Analyzing the Market Through Coinbase's Financial Report - Q3 2025

Many friends have interpreted the financial report, and I want to take a different approach to look at Coinbase's report this time.

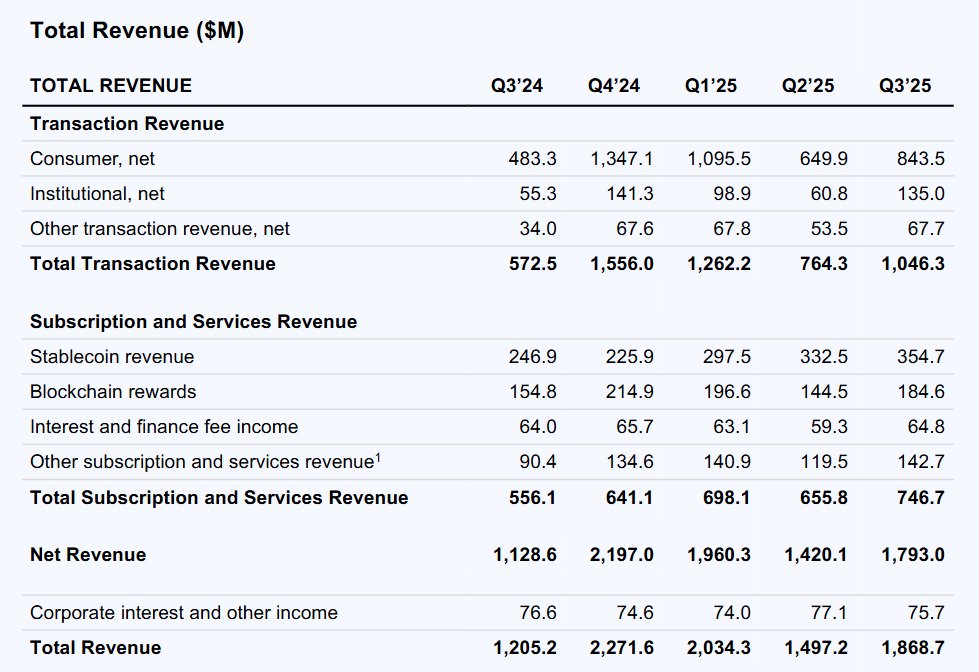

First, from the perspective of net income in the third quarter, it is lower than that of Q4 2024 and Q1 2025. These two quarters were primarily the biggest opportunities for growth during Trump's presidency, so the highest revenue is normal. The second quarter was mainly affected by poor market conditions in April, with gradual recovery in May and June. The performance in July and August of the third quarter was very good.

