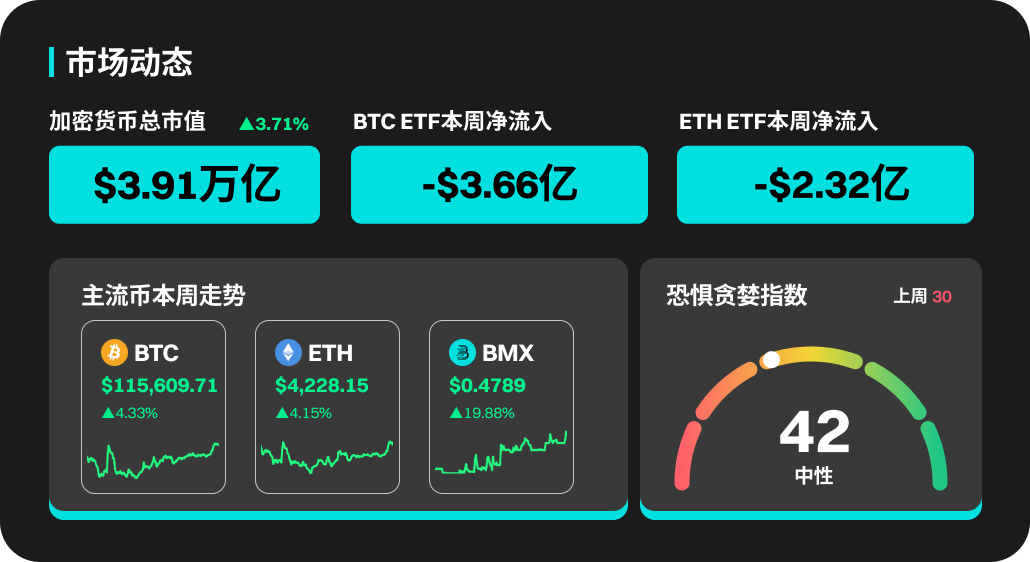

This Week's Cryptocurrency Market Dynamics

Bitcoin spot ETFs continue to see net outflows, with a cumulative outflow of approximately $366 million. After peaking in early October, Bitcoin has been oscillating in the $106,000–$112,000 range, with short-term resistance from the MA20 pressure level. The current candlestick pattern shows a series of small body lines, indicating a strong wait-and-see sentiment in the market. Trading volume has significantly shrunk compared to previous periods, with capital inflows and outflows slowing down. The MACD indicator's dual lines remain below the zero axis, with the red bars shortening and turning green again, indicating a weakening momentum. If the price continues to be pressured below $116,000, attention should be paid to the possibility of a retest of the $108,000 and $105,000 support zones; conversely, if it breaks through the MA30 with increased volume, it may reopen the space for a rebound.

ETH has continued a weak oscillation pattern over the past week, with prices fluctuating around the $3,800 mark, constrained by the dual pressure of MA20 and MA60. Although buying support at lower levels limits the downside potential, there is still a lack of effective rebound momentum overall. The MACD dual lines are close to the low and have not formed a golden cross, with the bars shortening below the zero axis, indicating that bearish momentum is weakening but bulls have not yet taken over. If ETH cannot stabilize in the $3,850–$3,900 range, the market may continue to consolidate at lower levels; only if it breaks through the upper moving average pressure with increased volume could a short-term rebound be confirmed.

This Week's Popular Cryptocurrencies

In terms of popular cryptocurrencies, PAYAI, SEDA, VIRTUAL, ZEC, and HYPE have all performed well. PAYAI's price increased by 1141.6% this week. SEDA's price rose by 167.4%. VIRTUAL's price increased by 90.9%, with a 24-hour trading volume of 0.6B. ZEC and HYPE rose by 43.2% and 27.6% respectively this week.

U.S. Market Overview and Hot News

Despite several companies reporting relatively strong earnings, the overall market price trend remains sluggish, as investors are generally waiting for the latest news regarding a possible meeting between Xi Jinping and Donald Trump, as this meeting could determine the direction of the current U.S.-China trade war. On Wednesday, Trump told reporters at the White House that he expects to reach agreements with China on trade, soybeans, and even nuclear weapons, stating, "I believe we will ultimately reach a great trade agreement with China." On October 23, the White House announced that Trump would meet with Xi Jinping during his visit to Asia on October 30. Asset prices cautiously reflected Trump's optimistic expectations— the S&P index rose slightly, BTC increased by 2.1%, while ETH fell by 0.3%. Meanwhile, gold prices fell sharply as investors took profits after last week's surge in gold prices.

The Federal Reserve will hold a policy meeting from October 28 to 29.

The Bank of Japan will hold its next monetary policy meeting on October 29.

The Federal Reserve will announce its interest rate decision on October 30, with Chairman Powell holding a monetary policy press conference.

Democrats in the U.S. Senate are demanding that Trump's advisors detail issues such as cryptocurrency investments on October 31.

Nasdaq has applied to the U.S. SEC to add XRP, SOL, ADA, and XLM to its cryptocurrency index, with a final decision expected by November 2.

Popular Sectors and Project Unlocks

Wallet Sector

This week, the Wallet sector performed outstandingly, with an overall increase of 44.5%, becoming one of the focal points of capital attention. As the market's demand for on-chain asset security and self-management rises, several wallet-related tokens have recorded strong rebounds, with representative projects like KARAT, TPAY, GMD, and SWTH leading the gains. The warming of capital combined with project narrative updates has allowed this sector to significantly outperform the broader market over the past week. Overall, the rise in the Wallet sector reflects the market's renewed focus on self-custody wallets, account abstraction (AA), and on-chain identity (DID) tracks. Against the backdrop of returning crypto capital and innovations at the application layer, wallet projects are gradually evolving from "tool products" to "ecological entry points," with increasing enthusiasm from both capital and developers.

Grass (GRASS) will unlock approximately 181 million tokens at 9:30 PM Beijing time on October 28, accounting for 72.4% of the current circulation, valued at about $79.3 million.

Jupiter (JUP) will unlock approximately 53.47 million tokens at 10:00 PM Beijing time on October 28, accounting for 1.72% of the current circulation, valued at about $23 million.

Zora (ZORA) will unlock approximately 167 million tokens at 8:00 AM Beijing time on October 30, accounting for 4.55% of the current circulation, valued at about $15.9 million.

Sui (SUI) will unlock approximately 43.96 million tokens at 8:00 AM Beijing time on November 1, accounting for 1.21% of the current circulation, valued at about $113 million.

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。