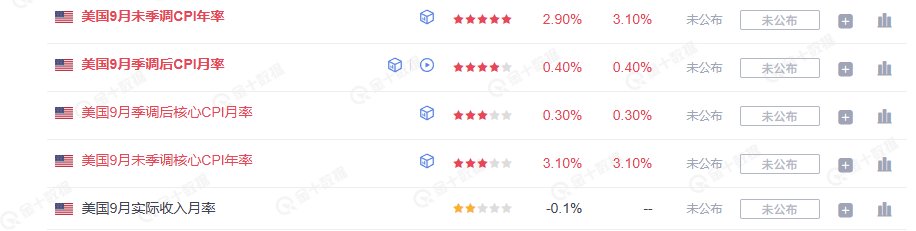

Before the CPI data, the U.S. inflation data for September will be released tonight at 8:30 PM. According to market expectations, the year-on-year rate of broad inflation is expected to be 3.1%, which is a significant increase compared to last month. The Cleveland Fed's expectation is 3.0%, and Nick's expectation is also 3.1%.

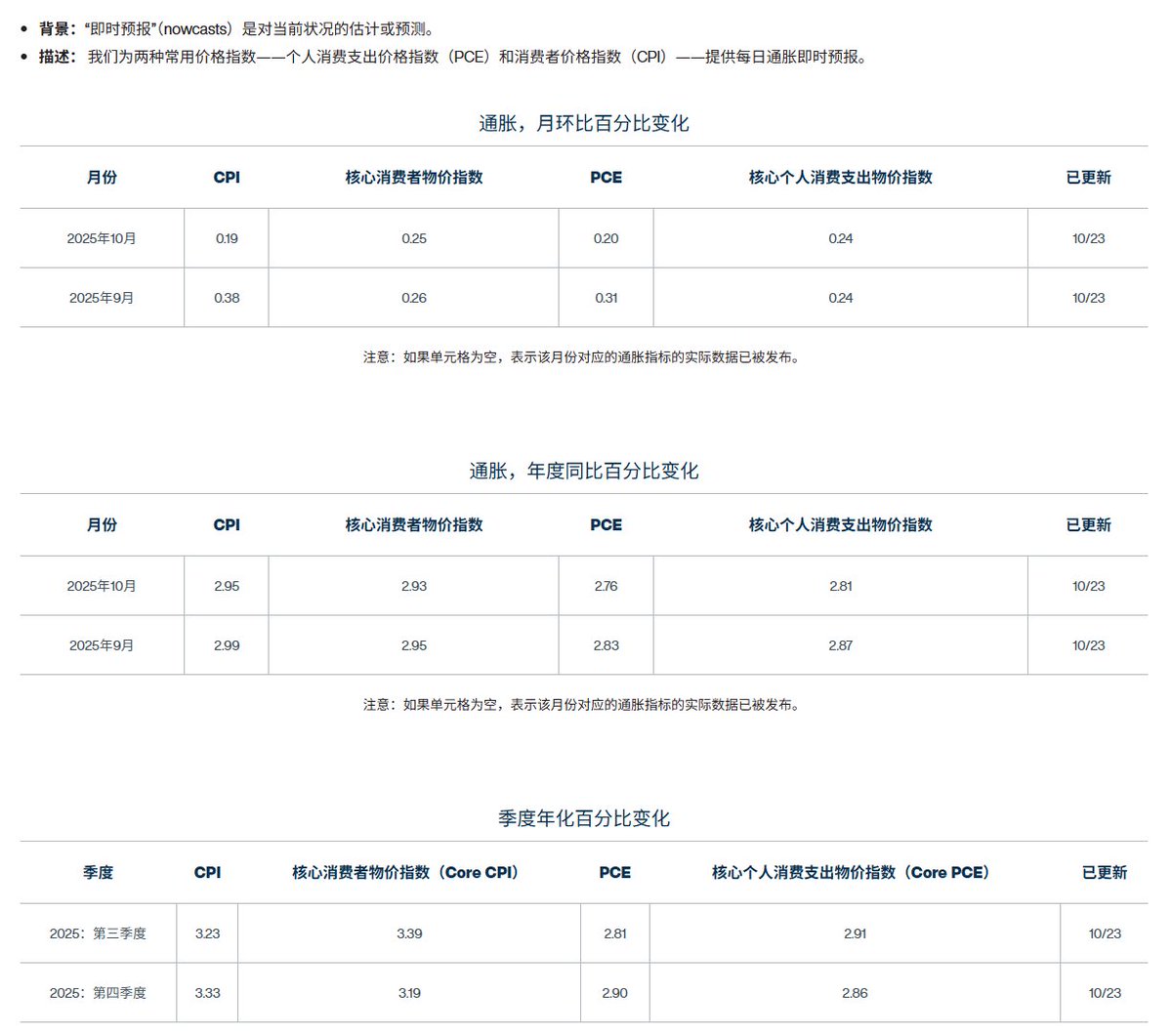

Although inflation is rising, the market interprets this as being due to the new tariffs that started in August, which have led to the increase in inflation. Since tariffs are one-time events (probably), inflation is likely to be one-time as well, which means it may not have a significant impact on the Federal Reserve's policy.

