Author: Shaw, Golden Finance

On October 30, the Federal Reserve's latest decision lowered the benchmark interest rate by 25 basis points to 3.75%-4.00%, in line with market expectations. However, the FOMC statement from the Federal Reserve indicated a rare situation of "hawkish-dovish duality" in this rate decision. Subsequently, Powell unexpectedly made a somewhat "hawkish" statement at the press conference, reducing expectations for whether the Fed could continue to cut rates in December, raising concerns in the market. After the announcement of the Fed's rate decision, major global markets reacted strongly, with U.S. stocks, bonds, gold, and cryptocurrencies experiencing sharp declines, while the dollar surged.

The Fed's rate cut in October came as expected, but why are internal divisions still unresolved, and what is the reason behind Powell's unexpected "hawkish" stance? How should we interpret this, and what is the market outlook moving forward?

1. October rate cut as expected, doubts about continued cuts in December

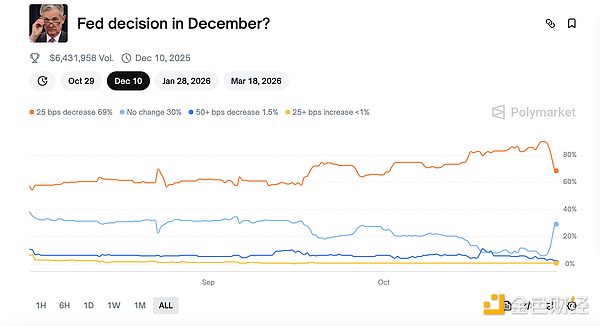

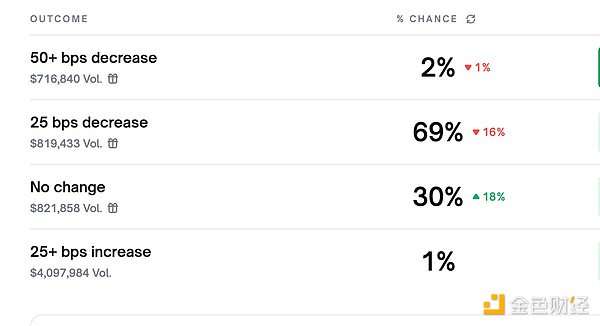

In the early hours of today, the Federal Reserve announced its October rate decision, lowering the benchmark interest rate by 25 basis points to 3.75%-4.00%, marking the second consecutive meeting of rate cuts, in line with market expectations. This is also the fifth rate cut since September 2024. However, the subsequent FOMC statement and a series of remarks from Powell lowered expectations for whether the Fed could continue to cut rates in December, raising market concerns. According to the latest CME "FedWatch," the probability of a 25 basis point rate cut in December is 67.8%, while the probability of maintaining the current rate is 32.2%. The probability of a cumulative 25 basis point cut by January next year is 56%, with a 21.5% chance of maintaining the current rate, and a 22.5% chance of a cumulative 50 basis point cut. Prediction market Polymarket data shows that the market is betting on the Fed's December rate decision. Before the announcement, the market bet on a 90% probability of a continued 25 basis point cut in December, which has since dropped to 69%. Meanwhile, the probability of pausing rate cuts in December has risen to 30%.

After the announcement of this rate decision, major asset markets around the world reacted strongly. U.S. stocks, bonds, gold, and cryptocurrencies all experienced sharp declines, with Bitcoin and Ethereum both dropping over 3% at one point. U.S. Treasury yields surged across the board, with both the 2-year and 10-year yields rising over 10 basis points, and the dollar briefly returned above the 99 mark. Nvidia hit a new high, closing up nearly 3%, with a market capitalization surpassing $5 trillion. Ultimately, supported by Nvidia, the Nasdaq closed up 0.55%, the S&P 500 index was flat, and the Dow Jones fell 0.16%.

The market had long anticipated the Fed's October rate cut decision and hoped it would stimulate the global economy and major asset markets. However, with the FOMC statement and Powell's policy explanations, the market is now questioning whether the Fed can continue to cut rates in December, which has raised concerns among investors.

