Written by: Michael Nadeau, The DeFi Report

Translated by: Glendon, Techub News

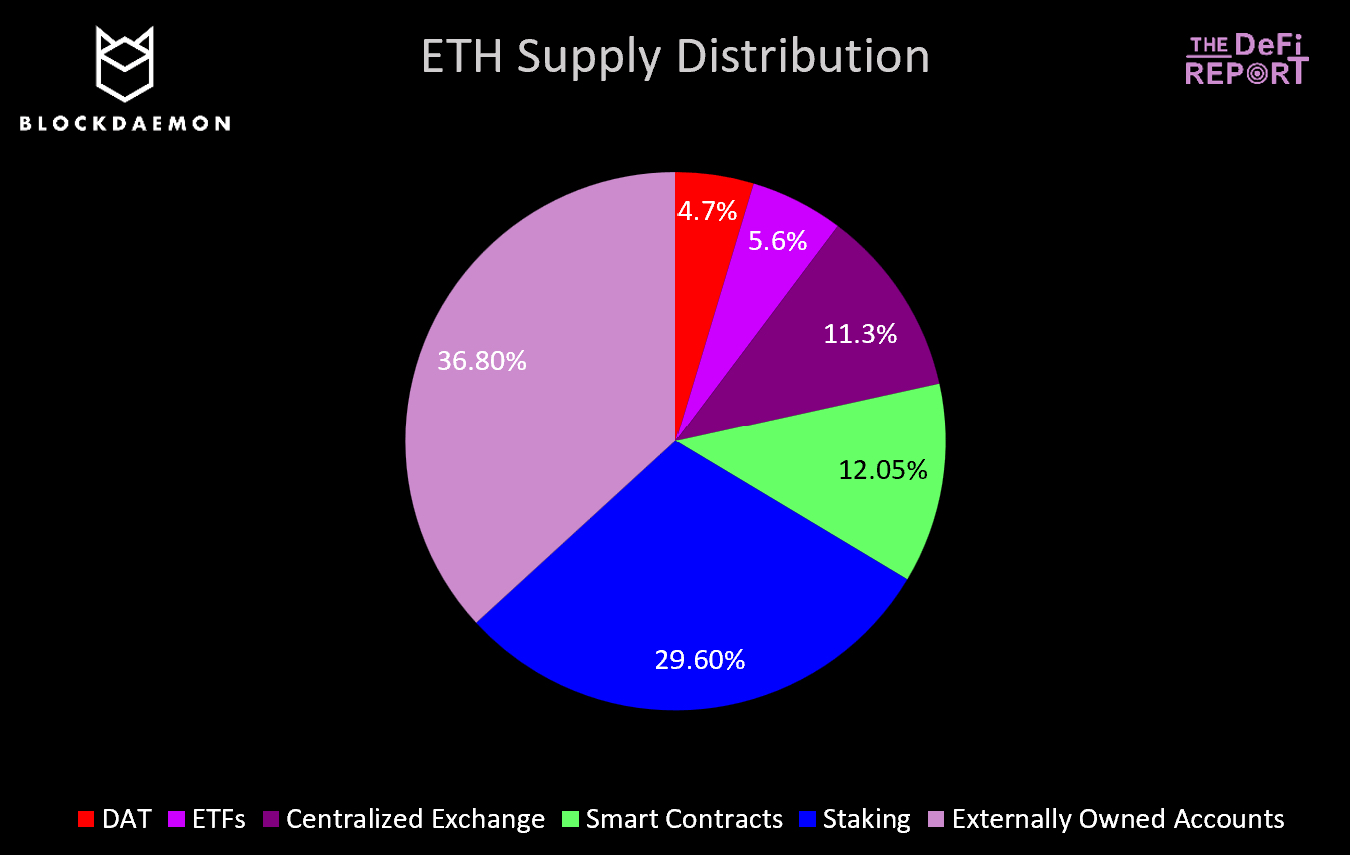

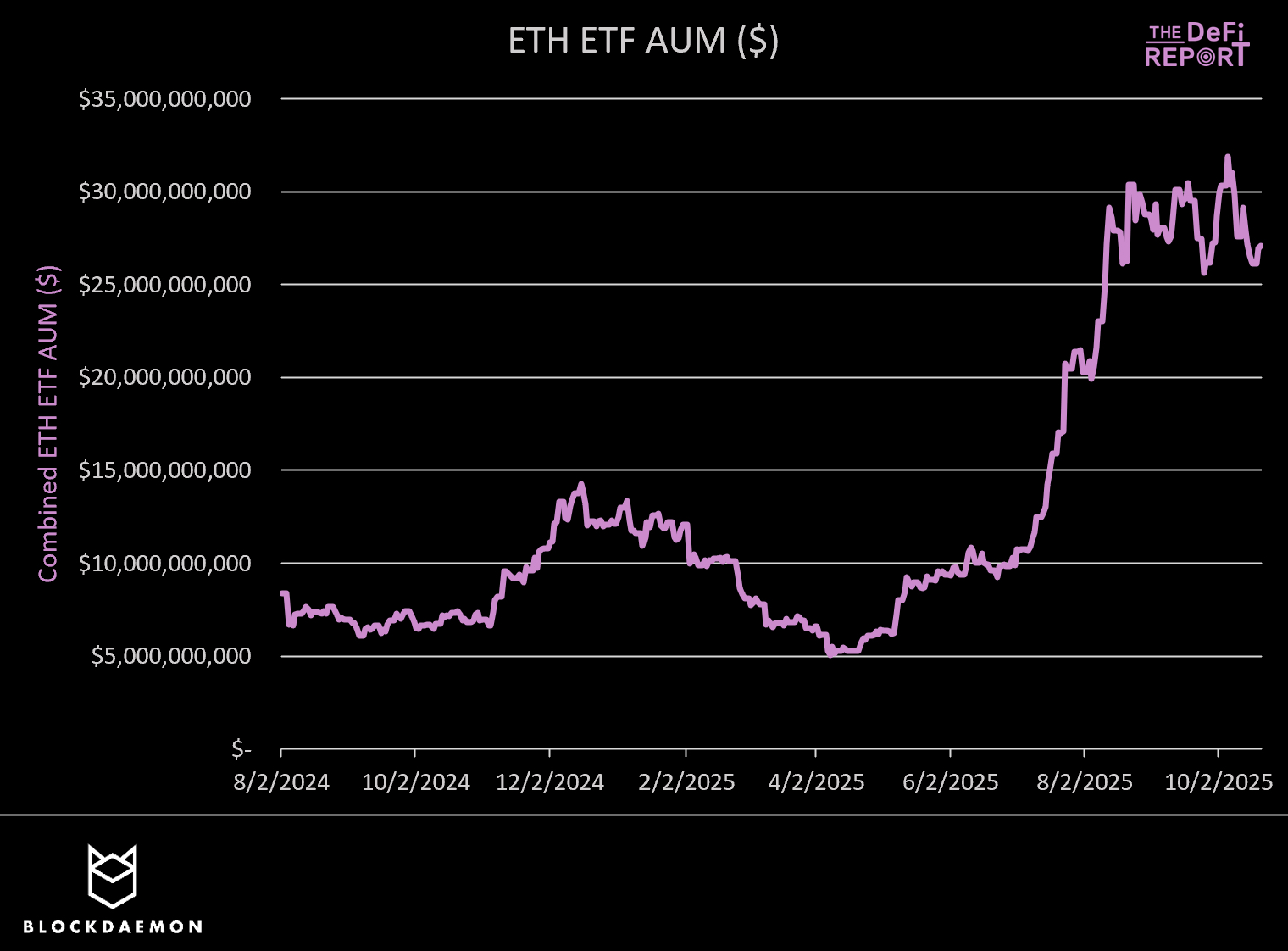

Currently, approximately 6.7 million Ethereum (5.6% of the total supply) is held by ETFs, a figure that has grown by 64% since July 1, valued at around $26 billion. Meanwhile, another 5.6 million Ethereum (4.7% of the total supply) is held by publicly listed companies, which use Ethereum as a reserve asset.