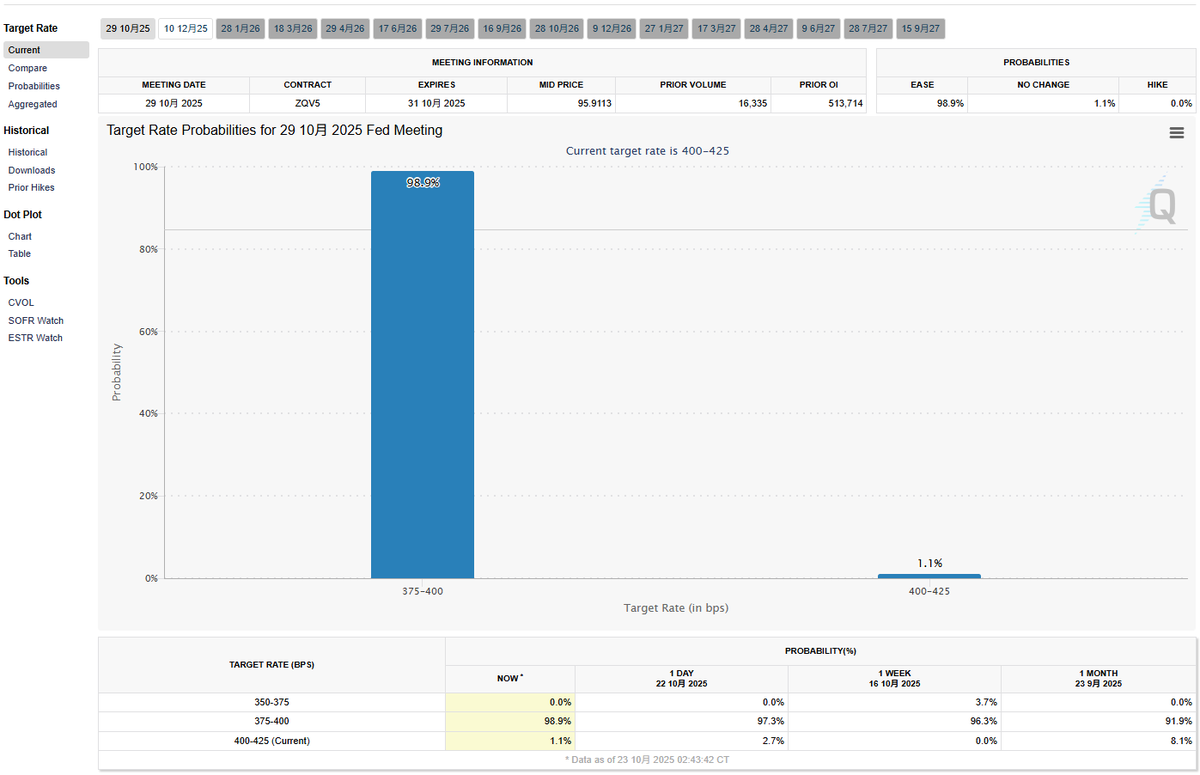

The current focus of the Federal Reserve should be on the labor market, especially during a government shutdown. Although labor data has not been released, it is likely not good. Therefore, based on the current data, the CME's probability of a rate cut in October is 98.9%.

Of course, this data may be adjusted downwards after the CPI data is released, but it is unlikely that the rate cut will be affected. However, if inflation continues to rise, the Federal Reserve may be more cautious about a rate cut in December.

Next is core inflation, with market expectations at 3.1%, the previous value also at 3.1%, Nick's expectation still at 3.1%, and the Cleveland Fed's expectation at 3% (2.95%). Therefore, the CPI and core CPI are likely to meet expectations, and as long as they do not exceed expectations, the impact on the market should be limited.

However, if both inflation data points are below expectations, it will definitely have a positive effect on market sentiment. For example, if both are at 3%, the market will be pleased, as inflation is not that extreme.

We should also pay attention to income data, which represents the current economic and employment situation. Overall, as long as tonight's CPI data is not excessively high, its impact on the market should be limited, and its effect on the October rate cut will also be very weak.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。