Author: fabiano.sol

Compiled by: Tim, PANews

There are more than a dozen projects on Solana that are conducting buybacks, but:

- Who is conducting a 100% buyback?

- Who is destroying tokens after the buyback?

A complete interpretation of the Solana ecosystem buyback manual.

1. deBridge

deBridge is using 100% of its revenue to buy back its own tokens, with specific handling plans for the buyback yet to be announced.

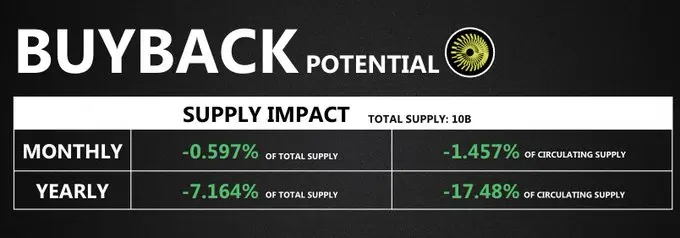

So far, they have repurchased 3% of the token supply. At this rate, they will be able to buy back nearly 20% of the circulating supply within a year.

2. Marinade

Marinade allocates 50% of its revenue each month to buy back MNDE tokens.

Marinade's annual revenue reaches up to $170 million, which could bring significant buying pressure for a token with a market cap of only $140 million.

The future use of these repurchased tokens will be decided by the DAO.

3. Jupiter

Jupiter is using 50% of its protocol revenue to buy back its own tokens.

The repurchased tokens are transferred to a burn address. So far, Jupiter has repurchased 95 million JUP tokens, accounting for 1.37% of the total supply.

A discussion on the handling of the repurchased tokens will take place tomorrow.

4. Jito

The Jito platform will allocate 1.5% of TipRouter fees for periodic buybacks of JTO tokens, followed by subsequent destruction.

At current market prices, this will result in over 11 million JTO tokens being repurchased and destroyed each year (accounting for 1.1% of the total supply).

5. Bonk

Bonk has launched several token buyback and destruction measures.

In this case, I will only explain the LetsBONK project.

The LetsBONK project allocates 50% of its revenue to buy back BONK tokens from the open market and destroy them.

6. Metaplex

50% of the protocol's revenue will be allocated to the DAO specifically for MTPLX token buybacks each month.

In the past 30 days, the Metaplex protocol generated $1.56 million in revenue, of which 50% ($780,000) was used to buy back approximately 3.5 million MPLX tokens, accounting for over 0.3% of the total supply.

7. Raydium

The annual issuance of Raydium tokens is very low, at only 1.9 million (with a total supply of 555 million).

Raydium allocates 12% of transaction fees to buy back RAY tokens.

This brings the buyback ratio to 5% of the current circulating supply.

8. Pump Fun

The Pump.fun platform currently generates over $1 million in daily revenue and allocates 100% of its revenue to buy back tokens.

In September, they repurchased $55 million worth of PUMP tokens, and within a year, they could buy back about 30% of the circulating supply.

9. Streamflow

39% of Streamflow protocol revenue is being used to buy back STREAM tokens and distribute them to stakers.

For example, in July 2025, this means that 39% of the month's revenue of $247,000 (i.e., $96,330) will be used for STREAM token buybacks and staking reward distribution.

Recently, Magic Eden also launched a token buyback mechanism, having repurchased 111,000 ME tokens, all of which will be used for staking rewards (with expectations for further expansion in scale). Step Finance will also invest all platform revenue (including earnings from Solanafloor, Remora Markets, etc.) into token buybacks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。