Original Title: Building The Attention Economy

Original Author: Eli Qian, Multicoin Capital

Translated by: Peggy, BlockBeats

Editor's Note: In an era of information explosion, attention itself is becoming a measurable and tradable asset. This article explores how "attention assets" can be monetized through prediction markets and oracle mechanisms, and proposes a methodology for constructing "Attention Perpetual Contracts." As meme value gradually emerges in traditional assets like stocks, we may be on the threshold of attention economy becoming a mainstream asset class.

The following is the original content:

Financial Potential of Attention Assets

Although it may be overly simplistic, assets can be broadly divided into two categories:

Cash Flow Assets — primarily including stocks and bonds. These assets generate cash flow, which investors use for valuation.

Supply and Demand Assets — mainly applicable to commodities and foreign exchange. Their prices fluctuate with supply and demand.

Recently, the crypto space has given rise to a new type of asset — assets based on attention as a value foundation. Today, "attention assets" mainly refer to user-generated assets (UGAs), such as NFTs, creator tokens, and meme coins. These assets serve as "Schelling points" of cultural attention, with their prices reflecting the fluctuations of attention.

From a cultural perspective, meme coins are interesting, but from a financial perspective, they still have many shortcomings. Efficient attention assets should allow market participants to gain direct financial exposure to the attention of a particular subject. This way, participants will be incentivized to trade assets they believe are mispriced, and the market can form prices that reflect attention predictions through collective behavior.

We believe that, if constructed properly, attention assets have the potential to become a true asset class. To promote this idea, this article introduces the concept of "Attention Oracles," a new type of oracle structure that can support "Attention Perpetual Contracts" — a new financial instrument that allows traders to go long or short on cultural attention.

In short, attention oracles construct a weighted aggregate index aimed at capturing changes in attention through binary prediction markets centered around a particular topic, utilizing their price, liquidity, and time dimensions. To ensure effective operation, the underlying markets must be carefully selected to represent relevant attention inputs in the real world. Using prediction markets as inputs for attention oracles also introduces "embedded manipulation costs," theoretically reducing malicious manipulation, as adversarial traders must bear capital risk to influence the index.

Why Do We Need Attention Perpetual Contracts?

UGAs have found product-market fit in the realm of pure speculation and are very good at tracking attention from scratch, such as emerging internet trends and memes.

The problem that UGAs solve is: creating assets for things that the traditional financial system cannot cover. The traditional asset issuance process is slow, expensive, and has high regulatory barriers, limiting the range of assets that can be issued. Attention assets must operate at internet speed to keep up with global cultural trends. Combined with permissionless token issuance mechanisms, clever pricing methods like bonding curves, and liquidity support from DEXs, almost anyone can create assets for free, launch liquidity, and push them to the market for others to trade.

One observation about UGAs is that their prices often start from zero. This is not a flaw but a feature. Because if you create a new meme from scratch, its attention at birth is zero, making it reasonable to enter at a low price. This also allows those skilled at early trend detection to monetize their abilities by creating low-cost assets. However, this also means that UGAs are not suitable for providing financial exposure to things that already have a lot of attention.

For example, suppose you want to go long on LeBron James's attention. You could create a meme coin, but there are already many LeBron tokens on the market; which one should you buy? Moreover, a new LeBron meme coin would be priced close to zero, but LeBron is one of the most well-known figures globally, and his attention should be very high; it is unlikely to surge 100 times in a short period. Finally, if you want to short his attention, meme coins would also struggle to achieve this.

So, what should assets targeting high-attention topics look like?

Some requirements might include:

Bidirectional trading capability: Assets should support going long and short.

Connection to real-world attention data sources: There must be reliable "fact sources" to measure attention.

Should not start from zero: Assets should have initial value reflecting existing attention.

If you examine these needs, you will quickly find that perpetual futures contracts (Perps) fit very well: they are bidirectional, have oracles (fact sources), and as derivatives, do not start from zero. The real challenge lies in how to construct an effective oracle for "Attention Perpetual Contracts."

Currently, some teams are researching this issue, such as Noise. On the Noise platform, traders can go long or short on the "mindshare" of certain crypto projects (like MegaETH and Monad). Noise uses Kaito as an oracle, which aggregates social media and news data to generate a number representing the level of attention on a topic.

However, this design still has room for improvement. The goal of attention oracles is to take attention-related data as input, apply certain functions to process this data, and output a numerical value for traders to go long or short.

One issue with using social media as input is that social media can be easily manipulated. This reflects a variant of Goodhart's Law: in adversarial markets, traders will attempt to manipulate input data to influence prices. Kaito has already had to redesign their rankings and anti-spam mechanisms to address this issue.

Additionally, social media does not perfectly capture attention. Take Shohei Ohtani as an example; he has a global fan base and uses various different social media applications, and these platforms may not all be indexed by Kaito. If he wins the World Series again, his star power will be stronger, but the number of his fans or mentions on social media may not necessarily grow linearly.

