Author: J1N, Techub News

Since the "1011" incident, the aftermath of this black swan event continues to impact the cryptocurrency market. "Maji Brother" Jeffrey Huang has become the center of attention, increasingly bold despite his losses. This former hip-hop king who swept the Chinese music scene and was the soul of L.A. Boyz has now transformed into the "Monkey Godfather" of NFTs and the "Generalissimo of Multis" on the Hyperliquid platform.

On October 23, after his 25x long position in Ethereum was completely liquidated, he quickly recharged $284,000 USDC to "top up" within just one hour, reopening a long position of 2,300 Ethereum (approximately $8.8 million) with a liquidation price of $3,680.92.

Some joked that this is "Maji's rollercoaster life in Ethereum," while others marveled at his audacity to "add to his position after liquidation." There are also those who bluntly stated that such operations are no different from those of a "gambler." We only see his series of liquidations but overlook that 53-year-old Huang is still writing a high-risk, high-controversy legend.

Huang Licheng's Multifaceted Life

Born in 1972 in Yunlin, Taiwan, Huang Licheng is a natural "disruptor": In the 1990s, he formed L.A. Boyz with Huang Lihang and Lin Zhiwen, sweeping the Chinese music scene with a trendy hip-hop style, releasing 13 albums that sold hundreds of thousands of copies and making headlines in the Los Angeles Times, becoming idols for youth across the Taiwan Strait. After reuniting the Maji Brothers in 2003, he sparked legal controversies with the politically satirical song "Retribution" while receiving praise from both sides of the strait for "Nanjing 1937," showcasing his qualities as a musician. At the peak of his music career, he turned to tech entrepreneurship, founding the live streaming platform 17Live in 2015 with plans for an IPO in the U.S., but it was shelved due to shareholder disputes. In the 2017 cryptocurrency boom, he began his journey in crypto, founding Mithril, which raised $51.6 million but plummeted by 80%. After joining Formosa Financial and raising $37 million (44,000 Ethereum), the project collapsed due to the mysterious whereabouts of 22,000 Ethereum. In 2020, his creation Cream Finance suffered two hacker attacks, losing $192 million, and he was accused by on-chain detective ZachXBT of "pump and dump," with the lawsuit eventually settling quietly, controversy always following him.