2. FOMC statement still shows internal divisions within the Fed

The FOMC statement announced that the Fed will end its balance sheet reduction on December 1. After the end of the balance sheet reduction on December 1, the principal repayments of mortgage-backed securities will be reinvested in short-term Treasury bonds. Starting December 1, all principal payments on maturing U.S. Treasury bonds will be rolled over. The FOMC statement also announced a reduction in the discount rate from 4.25% to 4%, and the overnight reverse repurchase rate from 4% to 3.75%. The statement indicated that current data shows the economy is expanding at a moderate pace, but uncertainty regarding the economic outlook remains high. Inflation has risen this year and remains at elevated levels. The committee is closely monitoring risks related to its dual mandate, noting that the downside risks to employment have increased.

The FOMC statement reflects a rare situation of "hawkish-dovish duality" in this rate decision. Fed Governor Stephen Milan advocated for a more aggressive rate cut for the second consecutive meeting, arguing for a one-time cut of 50 basis points instead of the actual 25 basis points; meanwhile, Kansas City Fed President Schmidt opposed any rate cuts from a hawkish stance, advocating for maintaining the current rate; other governors voted in support of this rate decision. This occurrence of dual dissent last happened in September 2019, reflecting significant divergence within the Fed regarding the economic outlook.

The FOMC statement demonstrates clear divisions within the Fed, indicating that during the U.S. government "shutdown" and in the absence of substantial economic data, the Fed lacks a clear and unified understanding of the economic situation and how future policies should be formulated.

3. Powell's unexpected "hawkish" statement raises concerns

Fed Chair Powell subsequently explained the rate cut decision and the economic situation at the press conference, answering reporters' questions. Powell stated that current data indicates that the U.S. economic outlook has not changed significantly and is expanding moderately. Data prior to the shutdown suggested that the economy might be moving towards a more stable trajectory; the government shutdown will temporarily hinder economic activity. He noted that inflation levels remain slightly elevated, and recent inflation expectations have risen; the Fed needs to manage the risk of prolonged inflation and has a responsibility to ensure it does not become a persistent issue. Regarding the impact of tariffs, Powell stated that under reasonable baseline scenarios, the impact of tariffs on inflation would be temporary.

On labor and employment issues, Powell indicated that the labor market seems to be gradually cooling; existing evidence shows that layoffs and hiring numbers remain low; the downside risks to employment appear to have increased. He mentioned that state unemployment claims data signals that everything remains unchanged; the low number of unemployment claims indicates that the labor market is only gradually cooling and has not shown a rapid decline; if data shows improvement in the job market, it will influence decision-making.

Regarding the Fed's decision to end the balance sheet reduction, Powell stated that market pressures necessitate immediate adjustments to balance sheet operations; December will enter the next phase of the balance sheet, which will remain stable in the short term. Over the past three weeks, liquidity in the money market has tightened, and continuing the balance sheet reduction offers little benefit; bank reserves are only slightly above adequate levels, and the balance sheet decision allows the market some time to adjust. He noted that there are "clear signs" that it is time to stop quantitative tightening; the reinvestment strategy will bring the weighted average maturity closer to the outstanding securities stock.

In explaining this rate decision, Powell stated that there has been no significant deterioration across various sectors of the economy, and overall, the economic situation is quite good. He expressed that he believes the Fed has taken the right actions so far this year. Powell reiterated that there is no zero-risk policy path, and the risk balance has shifted. The Fed's rate cut is "another step towards a more neutral policy stance"; the risk management logic also applies to today's rate cut, with the October cut sharing the same risk management logic as the September cut. He stated that the Fed cannot rely on a single tool to address both employment and inflation risks. Powell also indicated that the rate cut in December is "far from" a foregone conclusion, suggesting uncertainty about whether the Fed will continue to cut rates in December.

Market expectations for the October rate cut have been largely exhausted, and there is still hope that the Fed can continue to cut rates in December to stimulate further increases in major assets, but Powell's unexpectedly "hawkish" statement has cast a shadow over market confidence.

4. How to interpret the Fed's decision this time

In response to this Fed decision, Wall Street Journal reporter Nick Timiraos, known as the "Fed's mouthpiece," commented on Powell's remarks, stating: "Powell's press conference indicates that the FOMC as a whole does not agree with the market's previous high pricing for a December rate cut." Timiraos noted that the October FOMC meeting was somewhat different in the following aspects. The dot plot from September showed divisions within the committee: most leaned towards continuing rate cuts as a risk management tool, but a significant portion believed there was no need for a rate cut. Typically, data can help reconcile this division. However, due to the lack of high-level data to refine the outlook between FOMC meetings, members had less reason to change their positions.