Attention Oracles: A Market-Based Approach

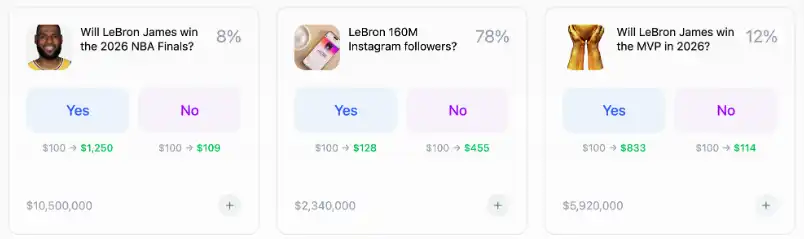

Returning to the earlier example of LeBron James, suppose you want to trade LeBron's attention. The first step to building an attention oracle for him is to collect (or create, if they do not exist) multiple binary prediction markets about LeBron, such as:

"Will LeBron James have over X million followers by the end of this month?"; "Will LeBron James win a championship in 2026?"; "Will LeBron James win MVP in 2026?"

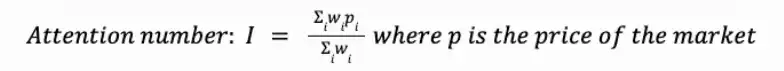

A well-constructed LeBron attention oracle would use more underlying markets, but for the sake of example, we will temporarily use these three. The index price will be calculated by a weighted aggregation of the price, liquidity, resolution time, and importance of each market.

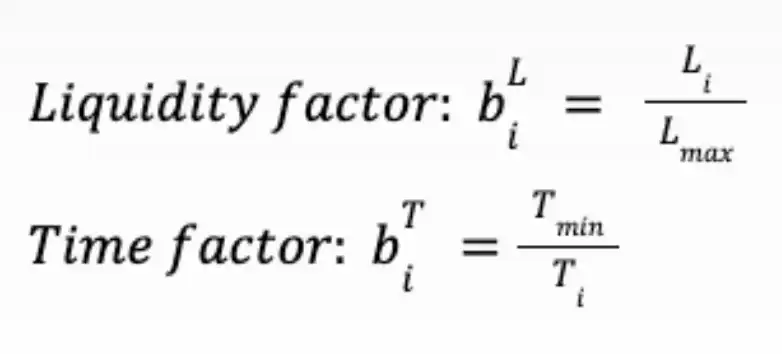

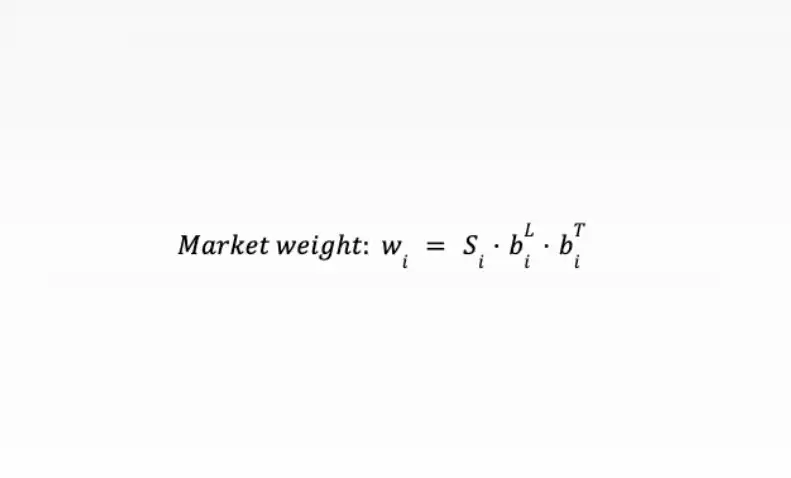

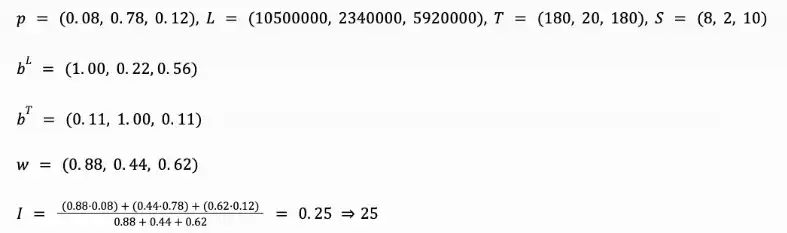

For each market, we have price, liquidity, resolution time, and an importance score. For simplicity, we use a very simple weight calculation formula. Each market's score ranges from 1 to 10 and combines liquidity and time factors:

Suppose we decide to set the scores of the three markets at 8, 2, and 10, then the weight of each market will be:

The final attention value will be:

If we assume the resolution times for these three markets are 180 days, 20 days, and 180 days, with importance scores of 8, 2, and 10 respectively, then combining the above factors will yield:

Of course, there are more complex methods to calculate attention metrics, such as using open interest instead of trading volume, considering related events, adjusting market depth, and nonlinear relationships between variables. We have also created an interactive website for readers to use real-time Kalshi markets to create indices themselves.