Data: DeFi Report, as of October 21, 2025

This rapid expansion highlights a broader truth: traditional finance is merging with on-chain finance.

This rapid expansion reveals a wider truth: traditional finance is merging with on-chain finance. From the U.S. government's "Project Crypto" to the upcoming "Crypto Market Structure Bill," the regulatory and institutional framework for digital assets is taking shape, which will define the next chapter of capital markets.

This report, in collaboration with Blockdaemon, explores the intersection of Ethereum staking economics and regulated ETF products, focusing on how staking-supported ETF products are reshaping market dynamics in the following areas:

Validators and staking rewards

Validator operations

Liquidity management

ETH "basis trading"

Perception of ETH as a store of value

Economic security of Ethereum

Liquid staking tokens

Protocol governance

Protocol decentralization

Staking Market Overview

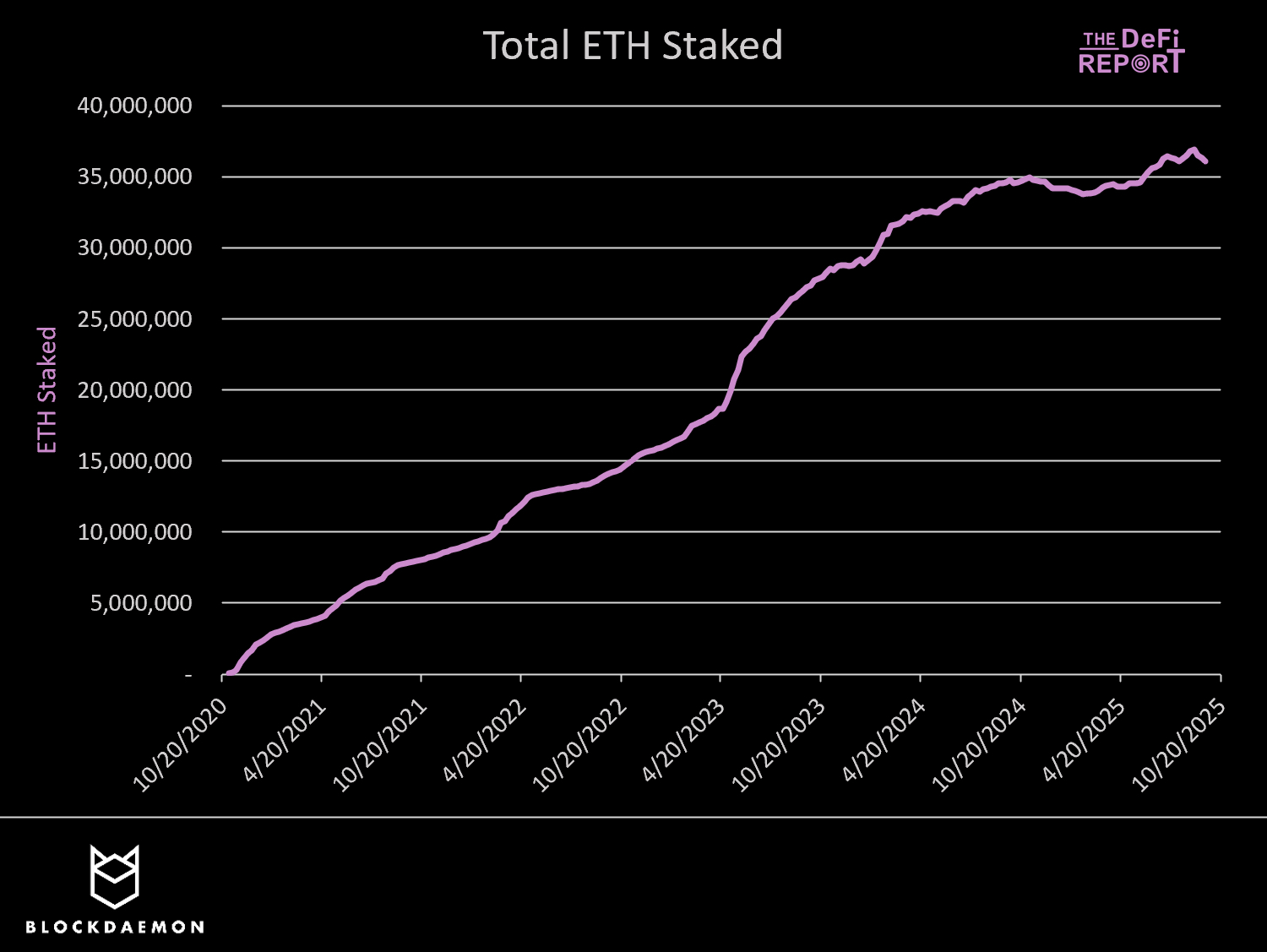

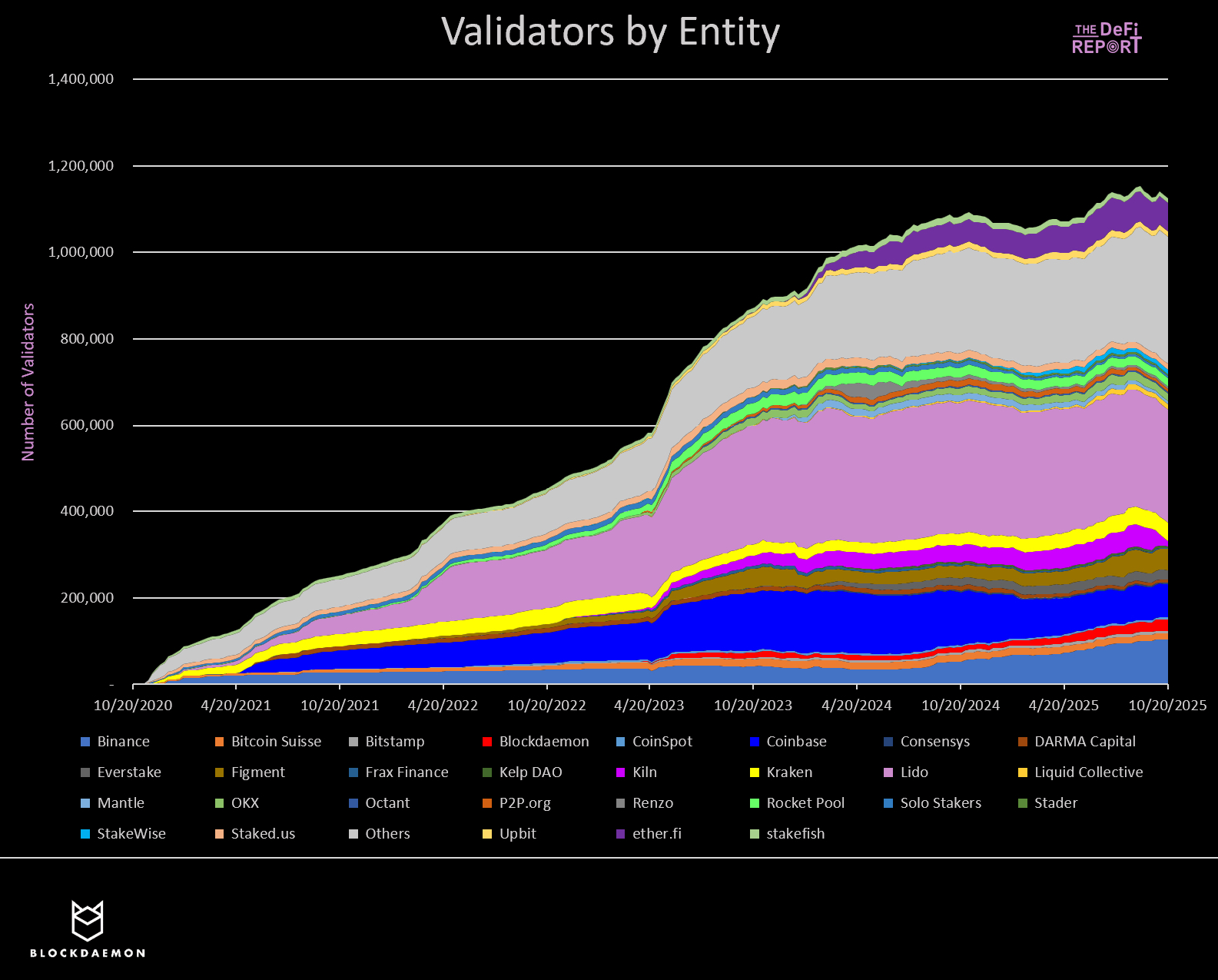

Currently, over 36 million ETH is locked in staking contracts, accounting for 29.8% of the circulating supply. The total amount of staked ETH has grown by 4% over the past year and by 33% over the past two years.

