Original | Odaily Planet Daily (@OdailyChina)

In one day, there were two instances of "chart door" market conditions.

As professional trader Eugene said, the crypto market is at a hellish level of difficulty, and even excellent traders are likely to fall victim to repeated "harvesting."

First, let's take a look at the market data. BTC surged to $114,000 before plummeting, currently reported at $108,260, with a 24-hour decline of 1.85%; ETH dropped from $4,110 to $3,850, a decrease of 2.73%; SOL is currently at $186, down 0.98%; BNB is reported at $1,062, down 3.13%. (If we ignore the process and just look at the daily decline, it’s not particularly impressive recently.)

In terms of derivatives data, in the last 24 hours, the total liquidation amount was $772 million, with long positions liquidated at $298 million and short positions at $261 million. The largest single liquidation occurred on Hyperliquid - BTC-USD, valued at $14.4539 million.

In yesterday's market, the word "fair" seemed particularly cruel—both bulls and bears were wiped out.

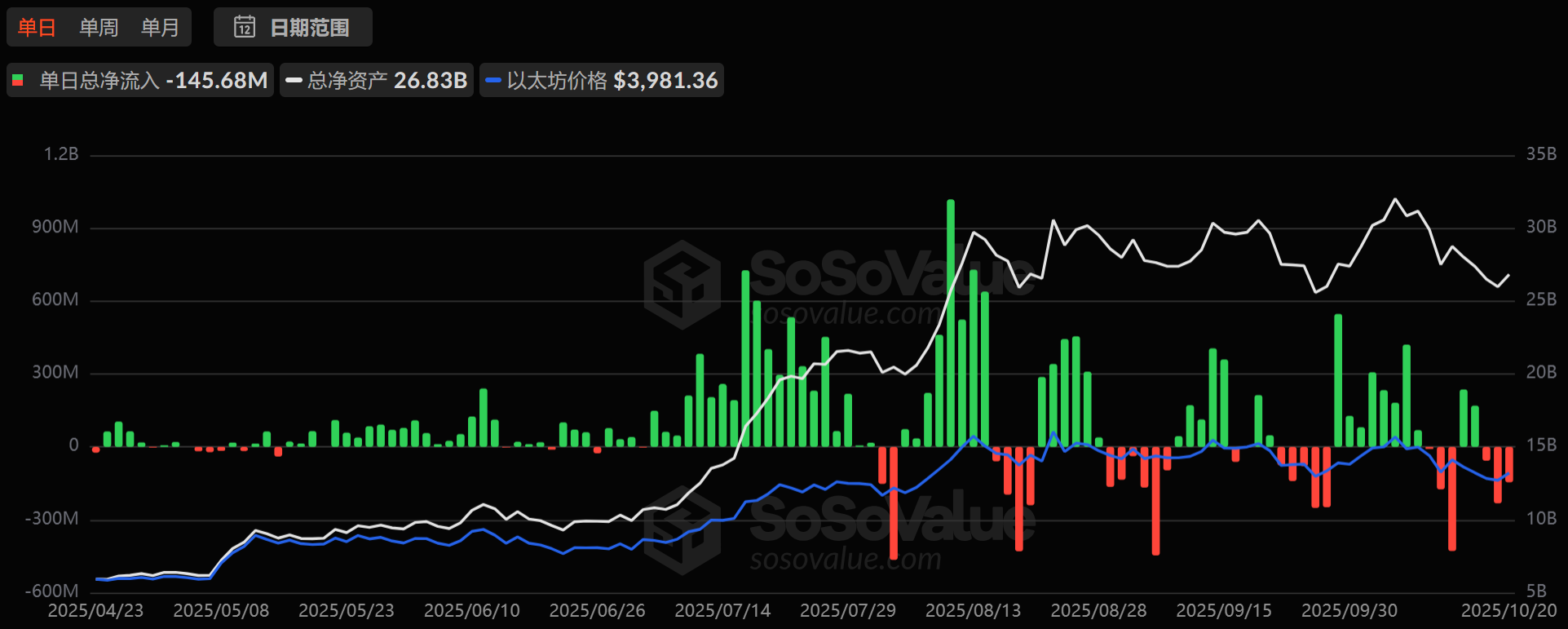

ETF capital inflows have also begun to cool. After the BTC spot ETF "storm of capital absorption" last week, it has recorded net outflows for four consecutive days; the ETH spot ETF has seen relatively weak net inflows recently and has recorded net outflows for three consecutive days.

