Currently, the total market capitalization of cryptocurrencies is $3.75 trillion, with BTC accounting for 59.1%, which is $2.21 trillion. The market cap of stablecoins is $308.3 billion, with a recent 7-day increase of 0.39%. The number of stablecoins continues to grow, with USDT accounting for 59.27%.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: H with a 7-day increase of 222.27%, VIRTUAL with a 7-day increase of 35.76%, AVNT with a 7-day increase of 51.05%, FF with a 7-day increase of 38.24%, and APE with a 7-day increase of 21.23%.

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $446.5 million; the net outflow for Ethereum spot ETFs in the U.S. was $243.5 million.

Market Forecast (October 27 - October 31):

The current RSI index is 52.11 (neutral range), the fear and greed index is 38 (higher than last week, in the fear range), and the altcoin season index is 37 (unchanged from last week).

BTC core range: $104,000 - $116,000

ETH core range: $3,800 - $4,200

SOL core range: $175 - $210

This week, the U.S. reported a September seasonally adjusted core CPI monthly rate of 0.2%, lower than expected, which has eased market panic. It is expected that the overall market trend will steadily rise next week, with a focus on the Federal Reserve's interest rate decision on October 30. Although the probability of a 25 basis point rate cut in October has reached 99.6%, attention should be paid to the market's "sell the news" phenomenon.

Investors should closely monitor key price levels: use the above support and resistance levels as important references for your decisions. Look for buying opportunities near support levels and be cautious about profit protection near resistance levels.

Pay attention to market sentiment: current market sentiment is polarized, with Bitcoin relatively strong while altcoins are more volatile. Avoid blindly chasing highs, especially during times of extreme greed in the market.

Understand Now

Review of Major Events of the Week

On October 20, according to Coindesk, cryptocurrency trading platform and wallet service provider Blockchain.com is in talks to go public in the U.S. through a special purpose acquisition company (SPAC) — according to two insiders, the platform has appointed Cohen & Company Capital to provide advisory services for the potential SPAC transaction;

On October 23, Bloomberg cited insiders reporting that the prediction market platform Polymarket is in early talks with investors to raise funds at a valuation of $12 billion to $15 billion, which is more than ten times the valuation from four months ago;

On October 23, The Wall Street Journal reported that U.S. President Trump pardoned Binance founder CZ, who has been working to support the Trump family's cryptocurrency company for months. Insiders said the president signed the pardon on Wednesday, and Trump recently expressed sympathy for the political persecution rhetoric related to CZ and others to his advisors;

On October 23, according to filings with the U.S. Securities and Exchange Commission (SEC), Osprey has submitted an S-1 application for a Solana ETF to the SEC;

On October 25, Bitcoin rebounded and broke through $110,000, currently quoted at $111,121, with a 24-hour increase of 0.61%;

Public company MicroStrategy announced that it purchased 168 Bitcoins for approximately $19 million in cash this week. As the "king of public company Bitcoin holdings," each of MicroStrategy's purchases is significant. However, compared to its historical purchases often in the tens of millions or even hundreds of millions, this purchase is relatively small. This may indicate that even for the most bullish investors, allocation at current historical highs has become more cautious.

Macroeconomics

On October 24, the U.S. reported a September seasonally adjusted core CPI monthly rate of 0.2%, expected at 0.30%, with a previous value of 0.30%. The unadjusted CPI annual rate for September in the U.S. recorded 3%, the highest since January 2025, slightly below the market's general expectation of 3.1%;

On October 25, according to the Federal Reserve's interest rate observer, the probability of a 25 basis point rate cut in October is 99.6%.