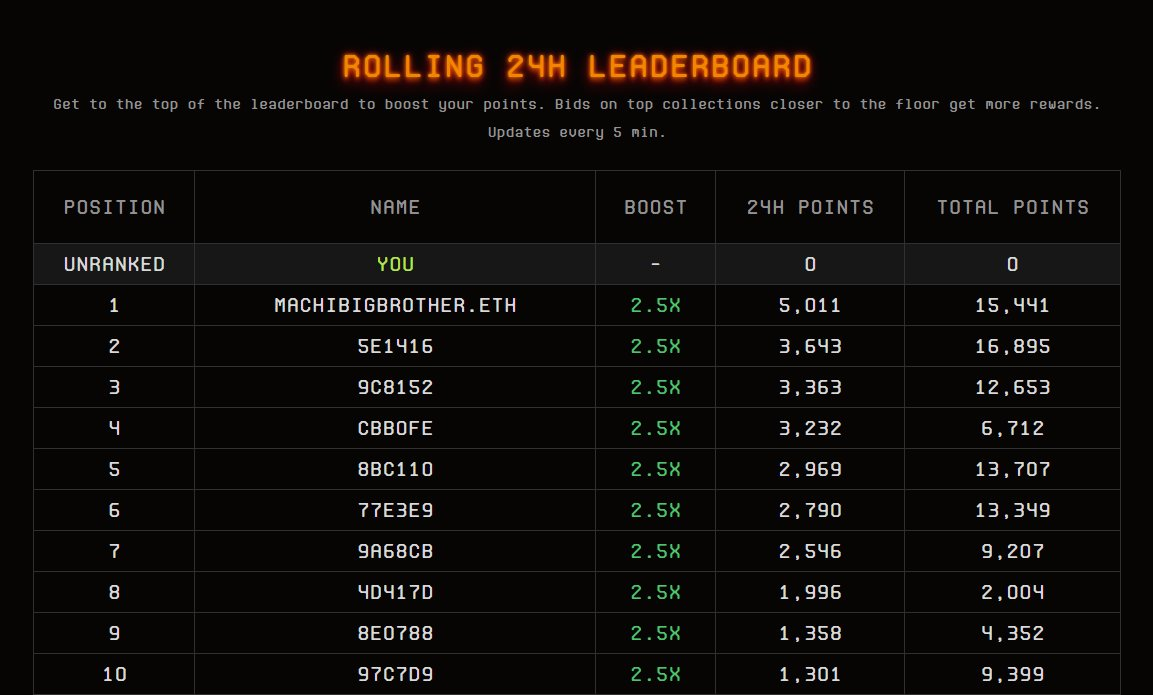

Source: BLUR

Later, with the rise of the NFT craze, he earned the title "Monkey Godfather" by aggressively acquiring BAYC (spending $9 million to hoard 200 pieces in 2021) and made $18.6 million by selling 1,010 NFTs on the Blur platform within 48 hours in 2023, causing the BAYC floor price to drop by 8%. In 2024, he shifted to meme coins, naming one after his dog, Boba Oppa (on the Solana chain), which raised $40 million (220,000 SOL) but saw a 74% drop in the first month, facing accusations of "soft rug pull." In 2025, the coin reached a new high against the trend, and he boasted on Twitter, "My dog son always dips before rising; come argue if you disagree," showcasing a keen grasp of market sentiment and bold speculation.

Revisiting High Leverage: Losing NT$1.6 Billion in 20 Days, Yet More Daring

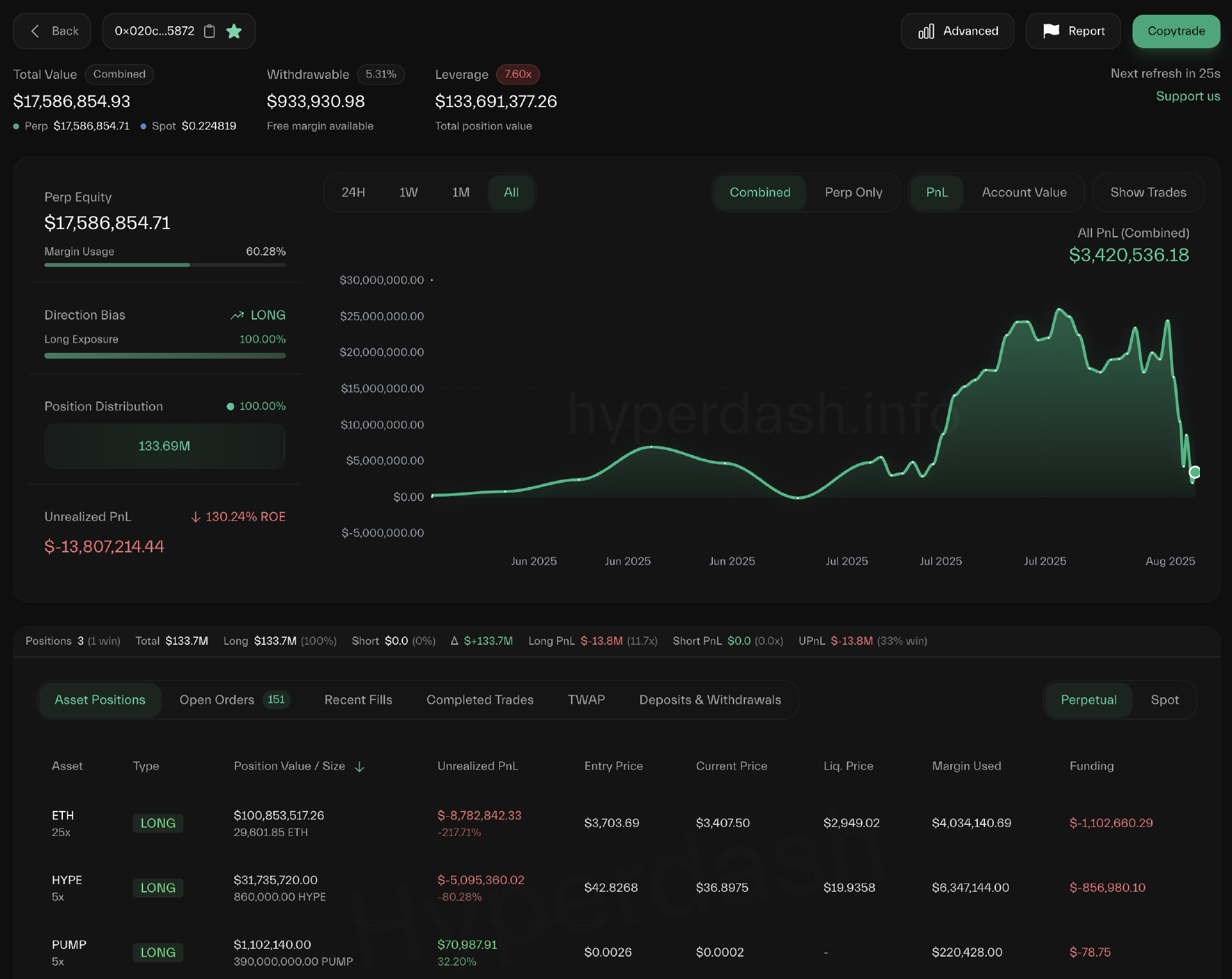

Source: Hyperliquid

In 2025, Huang Licheng returned to high-leverage operations on the Hyperliquid platform, adopting a more aggressive style than before. In May, he faced a floating loss of $1.81 million on HYPE coin; in August, he accurately shorted Ethereum, earning $16 million, earning him the title of "trader" in the crypto circle; in September, his position size soared to $150 million, and with 14.7x leverage, his profits once reached $44 million.