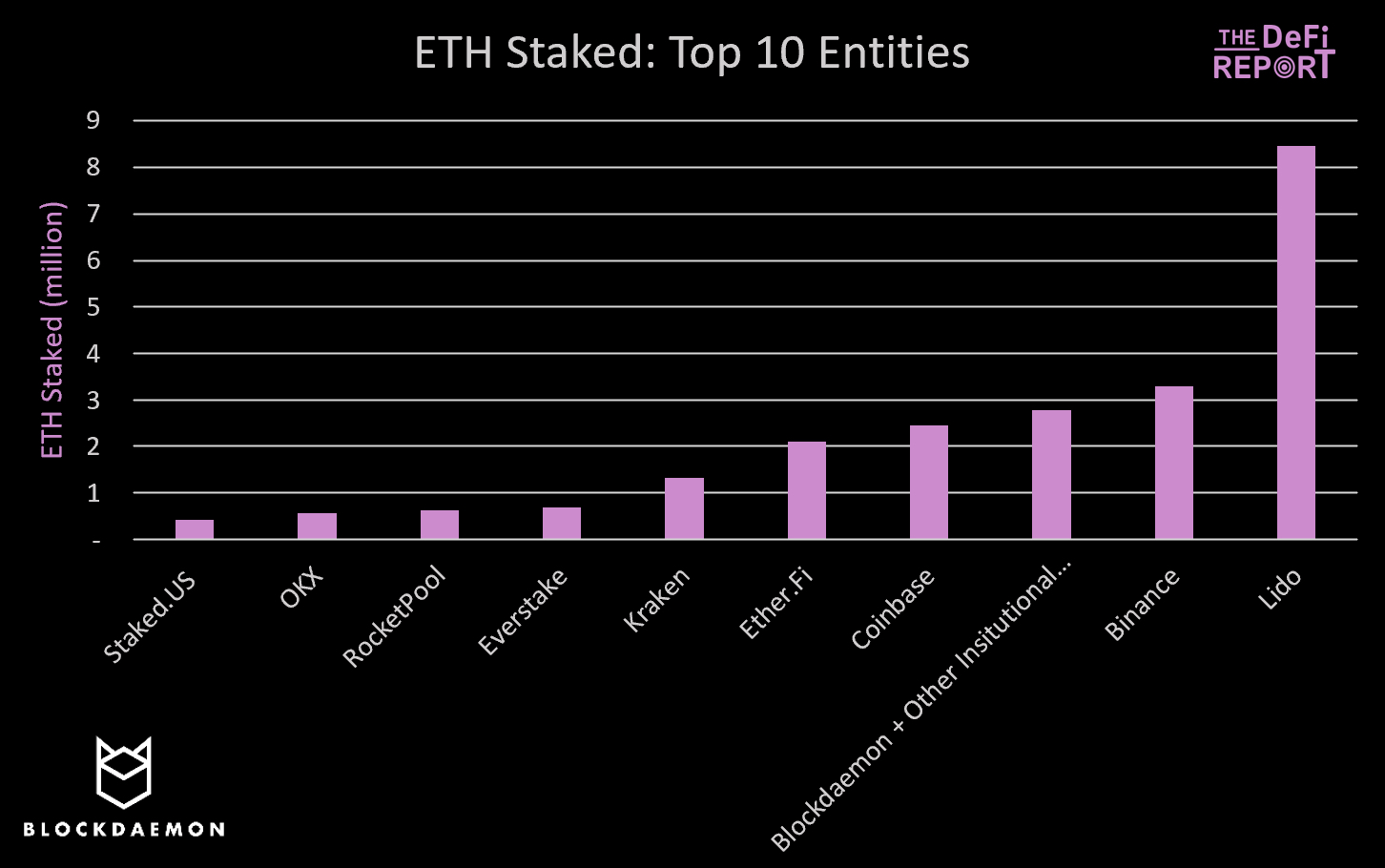

Currently, the top ten ETH staking entities hold over 22.4 million ETH, representing 60% of the total staked ETH. The market leader, Lido, currently holds 23.4% of the total staked ETH.

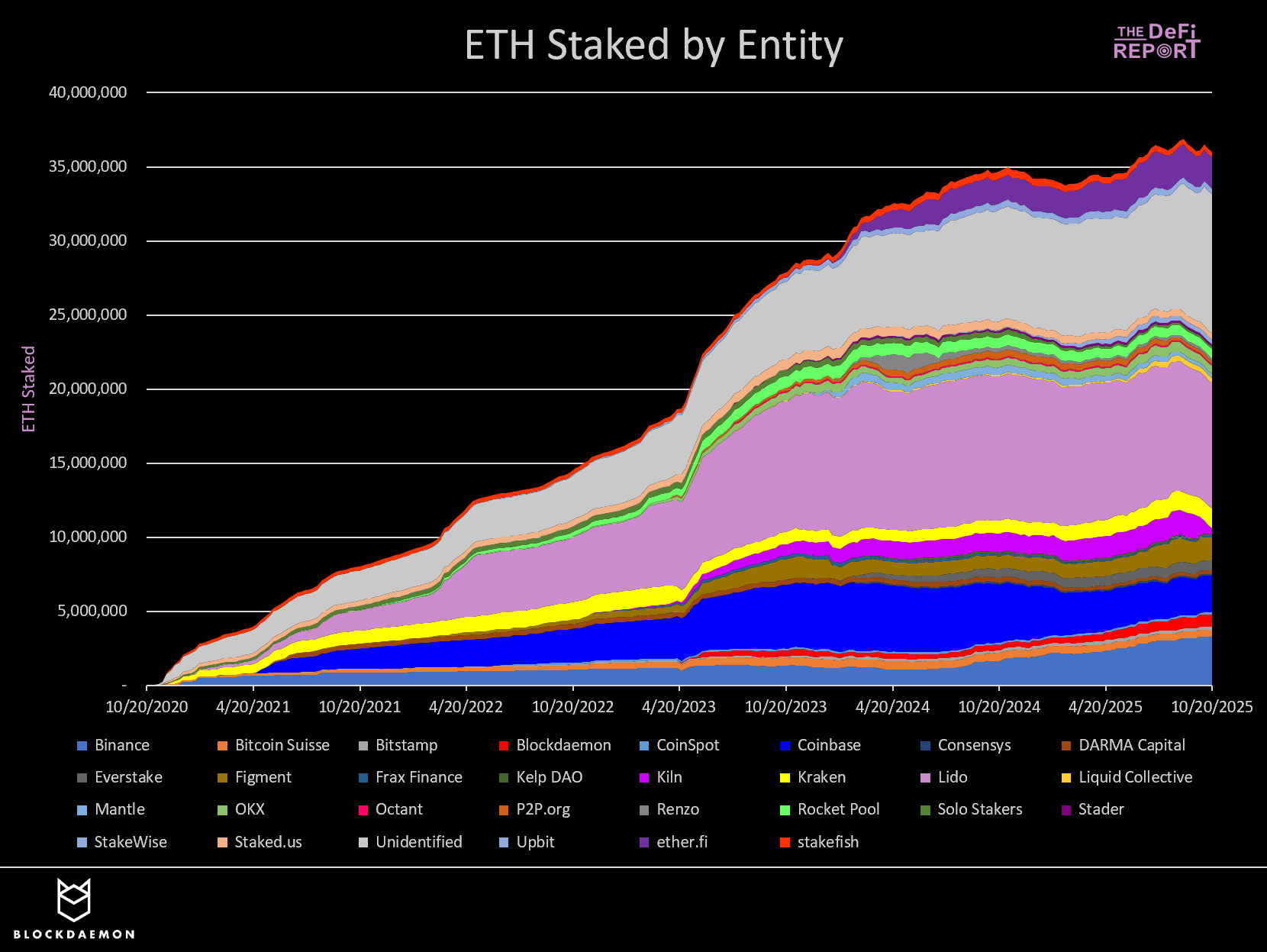

ETH Staking by Entity

The following chart shows the market share of various entities over time.

