Original | Odaily Planet Daily (@OdailyChina)

On October 27, Eastern Time, S&P Global rated the Bitcoin treasury company Strategy (formerly Microstrategy, stock code MSTR) for the first time.

Embarrassingly, as the absolute leader in the DAT field, Strategy only received a B- issuer credit rating — in other words, from S&P's perspective, Strategy is a "junk" with a very high risk of default.

S&P and Its Rating System

S&P, along with Moody's and Fitch, is one of the three major rating agencies in the world and is currently recognized as one of the most authoritative credit rating agencies in the international financial market.

According to S&P's official introduction, its credit ratings mainly reflect the agency's forward-looking opinions on the credit status of the issuer and its debt. When rating, the agency typically focuses on analyzing the issuer's ability and willingness to fulfill its financial commitments. The so-called credit status encompasses various considerations, including the likelihood of default, potential external support, the priority of repayment, and recovery rates, among others.

S&P's long-term credit ratings typically have ten main grades, ranging from high to low: AAA, AA, A, BBB, BB, B, CCC, CC, C, D. Except for AAA and CC and below, each grade can also be adjusted with a "+" or "-" symbol to indicate different levels within the same grade.

Under common understanding, the two sub-grades BBB- and BB+ are seen as a dividing line, with BBB- and above classified as "investment grade" and BB+ and below classified as "speculative grade," or more plainly, "junk."

Clearly, the B- rating received by Strategy is still some distance from BB+…

Why Doesn't S&P Recognize Strategy?

In the article rating Strategy, S&P detailed the reasons for the B- rating.

In S&P's view, Strategy has issues such as excessive business concentration, a high proportion of Bitcoin holdings, insufficient dollar liquidity, and extremely weak risk-adjusted capital. Although the company has strong financing capabilities in the capital market and manages its capital structure cautiously, this is not enough to offset the aforementioned negative impacts, leading to the B- judgment.

S&P emphasized that Strategy's Bitcoin strategy creates a natural currency mismatch issue — holding a large amount of Bitcoin (long position) while its debt and dividend obligations are denominated in dollars (short position). Strategy must make payments in dollars when facing debt maturities, interest payments, and preferred stock dividends, but its main asset is Bitcoin. Although Strategy maintains a certain dollar balance on its balance sheet, it is primarily used to support operating expenses for its software business, with remaining cash fully invested in Bitcoin.

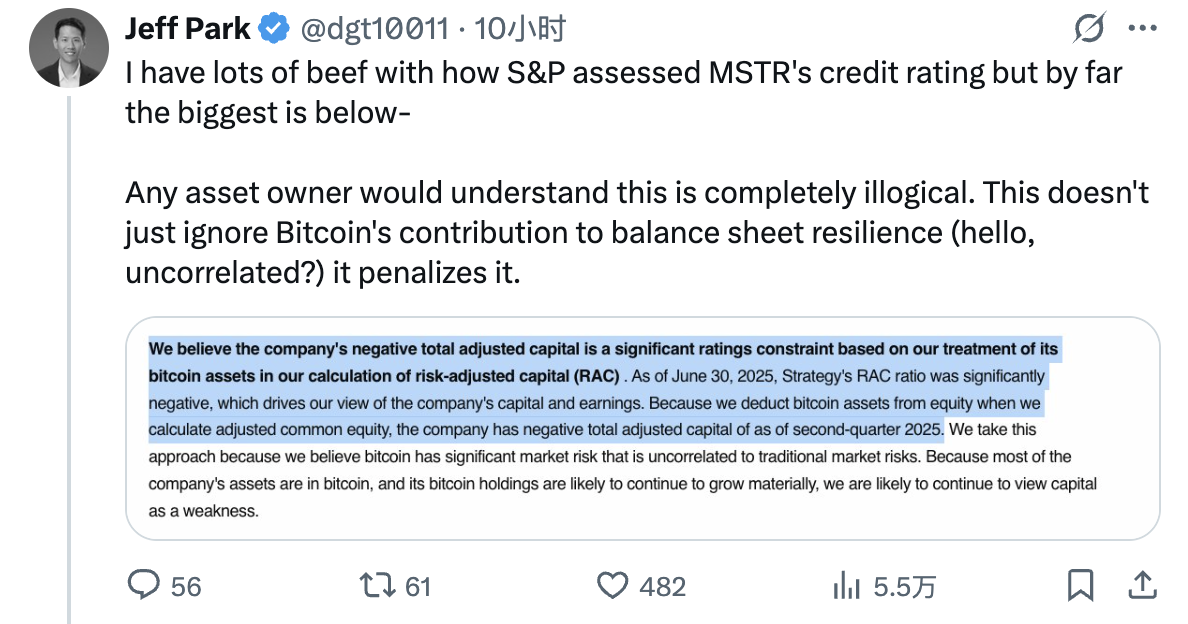

Additionally, based on S&P's treatment of Bitcoin assets when calculating "risk-adjusted capital" (RAC), Strategy's RAC is negative, which is also a significant factor leading to S&P's negative view on its capital and profitability. S&P explained that the agency deducted Bitcoin assets from equity when calculating adjusted common equity because it believes Bitcoin carries significant market risk unrelated to traditional market risks. Given that most of Strategy's assets are Bitcoin and that its holdings are expected to continue increasing, S&P believes that capital issues will remain a major flaw for the company.

S&P also noted that Strategy's operating cash flow for the first six months of 2025 was negative $37 million. The company's main source of profit is the appreciation of its Bitcoin holdings, which do not generate cash flow, while its software business is roughly break-even in terms of profit and operating cash flow. S&P believes this situation is unlikely to change in the foreseeable future.

At the end of the rating, S&P also added the possibility of rating adjustments for Strategy.

In the next 12 months, the rating may be downgraded under the following circumstances:

- Strategy's capital market financing ability is hindered (whether due to a significant decline in Bitcoin valuation or other reasons);

- We believe the company's risk in managing the maturity of out-of-the-money convertible bonds has increased.

The likelihood of an upgrade in the next 12 months is low. In the long term, the rating may be upgraded under the following circumstances:

- Strategy significantly improves dollar liquidity;

- Reduces the use of convertible bonds;

- Maintains strong capital market financing capabilities even under pressure in the Bitcoin market.

Strategy and Market Reactions

In response to S&P's evidently negative rating result, Strategy remains quite optimistic.

Strategy founder Michael Saylor generously shared the relevant updates on his personal X account, celebrating that "Strategy has become the first digital asset treasury company rated by a mainstream credit rating agency."

However, some financial institutions deeply involved in the cryptocurrency field are not satisfied with S&P's rating.

Matthew Sigel, head of digital asset research at VanEck, stated that while Strategy's business model is indeed vulnerable to (price fluctuations), the company's ability to repay debts is currently not an issue.

Bitwise advisor Jeff Park's view is even more direct, arguing that S&P's method of calculating Strategy's RAC is unreasonable, as Strategy's core business is to hold Bitcoin for appreciation, and there is no reason to deduct Bitcoin assets from equity.

In summary, even though cryptocurrencies have begun to gradually integrate into the traditional financial world, there are still many frictions surrounding accounting methods and rating treatments, and these contradictions will require more time to collide and resolve.

What is worth celebrating now is that digital asset treasury companies have opened the door to mainstream rating agencies, as obtaining a rating is often a necessary step for many pension funds and other institutional investors to enter the market. Although Strategy is currently rated as "junk," there remains potential for an upgrade, which may be an opportunity to attract more new funds into the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。