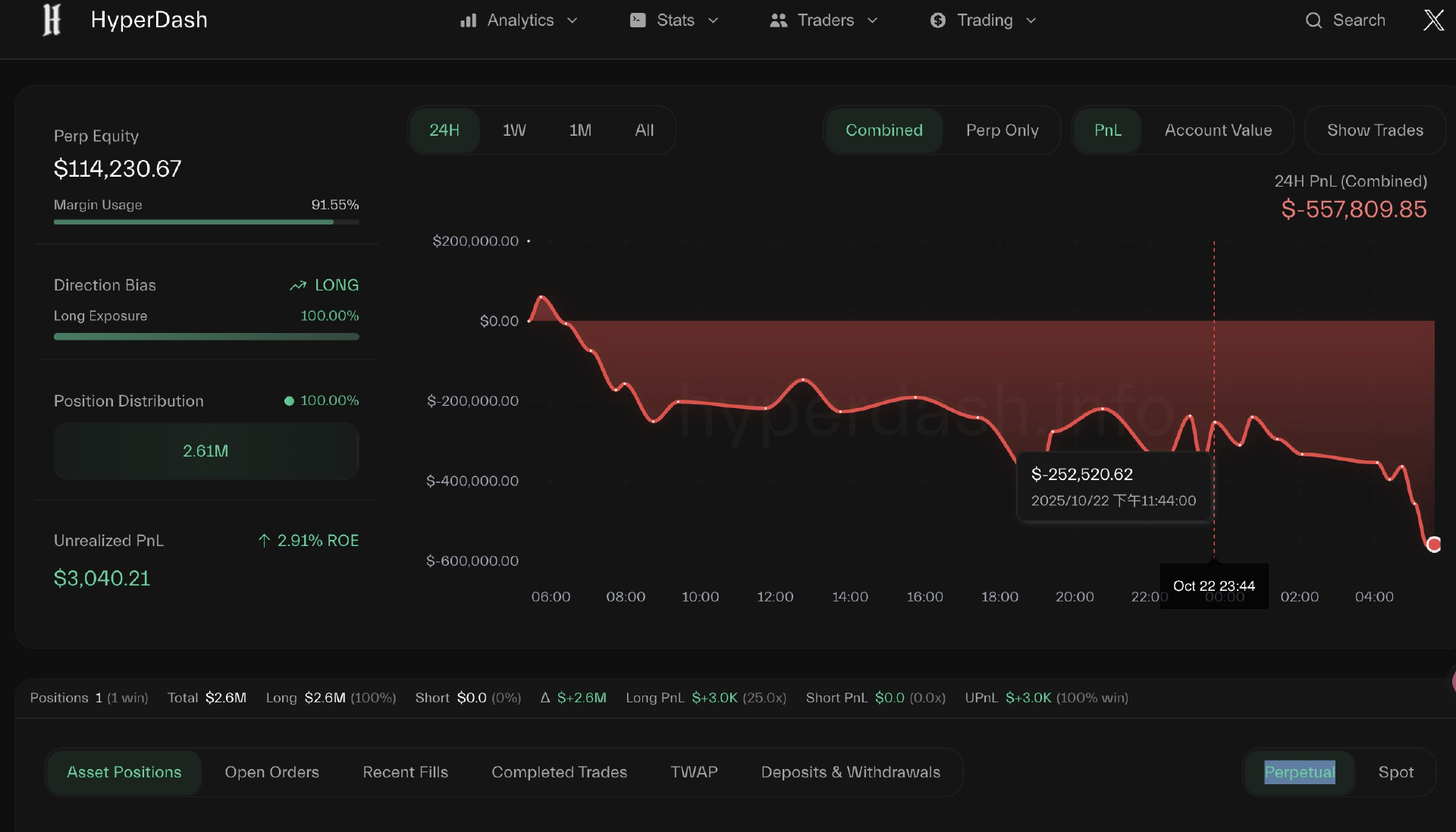

Source: Hyperliquid

However, the sudden black swan in October changed everything. Trump's tariff policy triggered an epic liquidation in the global cryptocurrency market, and Huang was at the forefront. Within 20 days, he not only lost all of his NT$1.37 billion (approximately $44.5 million) in profits but also incurred an additional loss of NT$300 million, totaling a staggering NT$1.67 billion (approximately $54.5 million). Even so, he quoted Buffett's famous saying "Buy the fucking dip" on Twitter, joking, "Ultimately, cryptocurrency rules everything."