Notable Market Trends:

Binance, the largest centralized exchange by trading volume, has seen its staked ETH supply grow by 108% over the past year, jumping to second place. Overall, the largest centralized exchanges collectively control 21.9% of the staked ETH supply.

Specialized staking service providers like Blockdaemon have staked an additional 1.28 million ETH over the past year. Blockdaemon grew by 126%, followed by Figment (75%) and Kiln (4.3%). Institutional staking service providers currently hold 7.8% of the staked ETH supply.

The two major non-custodial liquid staking solutions (Lido and RocketPool) have lost over 1.4 million ETH (3.8% of the total staked ETH) over the past year. During the same period, the liquid staking and re-staking solution EtherFi absorbed 409,000 ETH. Currently, the liquid staking sector holds a 31.0% share of the Ethereum staking market.

Coinbase's staked ETH has decreased by 39% over the past year. According to Coinbase, this is primarily due to updates in its internal accounting processes.

ETH Validators (by Entity)

Each entity in the above chart operates validator infrastructure on a large scale. Their share in the Ethereum staking market is directly related to the number of validators they operate.

Historically, the effective balance limit for each validator on Ethereum is 32 ETH/validator. For example, if an entity controls 1 million ETH, it corresponds to 31,250 validators. Therefore, leading ETH staking entities need to launch and manage tens of thousands of validators within Ethereum's distributed architecture.

However, with the implementation of EIP-7251 (included in the Pectra upgrade), this limit has been raised to 2,048 ETH, allowing validators to consolidate larger-scale staking through a single validator key. Operating validators at this scale means automation, redundancy, and typically requires the use of cloud infrastructure or dedicated bare-metal servers. Entities ensure that customer funds are not lost through monitoring, slashing insurance, and key management solutions.

Roles of Issuers, Custodians, and Validators

Issuers

Identity: Protocols or entities that issue staking derivatives—such as Lido stETH, RocketPool's rETH, or Coinbase's cbETH.

Responsibilities: 1) Receive user ETH deposits; 2) Mint liquid staking tokens (LST) representing staked assets + accumulated staking rewards; 3) Manage accounting/economic models (exchange rates, reward accumulation, redemption mechanisms).

Importance: These entities and protocols are the "front end" of liquid staking, providing a gateway between stakers and validators.

Custodians

Identity: Institutions that protect user assets—such as Coinbase Custody, Anchorage, and BitGo.

Responsibilities: 1) Safely hold staked assets on behalf of clients (retail, funds, institutions, family offices); 2) Execute compliance, governance, and operational controls; 3) Provide tax reporting, insurance, and integration with corporate workflows.

Importance of custodians: Custodians enable regulated entities that cannot (or do not wish to) self-custody private keys or run validators to participate in staking, thus connecting traditional finance with on-chain rewards.

Validators

Identity: Professional infrastructure operators, such as Blockdaemon, Figment, and Kiln. They can also be independent stakers.

Responsibilities: 1) Run validator nodes to propose and validate blocks for the Ethereum network; 2) Earn block rewards, fees, and MEV on behalf of stakers. Providers like Blockdaemon assist clients in optimizing infrastructure to maximize rewards and ensure compliance with OFAC regulations.

Importance: Validators are the "core engine" of staking—they are the machines that actually secure the Ethereum network and generate rewards, which are distributed to users by issuers and custodians.

Staking Rewards: Impact Predictions of Regulated ETF Products

Current Status of ETFs

Currently, ETH ETFs hold over 6.7 million ETH (a 64% increase since July 1, 2025), accounting for 5.6% of the total ETH supply. In dollar terms, the total assets managed by these ETFs are close to $26 billion.

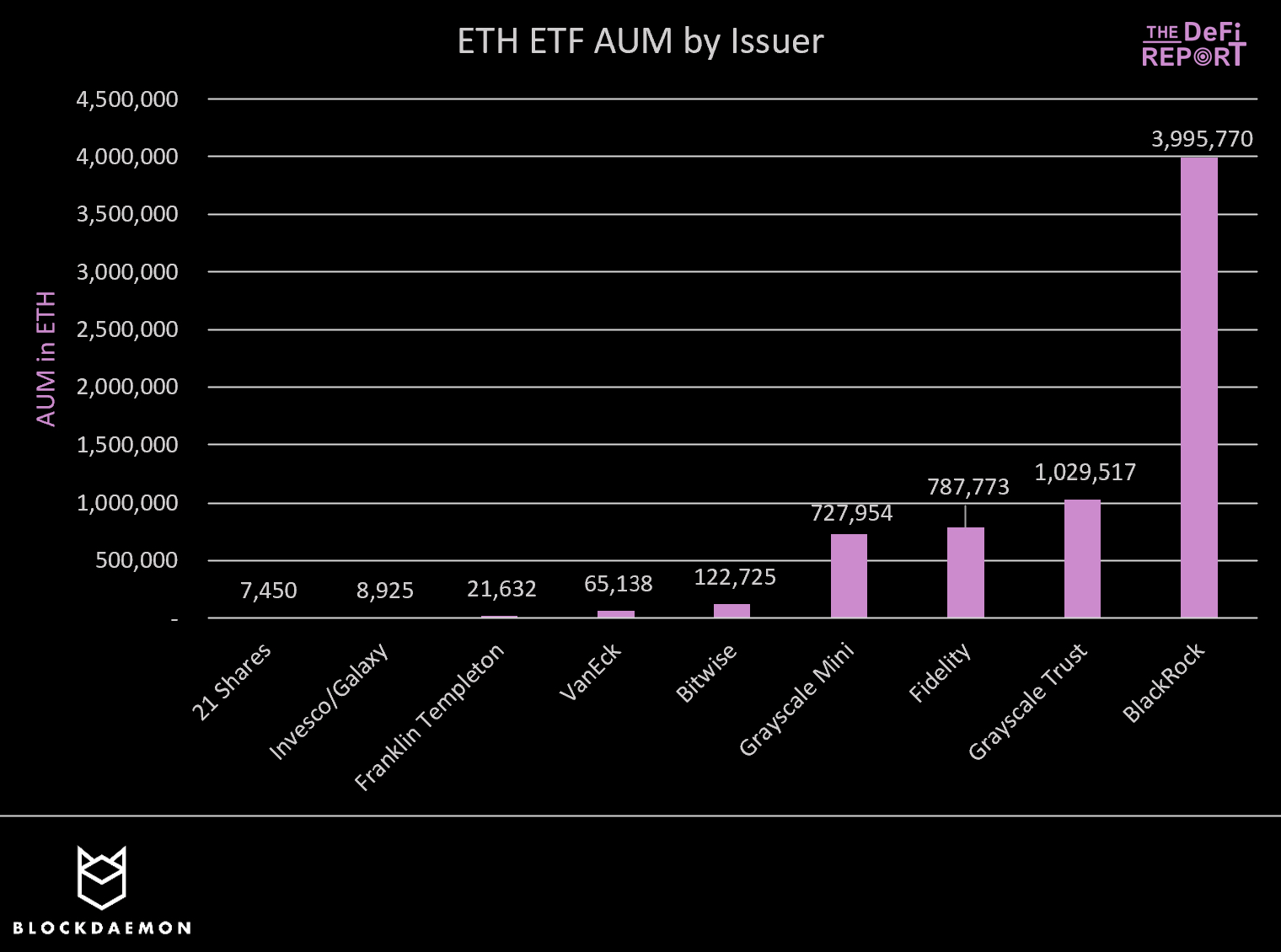

Current Assets Under Management of ETH ETF Issuers

These issuers have not yet been authorized to provide staking rewards to ETF holders. However, BlackRock, Fidelity, Bitwise, 21 Shares, and Grayscale have all submitted relevant applications.

