Key Points

- The total market capitalization of cryptocurrencies is $3.89 trillion, down from $4.01 trillion last week, a decrease of 2.9% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $61.5 billion, with a net outflow of $1.23 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $14.6 billion, with a net outflow of $311 million this week.

- The total market capitalization of stablecoins is $304.4 billion, with USDT having a market capitalization of $181.9 billion, accounting for 59.75% of the total stablecoin market; followed by USDC with a market capitalization of $75.9 billion, accounting for 24.93%; and DAI with a market capitalization of $5.37 billion, accounting for 1.76% of the total stablecoin market.

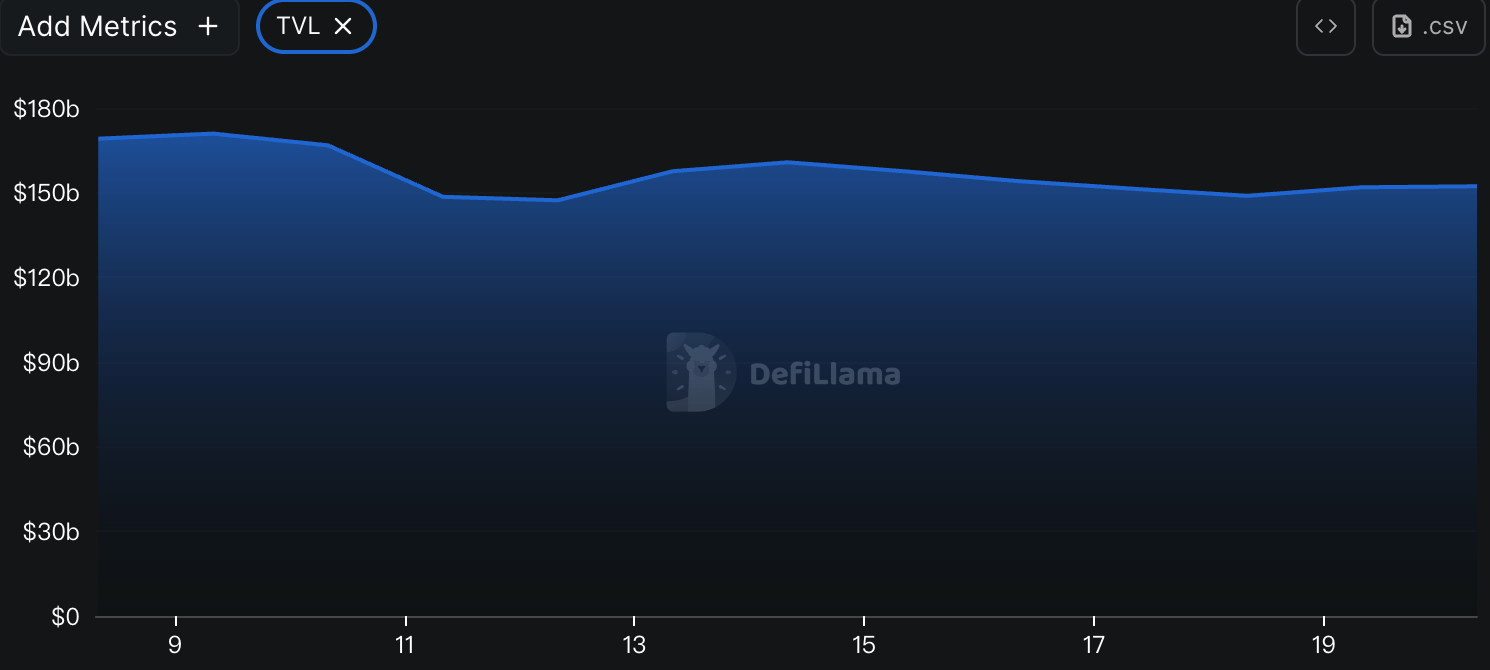

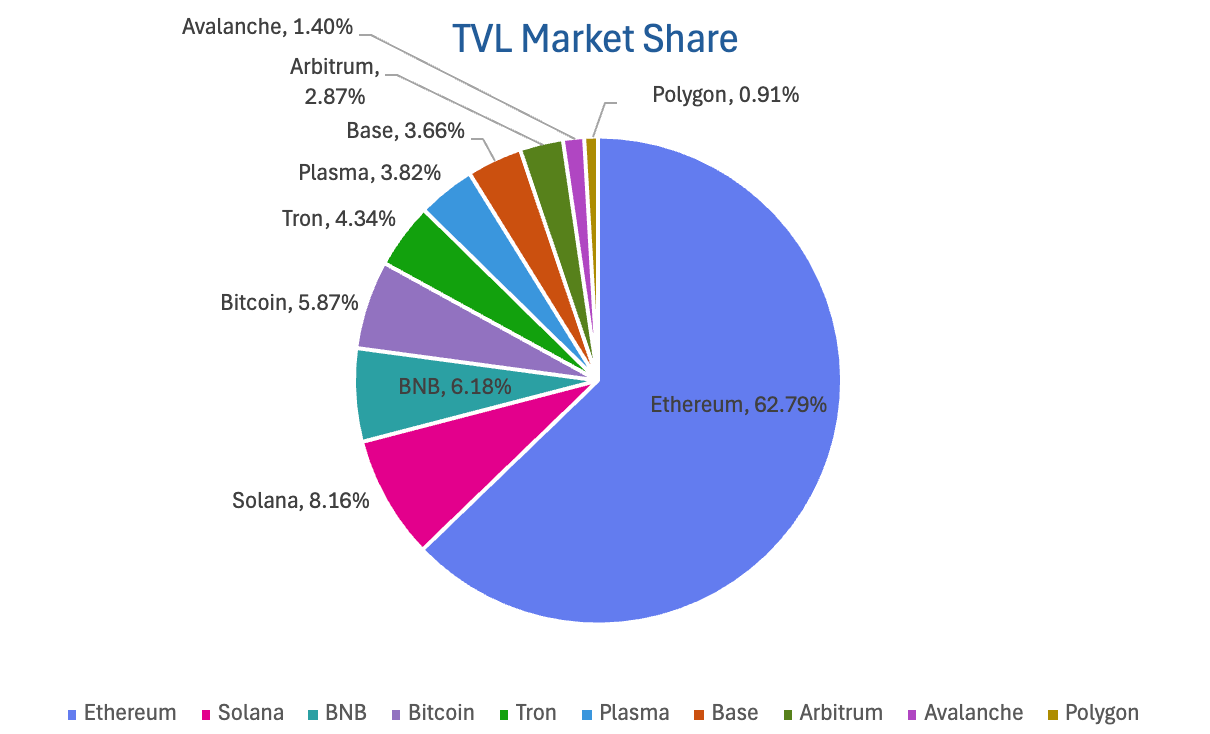

