Original Title: Narrative Crypto vs Usable Crypto

Original Author: @yashhsm

Translated by: Peggy, BlockBeats

Editor's Note: In the waves of the crypto world, we are often swept away by various narratives and technologies, making it difficult to clarify our direction. The author of this article presents an insightful framework: dividing the crypto world into two main camps: "Narrative Crypto" and "Usable Crypto." The former drives attention through stories, while the latter drives value through products. Both are opposing yet complementary, forming a dual engine of the crypto ecosystem. Whether you are a builder or a trader, this article will help you reassess your positioning and strategy, understand how attention translates into adoption, and how narratives feed back into products.

The following is the original text:

Usable Crypto vs Narrative Crypto

I used to view the crypto world as a whole, but recently my perspective has shifted. Now, I always divide the crypto world into two main areas, especially from the builder's perspective: Narrative Crypto and Usable Crypto.

Next, I will explain how to understand these two and how to build products or make money based on them.

Usable Crypto

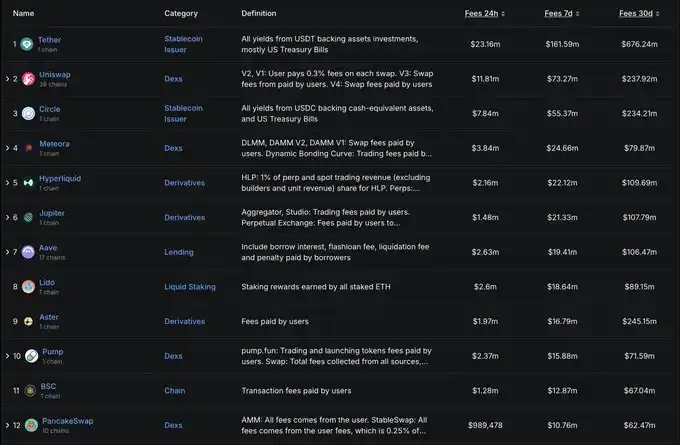

They are often "the best businesses": wallets (like @phantom, @MetaMask); stablecoins (like USDT, USDC); exchanges (like @HyperliquidX, @Raydium, @JupiterExchange); launch platforms (like @pumpdotfun); bots and trading terminals (like @AxiomExchange); DeFi protocols (like @aave, @kamino, @LidoFinance), and so on.

These products are genuinely usable and can generate substantial revenue.

(Reference: Projects with the highest fee income in the crypto space)

Narrative Crypto

Typically has a grand story or vision (market cap can reach $100 billion+), enough to change the world: Bitcoin (the narrative of "better money" or "digital gold"); AI x Crypto (most GPU infrastructure and agent frameworks); decentralized science (DeSci) or intellectual property projects (like Story Protocol); new L1/L2 (such as stablecoin-driven L1 or perpetual contract L2); privacy coins (like @Zcash); re-staking and other infrastructure projects; x402.

These projects generate almost no revenue, but due to their strong narratives, they can attract institutions and retail investors, driving token prices up.

Both are not mutually exclusive but can complement each other

For example:

Zcash has a low daily trading volume (5–10k transactions), but its current "privacy" narrative is very strong, thus gaining a lot of attention. This attention may also drive its usability (refer to the recent surge in trading volume).

Another example: @CoinbaseDev's x402 has almost no actual use, but it has recently become a hot topic, and speculative behavior can bring more attention and usage.

I always see this as a spectrum:

(If your logo is misplaced or missing, feel free to point it out!)

Both are equally important because they promote each other:

Narrative Crypto → Triggers speculation → Drives adoption of Usable Crypto

In Usable Crypto, products (users) are king;

In Narrative Crypto, the community is king.

The Dilemma for Builders:

Every builder faces a question: should they build a narrative-driven project or a usable project?

A simple criterion:

If you are good at attracting attention and have enough charisma to start a movement (or you are "scammy enough"—which is actually a skill and a compliment!), then you should build a Narrative Crypto project.

For example: If you excel at token economics, listing on CEX, networking, etc., then you should focus on building a grand narrative and vision. Once the narrative is strong enough, it may also become useful—like Solana, where capital attracted talent, ultimately making the chain practical.

If you want to create a narrative with a market cap of $1 billion+, you must start from first principles and think about what unique possibilities crypto technology can achieve.

Is this vision compelling enough? If realized, can it support a market of $100 billion+? Is it attractive enough to retail investors? (For example, Plasma, which, although not yet in actual use, achieved a valuation of $14 billion at TGE based on the narrative of a "$1 trillion stablecoin market.")

If you are good at product development, then you should build a Usable Crypto project—solving a problem for a niche market (like Axiom serving memecoin traders, or a DeFi protocol).

The core of Usable Crypto is to build products that traders (or crypto natives) directly need (like terminals/exchanges) or indirectly need (like stablecoins). It doesn't necessarily only serve speculation; the same product can also have non-speculative uses (like stablecoins used for payments).

Moreover, narratives are also important here (for example, Polymarket's narrative is "prediction markets")—narratives are marketing.

Of course, you can also build both simultaneously, but it's best to initially focus on one and establish a strong advantage within it. Finding your "competitive edge" is key.

For Traders:

You are always betting on narratives.

You are betting on what you believe to be the most promising narratives in the coming weeks, months, or even years.

Everyone trading tokens is essentially playing a game of "attention arbitrage"—buying projects that are gaining attention and selling those that have become outdated. For example, rotating from perpetual contract coins to privacy coins, then to AI coins.

In a particular narrative, you want to bet on the teams you believe are most likely to gain attention, becoming alpha or beta projects within that narrative. If they succeed, your bet will take off.

TL;DR

Usable Crypto and Narrative Crypto are equally important aspects of the crypto world.

As a builder, you should initially choose a direction and excel in it. Once you have established a foothold in one direction, then expand into the other direction; this is the ultimate goal.

I learned all this through "trial and error" during my full-time entrepreneurship over the past year. I used to always have a "moderate mindset," resulting in not accomplishing anything.

But ultimately, this is a game—you must play by the market's rules.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。