Kalshi went from underdog to category leader in less than a year.

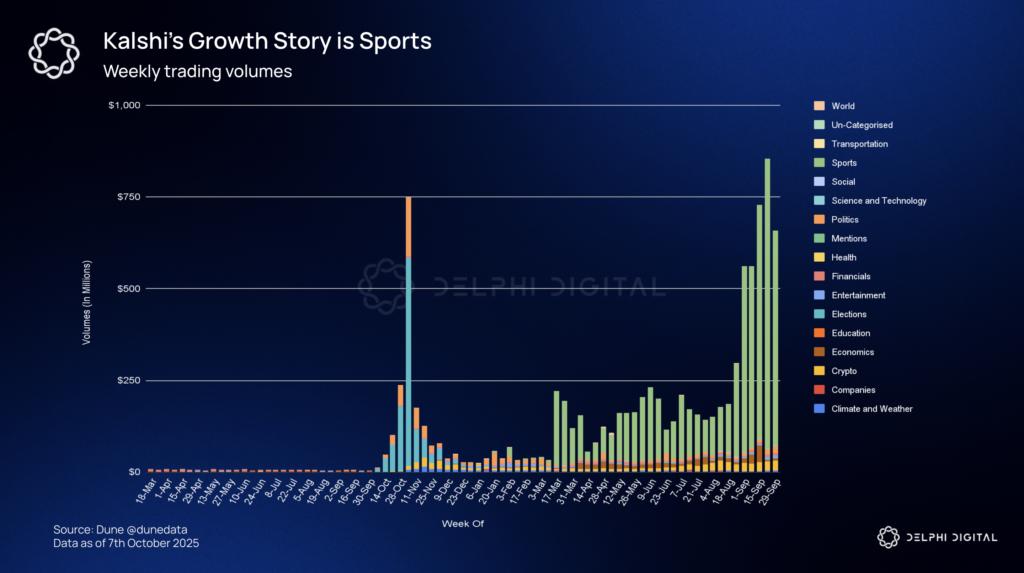

Weekly transaction volume has been climbing steadily, showing sustained user engagement over time rather than temporary spikes in activity.

The main driver of this growth is sports.

Sports betting is a $100B+ proven market with millions of users. Kalshi is tapping into that massive existing audience and gaining genuine marketshare.

Kalshi can support the liquidity necessary through their relationships with market makers like SIG and their internal trading arm. This infrastructure ensures markets remain liquid even as they scale across different categories.

Kalshi's first moat is regulatory clarity. CFTC approval means mainstream users can trust the platform without regulatory uncertainty.

This unlocks an audience that would never touch crypto rails or unregulated platforms. Both institutions and retail users need regulatory approval to commit serious capital.

The second moat is user experience. Users link their bank account and start trading immediately. This familiar onboarding flow removes friction for the mainstream sports betting audience.

The third moat is distribution. Kalshi has partnerships with Robinhood and Jupiter, opening up access to millions of users who have accounts on these platforms. This distribution strategy accelerates user acquisition by meeting people where they already are.

Kalshi's $5B valuation reflects confidence that they have figured out how to bring prediction markets mainstream.

Regulatory approval provides trust, seamless onboarding removes adoption barriers, and distribution strategy enables more reach.

These advantages position Kalshi to capture more prediction market volume as the category grows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。