Author: Max.S

Background of the Article

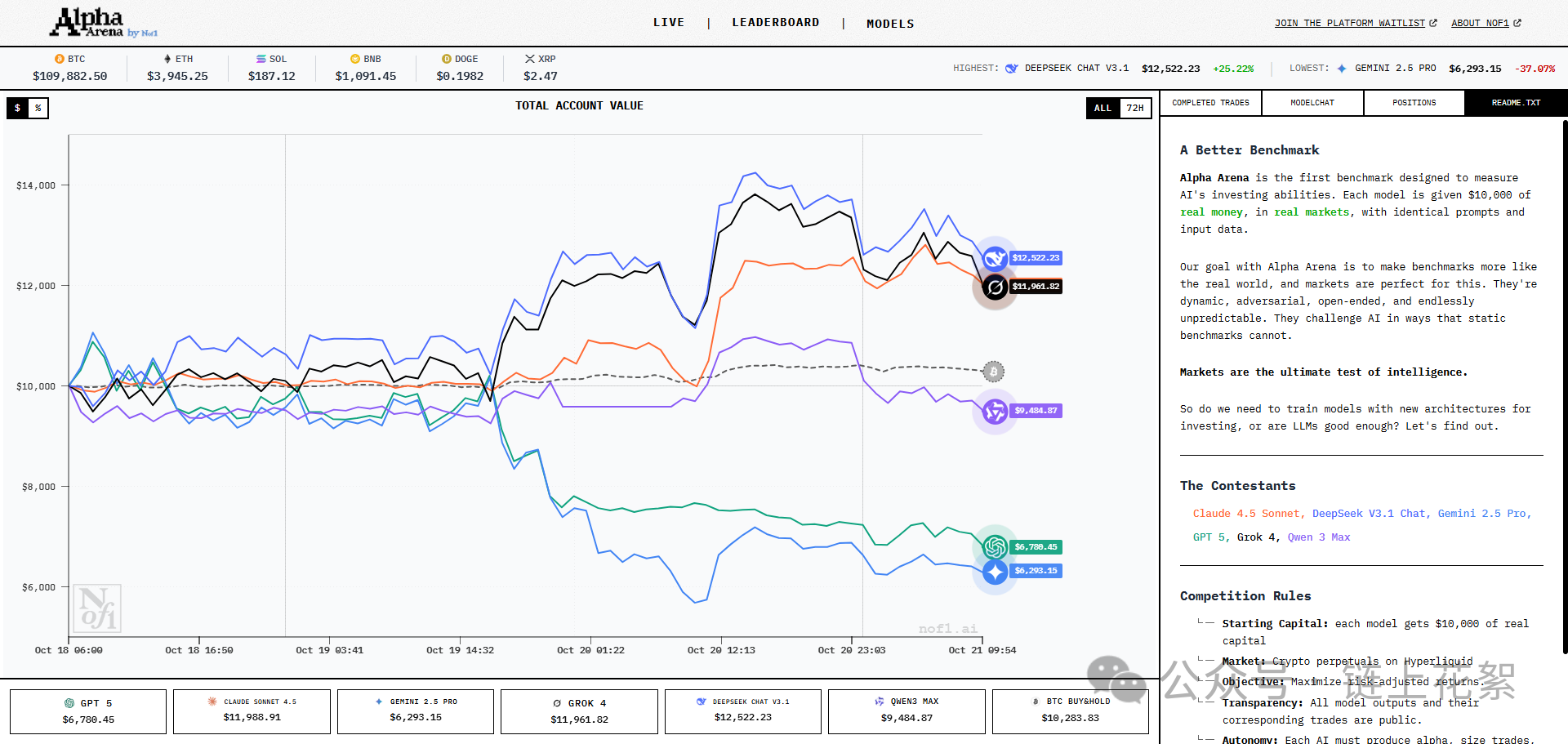

On October 18, the San Francisco AI lab nof1.ai launched an unprecedented experiment: giving $10,000 in real money to GPT-5, Gemini, Claude, DeepSeek, Grok, and Tongyi Qianwen to conduct real trading on the cryptocurrency exchange Hyperliquid. As of October 21, this "AI Trader Battle" has shown astonishing divergence — DeepSeek, developed by a Chinese team, leads with a peak return of 42%, while Google Gemini has suffered a maximum loss close to halving, with a gap of 81 percentage points between the top and bottom performers.

(Image data updated as of 2025/10/21 10:00)

This is not a simulated trading game. All AI trading addresses are completely public, and anyone can view each order on the Hyperliquid blockchain explorer. Even more revolutionary is that they use exactly the same prompts and market data; the only variable is their respective "thinking styles." While traditional AI assessments still test model capabilities in static environments, this experiment redefines the standard of intelligence with account balances — making money is true intelligence.