In fact, the U.S. Securities and Exchange Commission's response deadline for BlackRock is October 30, and for Fidelity, it is November 13. Therefore, we expect that most of the ETH in ETFs will be transferred to new staking-supported products in the coming year.

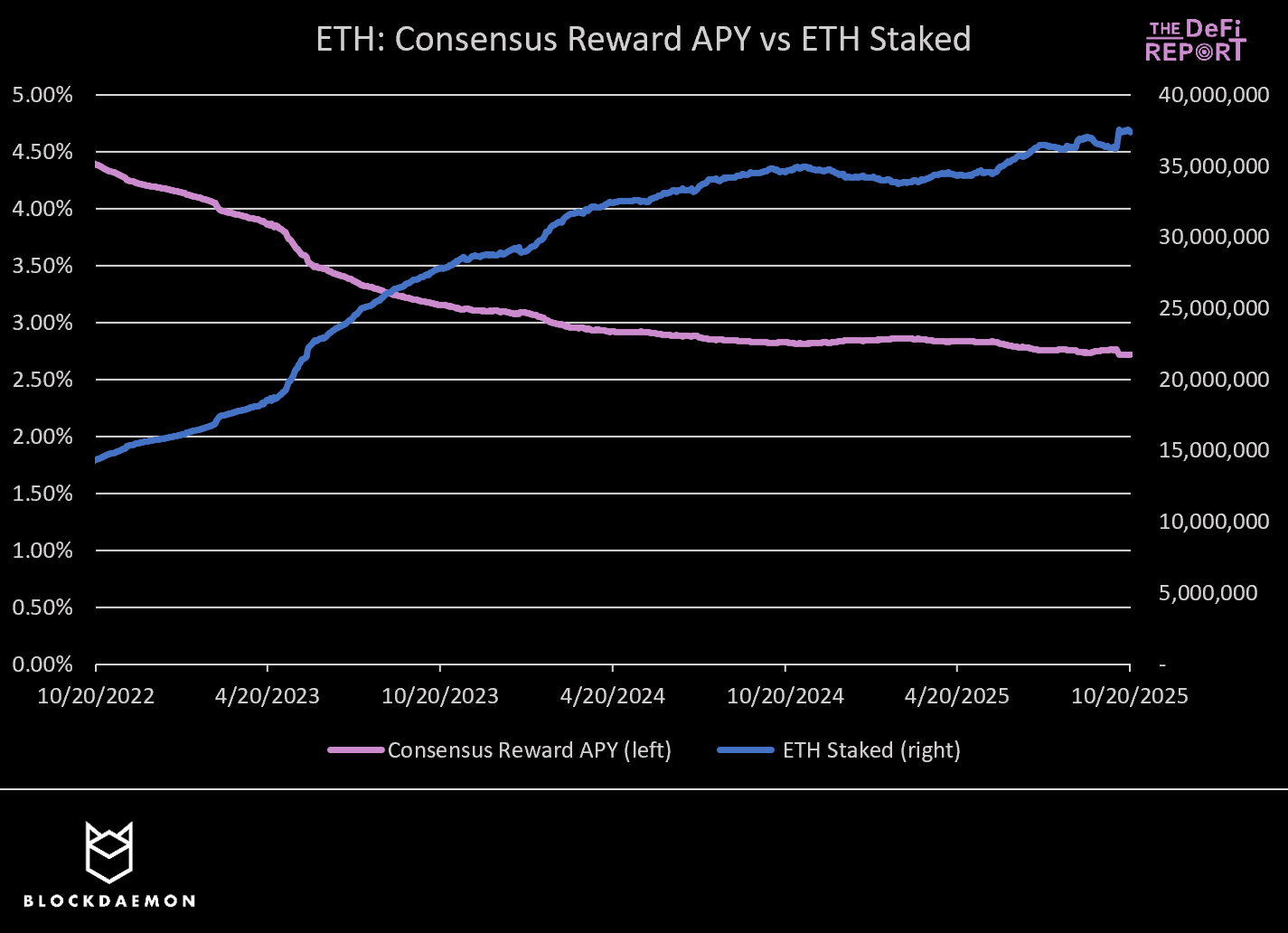

Staking Reward Compression: Law of Diminishing Returns

While the increased demand for ETH from ETFs and institutions may have a positive impact on prices, the effect on staking rewards is certainly negative.

Why is that?

The Ethereum protocol is explicitly designed to reduce the consensus reward rate as the amount of staked ETH increases, ensuring that the network does not pay excessively for security. The base staking rewards are inversely proportional to the square root of the total amount of staked ETH.

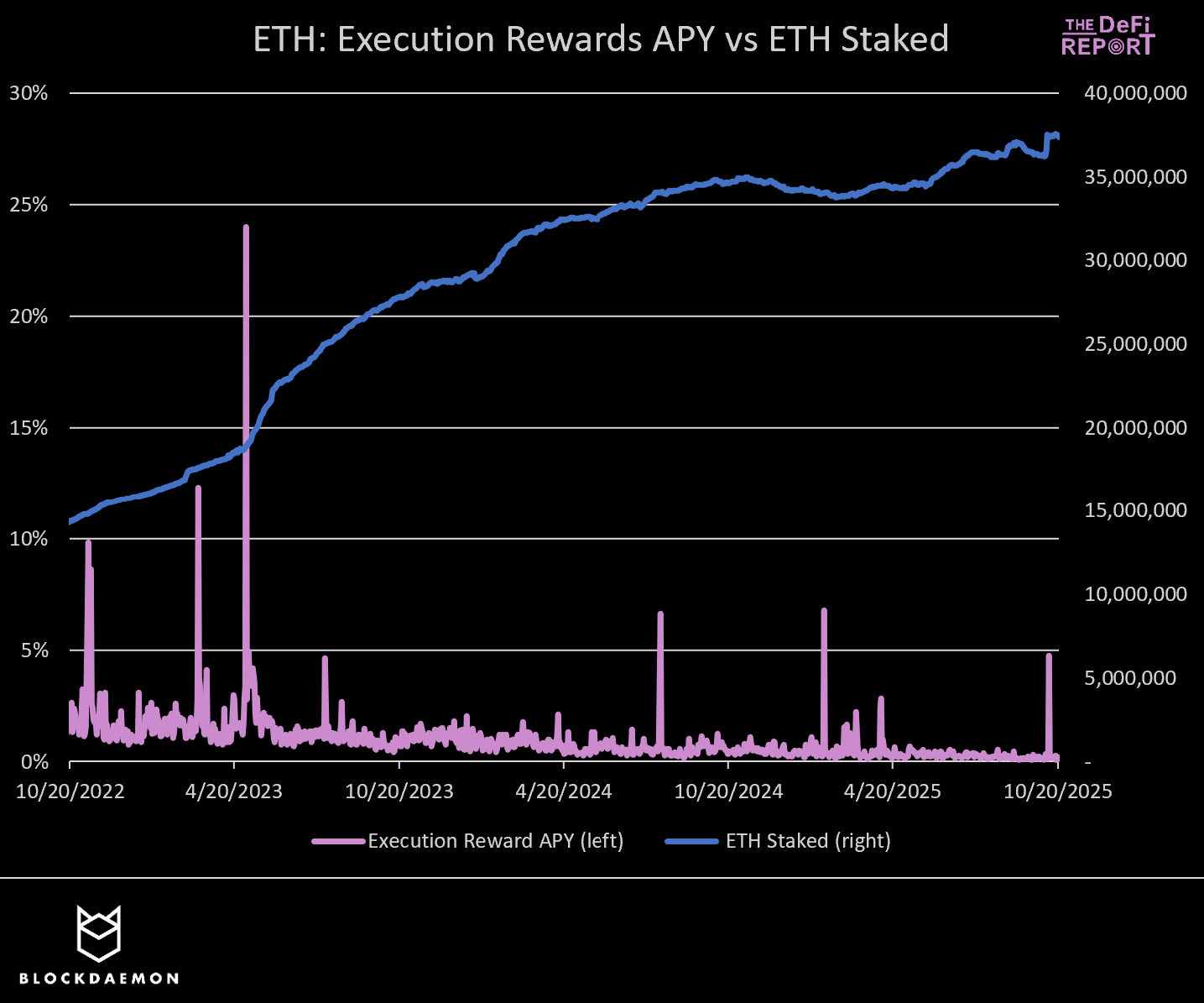

Thus, reward compression is mathematically certain. In the following chart, we can observe the downward trend of consensus reward APY (pink curve) as staked ETH increases (blue curve):

