Written by: Glendon, Techub News

In the early hours of today, the major news that U.S. President Trump has pardoned Binance founder Zhao Changpeng has once again sparked heated discussions in the industry.

According to insiders, Trump officially signed the pardon on Wednesday. White House Press Secretary Caroline Levitt publicly stated that Trump's action was "an exercise of the constitutional power to pardon Mr. Zhao, who was prosecuted in the Biden administration's war on cryptocurrency." She also emphasized, "The Biden administration's war on cryptocurrency is over."

Regarding this pardon, Trump himself provided a clear reason. He stated that the pardon for Zhao Changpeng was because "he is innocent" and "a victim of persecution by the Biden administration."

Following the announcement of this news, the market reacted quickly and strongly. The price of Binance's platform token BNB surged, reaching as high as $1161.9, with a short-term increase of nearly 8%. Moreover, the price of Bitcoin also broke through the $113,000 mark.

Looking back, in 2023, Zhao Changpeng was convicted for failing to effectively implement anti-money laundering (AML) procedures and was accused by regulatory agencies such as the U.S. Commodity Futures Trading Commission (CFTC) of violating the Bank Secrecy Act (BSA). On November 21 of the same year, Zhao admitted that Binance had failed to implement effective anti-money laundering procedures and subsequently resigned as CEO. At the same time, Binance agreed to pay a hefty fine of $4.3 billion (including $2.5 billion in forfeiture). On April 30, 2024, Zhao was sentenced to four months in prison and was not released until September 27 of the same year.

Upon closer examination of Zhao Changpeng's pardon, while it seems sudden, there were already signs leading up to it, and it was not entirely unexpected.

On September 17, Zhao quietly changed his personal profile on the X platform back to "@binance," removing the previous "ex" prefix. This subtle action immediately sparked speculation in the industry: Is he about to make a full return to Binance and take the helm of this giant in the cryptocurrency field again?

Earlier this year in March, when The Wall Street Journal reported on Zhao seeking a pardon from the Trump administration, Binance co-founder He Yi commented, "Why not try to apply? What if a special pardon really happens? I believe good things will always happen." She even tagged Trump's X account.

Despite ongoing rumors in the industry about Zhao seeking a pardon, it wasn't until early May that Zhao confirmed in a recent podcast that his legal team had submitted a pardon application to Trump on his behalf.

In fact, Trump's pardoning actions in the cryptocurrency field have precedents. Prior to this, he had pardoned several well-known figures in the cryptocurrency space, including Silk Road founder Ross Ulbricht and the three co-founders of BitMEX: Arthur Hayes, Benjamin Delo, and Samuel Reed. Moreover, FTX founder SBF has also been seeking a pardon from Trump.

Before the pardon news was officially announced, the probability of "Trump pardoning Zhao Changpeng in 2025" had already reached 41% on the Polymarket prediction market. In contrast, SBF's probability was only 8%.

It is worth mentioning that in early May of this year, a notable large transaction occurred in the cryptocurrency market. The Abu Dhabi-based investment firm MGX announced it would invest $2 billion to purchase shares in Binance, while the Trump family business World Liberty Financial (WLFI) issued the dollar-pegged stablecoin USD1 as the official stablecoin for completing this investment. The market generally believes that behind this transaction, there is a "shadow" of Binance promoting the use of the WLFI stablecoin USD1, and Binance likely played a key role in it.

Furthermore, reports from Wall Street Journal further pointed out that there are some unspeakable subtle relationships between Binance and the Trump family's cryptocurrency business WLFI.

In June, WLFI announced a partnership with PancakeSwap to enhance the adoption of the USD1 stablecoin. After the partnership was established, the trading volume of USD1 on PancakeSwap significantly increased, experiencing explosive growth and becoming a core engine driving WLFI's profit growth.

In this regard, the media pointed out, "A key fact not disclosed in the partnership announcement is that PancakeSwap was actually created and is continuously supervised by Binance's internal employees. This hidden management relationship means that Binance has actually provided critical infrastructure and market channels for the success of USD1, and all of this has not been fully disclosed to the public."

Because of this, Trump's pardon of Zhao Changpeng has raised many questions, with many believing there is "interest transfer" involved. Despite the ongoing doubts, the cryptocurrency industry as a whole has shown a positive attitude, with many industry figures expressing their congratulations on this matter, indicating that the market actually holds optimistic expectations for regulatory easing in the cryptocurrency industry.

