Discussing spot ETFs is quite interesting. First, let me answer the question from @TJ_Research01. In fact, I have conducted a large amount of backtesting data as part of my investigation, and I found that in most cases, the data from spot ETFs for both $BTC and $ETH does not have a significant correlation with the price trends of spot Bitcoin and Ethereum.

Yes, this is the case in most situations. Only in very rare instances can we feel that the buying volume of spot ETFs is driving the spot prices. The most obvious example is the ETH spot ETF in July and August, where there was an exaggerated net purchase of nearly 2.5 million ETH over two months. It’s worth noting that by the end of August, all U.S. institutional holdings of ETH were just under 6.6 million.

Moreover, we cannot only look at the primary market; we also need to consider the secondary market. In particular, the secondary market for $ETHA experienced the largest trading volume in history during July and August. The trading volume of ETHA alone exceeded that of ETHUSD on Coinbase and even matched more than half of Binance's trading volume. One can only imagine.

The price trend and trading volume of BlackRock's ETH spot ETF $ETHA.

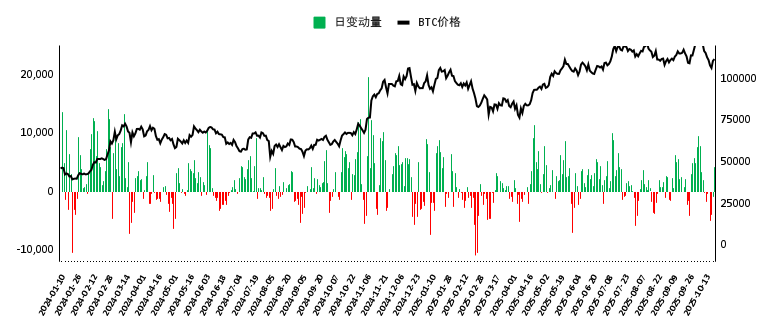

Then, the BTC spot ETF is expected to explode in 2025, with two significant occurrences. One was at the beginning of the year, due to expectations that Trump's administration would lead to a strategic reserve of BTC, so there would be more activity. The second was a small-scale explosion from April to July, but the volume was not very large.

By September, there were slight signs of an explosion, but it was quickly extinguished by Trump's remarks. The volume was just mediocre, and similarly, from the secondary market of $IBIT, the gap compared to BTC's spot trading volume is still quite large, and it is not comparable to mainstream exchanges.

The net flow and price trend of the BTC spot ETF.

The purchases of ETFs are mainly done by APs, and APs may not necessarily buy from the spot market of exchanges, which also weakens the impact of ETF purchases on spot prices. Therefore, from the perspective of spot ETFs, the impact on spot prices is not significant in most cases.

Additionally, spot ETFs can be divided into three groups:

The first group is BlackRock, whose investors are very active in buying and can occasionally synchronize with spot prices.

The second group includes Fidelity, Grayscale, and ARK. The latter two institutions are somewhat reluctant, mainly Fidelity. Fidelity's investors are very sensitive to price and often exhibit emotional trading behavior, usually buying after prices rise and selling after prices fall.

The third group consists of sentiment-driven investors, which includes everyone else besides the four mentioned above, and their data can generally be ignored.

These three groups of data also indicate that only the buying volume of BlackRock's investors has a positive correlation with price trends. For others, including Fidelity, the basic correlation is lagged by one day, which is why I mentioned chasing highs and cutting losses.

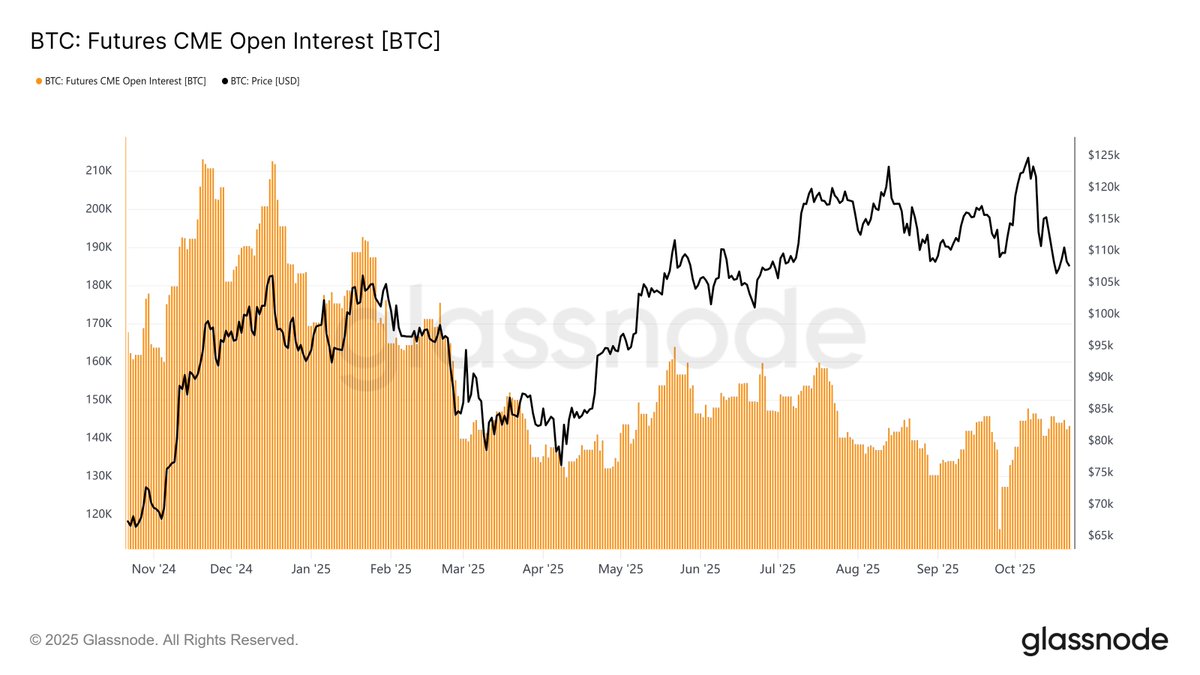

Then, regarding the comparison between CME and spot ETFs, I also communicated with Brother Wu @qinbafrank at noon. My personal view is that CME data cannot represent all spot ETF data, and we cannot simply use the difference to derive the non-hedged value of BTC spot ETFs. Of course, it can serve as a reference for maximum values.

From the perspective of CME's open contracts, aside from a few times with significant fluctuations, the usual volume is around 140,000 BTC, while the holdings of U.S. spot ETFs alone are 1.35 million BTC. In fact, the net increase in BTC spot ETF holdings from January 1, 2025, to now is about 160,000 BTC. It shouldn't be appropriate to compare the net increase in spot ETF data from 2025 with CME's total data. If a comparison is to be made, it should be between CME's total data and the total amount of all U.S. spot ETFs.

Overall, my personal view is that the data from spot ETFs has very little impact on spot prices most of the time. However, this portion of capital represents real buying, whether as a hedge or as a reserve, which genuinely reduces the circulating supply in the market and decreases the quantity that might circulate on exchanges. Moreover, the stock of spot ETFs continues to increase, while the selling volume remains relatively low, effectively locking in liquidity.

Of course, these are just my personal views and may not be correct. I warmly welcome discussions with friends on this topic.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。