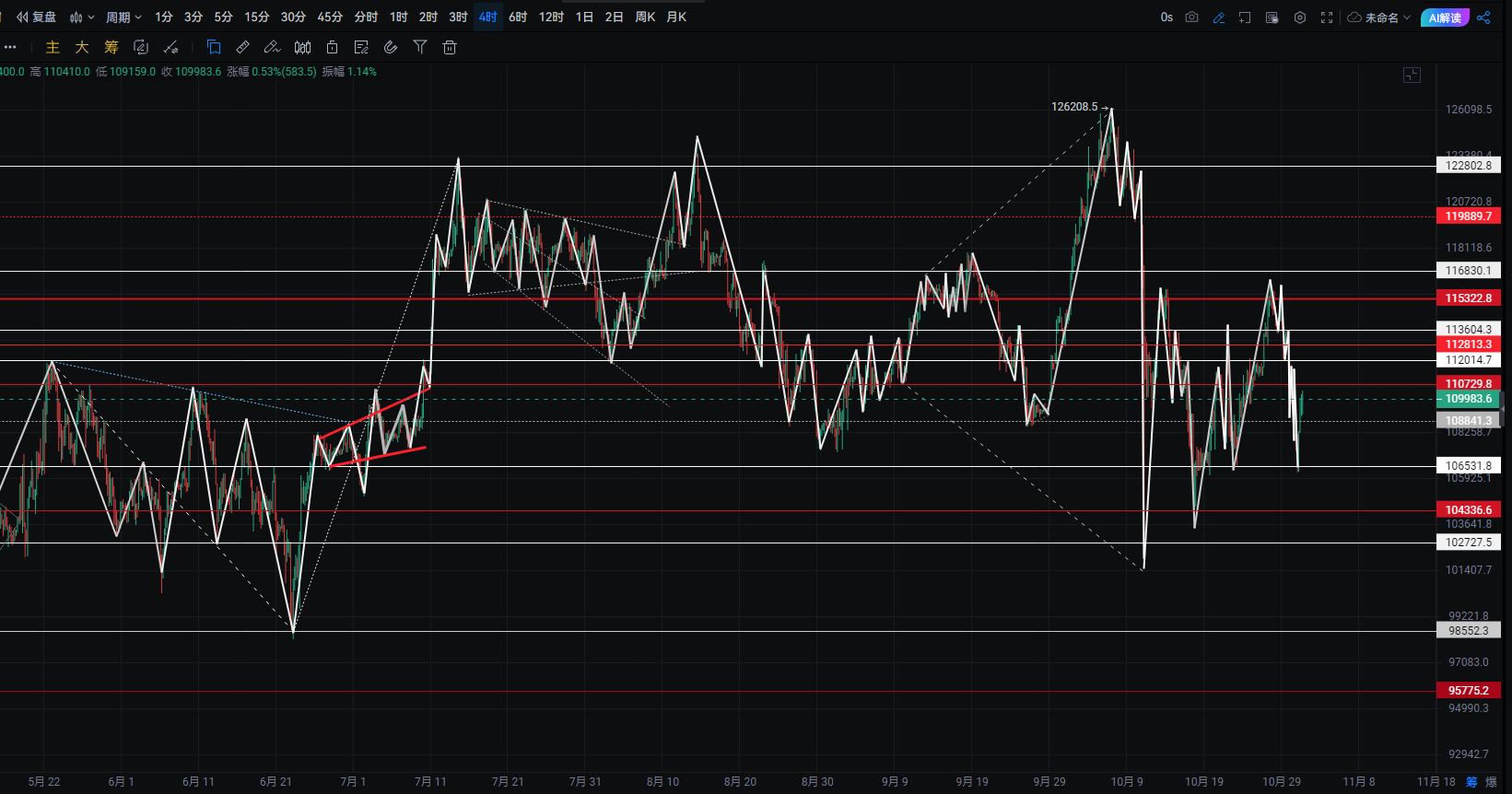

Let's review. Starting from 4 PM yesterday, Bitcoin experienced three consecutive four-hour bearish candles, pulling the price down by 5,000 points from around 111,500. After hitting around 106,299, it rebounded with four consecutive bullish candles, rising back to the 110,000 mark, then dropped again by 5,000 points, and finally bounced back up by 4,000 points. This process crushed a significant amount of long positions, totaling $760 million, while only $120 million of short positions were cleared. It is evident that this rebound process mainly dealt with high leverage and panic selling. Normally, during a rebound, there would be continuous pressure from sellers, but the six consecutive hourly bullish candles from 4 AM to 9 AM, along with the rebound at 10 AM, indicated a good recovery trend, liquidating many short positions.

From this, we can infer that there are always persistent bulls, and the high level of control behind indicates that bulls view the 106,000 level as a bottom, aiming for a structure similar to that of October 17 and October 22. Alternatively, they might believe in a rebound proportionate to the 12th, thinking that Bitcoin could test around 112,500. Therefore, large short positions have not significantly intervened during this process.

Recently, whether on the daily, four-hour, one-hour, or fifteen-minute charts, there has been a continuous battle between bearish and bullish candles, no longer driven by smaller timeframes leading larger ones, but rather a mutual restraint across all levels. Currently, on the one-hour level, the MACD is returning to the zero axis, the KDJ shows signs of resistance in the rebound, and the RSI is still showing clear exhaustion in the rebound, but it is not over yet.

For the weekend, we will mainly focus on the large range of 107,500-111,500. The closest trend is to wait for the bears to exert pressure, leading to a series of bearish candles, and then push to lower levels. Our key focus remains unchanged: for Bitcoin, the upper levels are still 111,500 and 112,500, while the lower levels are 108,800, 107,500, and 107,200.

We conservatively maintain pressure at 111,500. If Bitcoin reaches this position again, it will force many trend-following shorts to close their profitable positions, which may lead to increased pressure or bears withdrawing, causing Bitcoin to spike upwards. We do not consider this possibility, but it cannot be ruled out.

Ethereum is performing worse than Bitcoin, dropping nearly 300 points from the high of around 3,950 to around 3,680, and rebounding nearly 200 points, completely clearing out short positions in a relay manner. We can only wait for the next series of four-hour bearish candles to appear, leading to a one-sided trend, as previously it was mainly in segments. The key point to watch remains around 3,850, while other divergence points like 3,800, 3,750, and 3,900 should also be monitored.

It is recommended to focus on Bitcoin around 110,000 and Ethereum around 3,850 for shorts, looking for a downward movement before entering a consolidation phase. For now, we are not looking for significant movements, focusing first on around 108,800 and 3,780, and possibly taking a small rebound after reaching these levels. Finally, we continue to hold shorts, looking for a dip to 107,500 and 3,720. When we reach these levels, we will apply the same methods of rebound and consolidation. Then we will see if we can refresh the lows.

The significant divergence between bulls and bears will be intense, continuously shaking out positions, making this a good opportunity for short-term trading. This weekend, we will see if it trends downwards or oscillates downwards. I hope everyone can achieve satisfactory results. On October 30, I had a series of six losses, and today with the rebound and shorts, overall it is flat. Let's see how the weekend plays out.

If you want to follow along with Jiang, you can contact the public account: Jiang Xin Lun Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。