Original | Odaily Planet Daily (@OdailyChina)

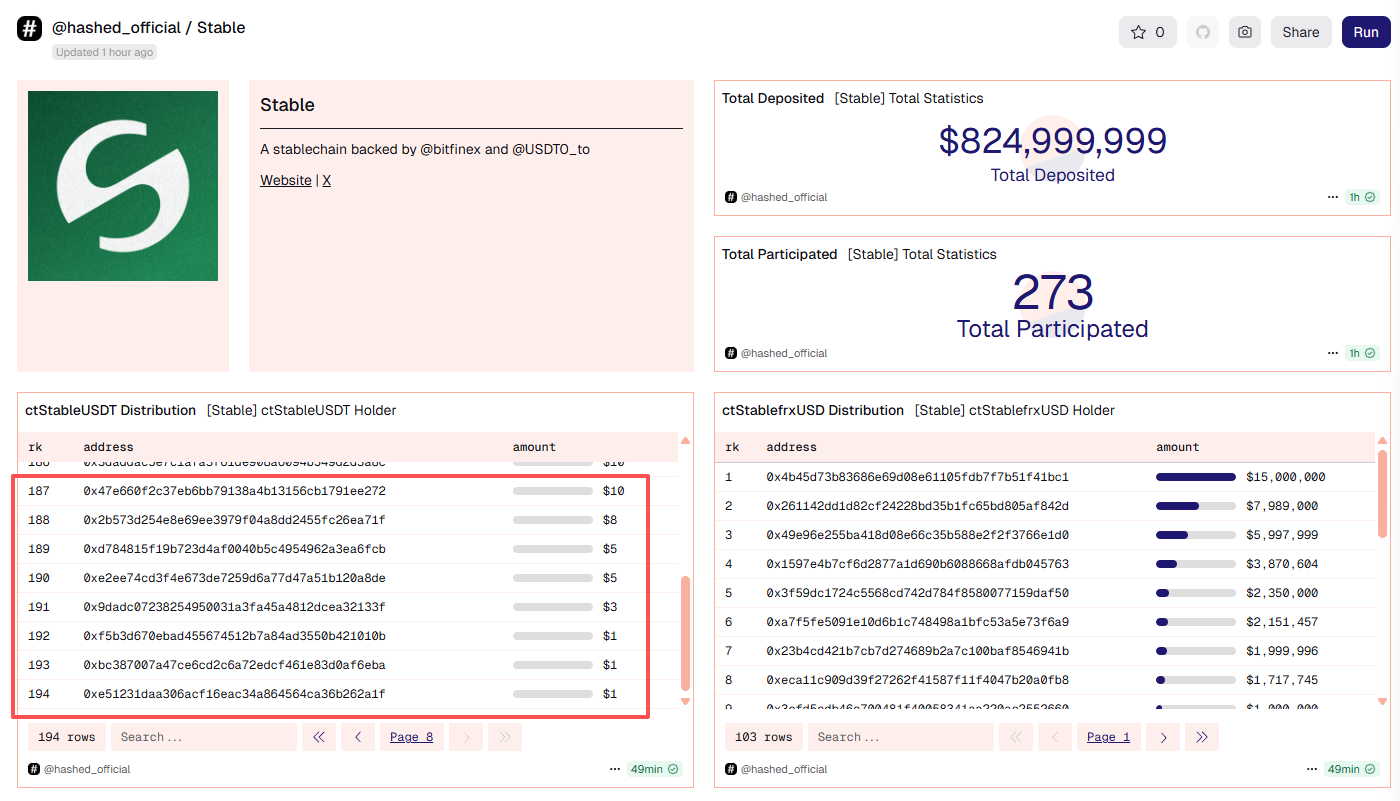

Recently, the community has been buzzing about the project Stable, which announced this morning on the X platform that its pre-deposit activity's first phase has reached the $825 million cap.

“What? I turned on the notifications, and as soon as I opened the page, there were no funds left?” — This is the reality for many users who tried to participate at the first opportunity this morning. Below, Odaily Planet Daily will take you through the Stable project and review the entire process of “$825 million in pre-deposits disappearing in seconds” this morning.