Inflation Insights analyst Omair Sharif believes that the U.S. government shutdown and the lack of related official economic data may hinder the Fed's plans for a third consecutive rate cut in December. If there is no official data reflecting October and November economic activity at the meeting on December 10, officials may be hesitant to cut rates again. They may find it difficult to reach a consensus on another rate cut, especially considering the divisions shown in the September dot plot.

Analyst Joseph Richter stated: "After Powell indicated that a December rate cut is not a done deal, the bear flattening of the yield curve seems a bit overdone in our view." "While the Fed may not cut rates at every meeting (though we believe they will), we think this statement is an attempt to regain flexibility. The market may view this as hawkish, but it may not materialize."

Vincent Reinhart, chief economist at BNY Mellon Investment Management and former senior advisor to the Fed, believes that given the data vacuum, "the data must prove that further easing is unreasonable, which is a high bar," adding that "it will be very difficult for them not to cut rates in December. Continuing is easier than stopping."

James Bullard, dean of Purdue University's business school and former president of the St. Louis Fed, believes that the prospects for a December rate cut are "more nuanced than the market currently thinks." He pointed out that strong consumer spending and economic growth, along with recent inflation setbacks, could provide reasons to slow the pace of rate cuts. "You are betting too much on a slowdown in non-farm payroll reports," Bullard said. He also questioned whether policymakers have truly adapted to the new normal where adding 50,000 jobs per month is "perfectly acceptable."

Additionally, Trump criticized the Fed on Thursday, once again targeting Fed Chair Powell, accusing him of being slow to act on rate cuts. In a speech in South Korea, Trump referred to "Jerome 'Too Late' Powell" and stated that he would not allow the Fed to raise rates out of concern for inflation three years from now. He predicted that the U.S. economy would achieve 4% growth in the first quarter of 2026, far exceeding economists' forecasts. This statement highlights the tension between Trump and the Fed.

5. What is the market outlook moving forward?

After the announcement of the Fed's October rate decision, how should major asset markets, including cryptocurrencies, move forward? The market has made the following interpretations.

1. Glassnode expressed the view that the market continues to struggle above the short-term holding cost price (around $113,000), which is a critical battleground for both bulls and bears. If it fails to regain this level, it may further retreat to the actual price of active investors (around $88,000). Glassnode stated that the current calm in the market is conditional, but if the Fed's actions deviate from expectations, this calm will become fragile.

2. Michael Saylor, founder of Strategy, in an interview, made a new Bitcoin price prediction, stating it will reach $150,000 by the end of the year, with a target of $1 million in the next 4 to 8 years.

3. Matrixport stated that Bitcoin is still in a range-bound consolidation; in contrast, U.S. stocks have repeatedly hit historical highs driven by the AI boom. There is a certain similarity to the rhythm seen last year: after a prolonged period of low volatility consolidation, prices experienced a relatively rapid upward movement within about three weeks. The current narrow fluctuations demand greater patience from traders. The short-term focus is on observation, while the mid-term pattern remains unchanged. If the Federal Reserve maintains a dovish stance and continues to cut rates, the market will likely reflect a wait for clearer external driving signals. Similar rhythms have been common in history: after prolonged consolidation, volatility tends to be released in a shorter time frame.

4. Crypto analyst @IamCryptoWolf posted on social media that ETH is undergoing an expanding wedge backtest, with previous resistance now acting as solid support. November looks set to show steady consolidation, with a potential breakout by the end of the month, followed by accelerated growth in December.

5. Michael Rosen, Chief Investment Officer of Angeles Investments, stated that this rate cut was expected by the market, but Powell's remarks weakened optimism about another rate cut in December. Powell's statements reflect the tension within the Federal Reserve regarding whether to cut rates further, especially given that inflation remains high and exceeds the Fed's own targets. Investors should anticipate that inflation may remain elevated for an extended period, which will limit the extent of further monetary easing. As a result of these remarks, the stock market experienced a pullback, as investors had initially expected more rate cuts to provide a boost. However, this is only a temporary reaction. Ultimately, it is corporate earnings that drive the stock market, and earnings performance remains strong, so we maintain a full position in our portfolio.

6. Investment firm Aureus Asset Management stated that the market expects the Federal Reserve to cut rates at least before December, but the risk of rising inflation remains significant. Despite all the tariff negotiations, prices are still high. We have been focusing more on fixed income, finding that its volatility can actually decrease, rather than just going long on stocks as in the past.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。