Market Rebalancing: Derivatives Return to the Core of the Industry

The cryptocurrency market in 2025 is undergoing a deep restructuring. Since the sweeping liquidation wave on October 11, over $40 billion in cumulative leveraged positions have been forcibly liquidated, prompting the market to reassess the balance of "risk, transparency, and efficiency." Derivatives have returned from being marginal speculative tools to the core of market pricing, becoming the foundational layer of the entire trading system.

According to data from CoinGlass and Kaiko, derivatives trading volume now accounts for 71% of the total cryptocurrency market, with an annualized scale exceeding $10 trillion, an increase of nearly 20 percentage points compared to 2023. Binance, OKX, and Bybit still control about 60% of the market, but the focus is shifting downward.

Second-tier trading platforms such as Gate, Bitget, and LBank recorded significant growth in the third quarter of 2025, with LBank's contract trading volume increasing by 92% month-on-month, making it one of the fastest-growing exchanges in the mid-tier segment.

This trend indicates that the logic of market competition is undergoing structural changes. Traders are no longer solely pursuing liquidity and leverage but are beginning to seek platforms that offer "both high performance and robustness." Platforms like LBank are becoming representatives of this realistic path with their stable architecture and clear risk systems.

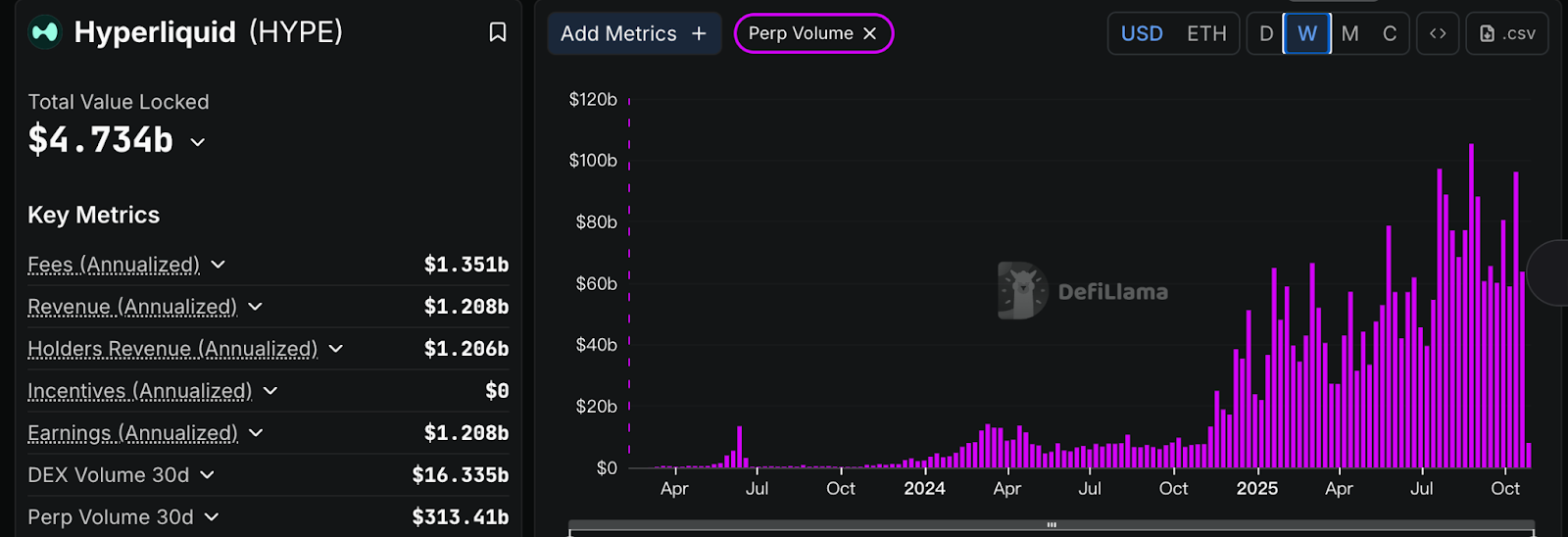

At the same time, decentralized derivatives protocols are forming a second growth pole. Hyperliquid achieves high transparency matching with a fully on-chain order book (on-chain CLOB), while Aster combines a self-consensus chain with off-chain matching, balancing performance and verifiability. The rise of these two models has created a multi-polar landscape in the derivatives market, where centralized efficiency coexists with on-chain transparency.