Stable: A Layer 1 Public Chain Designed for USDT

Stable is a high-performance Layer 1 public chain specifically built for USDT, aiming to provide a fast, low-cost, and low-latency stablecoin trading network. Unlike general-purpose public chains, Stable focuses on the payment and settlement functions of USDT, hoping to provide a cash-like user experience for USDT on-chain, suitable for scenarios such as cross-border payments, e-commerce payments, and corporate settlements.

In terms of technical design, Stable adopts an independent public chain architecture, supports EVM compatibility and sub-second transaction confirmations, and plans to launch a gas-free USDT0 transfer model, providing institutions with exclusive block space and compliant privacy transaction support. These features aim to lower the barriers for enterprises and end-users to use blockchain payments and enhance the efficiency of stablecoin transactions. The core technical framework of the project has been largely completed, but the launch dates for the testnet and mainnet have not yet been announced.

It is worth mentioning that Stable has received investments from well-known institutions including Bitfinex, Hack VC, and Franklin Templeton, and has the official endorsement of Tether, with Tether CEO Paolo Ardoino publicly supporting the project. These funds are primarily used for network infrastructure development and the global expansion of the USDT payment ecosystem.

Stable's Pre-deposit Activity Faces Scrutiny

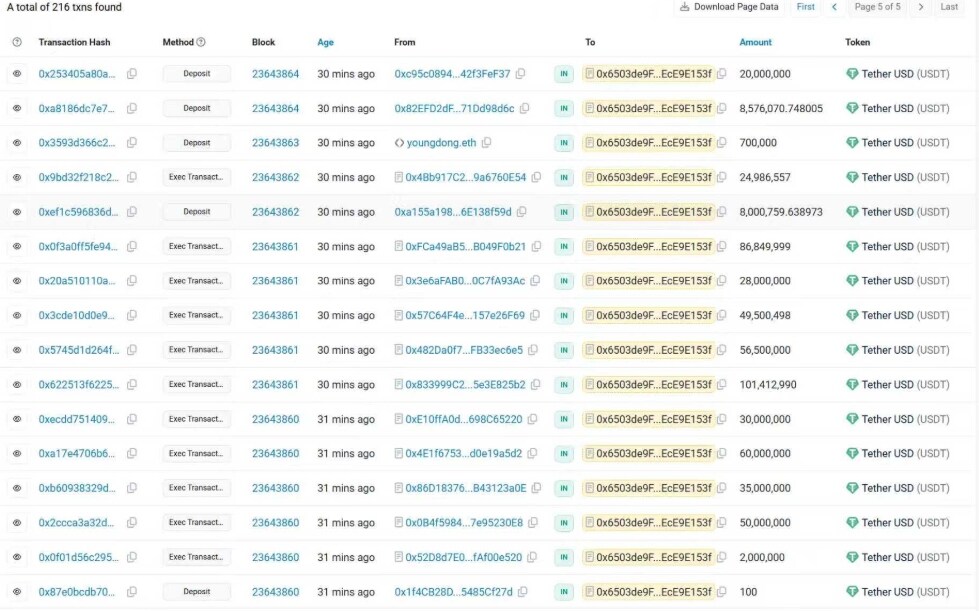

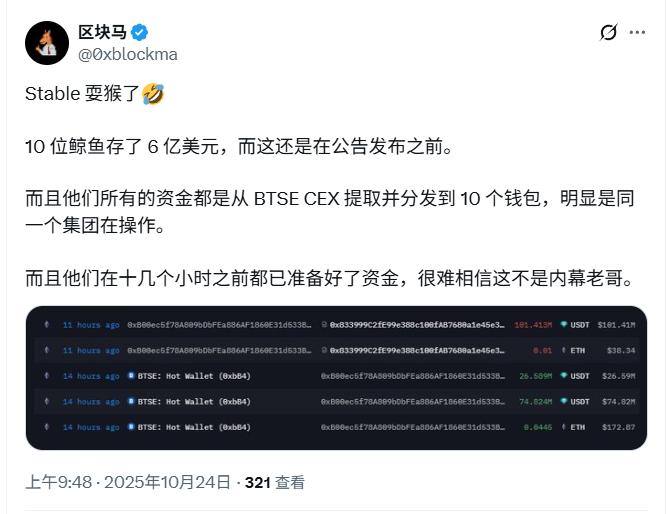

The first phase of Stable's USDT pre-deposit activity quickly sparked significant controversy, with many community users questioning the existence of serious “insider trading” operations. According to the official timeline, Stable officially tweeted to announce the opening of pre-deposits at 9:10 AM Beijing time, but on-chain data shows that funds were already deposited as early as 8:48, which is clearly inconsistent with the official timing.

