Do not worry about having no friends on the road ahead; there are like-minded individuals on the investment journey. Good afternoon, everyone! I am the King of Coins from the Coin Victory Group. Thank you all for coming here to watch the articles and videos from the King. Every day, I bring you different news from the crypto world and precise market analysis. Last night, our community live-streamed the entire Federal Reserve meeting (including Powell's subsequent speech). Before the results were announced, we had already set up a short position around 111,600, taking profit at 109,500—a very perfect strategy. Congratulations to those who followed along with the live broadcast and executed the trades. We have live streams every night at 8 PM, and we will work overtime when important news is released, so stay tuned.

Click the link to watch the video: https://www.bilibili.com/video/BV1jKyhBdE6W/

Today, we will first discuss hot topics, then dive into trading insights, and finally analyze the market—it's all practical information, and you will definitely gain something from it! Let's first look at the hot topics for October 30, each of which is interesting: the former head of FTX US is making new moves, as a startup has received approval to launch a cross-asset perpetual futures platform—this veteran is truly not idle, and we need to see if they can come up with something new; a U.S. senator has criticized Trump, saying he wants retirees to buy more cryptocurrencies and private equity, which could potentially lead to millions of Americans losing money—let's see how this develops; TON is planning to create a confidential computing network, which won't launch until November 2025, so we have to wait a while; OpenAI is even more ambitious, planning to go public in 2027 with a valuation of $1 trillion—this is quite a big pie; and there's a company called Fight Fight Fight LLC that wants to acquire Republic's U.S. business to expand co-branded token fundraising, so we might see more "co-branded coins" in the future!

Now let's take a look at the market, starting with Bitcoin. After the U.S. stock market opened last night, Bitcoin fell all the way down, even though the stock market itself was doing okay! Even with the Federal Reserve cutting rates by 25 basis points and saying they would stop tapering in December, it didn't stop the decline. I searched for a long time and couldn't find any negative news; I suspect it might be that tech stocks in the U.S. are absorbing liquidity—money is going into tech stocks, and no one is paying attention to Bitcoin! Looking at the technical side: the weekly chart is currently showing "two bearish candles sandwiching one bullish candle" (the weekly candle hasn't closed yet), and it has lost the middle band of the Bollinger Bands; if it doesn't return to 113,800, the weekly chart might test the lower band at 10,400; the daily chart is even more obvious, with a large bearish candle closing and increasing volume, forming a "three black crows" pattern (three consecutive bearish candles), indicating a short-term bearish trend, and the ascending channel and W bottom neckline have also been broken. But don't panic; just look for opportunities on the 4-hour chart in the short term; and although the price has dropped, the turnover rate hasn't increased, indicating that sentiment hasn't worsened—it's just short-term funds adjusting their positions, while long-term holders are still steady! As long as the upcoming tech stock earnings reports are strong, they might drive a market rebound, and Bitcoin could recover as well.

Now let's talk about Ethereum. Powell has recently been mentioning the unemployment rate, saying that the current 4.3% is a historical low—unless the unemployment rate rises above 4.5%, there might be a chance for a rate cut in December! He also mentioned that he can tolerate rising inflation, believing that the current rise in commodity inflation is mainly due to tariffs, and once tariffs stabilize, inflation will stabilize too; non-tariff inflation is not far from 2%, so the focus is still on the labor market.

For Ethereum, it has recently dropped below 4,040, and we need to focus on whether it can quickly recover above this level—ideally, it shouldn't stay below 4,040 for too long! There are too many news items right now, so there's no need to get caught up in short-term fluctuations; altcoins are even more volatile in the short term. Moreover, large whales are still continuously buying, indicating that long-term funds haven't exited, so there's no need to panic.

In terms of specific entry points, let's start with BTC: for those looking to short, you can enter at 111,000; if it rebounds to 111,800 later, remember to add to your short position, with the initial target at 109,000, and if it can go lower, then look at 108,000. As for long positions, don't rush in; wait until it drops to 106,500 or 105,000 before considering entering for a more stable approach. Now for ETH: if you're looking to short, you can act at 3,950; if it rebounds to 4,030, continue to add to your short position, with the initial target at 3,850, and if it can go lower, then look at 3,750. For long positions, wait until it drops to 3,700 or 3,650 before considering entering—don't jump in too early. Remember these key levels, and don't panic when trading; follow the rhythm, and we can adjust as needed!

