Good evening everyone, I am Jiang Xin. The results from yesterday were so beautiful.

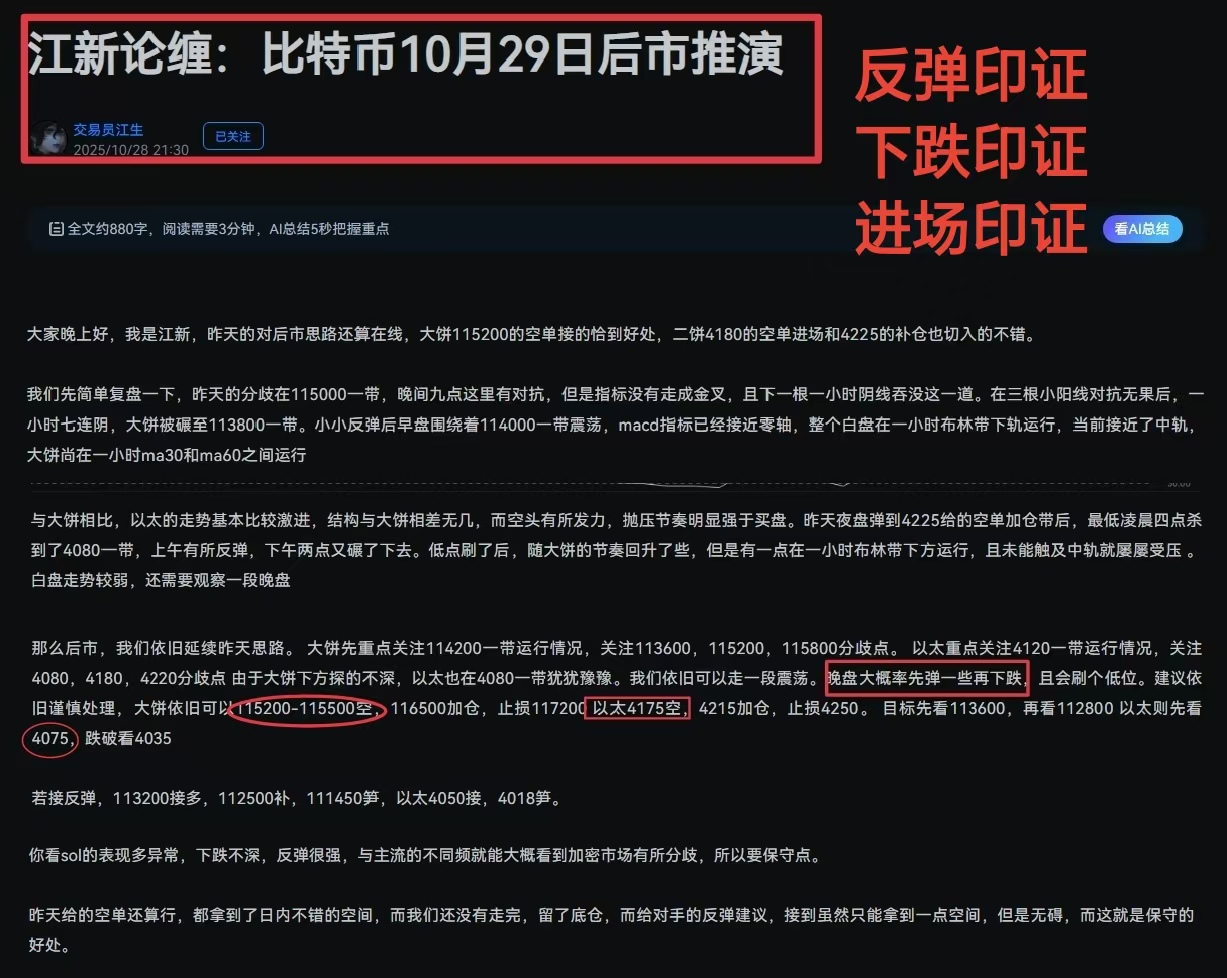

Let's briefly review. Yesterday, Bitcoin surged to around 116,000 at ten o'clock, then quickly fell back. It found support in the dense moving average area around 113,600, bounced back to around 115,200, and faced resistance. This was exactly the short entry zone of 115,200-115,500 that Jiang Xin provided. After a tug-of-war between bulls and bears for two hours, the second rebound confirmed the pressure at this point. At two o'clock in the morning on October 29, the fifteen-minute long indicator crossed bearish, and the market was dominated by bears. The two hourly bearish candles at three and four o'clock broke through 113,600 and 112,500 respectively, buffered by ema120 and ema144, leading to a period of consolidation. This was also Jiang Xin's target level. The large entry and exit range was clearly seen by Jiang. Today, the daytime market is in recovery, facing resistance at the one-hour ema30 moving average in the afternoon and evening.

From yesterday to today, Ethereum still showed a stronger decline than Bitcoin. Whether it was the first crash at ten o'clock in the evening or the second spike at five o'clock in the morning, the magnitude was stronger than Bitcoin. However, during the daytime, Ethereum faced resistance after rebounding to around 4,030 at two o'clock, while Bitcoin only faced resistance at four o'clock. The different timing of these tests indicates that the current divergence has not yet been digested.

We focus on the important divergence points: Bitcoin at 112,500, 113,500, and 115,200; Ethereum at 3,980, 4,020, and 4,145.

Due to significant news, today's volatility is not large, but it is within the range of recovery. This movement ensures the interests of the short positions while providing an opportunity for the long positions to break even. We will first look at a large range of fluctuations.

Bitcoin is between 111,200-114,800, and Ethereum is between 3,920-4,150, still suggesting a conservative approach. The night market is expected to rise first and then fall.

It is recommended to go long on Bitcoin at 112,200-112,500, with a stop loss at 111,450, initially looking at the 113,500 contention area. In the short term, it may fluctuate within this narrow range. For Ethereum, there are long positions around 3,950 at the old divergence point, initially looking at the 4,030 contention area, and it will consolidate around here. Stop loss at 3,918.

For shorting Bitcoin, consider a compromise at 113,600 short, with a stop loss at 114,200, or 113,800 short, adding at 114,800, stop loss at 115,500. For Ethereum, short at 4,080, with a stop loss at 4,125.

The direction of the market in the future needs to observe the contention signs in the 112,500-113,600 range for Bitcoin, while for Ethereum, it is to watch the contention signs in the 3,950-4,030 range. We will first handle the large range, and high selling and low buying is fine; this is unrelated to the news.

As always, the market changes rapidly. It is recommended to consider working with Jiang, the public account: Jiang Xin on Chan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。