Mechanism Comparison: Balancing Centralized Performance and On-Chain Transparency

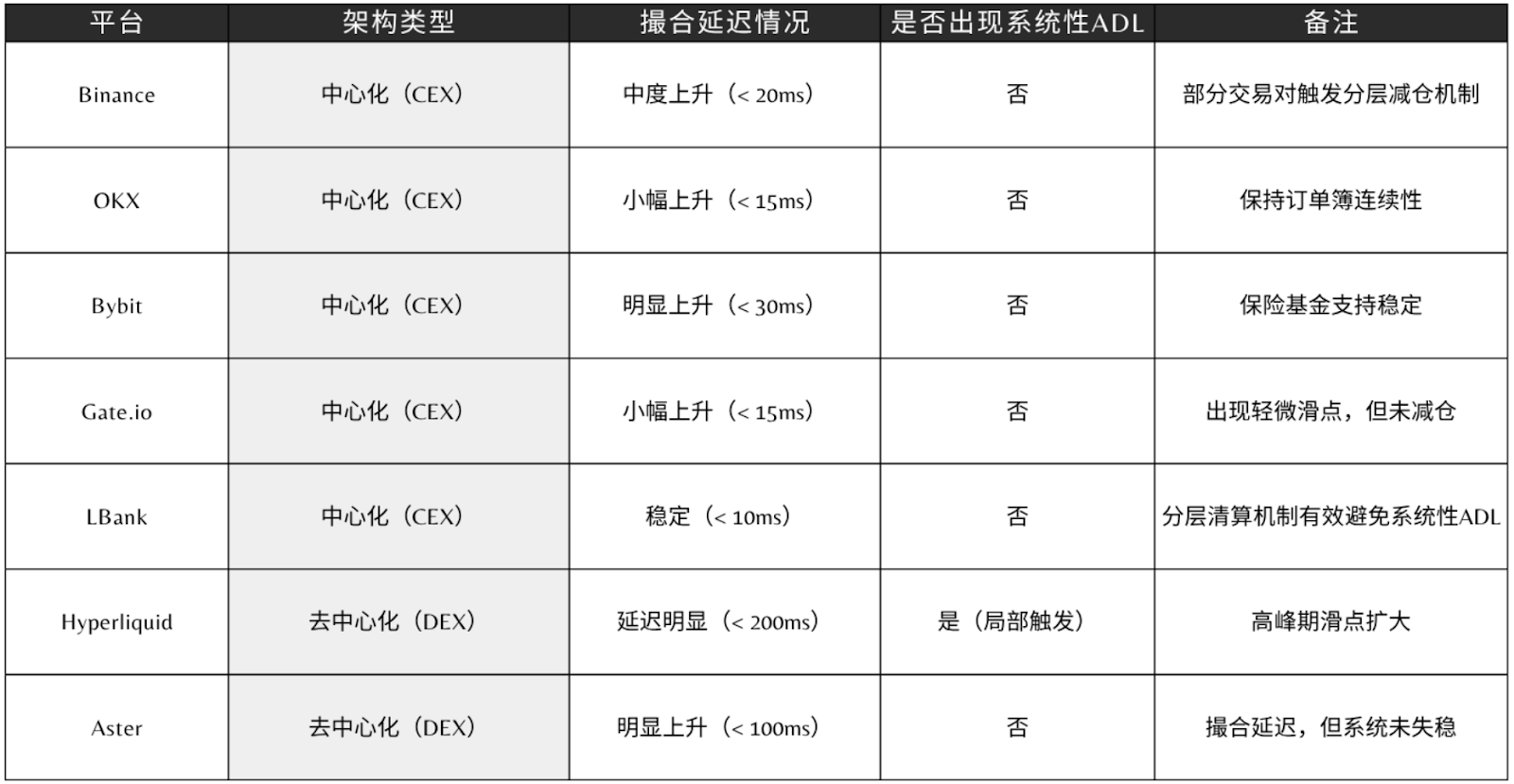

The liquidation wave on October 10-11, 2025, became a true test of the resilience of the derivatives system. According to CoinGlass data, approximately $19 billion in leveraged positions were liquidated globally within 24 hours on that day, marking the largest single-day scale in nearly three years.

In extreme market conditions, derivatives platforms with different architectures exhibited vastly different pressure responses:

Centralized platforms rely on mature matching systems and layered risk control mechanisms, maintaining high execution efficiency and liquidity during severe volatility, with the liquidation process typically completed within seconds, avoiding larger-scale chain liquidations. However, the shortcoming of this architecture lies in insufficient transparency, making it difficult for users to directly verify the specific processing logic of the system under extreme conditions.

Decentralized platforms, on the other hand, are characterized by openness and transparency, with all trading and settlement records being traceable, providing more credible risk control. However, their performance is limited by block throughput and gas costs, leading to issues such as delays, slippage, and even untimely oracle updates during extreme market conditions. Transparency brings trust but also imposes technical constraints.

Between these two models, an increasing number of platforms are opting for a compromise solution of "elastic centralization": core matching and liquidation remain centralized to ensure performance, while key risk nodes are auditable on-chain to enhance verifiability. This structure is not perfect, but it is more balanced in the real market environment and has become a gradually accepted direction in the industry.

LBank's risk control practices are a microcosm of this trend. In March of this year, the platform established a contract risk protection fund totaling $100 million to address user losses caused by system anomalies or price "spikes." In the event of abnormal fluctuations leading to forced liquidations or stop-loss losses, the platform will compensate users at 120% of their loss amount and proportionally distribute additional airdrops to all users with open positions. The core of this mechanism is to establish a risk safety net and a trust recovery path, introducing a quantifiable accountability mechanism into the centralized architecture, reflecting the institutional exploration of risk governance by exchanges.

