Original Title: Coinbase acquires Echo: Unlocking the future of onchain capital formation

Original Authors: Shan Aggarwal, Aklil Ibssa

Translated by: Peggy, BlockBeats

Editor's Note: Against the backdrop of onchain financing gradually becoming a new trend in the crypto industry, Coinbase is accelerating the construction of its capital market infrastructure. On October 20, 2025, the American crypto trading platform Coinbase announced the completion of its acquisition of the onchain financing platform Echo. This acquisition is not only a fusion of technology and ideas but also a key step for Coinbase towards the "onchain primary market." This article is translated from the official Coinbase blog and aims to help readers understand the strategic logic and industry significance behind this transaction.

The following is the original content:

Enabling More People to Participate in Early Investments in Next-Generation Innovations

Coinbase has officially acquired Echo—a onchain platform dedicated to helping communities co-invest and providing entrepreneurs with more options for equity structure management. In line with our philosophy, Echo believes that early investments should be democratized, allowing more people to support the next generation of groundbreaking innovative companies.

Echo was founded by crypto OG Cobie, a long-time advocate for "community-driven investment." Over the years, Echo has been building tools to make financing more inclusive, transparent, and efficient, driving innovation in onchain fundraising methods.

Why do this? The answer is simple: we want to build a more open, efficient, and transparent capital market. However, currently, entrepreneurs still face difficulties in financing, while ordinary investors have almost no access to private token offerings.

The emergence of Echo has changed this. It allows projects to raise funds directly from the community—whether through private placements or via the Sonar platform for self-custodied public token sales. By integrating Echo's tools into the Coinbase ecosystem, we will enable more communities to participate directly in fundraising, achieving seamless onchain connections between projects and capital.

For now, we will start with crypto token sales based on Sonar, but we plan to expand into tokenized securities and real-world assets in the future, fully leveraging Echo's infrastructure capabilities.

Since its launch, Echo has made significant progress in the private placement market—helping various projects raise over $200 million across approximately 300 transactions.

Its recently launched self-custodied public token issuance product Sonar has also achieved initial success, providing technical support for the XPL token sale of Plasma.

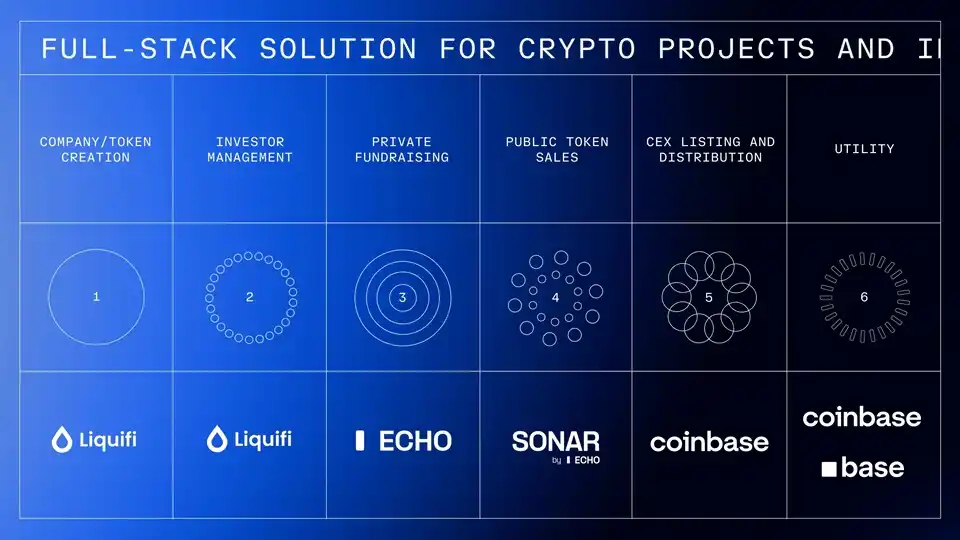

Through this acquisition, Coinbase is building a full-stack solution for crypto projects and investors, covering the complete cycle from project initiation, fundraising to secondary market trading.

For Builders: Easier access to capital and the ability to use fundraising tools aligned with community interests—such as Echo's private investment platform and Sonar's self-custodied public token sale solution.

For Investors: Access to new and diverse investment opportunities that were previously unreachable through trusted platforms like Echo or through Sonar's direct issuance channels.

For the Onchain Economy: Building a more efficient, transparent, and globally accessible capital market, further driving innovation and growth.

Echo complements our recent acquisition of Liquifi well. Liquifi enables early teams to create tokens and manage equity more efficiently; while Echo extends our support from the "startup phase" to the "fundraising phase."

Combining our existing advantages in areas such as exchange listing, custody, staking, trading, and financing, Coinbase now has the capability to serve the entire lifecycle of token issuers and investors—from project inception and financing to secondary market circulation, all within one system.

Coinbase has always been the intersection of users, liquidity, and trust. This foray into the fundraising space is aimed at further eliminating ecological barriers, empowering builders and investors, and jointly promoting the continuous growth of the entire crypto ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。