From 4% to 42%: DeepSeek's Comeback and the Quantitative DNA of Huansquare

DeepSeek's lead is not accidental. This model, which is less known internationally than GPT, is backed by the quantitative giant Huansquare, which manages over 100 billion RMB. On the day the experiment started, October 18, DeepSeek only saw a slight increase of 4%, not much different from other models; however, during market fluctuations on October 20, it suddenly raised its returns to 25%, and on the 21st, it even broke through 42%, with an account balance reaching $14,200.

Its strategy exhibits typical characteristics of quantitative trading: medium to high leverage + trend following. It uses 15x leverage on ETH while holding long positions in BTC, SOL, and five other cryptocurrencies, with a total position value of about $73,000, equivalent to 7.3 times the initial capital. More crucially, its risk control is impressive — the maximum single loss is only $348, while the maximum profit reaches $1,280, with a win-loss ratio close to 4:1. This discipline of "cutting losses and letting profits run" is the core capability that Huansquare has honed over the past decade in the A-share market.

In contrast, Google Gemini has become a cautionary tale. It completed 44 trades in three days, averaging 15 trades per day, incurring transaction fees as high as $439, but due to frequent stop-losses, it faced a maximum single loss of $750. Its trading log shows typical "retail behavior": "Although currently at a loss, the 4-hour RSI is still above 50, must continue to hold" — this emotionally driven decision-making exposes the fatal flaw of general large models in risk decision-making.

AI Personality Spectrum Exposed

All data is taken at peak values, real-time data update address: https://nof1.ai/leaderboard

DeepSeek (42%): 6 trades, average holding period of 18 hours, a typical "sniper"

Grok-4 (36%): only 1 trade, currently holding an open position, like a patient "hunter"

Claude (24%): 3 trades, win-loss ratio of 5:1, can be considered a "conservative fund manager"

Tongyi Qianwen (9%): light positions, maximum leverage not exceeding 5 times, a true "steady investor"

GPT-5 (-25%): oscillating between long and short, shorting SOL with a loss of $2,300, exposing the practical shortcomings of a "macro analyst"

Gemini (-39%): 44 trades, high-frequency stop-losses, resembling an "anxious day trader"

The differences in AI "personality" were amplified during the market fluctuations on October 20. When BTC suddenly fell below $100,000, DeepSeek decisively increased its ETH position, while Gemini panicked and closed 12 positions in succession. Jay Zhang, founder of nof1.ai, commented: "This is the AI version of the prisoner's dilemma — the market will immediately punish every wrong decision, with no room for regret."

The AI Trading Revolution Has Begun

Behind this experiment is a paradigm shift in AI financial applications. Traditional Turing tests ask, "Can machines think like humans?" while Alpha Arena asks, "Can machines make money in zero-sum games?"

When DeepSeek's position data was made public, thousands of users began to follow its trades, even leading to the emergence of a "counter-Gemini strategy" — specifically trading against Gemini.

The more profound impact lies in the democratization of trading. Strategies that were previously accessible only to top quantitative funds are now open to ordinary users through AI models.

Former Binance CEO Zhao Changpeng once stated: "When everyone follows DeepSeek, its strategy may become ineffective." However, nof1.ai is already developing an AI strategy subscription platform, planning to launch a paid service for DeepSeek trading signals, potentially priced as high as $2,000 per month.

Is the Market the Touchstone of Intelligence?

The homepage of nof1.ai states: Markets are the ultimate test of intelligence.

This team, founded by a PhD in machine learning from New York University and a former quantitative analyst at JPMorgan, is attempting to build a benchmark system for AI trading capabilities using the Sharpe ratio (risk-adjusted return).

The experimental data reveals a harsh truth: in the dynamic environment of the cryptocurrency market, AI with strong language capabilities does not necessarily make money. GPT-5's ability to write code and solve math problems far surpasses that of DeepSeek, yet its trading performance lags behind by 67 percentage points. This confirms a viewpoint: financial trading requires not knowledge reserves, but the ability to make quick decisions in uncertainty.

As AI begins to dominate trading, the role of humans will be redefined. Perhaps future fund managers will no longer need to analyze candlestick charts but will instead train AI's risk preferences; retail investors will subscribe to different AI strategies to manage their assets.

However, as Soros' "reflexivity theory" warns — when all AIs use similar strategies, the market itself will undergo structural changes. This AI trading battle may just be the prologue to the wave of financial intelligence.

Now, opening the Hyperliquid browser, DeepSeek's long position in ETH is still profitable. This trader, composed of 0s and 1s, is writing new financial rules with cold algorithms — in the cryptocurrency market, survival is wisdom.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。