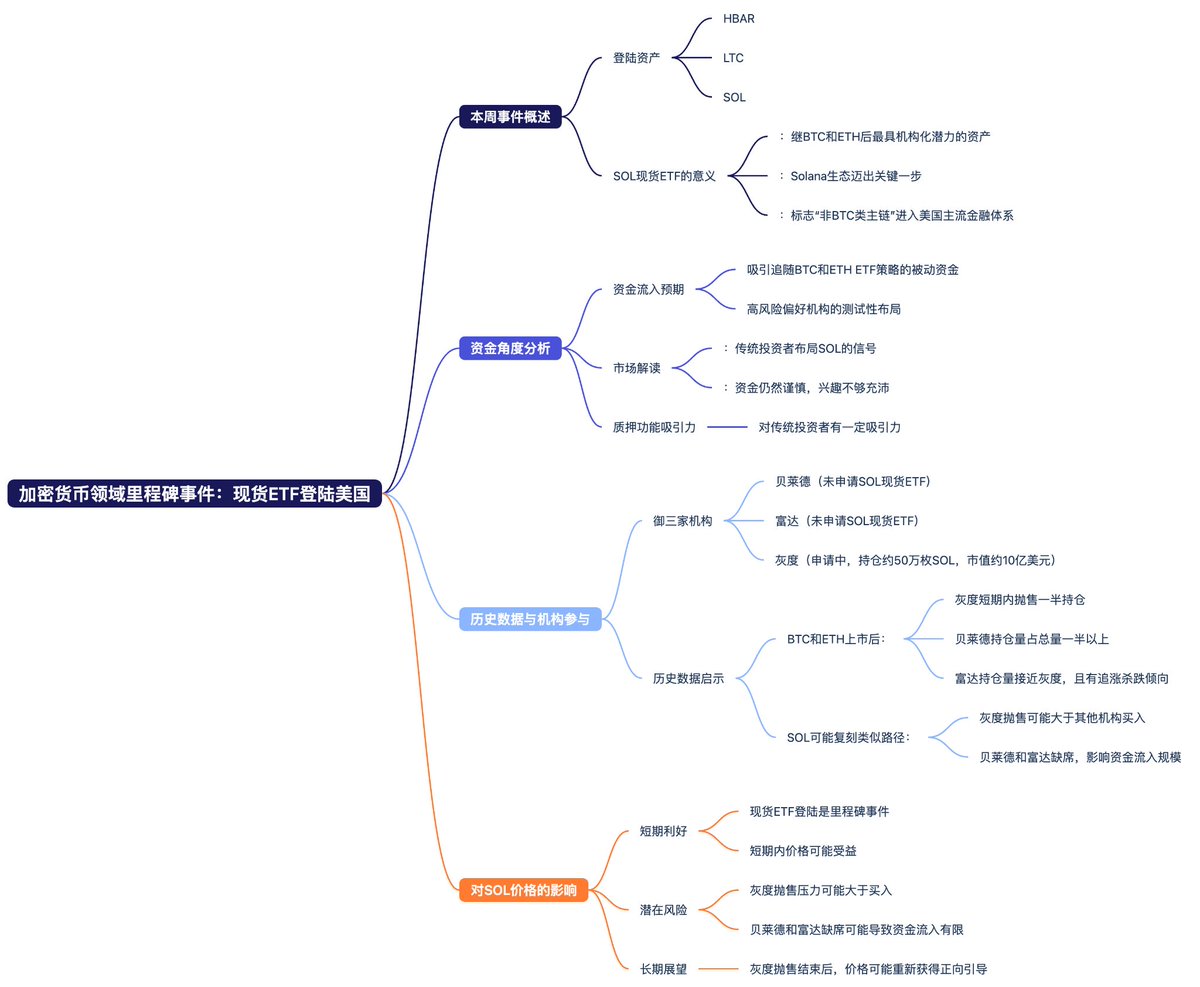

From a funding perspective, these new ETFs typically attract some passive capital that follows BTC and ETH ETF strategies during the initial listing period, while also encouraging some high-risk preference institutions to test their positions. This means that if the trading activity of $SOL exceeds expectations, the market may interpret it as a signal that traditional investors are positioning themselves in SOL.

Conversely, if trading is sluggish or inflows are limited, it indicates that capital remains cautious and current interest in cryptocurrencies is still not robust enough. Of course, this time the SOL spot ETFs come with staking features, which also have a certain appeal for traditional investors.

However, based on historical data for $BTC and $ETH, only the "big three" are truly significant holders: BlackRock, Fidelity, and Grayscale. This time, aside from Grayscale's application, neither BlackRock nor Fidelity has applied for the SOL spot ETF. In terms of capital volume, a single BlackRock often accounts for more than half of the total holdings, while Fidelity's investors, although suspected of chasing highs and cutting losses, are often among the top three holders. The holding volume of BTC is almost catching up with Grayscale, so the lack of plans from these two large institutions may result in SOL's purchasing power being significantly lower than that of BTC and ETH.

On the other hand, Grayscale was one of the earliest to invest in cryptocurrency assets. According to the latest S-1 filing and market cap estimates, Grayscale currently holds about 500,000 SOL (valued at $1 billion). Based on the initial data for BTC and ETH, it is very likely that they will sell about half in the short term. This also puts pressure on the spot price of SOL.

Therefore, from a historical perspective, the launch of a spot ETF is undoubtedly a milestone positive development, which will help SOL's price in the short term. However, once it officially goes live, Grayscale's selling may outweigh the buying from other institutions.

Especially in the absence of BlackRock's participation, there will likely only be a positive price guidance once Grayscale's investors finish selling. Of course, this has only happened historically with BTC and ETH and does not necessarily mean that SOL will replicate it. After all, SOL also has a staking system.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。