The main advantage of this prediction market-based oracle structure is that manipulation behavior has real costs. If a trader goes long on LeBron's attention and wants to manipulate the price upward, they must buy positions in the underlying binary prediction markets. Assuming the underlying markets have sufficient liquidity, this means they need to buy positions at prices that the market considers overvalued.

We believe that as these markets develop, another very important advantage is that binary prediction markets provide spot markets for market makers to hedge. If a market maker shorts the attention index, they can hedge their risk exposure by going long on the underlying prediction market positions that constitute that index.

Adjacent has already created indices using real-time, liquid markets on Kalshi to track political trends, such as the power struggle between Democrats and Republicans, and the New York City mayoral election. We believe similar methods can also be used to track attention on any topic. As prediction markets develop, the set of topics available for constructing attention indices will continue to expand.

Design Space for Attention Oracles

The oracle structure we propose is not without trade-offs. When thinking more broadly about attention oracles, we believe the following aspects are major considerations:

How relevant is the input data?

How feasible is it to obtain this input data?

Is the input data easy to manipulate or game?

What functions do we apply to the inputs to calculate the attention value?

The most obvious trade-off of the oracle we propose is that input data can be difficult to obtain. If you want to build an attention oracle for LeBron James, you must first create multiple liquid prediction markets for various topics related to LeBron. Additionally, these markets must maintain liquidity over time and be promptly replaced by new liquid markets when the original markets resolve or become irrelevant. Therefore, we believe this design is best suited for a few high-attention topics that already have mature prediction markets (such as Donald Trump or Taylor Swift).

Another trade-off is that attention may increase regardless of the outcome of events. For example, even if LeBron does not win another championship, people's attention on him may still rise as they begin to question his performance. There could be widespread discussions about whether he is really getting old or if he is declining in form. Similarly, attention in the real world often flows toward unexpected events, while prediction markets measure the expected occurrence of events. If the market expects LeBron to win MVP but he does not, attention may rise while the index falls. Fans and commentators might discuss whether he was "robbed" of the MVP or whether the selection process was unfair.

The best oracle design may ultimately be a combination of prediction markets, social media data, and other sources. Google Trends recently launched an alpha project that allows developers to access search trend data via API. The internet search volume for a topic is clearly highly correlated with its attention, and since Google Trends filters out duplicate searches, it may be less susceptible to manipulation than social media data. Another source could be using large language models (LLMs) to analyze more easily manipulated inputs and attempt to filter out noise. For example, an LLM could score attention based on headlines from mainstream news media or trending posts on X (formerly Twitter).

We believe that mature exchanges like Kalshi and Polymarket are best positioned to offer Attention Perpetual Contracts, as they already have many liquid underlying markets and users willing to trade in new markets. However, we do not think the opportunities for attention assets are limited to these large platforms.

One configuration could involve vaults trading prediction markets, targeting a specific topic for going long/short. For example, a vault going long on Taylor Swift could purchase "yes" contracts on whether she will have a Top 10 single or perform at the Super Bowl. It would be up to the vault manager to determine which markets are related to rising attention.

Another example is using Hyperliquid's builder-deployed perpetual contracts. HIP-3 provides flexibility, allowing market deployers to customize oracles — a HIP-3 market could use a combination of prices from Kalshi/Polymarket, social media metrics, Google Trends, news headlines, etc.

Attention as an Asset Class

Ironically, the first mature application scenario of the attention economy may emerge in the stock market. Stock prices consist of two parts: DCF value (i.e., intrinsic value) and memetic value.

Historically, most stocks did not have significant memetic value. However, in recent years, thanks to retail trading platforms like WallStreetBets and Robinhood operating 24x5, an increasing number of stocks have begun to exhibit sustained memetic value.

The goal of stock research analysts is to determine the price of a stock. While there are established methods for calculating the DCF portion, how should the memetic value portion be modeled? As more and more assets are traded under the influence of memetic value, developing methods to model memetic value will become necessary. Mature investors are already using metrics like follower counts, likes, and views to gauge market sentiment. Prediction markets and other oracle structures can serve as useful tools for measuring stock attention, thereby building better trading models.

However, the opportunities for attention assets extend far beyond stock pricing. We believe that predicting attention itself is an economically valuable activity. Attention is a leading indicator of consumer preferences and spending. Companies allocate R&D, hiring, and marketing budgets based on the flow of attention. The key is to find new heuristic methods to model these flows.

If you are building attention assets or related infrastructure, feel free to contact us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。