According to Glassnode data, Bitcoin's open interest has decreased by about 30%, indicating that excessive leverage in the market has been significantly cleared. The funding rate is approaching neutrality, which means the probability of triggering another "liquidation waterfall" in the short term has significantly decreased.

Macroeconomic Script: Gold Plummets, Is the Russia-Ukraine Conflict Coming to an End?

On the macro level, what script is the crypto market holding onto yesterday?

Masamichi Adachi, Chief Japan Economist at UBS Global Research, stated that the Bank of Japan is "very likely to raise interest rates" in the coming months. He pointed out that Japan's real interest rates remain negative, indicating that the financial environment is still too loose. Inflation expectations continue to rise to the 2% range, making the argument for "exit from easing" increasingly firm. UBS expects the Bank of Japan to raise rates by 25 basis points in January, but does not rule out the possibility of an earlier action in December.

Last night, spot gold plummeted by 6%. After reaching a high of $4,381 per ounce on Monday, the price dropped sharply to $4,082 on Tuesday, marking the largest decline in over 12 years. At the same time, market news indicated that Europe and Ukraine are reportedly ready with a 12-point plan to end the Russia-Ukraine conflict. Meanwhile, U.S. President Trump stated that a meeting with President Xi might not take place. This caused the market to turn sharply downward again.

This series of events allowed the market to complete the entire process from "reversal" to "plummet" in just a few hours. It truly confirms a saying in the community: A thorough analysis is as fierce as a tiger, but the rise and fall depend entirely on Trump.

Currently, the only hope the market can cling to may be—interest rate cuts. According to a Reuters survey of economists conducted from October 15 to 21, the Federal Reserve is highly likely to cut rates by 25 basis points next week and in December. CME's "FedWatch" data also shows: the probability of a rate cut in October is as high as 99.4%, and the probability of a cumulative 50 basis points cut in December is 98.6%.

However, there are still sharp disagreements regarding the interest rate level by the end of next year—this means the market has not truly found direction.

"The Star" Trader

Currently, the only true trading star in the crypto market is the "10.11 Insider Whale," who has once again taken a 10x short position on BTC. The current short position is valued at $227 million, with unrealized profits exceeding $5 million, liquidating at $123,271.

Another trader serves as a cautionary tale. A hacker who previously lost $8.88 million in ETH trading chased the market again last night, buying 7,126.74 ETH at an average price of $4,020 (total value of about $29.03 million), and woke up to an unrealized loss of over $1 million. Analysts joked, "Spending money that isn't yours doesn't hurt as much."

Market Opinions

Matrixport: Bitcoin Hits 21-Week Moving Average, Market Focuses on Key Technical Levels

Matrixport released a chart stating that the 21-week moving average has once again become a key observation point for Bitcoin's movement. This level has historically been seen as an important boundary for bull-bear transitions: when the price is above it, it often indicates a market shift from bearish to bullish; when it falls below, it usually signals the market entering an adjustment phase. If Bitcoin fails to regain this level for an extended period, the current consolidation trend may further evolve into a deeper correction.

Currently, the retracement is still relatively mild, and against the backdrop of the market generally expecting the Federal Reserve to cut rates, the overall trend may remain controllable, unless the U.S. economy shows significant weakness.

Historically, the ideal entry point often occurs when Bitcoin briefly falls below this moving average, then regains and maintains it for a long time. Until this signal appears, investors should remain cautious.

CryptoQuant: Bitcoin Futures Liquidity Weak, Buyer Initiative Significantly Diminished

According to analysis by CryptoQuant analyst Axel Adler Jr, the Bitcoin futures liquidity index indicates that the market is still in a weak zone (45). Bulls attempted to regain market control on October 13 and October 20 but failed both times. The first attempt seemed strong but quickly lost momentum, while the second lacked sustained driving force.

Currently, the price remains below the 30-day fair value, futures liquidity is weak, and buyer initiative has significantly diminished, indicating that market bulls are showing signs of fatigue.

Trader Nachi: Extremely Bullish on Bitcoin, Expects BTC to Break $200,000 in the Next 6 to 12 Months

According to the latest post from Binance trader Nachi, he stated that he has closed all short positions and fully switched to long perpetual contract positions. He firmly believes that last Friday may have been a key bottom for Bitcoin, with market funds flowing from gold to Bitcoin. Nachi remains extremely bullish on the market, expecting Bitcoin to break $200,000 and Ethereum to surpass $10,000 in the next 6 to 12 months.

In the current market, discussions about bulls and bears are increasing. And in this hellish market, there are no myths, only survivors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。