Trading Experience: Balancing Leverage and Depth

The quality of the derivatives trading experience depends on two dimensions: execution speed and market depth.

CEX Model: High Performance and Centralized Risk Coexist

In the centralized trading model, mainstream platforms such as Binance, OKX, Bybit, and LBank rely on centralized liquidity pools and professional market-making systems to build a matching network with ultra-low latency and high throughput.

Their order matching latency is typically less than 10 milliseconds, supporting institutional-level high-frequency trading and large-scale liquidations. At the same time, exchanges maintain market stability and continuity during extreme conditions through layered risk engines, insurance funds, and ADL (automatic liquidation) mechanisms.

The hidden concern of this centralized architecture is single-point vulnerability: when a core matching node or liquidation engine fails, the matching and liquidation system may become instantly unbalanced, leading to a sharp drop in market depth and obstructed order execution.

DEX Model: Redistribution of Efficiency and Trust

In contrast, the DEX model represented by Hyperliquid and Aster shifts trust from institutions to code. In Hyperliquid's fully on-chain order book model, every order and transaction can be verified on-chain; Aster achieves high-performance matching at the main chain level, but some settlements still rely on off-chain nodes.

Kaiko data shows that the mainstream trading pairs (BTC/USDT, ETH/USDT) of OKX, Binance, and LBank have a 1% depth exceeding ten million dollars, while Hyperliquid and Aster have on-chain depths for similar pairs that are only one-tenth of that. This means that during severe volatility, CEX can provide more stable transaction prices. The main trading pairs of Binance, OKX, and LBank all demonstrate robust liquidity depth, providing more reliable price support for the market.

