The weekend homework is still quite easy to write, having spent a relaxed day. Trump is seriously engaged in his politics, and the market is enjoying a calm weekend before the storm. Next week, there will be a monetary policy meeting for everyone to speculate on, Powell's speech for everyone to guess, and the China-U.S. relationship that is concerning. There is a high probability of further information regarding the government shutdown, and not to mention, Coinbase's financial report will also be released after the U.S. stock market closes on October 30.

Enjoy this weekend; next weekend, who knows if there will be any surprises, such as the Federal Reserve not lowering interest rates in October, or if the China-U.S. trade war continues, with a 150% tariff actually being enforced, and the shutdown persisting. That would be a significant blow to the entire risk market in the short term.

Of course, if all the data next week is favorable, the Federal Reserve lowers interest rates, Powell is not too hawkish, the China-U.S. relationship eases or is postponed, and there are signs of the shutdown coming to an end, then the market will be greatly encouraged.

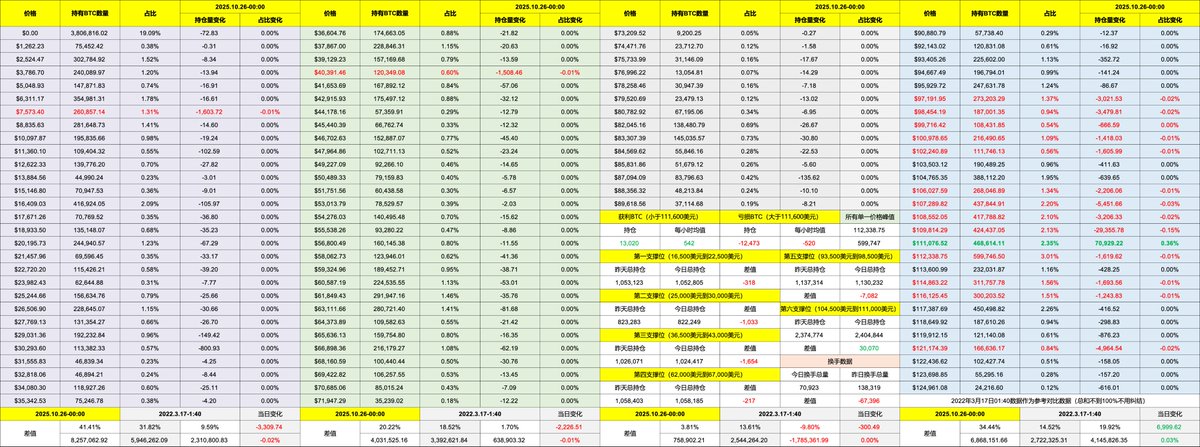

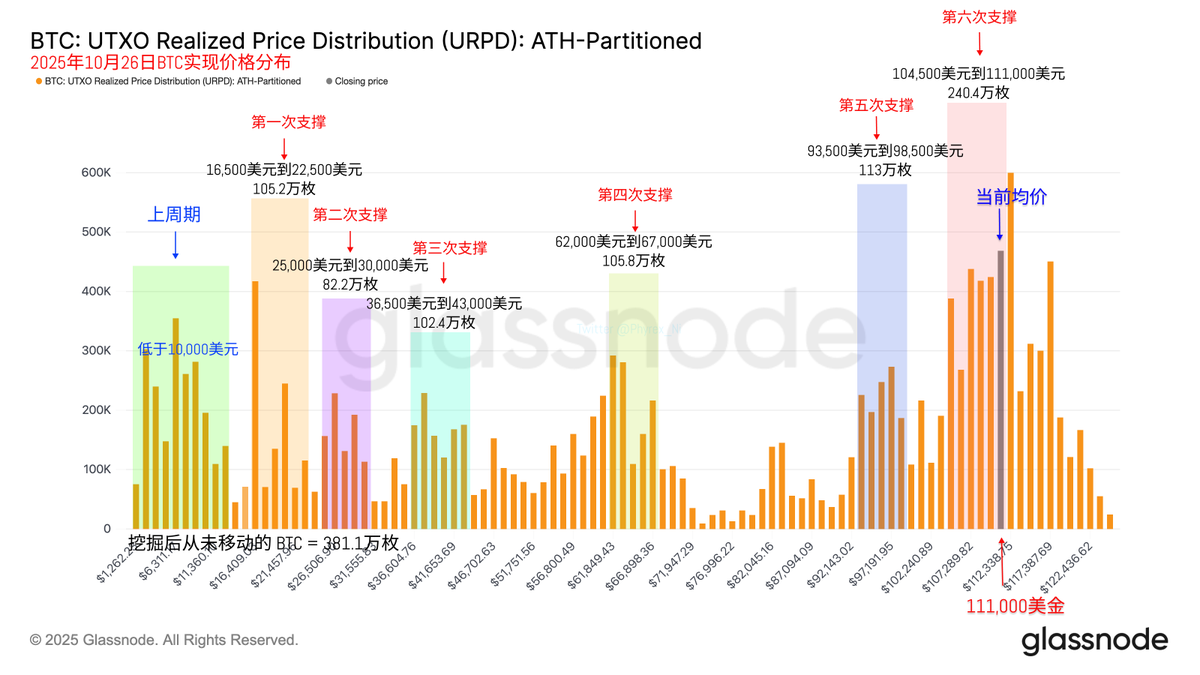

Looking back at Bitcoin's data, after entering the weekend, the turnover rate has halved, with most of the turnover likely occurring on Friday. Currently, investor sentiment remains very stable, and the limited turnover has a very minimal impact on the spot market. As mentioned earlier, let's just get through this weekend first.

Everything else seems fine; as long as Trump doesn't cause any trouble, there shouldn't be any issues. The chip distribution is also very healthy, just waiting for next week.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。