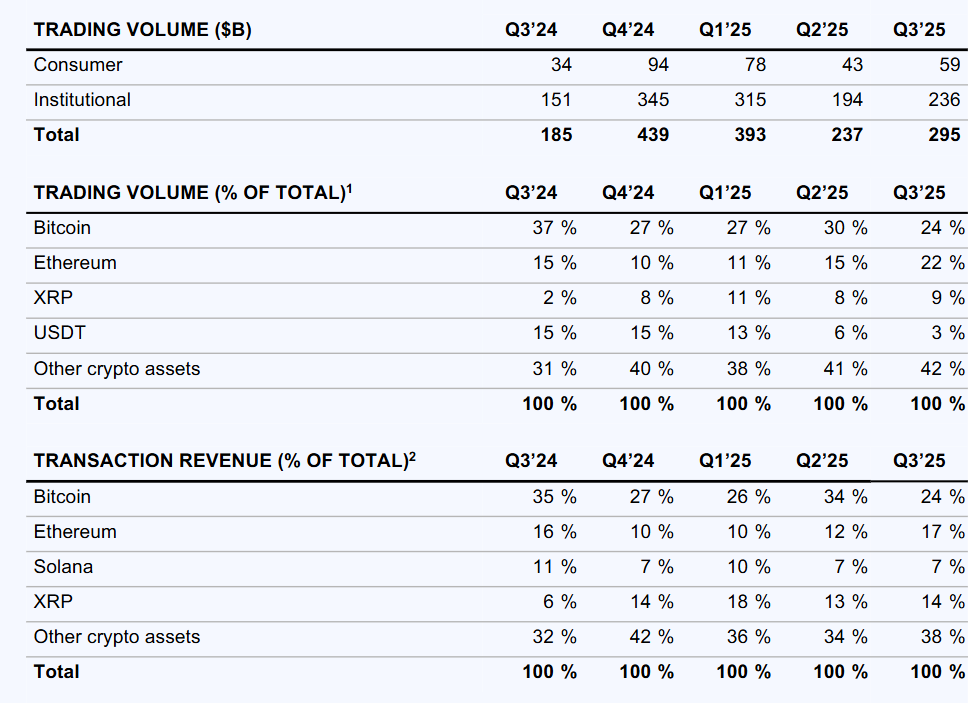

From the detailed data, the proportion of institutional trading in the third quarter significantly increased compared to the second quarter, and even the gap compared to Q4 2024 is not large, indicating that more and more institutional investors are entering the cryptocurrency market. One reason for the increase in institutional users is the acquisition of Deribit. After the acquisition was completed on August 14, Deribit contributed $52 million in revenue to the third quarter, accounting for one-third of Coinbase's Q3 revenue.

The global cryptocurrency market's spot trading volume increased by 38% quarter-on-quarter, while the U.S. cryptocurrency market's spot trading volume grew by 29%. On one hand, this is due to the positive trend of $BTC and $ETH in the third quarter, and on the other hand, it reflects the easing of monetary policy. The yield of stablecoin (USDC) is gradually increasing, indicating that Circle's development is still good. However, the financial report also states that as monetary policy loosens, the interest income from USDC relying on U.S. Treasury bonds will begin to weaken.

From the data, it can be seen that although retail investors provided the largest trading revenue for Coinbase, institutional investors had the highest trading volume, which is still lower than Q4 2024 and Q3 2025. However, both BTC and ETH prices are higher than in those two quarters, which raises the question of what this indicates about the trading volume of institutions and retail investors being lower than in those two quarters.

In detail, the third quarter was mainly driven by $ETH, with the trading volume of $BTC being the lowest in the last five quarters, while the trading volume of ETH rose to the highest in the last five quarters. As USDC's status in the U.S. rises, the usage of USDT on Coinbase has decreased to 3%.

In terms of trading revenue, the proportion of BTC has also shrunk to the lowest point in the last five quarters, while ETH has risen to the highest point in the last five quarters. ETH has even taken a portion of the market share from $XRP and $SOL.

Do you remember what we have always said? The rise in Bitcoin's price is not due to very strong purchasing power, but rather because the number of users selling is decreasing, while the rise in Ethereum is mainly due to an increase in purchasing power. I believe this is still the case now.

Therefore, I personally think that the main reason for the decline in trading volume in the third quarter is not just related to altcoins, but rather due to the significant drop in Bitcoin's turnover rate. The number of investors buying BTC is decreasing, and the number of holders selling BTC is also decreasing, with more and more retail investors no longer wanting to trade BTC.

In the third quarter, Coinbase's custodial fee income increased. By the end of the third quarter, custodial assets had grown to $300 billion. The main reason is the rising number of custodial assets for $BTC and $ETH spot ETFs, and the prices of BTC and ETH also increased in the third quarter. The rise in custodial assets indicates that investors are actively buying BTC and ETH while selling less, which corresponds with our ETF data.

From the overall Coinbase Q3 2025 financial report, it further supports the view that $BTC is a "store of value" and ETH is a "productivity engine." The net income of institutional investors is only slightly lower than that of Q4 2024, and the increase in custody and clear signals of institutional trading indicate that large funds are gradually buying rather than selling.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。