Leverage flexibility is also one of the core differences. Platforms like LBank and MEXC offer leverage up to 200 times, equipped with insurance funds and automatic liquidation mechanisms to control risk; Hyperliquid's leverage limit is about 50 times, which systemically restricts the contract risks associated with excessive leverage.

Product Innovation: From Leverage Competition to Ecological Competition

The focus of competition in derivatives is shifting from "single leverage efficiency" to "ecological experience." Major platforms are attempting to establish a more robust capital cycle and behavioral loop among different tiers of user groups.

Binance builds a strategy ecosystem through the Web3 wallet Alpha, OKX expands structured yield spaces, and Bybit enhances capital utilization with a unified margin system. Mid-sized platforms are also exploring new directions in product mechanisms and user incentives. LBank combines the Meme section, BonusPro reward program, and points system to create an ecosystem of "trading as incentive," making the trading process both participatory and sustainable.

After the market's severe fluctuations on October 10-11, several exchanges quickly launched compensation and incentive plans to stabilize user confidence and restore market activity.

- Binance was the first to announce a compensation plan totaling $283 million to cover losses caused by collateral asset decoupling and settlement delays, and added a $400 million "peer initiative" trust rebuilding plan, with $300 million allocated for issuing USDC vouchers and system compensation to users who suffered significant forced liquidation losses, marking a symbolic event in crisis response.

- Bitget continued to promote its multi-period contract leaderboard to maintain trading enthusiasm;

- Bybit launched the 0G Launchpool, autumn trading battle, and a $5 million welcome reward plan to expand user incentive coverage;

- OKX stabilized traffic and retention through referral bonuses and USDG recharge activities.

- LBank launched the "Million Guardian" event with a total prize pool of $1 million in mid-October and initiated a special subsidy plan for users who incurred losses during the market on October 11, providing additional support and compensation to affected users, helping them rebuild confidence and return to the market steadily after extreme conditions.

Innovation in decentralized derivatives is focused on underlying mechanisms. Hyperliquid builds an on-chain reputation points system, while Aster explores options and cross-margin structures, bringing traditional financial logic into smart contracts. These designs enhance the composability and autonomy of the protocols but also increase operational thresholds and complexity in capital management.

Overall, DEX emphasizes mechanism transparency and algorithmic autonomy, while CEX maintains dominance through a more complete product experience, capital efficiency, and risk control. For institutional investors, the verifiability of on-chain protocols is attractive; for ordinary users, the advantages of centralized platforms in performance, security, and service systems remain more practically significant.

The Reconstruction of Trust and Systematic Competition

The evolution of the derivatives market is essentially a reconstruction of the trust system.

From the collapse of FTX to the rise of Hyperliquid, from Binance's institutional transformation to LBank's hybrid innovation, the market focus is shifting from scale expansion to competition over mechanism credibility. Future exchanges will no longer just be tools for matching orders but will become complex financial systems that coordinate trust, risk, and returns. In this new system, CEX, DEX, and Hybrid represent three trust logics:

CEX (Binance, OKX, Bybit, Bitget, LBank) relies on centralized clearing networks, emphasizing performance, stability, and compliance safety; DEX (Hyperliquid, Aster, Aevo, dYdX) centers on transparency and autonomy; the Hybrid model balances performance and verifiability between the two.

The boundaries among the three are gradually blurring: CEX introduces on-chain audits to pursue transparency, while DEX leverages professional market makers to enhance liquidity. New platforms like LBank are finding practical points between the two through hybrid architectures, pushing the derivatives market into a new stage where performance and trust coexist.

The future world of derivatives will no longer belong to a single model but to an era of coexistence of efficiency, transparency, and mechanisms. Binance and OKX remain the cornerstones of global liquidity, Hyperliquid and Aster push the boundaries of transparency, while emerging platforms like LBank reshape market order through pragmatic innovation, defining a new trading order for the new cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。