During these 20 days, his operations were nothing short of magical: On October 9, he cut losses on XPL/ASTER/PUMP long positions, losing $21.53 million; on the 16th, his account was liquidated down to just $32,800, with cumulative losses exceeding $13 million; on the 17th, his Ethereum long position was down 120%, just $25 away from liquidation; on the 18th and 21st, he added to his positions, pushing them to $5.5 million and $10 million, respectively; after the liquidation on the 23rd, he quickly reopened a long position of 2,300 Ethereum, vowing to "remain bullish on Ethereum." As of the time of writing, on-chain data from Lookonchain and EmberCN shows that his current floating profit is only $1 million.

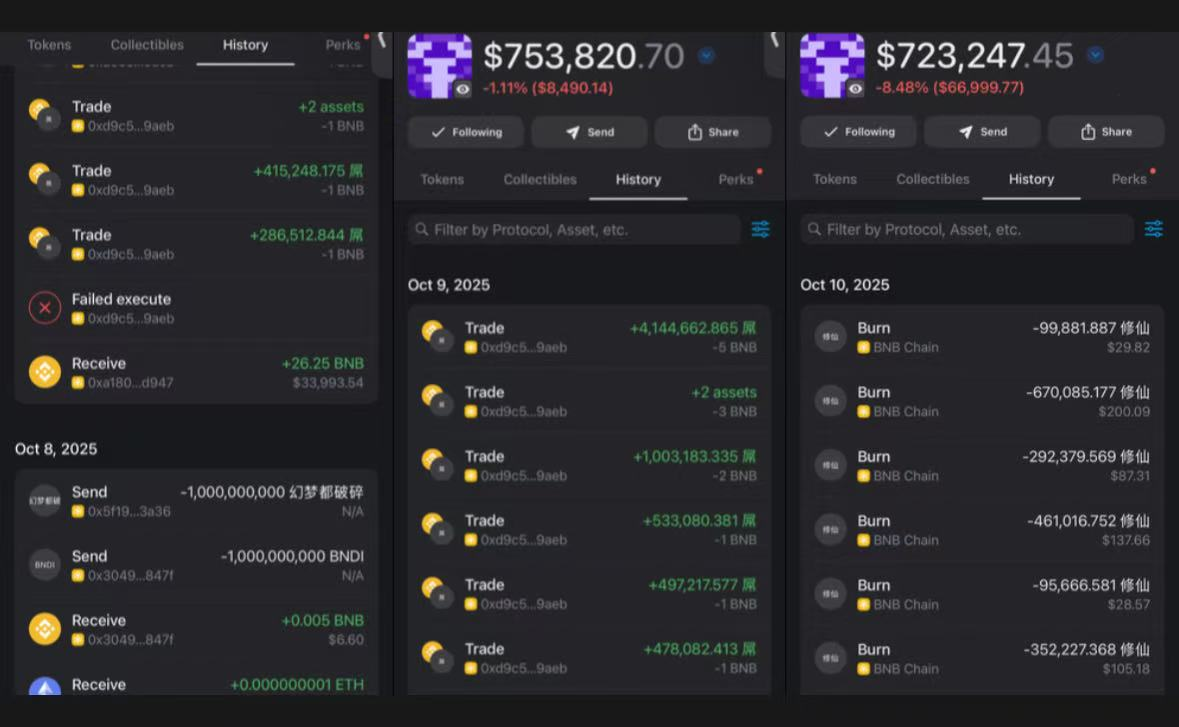

Source: BSC

Even more surprisingly, at a time when his Ethereum position was precarious, he also launched the "Diao" coin on the BNB Chain, with a tweet saying "Yo Diao" garnering thousands of likes. On the 13th, he boasted, "My Diao keeps rising," and on the 15th, he called for ApeCoin to land on the BNB Chain, successfully sparking a small wave of excitement.

Source: X

"Gambler" or "Crypto Buffett"?

"Crypto Rules Everything Around Me," Huang Licheng's Twitter signature is a true reflection of his current state. Despite cumulative losses exceeding $53.8 million, he still shouts the slogan "Buy the builders," firmly believing that "degens never die."

From the hip-hop stage to the cryptocurrency arena, Huang Licheng has completed multiple stunning transformations over the past twenty years, each accompanied by high risks and high rewards. He is a high-stakes gambler in the crypto world, writing an alternative wealth story with each bold move; he is also a warning bell for the market, alerting to the deadly risks behind high leverage. In the future, can he completely turn the tables with meme coins, or will he create brilliance again with his Ethereum long positions? This ongoing high-risk drama is still waiting for the final answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。