I don't know if Trump is very disliked (probably so) when others say he is always TACO. This time, his attitude towards China has changed a lot. At first, when everyone thought the increase of tariffs by 155% was a crisis, he came out and said he didn't really want to impose high tariffs on China. When the market had already anticipated that there was no problem, he then said he was prepared to raise tariffs on China again, and then mentioned he was ready to meet Xi Jinping, triggering expectations of TACO.

Next, today he announced again that he is considering export restrictions on software to respond to China's restrictions on rare earth exports. Although it's just a consideration, it is likely to trigger a new round of statements from China, and then it will be uncomfortable again. Well, anyway, many things will be revealed next week, including the Federal Reserve's interest rate meeting, China's tariff increases, and even the progress of the government shutdown.

From the current CME data, the probability of the Federal Reserve cutting interest rates in October has reached 99%. In the face of the labor participation rate decline caused by the current shutdown, the Federal Reserve should still lean towards cutting rates. However, it is hard to say for December, as the inflation issue still needs to be monitored with more data. After all, monetary policy is currently the main narrative in the U.S., and as long as this line can maintain a loose environment, it can be expected.

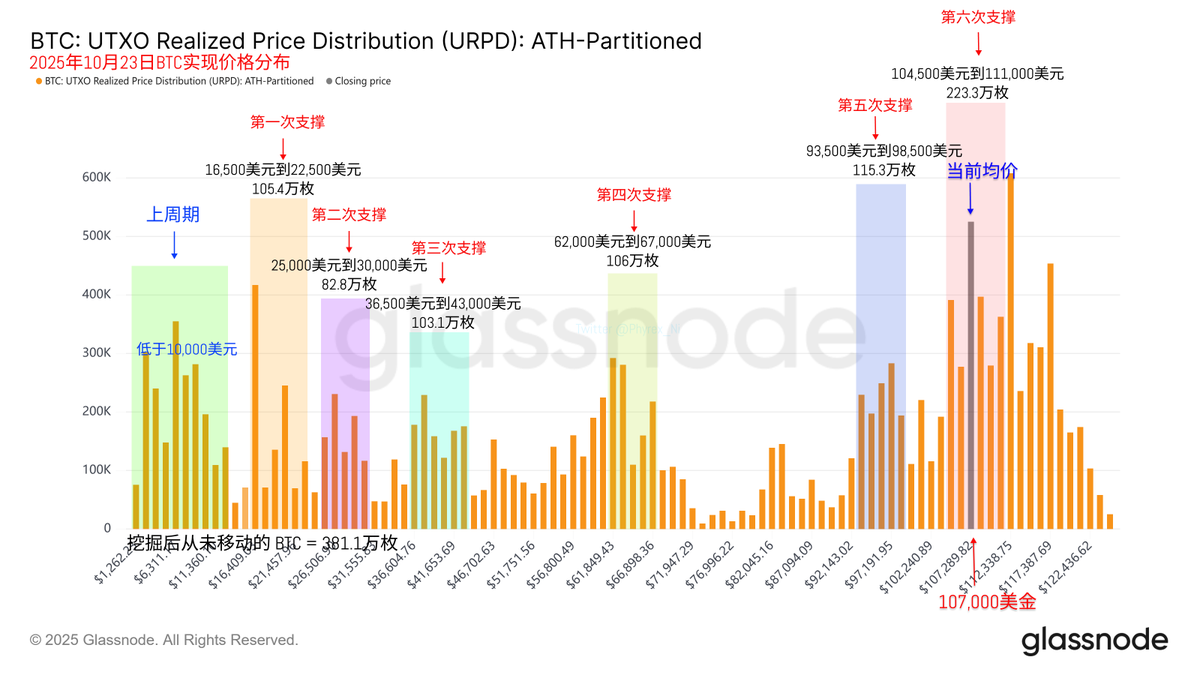

Looking back at Bitcoin's data, the turnover rate has suddenly increased significantly, indicating that panic has emerged in the market. Investors with a holding cost above $100,000 have faced setbacks, but the ones selling the most are still those who bought in the last two days, especially those who bought at a loss. They originally thought Trump was TACO, but they continue to be suppressed by Trump's successive statements.

To be honest, although I think a rate cut at the end of the month is highly likely, the days before the cut may not be too pleasant, especially since Trump likes to stir things up around the time the U.S. stock market closes on Fridays. Although it doesn't harm the U.S. stock market much, it has a significant impact on cryptocurrencies. There will also be CPI data released on Friday, and a rise in CPI is also highly probable, which might dampen market sentiment.

However, from the URPD data, investors' resistance awareness is still quite strong. There are still many investors buying between $104,500 and $111,000, but the selling pressure is not very large, and the support level is quite stable. In fact, $111,500 is currently the price level with the most BTC held, and no collapse has been observed for now.

Most investors' sentiment is still manageable. The main expectation should still be on the rate cut at the end of the month.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。