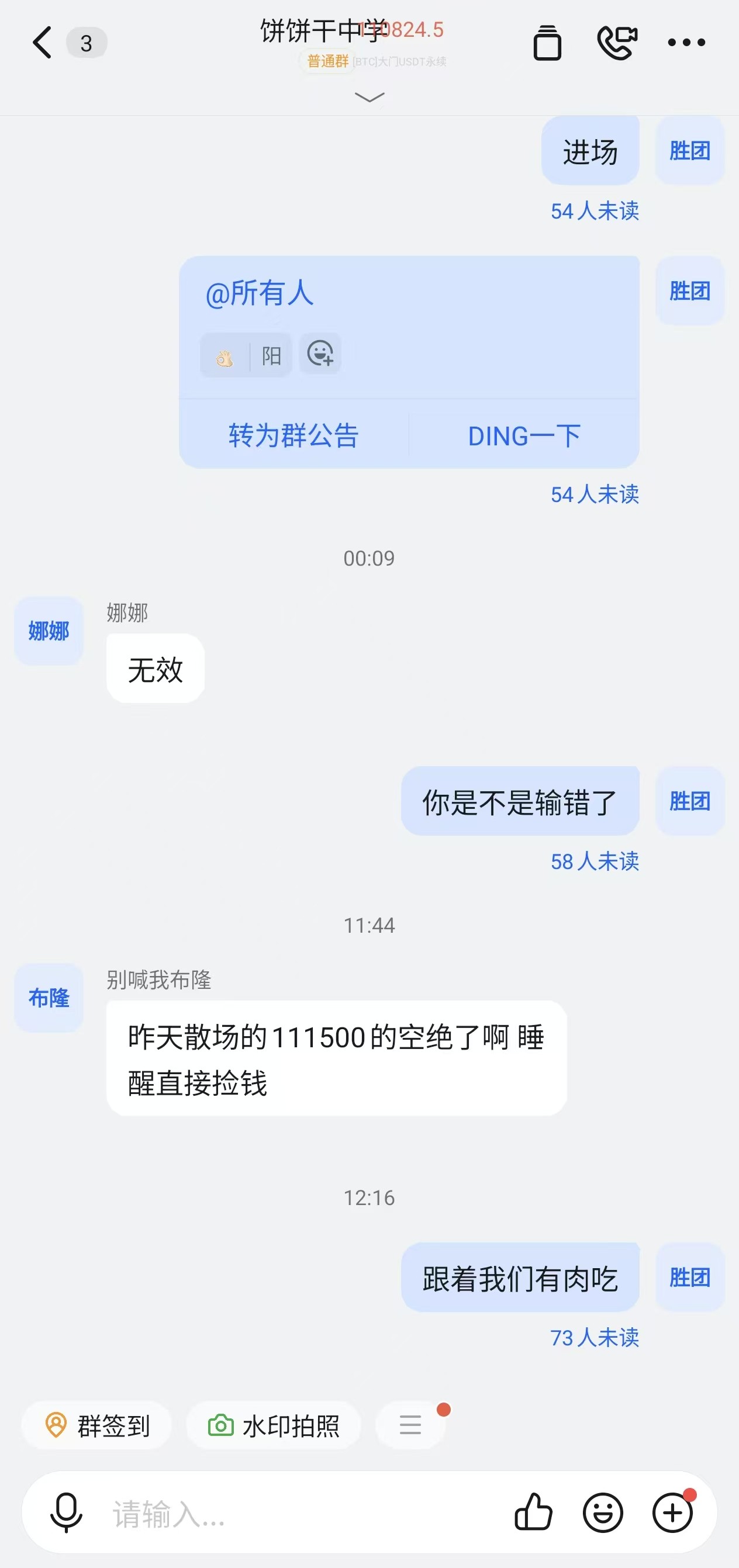

By the way, the trades from the Coin Victory Group's live trading group this week have made profits for those who followed along! If your trades haven't been going well, you can come and try it out; every trade has a screenshot from when it was sent out, and the data is real and not fabricated. If you're looking for a community, just search for the public account "Coin Victory Group"! That's all for today; remember the hot topics, grasp the trading insights, and keep an eye on the key points in the market. We'll continue to profit next time! If you find this useful, please like and follow to stay on track! Lastly, let me say something from the heart: if you truly want to learn from a blogger, you need to follow them long-term; don't just look at a few market updates and jump to conclusions! There are too many "performative players" in this market—today they show screenshots of long positions, tomorrow they summarize short positions, making it seem like they are "always catching tops and bottoms," but in reality, it's all hindsight! What truly deserves attention is consistent trading logic that can withstand scrutiny, not those who only "jump in" when the market moves! Don't be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to distinguish who is a true thinker in the field and who is just a dream seller!

This content is exclusively planned by the Coin Victory Group. Search for "Coin Victory Group" on public accounts; we have the same name across the internet! If you want to learn about real-time strategies, liquidation techniques, or K-line and contract methods, you can chat with the Coin Victory Group. We currently have free experience groups and community live streams for fans, all filled with practical information—no fluff! Let's keep an eye on the meeting together on Thursday morning; if anything happens, we can discuss it anytime. If you find this useful, please like and follow to stay on track!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。