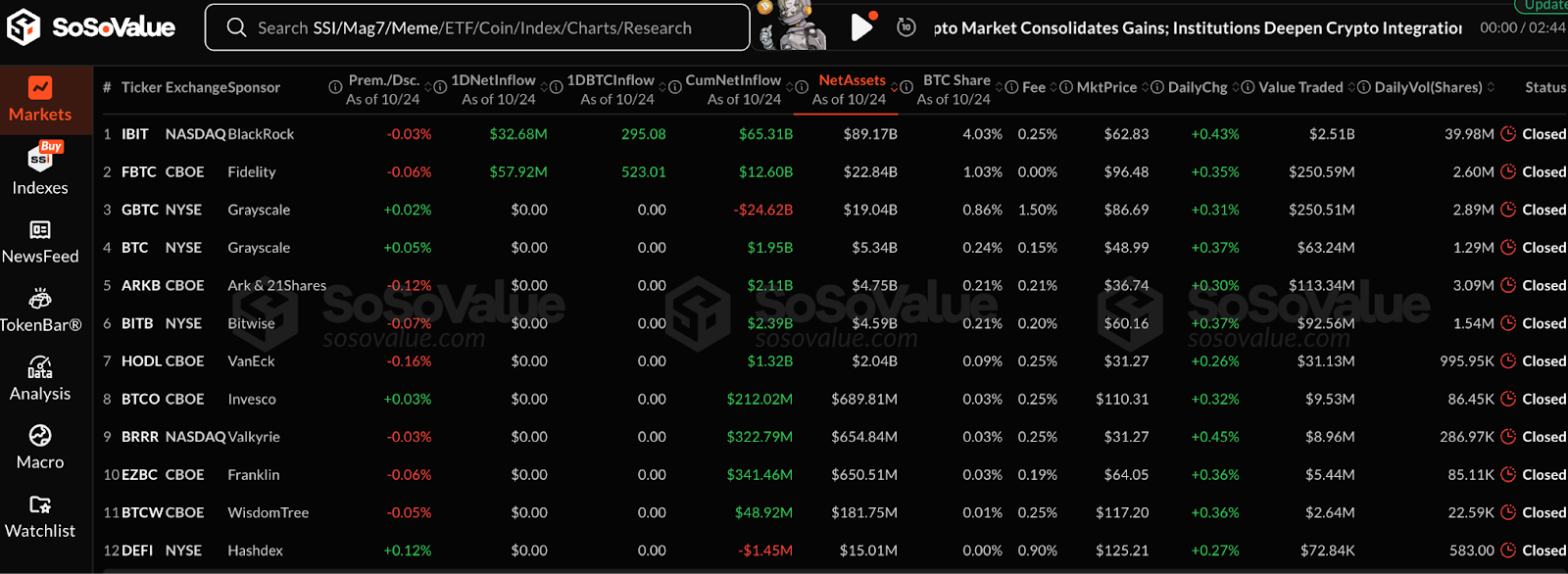

ETF

According to statistics, from October 20 to October 24, the net inflow of U.S. Bitcoin spot ETFs was $446.5 million; as of October 24, GBTC (Grayscale) had a total outflow of $24.57 billion, currently holding $19.045 billion, while IBIT (BlackRock) currently holds $89 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $150.255 billion.

The net outflow of U.S. Ethereum spot ETFs was $243.5 million.

Envisioning the Future

Event Preview

Blockchain Life 2025 will be held in Dubai, UAE from October 28 to 29, 2025;

Bitcoin MENA will take place at the Abu Dhabi National Exhibition Centre (ADNEC) from December 8 to 9;

Solana Breakpoint 2025 will be held in Abu Dhabi from December 11 to 13.

Project Progress

Vultisig will have its TGE on October 27;

The Ethereum Fusaka upgrade is scheduled for a final rehearsal on the Hoodi testnet on October 28;

The first season token airdrop claim for ZEROBASE will end on December 31.

Important Events

The deadline for the three-phase repayment of Mt.Gox is October 31;

On October 29 at 8:30, Australia will announce the annual CPI for the third quarter;

On October 29 at 21:45, the Bank of Canada will announce its interest rate decision and monetary policy report;

On October 30 at 02:00, the U.S. will announce the Federal Reserve's interest rate decision (upper limit) as of October 29;

On October 30 at 21:15, the European Central Bank will announce its interest rate decision.

Token Unlocking

Sign (SIGN) will unlock 290 million tokens on October 28, valued at approximately $11.81 million, accounting for 21.48% of the circulating supply;

Grass (GRASS) will unlock 181 million tokens on October 28, valued at approximately $7.881 million, accounting for 72.4% of the circulating supply;

Jupiter (JUP) will unlock 53.47 million tokens on October 28, valued at approximately $2.125 million, accounting for 1.72% of the circulating supply;

Zora (ZORA) will unlock 166 million tokens on October 30, valued at approximately $15.23 million, accounting for 4.55% of the circulating supply;

Optimism (OP) will unlock 31.34 million tokens on October 31, valued at approximately $13.91 million, accounting for 1.71% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. We analyze market trends through "Weekly Insights" and "In-Depth Reports"; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening) to identify potential assets and reduce trial and error costs. Each week, our researchers will also interact with you through live broadcasts to interpret hot topics and predict trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。