Multiple addresses with large funds participated before the official announcement of the pre-deposit activity.

On-chain data indicates that of the $825 million pre-deposit cap, $700 million had already been “reserved” before the public announcement. Among them, 10 whale addresses collectively deposited about $600 million USDT, and all funds came from the same wallet address, which were split and filled the cap within 10 seconds. Further analysis revealed that these funds were all withdrawn from BTSE CEX and then dispersed into different wallets to participate in the pre-deposit, suspected to be operated by the same capital group. Additionally, these addresses had prepared and arranged their funds several hours before the activity started, further fueling community dissatisfaction.

Before the pre-deposit activity, 10 whale addresses with the same source of funds collectively deposited 600 million USDT.

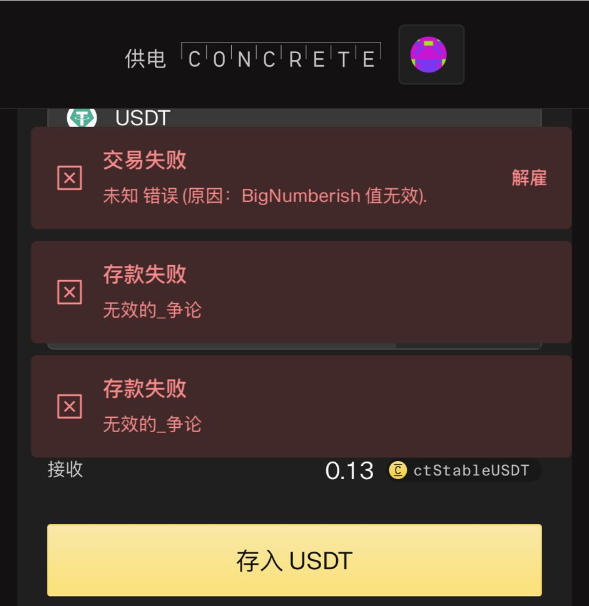

In contrast, ordinary users had almost no opportunity to participate. Many users reported that upon entering the official website at the first opportunity, they either faced authorization failures or their transactions could not be packaged for a long time. By the time they saw the official tweet, only 0.13 USDT was left available for deposit on the page, which seemed to indicate a small amount of capacity, but in reality, retail investors could hardly participate.

Community feedback: After the official tweet, the deposit page only had 0.13 USDT available for deposit.

According to Dune data, the total of $825 million in the pre-deposit activity actually had only 273 addresses participating, with the participation rate of ordinary users being almost negligible. More notably, among all participating addresses, nearly 40 addresses had deposit amounts below 500 USDT, with some even showing deposits of 1 USDT, 3 USDT, 5 USDT, or dozens of USDT, leading the community to sarcastically claim that these small addresses were merely props to inflate the numbers, lacking any real sense of participation.

Overall, the first phase of Stable's $825 million pre-deposit activity quickly reached its cap, but community sentiment was very negative, being described as “epic insider trading” and “a pre-sale predetermined in advance.”

Summary

“Criticism aside, profits are still to be made.” Although Stable's first phase of the pre-deposit activity faced significant controversy due to serious “insider trading” issues, considering the backing from Tether and support from leading capital, the project still possesses strong market influence and ongoing tracking value.

What is more worth paying attention to next is the pre-deposit activities related to centralized exchanges, especially whether Binance will launch deposit or participation activities for Stable. Previously, Binance had launched a deposit activity for Plasma (XPL), with a personal deposit cap of up to $100,000 in the first phase, and subsequent batches could also deposit up to $50,000. Since it involved depositing stablecoins, with no principal loss, the annualized returns from selling the proceeds immediately after XPL's launch reached as high as 79%, making it one of the highest-yielding projects on CEX this year.

From this perspective, Stable remains a high-priority project to watch, and while on-chain activities may have been consumed by large funds, the CEX phase may be the window for ordinary retail investors to participate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。