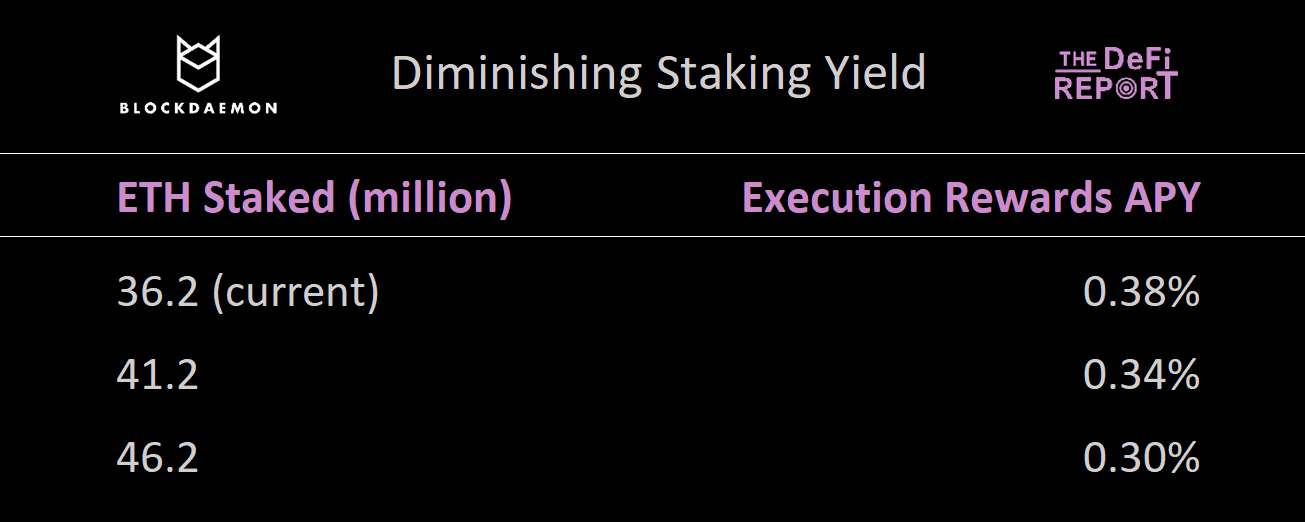

Assuming that out of the 6.7 million ETH currently in ETFs, 5 million ETH is added to staking products within the next year, we can estimate its impact on consensus reward APY as follows:

Based on the calculations from the inverse square root curve, if the staking amount increases by 5 million ETH ($19.2 billion), the consensus reward is expected to decrease by 13 basis points; if the staking amount increases by 10 million ETH ($38.4 billion), the consensus reward will decrease by 28 basis points.

Execution Rewards

These same reward compression dynamics also apply to the execution reward APY of ETH—it relies on on-chain user activity (priority fees and MEV) as well as the amount of staked ETH.

The following chart illustrates the volatility of rewards (based on on-chain activity) and how rewards decrease as the amount of staked ETH increases (all else being equal). It is important to clarify that there is no protocol dependency between staked ETH and execution rewards (there is for consensus rewards). Simply put, under the same conditions, the more ETH that is staked, the less proportional execution reward each validator on the network receives.

Year-to-date, the Ethereum network pays an average of 376 ETH daily to validators, including user priority fees and MEV, which corresponds to an execution reward APY of 0.38%.

Below is the impact assessment of execution rewards under the same network economic assumptions:

Assuming priority fees + MEV are 376 ETH per day (average year-to-date)

Of course, if more users flock to Ethereum, we expect to see higher priority fees and MEV—which may offset the decline in execution rewards from more ETH being staked.

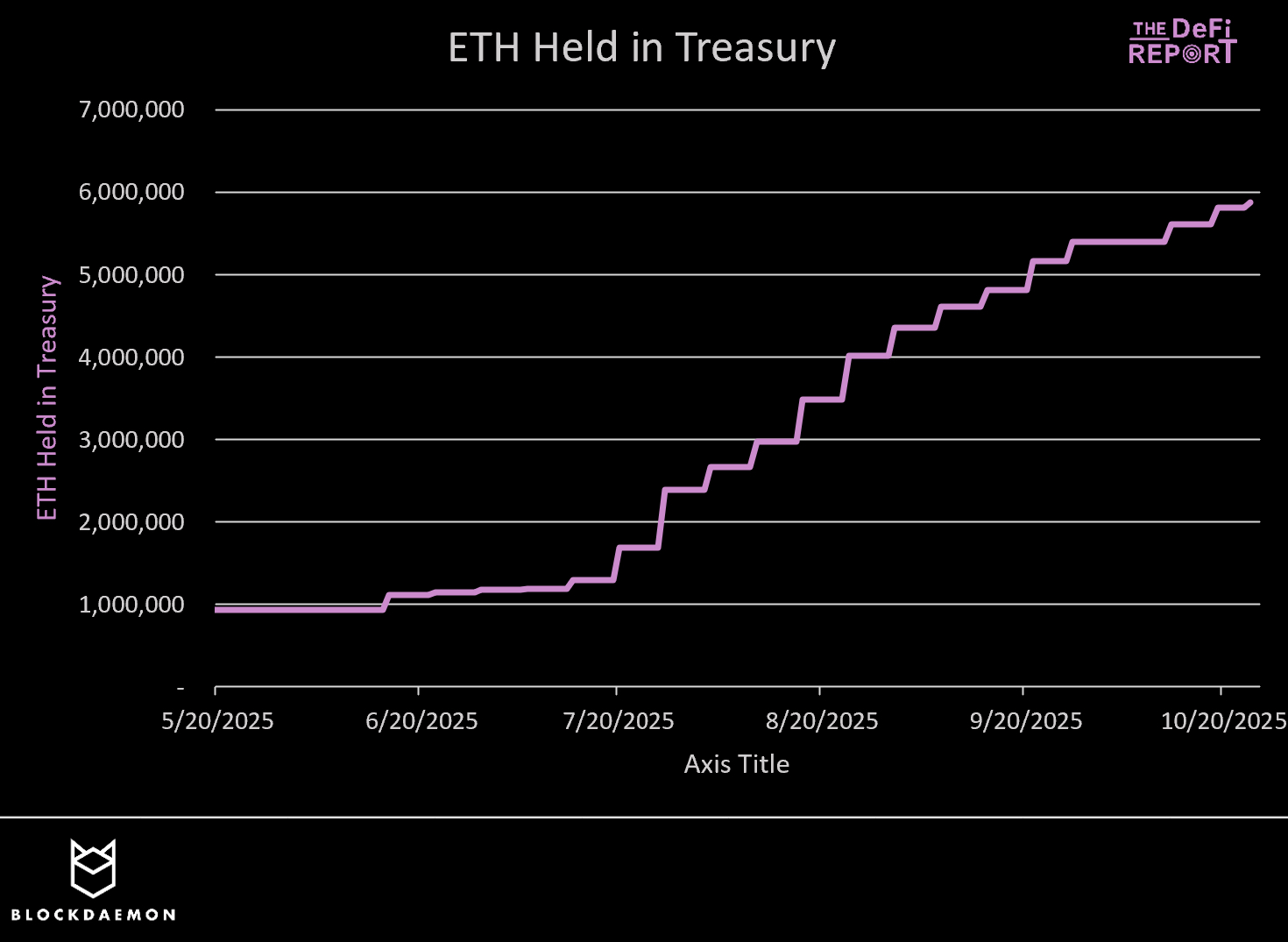

ETH Treasury Companies

In addition to the growth of ETH ETF products, 2025 has seen a strong new trend: the rise of ETH asset management companies (DATs). Following the path paved by Bitcoin asset management pioneers, a wave of publicly listed companies is accumulating ETH as a primary reserve asset.

