Today, two events have a significant impact on the market. One is that the war between Russia and Ukraine finally has a possibility of coming to an end. We analyzed earlier that once this war ends, it will greatly help reduce inflation in the United States. We hope it can really stop. The second issue is the relationship between China and the United States, which is largely affected by Trump. Trump's unpredictability is quite alarming.

Earlier, it was said that a meeting with Xi Jinping had been arranged, but then it was stated in the early hours that a meeting was no longer necessary, and hostility towards China began to increase. The Nasdaq, which was just 20 points away from breaking its historical high, has turned into a decline. The market is once again worried that Trump's remarks will exacerbate the relationship between China and the United States, thereby affecting inflation.

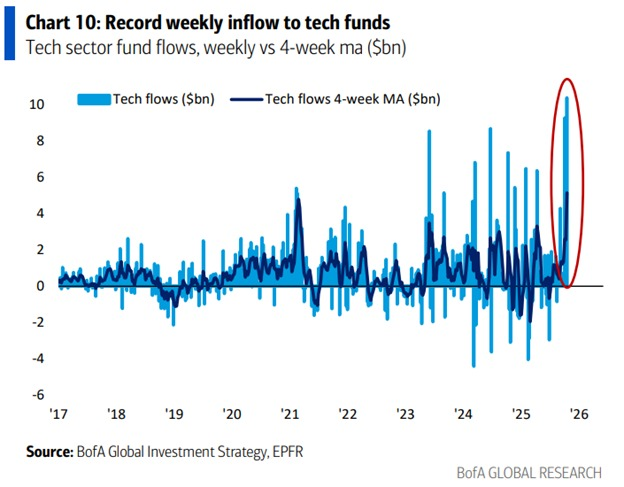

Of course, although there are still unfavorable factors in the market, investors have given their answer with their money. This week, there was a net inflow of $10.4 billion into tech stocks, while last week this figure was $9.2 billion, marking nearly $20 billion in net inflows over two consecutive weeks, setting a record for the largest two-week net inflow ever. This also marks the fourth consecutive week of significant capital inflow into tech stocks.

Previously, we spent a lot of time discussing the relationship between tech stocks and $BTC. I believe this wave is not over yet, and the money from users is the most tangible and real buying. As long as there are no issues with tech stocks and AI, Bitcoin should not perform poorly.

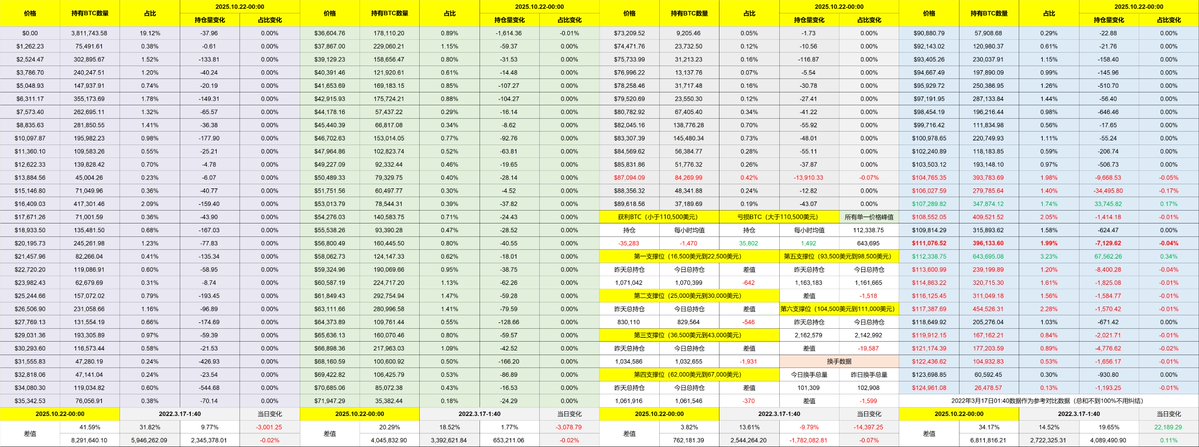

Looking back at Bitcoin's data, the turnover rate on Tuesday was even lower than on Monday, indicating that investors are not in a state of panic. The main sellers are still the investors who bought in at the bottom last week, while long-term investors have not reacted much. Next week, there will be the October interest rate meeting, and currently, the probability of a rate cut is quite high, although inflation is expected to trend upward, largely due to tariffs.

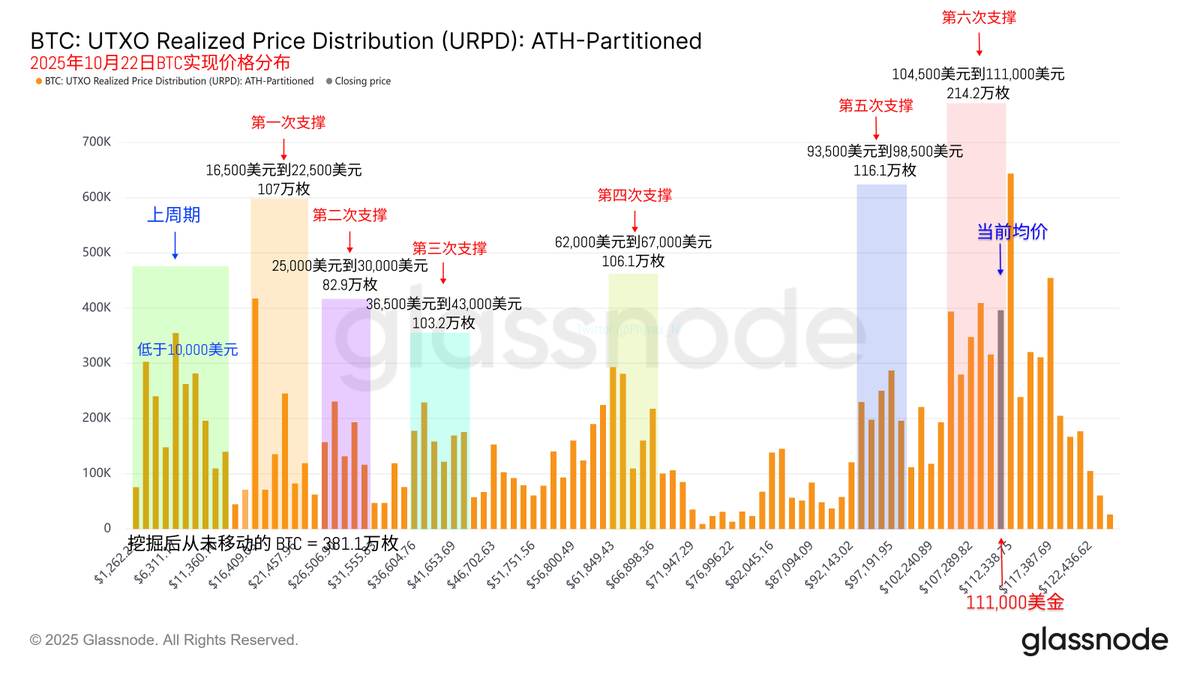

The chip structure remains very stable, with no signs of collapse. The support level between $104,500 and $111,000 is also very solid. Unless there is a systemic risk, at least a fluctuating trend can be maintained.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。