Could Binance Return to the U.S. Market?

On a more significant level, this pardon has profound implications for Binance and the U.S. cryptocurrency market. It removes the legal obstacles faced by Zhao Changpeng personally and Binance, clearing the way for their return to the U.S. market. It is important to note that Binance and its U.S. branch Binance.US have been working hard to repair their relationship with regulators, attempting to reshape their brand image through compliance transformation. This pardon undoubtedly provides an opportunity for Binance's return.

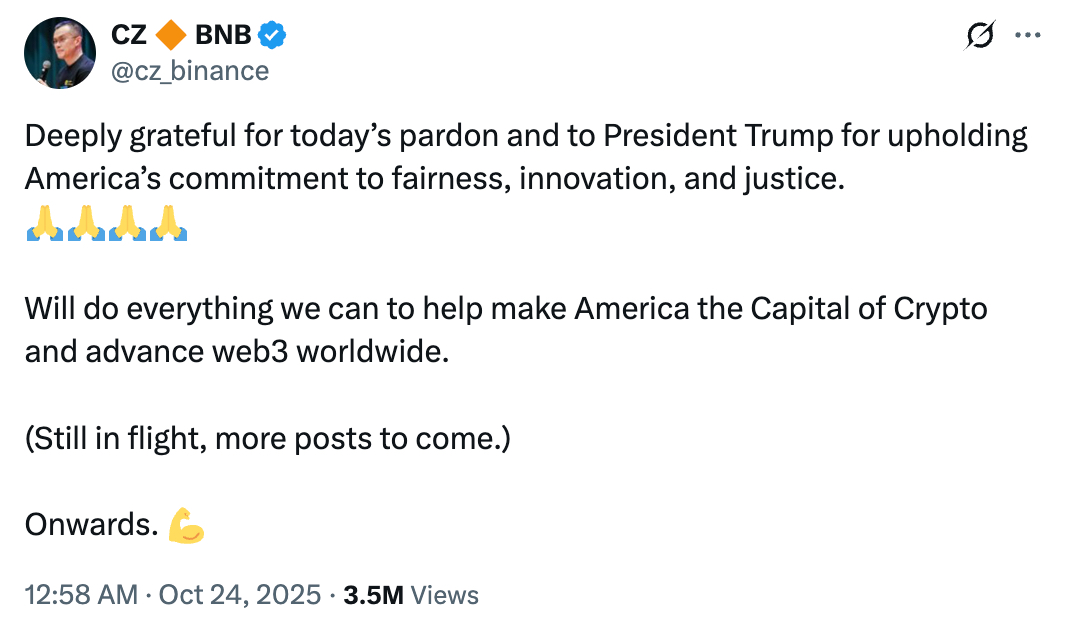

At the same time, Zhao Changpeng and He Yi both posted on social media to thank Trump for the pardon and emphasized their commitment to helping the U.S. become the capital of cryptocurrency. The attitude of the two co-founders of Binance clearly indicates that, freed from regulatory constraints, Binance is very likely to return to the U.S. market.

From market data, Coingecko shows that the market capitalization of Binance's platform token BNB is close to $158 billion, making BNB the third-largest cryptocurrency after Bitcoin and Ethereum, excluding the stablecoin USDT. Moreover, Binance has been deeply involved in various fields of the cryptocurrency market for many years. As the largest cryptocurrency exchange in the world, resuming operations in the U.S. would undoubtedly bring more liquidity to U.S. investors and inject more competitive vitality into the U.S. cryptocurrency market, potentially even completely changing the existing market game rules and reshaping the market landscape.

Additionally, from a macro perspective on industry development, this pardon serves as an industry barometer, seen as a signal of the Trump administration's relaxation of cryptocurrency regulation, once again reflecting the openness of regulation, which may attract more cryptocurrency companies to develop in the U.S.

It is noteworthy that the formulation of U.S. regulatory policies is still progressing in an orderly manner. Coinbase CEO Brian Armstrong revealed today on the X platform that although the U.S. government is currently in a shutdown, the market structure bill is "90% finalized," and all parties are working to determine the final 10%, with expectations for smooth passage by the end of the year. This statement acts like a "shot in the arm," undoubtedly bringing positive signals to the regulatory framework of the U.S. market.

As the regulatory environment becomes increasingly clear, how will the competitive landscape in the cryptocurrency field change if Binance returns to the U.S. market?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。