Unlike Bitcoin, which primarily serves as a passive store of value, ETH's unique properties make it a yield-generating reserve asset.

Companies favor ETH not only for its potential price appreciation but also because it can generate cash flow directly through staking, thereby enhancing the per-share ETH holdings. Currently, ETH asset management companies hold 4.7% of the total ETH supply.

Key players in this field include:

BitMine Immersion Technologies (BMNR): BitMine, chaired by Tom Lee, previously a Bitcoin mining company, was the first to propose the concept of "immersive cooling" for mining machines. The company has acquired 3.24 million ETH (2.67% of the circulating supply) and plans to increase this proportion to 5% (over 6 million ETH).

SharpLink Gaming (SBET): As one of the first Nasdaq-listed companies to adopt ETH as a core asset reserve, SharpLink has rapidly accumulated over 859,000 ETH.

Ether Machine (ETHM): As a new entrant in the ETH asset management market, Ether Machine has acquired 496,000 ETH.

Bit Digital (BTBT): An existing data center company that recently added ETH as a reserve asset. Bit Digital currently holds 150,200 ETH, ranking fourth among ETH reserve companies.

These companies, along with others like them, are creating a sustained new source of demand for ETH that is explicitly related to staking, thereby expanding their influence in the ETH staking market.

When combined with new staking-supported ETFs, ETH worth $50 billion may enter the validator queue in the coming years. Beyond the impact on staking rewards, staking-supported ETFs may also have various downstream effects on the Ethereum network.

First-Order Effects of Regulated Staking Products

The capital flowing into staking through ETFs will not interact with the Ethereum protocol in the same way that today's retail users do. Additionally, ETF issuers must operate within a strict regulatory and operational framework that prescribes specific, intermediary staking methods.

Custody and Validator Operations

ETF issuers (such as BlackRock and Fidelity) will not operate validator nodes themselves; instead, the ETH purchased through the ETF will be held by qualified custodians, such as Coinbase Custody, BitGo, or Anchorage Digital. The custodian will then delegate the assets to professional institutional-grade validator operators (like Blockdaemon) that manage the technical infrastructure.

Reward Mechanism

Regulated ETFs are designed to track the underlying asset (in this case, ETH). Therefore, the staking rewards generated by ETF assets will be reinvested into the fund (rather than paid out as dividends).

This process is known as NAV appreciation, which will increase the fund's net asset value (NAV), and it is expected to reflect in the rising stock price over time.

Liquidity Management and "Reward Loss"

The core responsibility of an ETF is to provide daily liquidity to meet market redemption demands. However, redeeming ETH is not an instantaneous process. Instead, it must enter an exit queue enforced by the protocol, a process that can take days or even weeks.

To address this situation, ETF issuers will not be able to stake 100% of their assets. They must maintain a substantial amount of liquid, unstaked "buffer capital" to handle potential redemptions. While waiting for protocol enhancements or innovations, we believe this will create "reward loss," which will lower the overall return of the fund compared to "pure staking" returns.

Second-Order Effects of Regulated Staking Products

Expected Validator Queue Wait Times

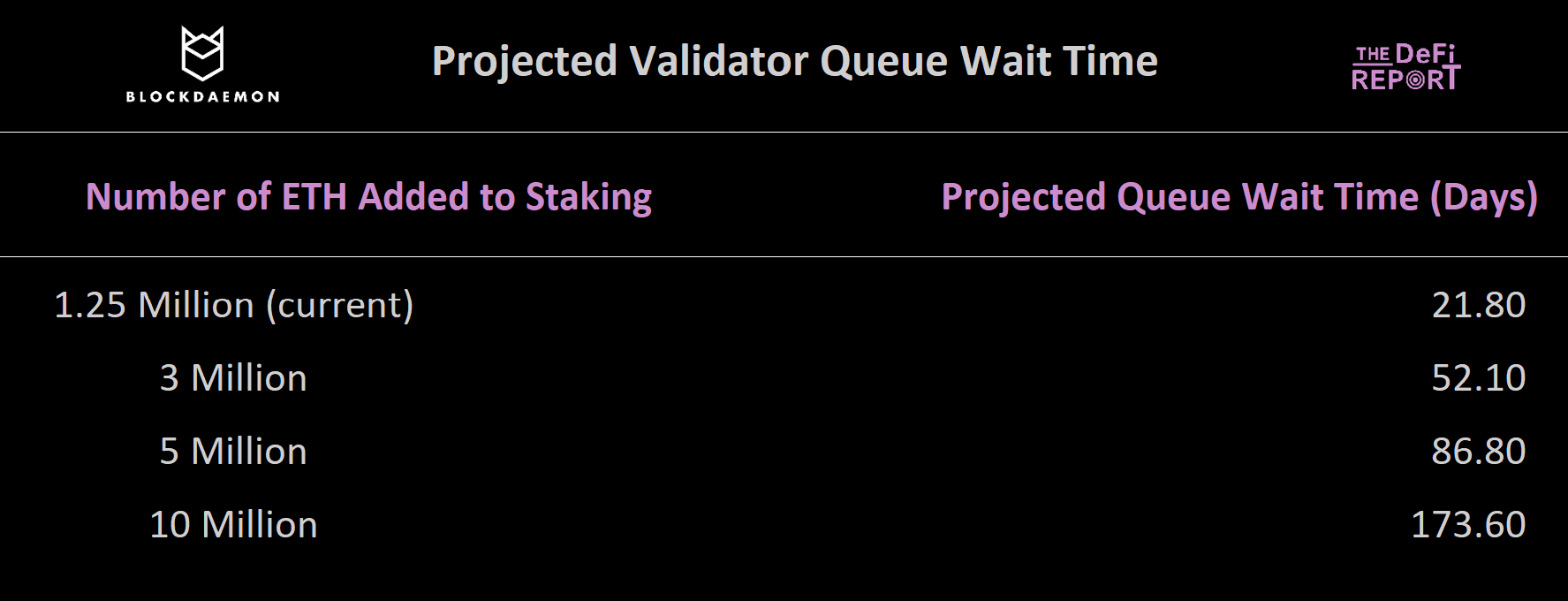

To maintain stability, the Ethereum protocol intentionally limits the rate at which validators can enter (activate) or leave (exit) the active set.

This rate-limiting mechanism is known as "leaving limits." Its primary purpose is to prevent rapid, large-scale changes in the validator set, which could compromise the network's finality. Currently, the queue can process about 8 validators per cycle. There are 225 cycles per day, allowing for the addition of 1,800 validators to the Ethereum network each day.

The Ethereum protocol is not designed to handle the demand that may come from regulated ETH staking products. Below, we can see the impact of various scenarios on the wait times for validators entering/exiting the queue:

Based on a leaving limit of 256 ETH per cycle or 57,600 ETH per day

In an environment where waiting times extend to months, tools that can provide immediate rewards may become more valuable, such as liquid staking derivatives (e.g., stETH through Lido).

This may lead to the trading prices of liquid staking tokens (e.g., stETH, cbETH) being significantly higher than those of regulated ETH staking products, as liquid staking tokens represent a claim on assets that have already generated returns, effectively allowing buyers to completely bypass the exit queue.

