"Recording My Logic for Buying Bilibili Stocks"

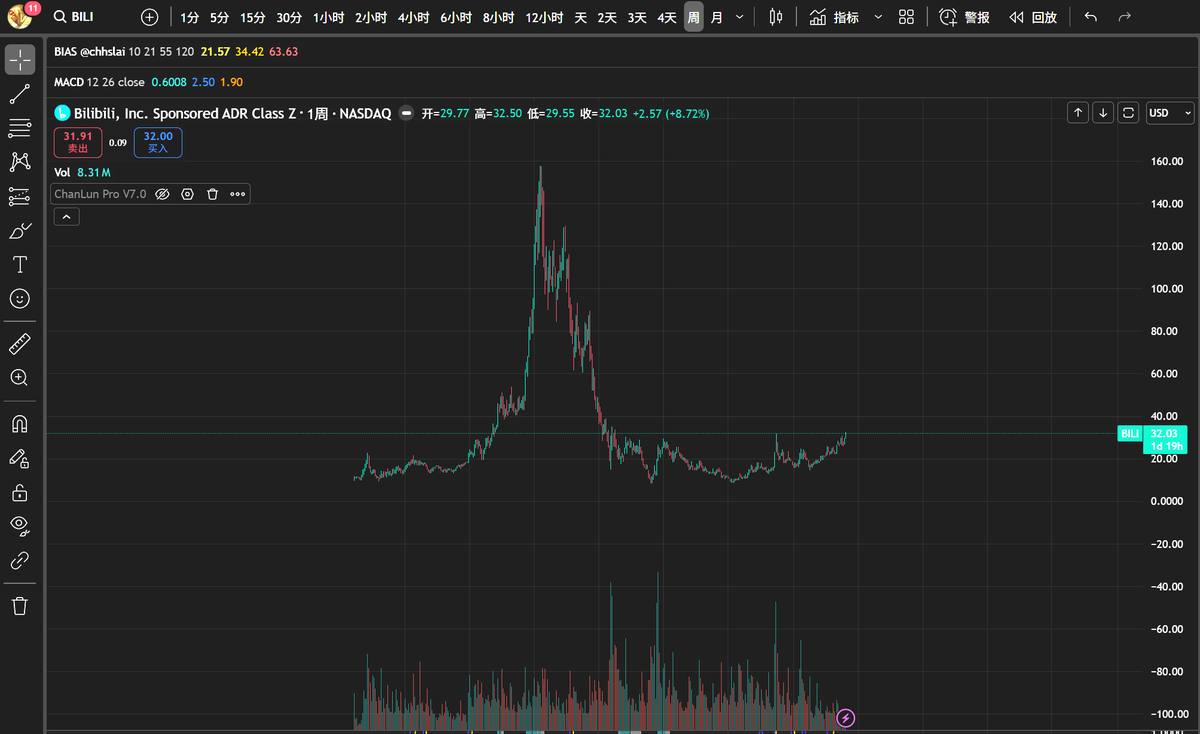

First qualitative then quantitative, there is less quantitative research, but the K-line looks good.

Let’s talk about the qualitative:

Bilibili has four fundamental aspects:

- A Huge User Base

Bilibili's monthly active users reach 368 million, with daily active users averaging 107 million.

I mentioned this data when discussing ROBLOX; back then it was around 30 million, now it's close to 150 million. I was very shocked by the number of online users for ROBLOX, which is many times that of STEAM, and these kids will grow up. Unfortunately, I hadn’t yet entered the world of stock investment and missed the opportunity.

Fortunately, opportunities are always present.

Bilibili's user numbers, along with the community stickiness fostered by the bullet screen culture (viewers get used to the bullet comments while watching shows, making it feel like they are not watching alone but with a group), form a solid foundation.

The so-called foundation means you just need to wait for an opportunity.

- Anime Will Become Mainstream, on the Eve of an Explosion

Thanks to the emergence of AI, the excellent literary works formed over thousands of years can now be adapted into films with significantly less investment, production time, and effort.

This acceleration will make animated films increasingly resemble live-action, without any sense of incongruity, and they can freely spread imagination, achieving effects that live-action films cannot.

Nolan's "Interstellar" had a large cornfield, which is great, but the cost is high and the production cycle is long. In fact, if the storyline is solid, AI-produced content can be just as impressive.

So, several judgments:

- AI will accelerate the entry of anime into the mainstream.

- Thousands of years of quality texts will be rapidly transformed into videos.

- Excellent anime will attract more and more people to accept them.

(After watching Bilibili's "Mortal Cultivation" and "Spirit Cage," I am even more convinced of this. You can also confirm this by looking at the view counts and follow counts of anime films on Tencent and Bilibili. Of course, Tencent has realized this as well, investing hundreds of millions in "Spirit Cage," and their own production "Xian Ni," which faced criticism at first, has now become a masterpiece.)

- "Nezha 2" is a confirmation that gives us confidence in this field.

- Bilibili has the largest scale of anime foundation.

- Anime going overseas has become easier; AI will make native dubbing in multiple languages very simple, which is a huge cost reduction.

Tencent's stock is certainly good, but Bilibili is only about 1/100th of its level.

- Games May Be Bilibili's NetEase Moment

Duan Yongping made his first pot of gold from investing in NetEase because he believed in the power of games.

Bilibili had been losing money until it developed its own games that became popular, leading to profitability.

When I started buying Bilibili stocks in my twenties, I had a judgment that Bilibili was likely to continue producing hit games because the foundation is there; as long as the games are fun, the UP owners within the platform have a very strong dissemination chain.

Recently, there was a game called "Escape from Duckkov," which had simultaneous online players exceeding 300,000 on Steam, and its reputation can overshadow most new games this year, with over 17,000 reviews and 96% overwhelmingly positive feedback.

And "Escape from Duckkov" is actually a self-developed work by Bilibili.

- Amidst the AI Boom, Capital Will Still Seek Opportunities in Undervalued Stocks.

My expectations for Bilibili stocks are even greater than for PDD's growth—this doesn’t mean it’s better, perhaps it’s just that it has dropped enough.

Having missed out on ROBLOX, I hope Bilibili won’t disappoint me.

This is the only UCG video platform in the country, comparable to YOUTUBE in terms of UCG, while in original video content, thanks to AI, it is on par with NETFLIX. In terms of games, it may also add a separate valuation for a gaming company (a company with a user base of 100 million).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。