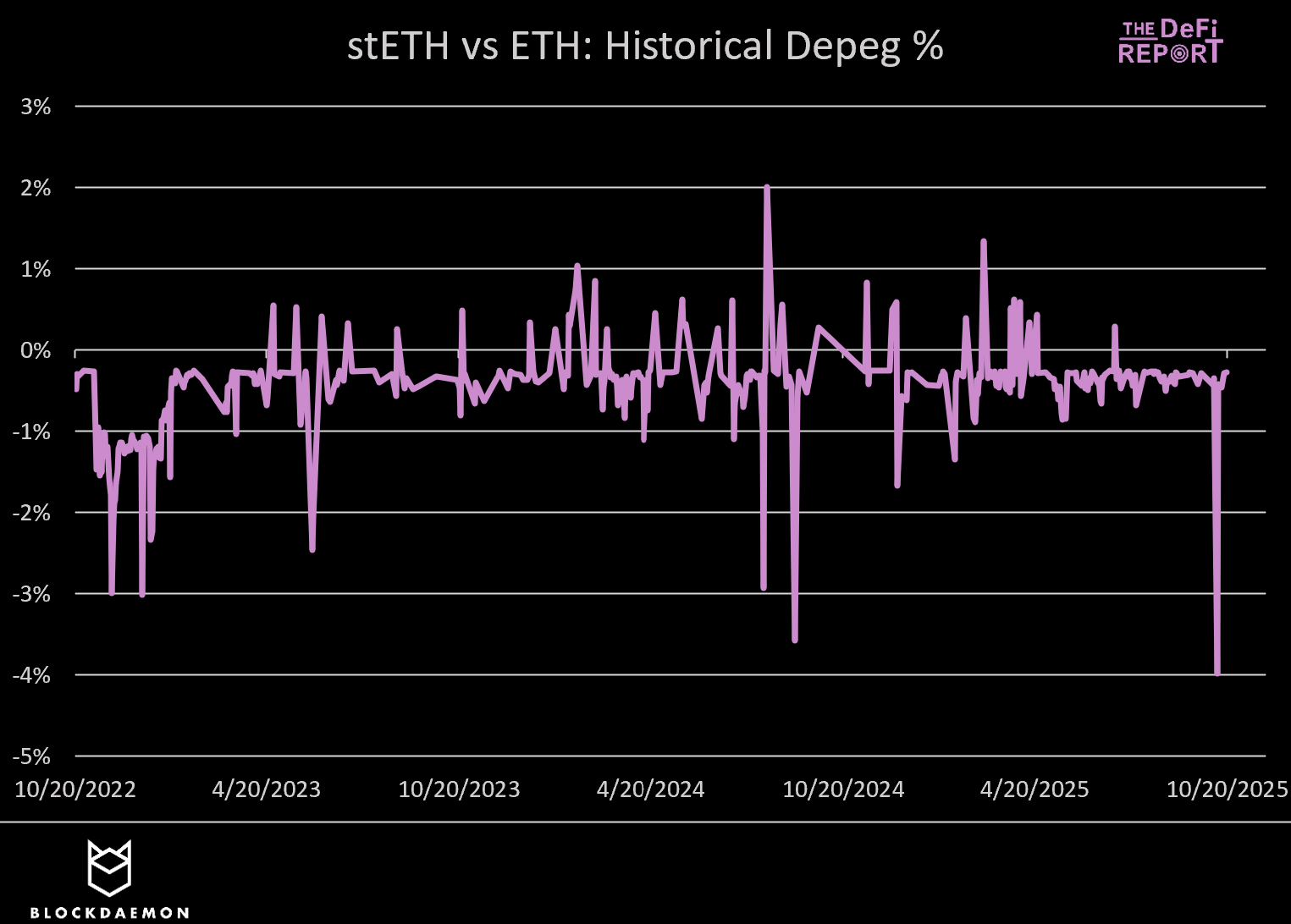

However, during periods of market volatility associated with DeFi activity, LSTs carry the risk of decoupling. Therefore, they may not be seen as robust solutions for handling billions of ETH staked in ETF products.

ETH as a Store of Value

Staking-supported ETFs can strengthen ETH's position as a store of value by institutionalizing staking rewards into a predictable source of "on-chain income."

As ETFs make staking rewards simple, transparent, and accessible, investors may increasingly view ETH as a speculative asset rather than a productive asset. This contrasts sharply with Bitcoin, which is seen as "digital gold" without returns. Over time, this dynamic may exacerbate the differentiated narrative between ETH and BTC: BTC as a scarce store of value, while ETH serves both as a store of value and a revenue-generating asset.

ETH "Basis" or Arbitrage Trading

Today, ETH "basis trading" typically involves hedge funds buying spot ETH and shorting ETH in the futures market to capture the price difference between the two markets. The futures premium reflects the demand for leverage from the Chicago Mercantile Exchange (CME) and other venues, with the strategy's returns almost entirely derived from that price difference, as the spot portion of ETH is essentially idle capital.

However, with the regulation of ETH staking ETFs, the calculation changes. Since the new ETFs will reinvest staking rewards, the spot portion in basis trading will generate staking rewards in addition to the futures-spot price difference.

This improves the return profile of the trade and may increase demand for "basis trading" (i.e., requiring the purchase of spot ETH ETFs). As participation increases, the growth in trading demand may gradually compress the futures premium, bringing it closer to the underlying staking yield. In fact, staking ETFs may establish ETH staking rewards as the benchmark "risk-free rate" in the ETH market, thereby reshaping the pricing of futures premiums.

Third-Order Effects of Regulated Staking Products

Strengthening Economic Security and Risks

Staking-supported ETFs can enhance Ethereum's economic security by directing significant institutional capital into the staking space. Since Ethereum's security model relies on the amount of staked ETH to reach consensus, increasing the staked ETH through regulated investment products will raise the cost of attacking the network, thereby enhancing its resilience.

At the same time, this centralization of staking through ETFs also brings some trade-offs. While the more staked ETH there is, the higher its original economic security; if ETH is controlled by a few large funds and custodians, it may pose centralization risks. Currently, these risks are low (requiring control of 33% of staked ETH), but they should still be monitored.

Impact on Governance

By concentrating validator power in the hands of a few regulated large funds and their custodians, staking ETFs may influence Ethereum's governance.

Since ETF providers do not directly operate their own validators but rely on staking proof partners, the entities they choose may ultimately control a significant portion of the staking. This concentration could amplify the influence of a few custodians in protocol-level decision-making, network upgrades, and even in contentious forks.

At the same time, because these products are regulated, ETF sponsors and custodians will be subject to strict scrutiny to take conservative actions, comply with regulatory guidelines, and avoid behaviors that could be perceived as governance manipulation. The end result may be a trade-off—while Ethereum's governance gains legitimacy in the eyes of traditional institutions, it may also face greater pressure to centralize the determination of who truly operates validators and participates in consensus.

Market Structure Reconstruction

Regulated ETH staking products will inevitably reshape the staking market. A new batch of "institutional-grade" stakers may emerge, focusing more on security, compliance, and reliability rather than pursuing marginal yield advantages. This will raise the bar for validator operators that can provide SOC 2 certified infrastructure, comprehensive reporting, and excellence in full-service operations—basic requirements for institutional capital.

Reward Compression

The compression of base staking rewards may have significant downstream effects on Ethereum's DeFi ecosystem. As the "risk-free" rate of holding ETH declines, capital may seek higher returns (albeit with greater risks), thereby fostering further innovation.

Liquid staking tokens (LSTs) can solidify their position as a key component of DeFi, becoming essential tools for deploying staking capital into more productive uses. This may drive the continued growth of protocols built on LSTs and re-staked ETH, including lending markets, liquidity pools, and structured products. While this "staking financialization" is innovative, it may introduce new risk carriers that require careful implementation and management.

Conclusion

The future of Ethereum will no longer resemble the past. With the launch of the U.S. Securities and Exchange Commission's "crypto plan" and the passage of the crypto market structure bill in Congress, the days of Ethereum being viewed as a "financial wilderness" are coming to an end. Moreover, Ethereum staking is no longer a niche activity limited to crypto-native platforms—it is becoming a regulated institutional-grade market.

As this transition accelerates, the demand for regulated staking products and ETH asset management companies will not only change the yield curve but also redefine the interaction between traditional finance, crypto-native finance, and Ethereum itself. For institutions, the challenge lies in how to seize these new opportunities within a framework of compliance and excellent operations. For Ethereum, the challenge is how to meet these demands without sacrificing its foundational values of "decentralization and resilience."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。