- According to data from DeFiLlama, the total TVL of DeFi this week is $152.2 billion, down from $157.4 billion last week, a decrease of approximately 3.3%. By public chain, the top three chains by TVL are Ethereum, accounting for 62.79%; Solana, accounting for 8.16%; and BNB Chain, accounting for 6.18%.

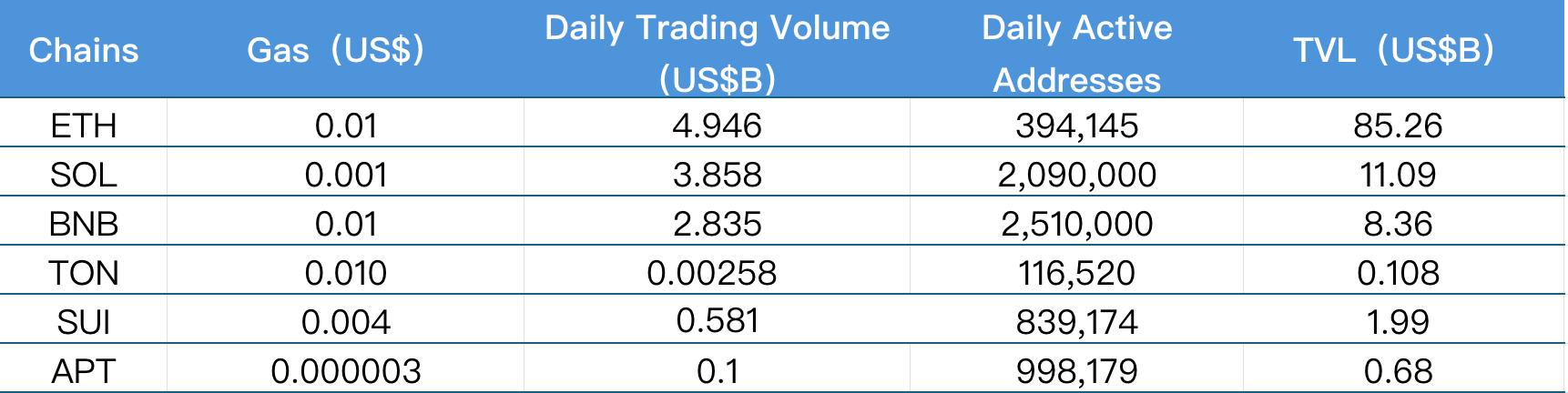

- This week, the overall activity of public chains has declined, with daily trading volumes generally decreasing. Ton saw the largest drop (-63.14%), while Ethereum had the smallest drop (-8.41%). BNB, Sui, Solana, and Aptos each fell by approximately 30–50%. Transaction fees remained stable overall, with ETH, BNB, and TON unchanged, while other chains saw slight declines, mainly Solana (-27.06%) and Aptos (-18.37%). In terms of active addresses, Sui (+19.37%) and Aptos (+20.22%) performed well, while Solana and BNB remained roughly flat, and Ethereum (-12.71%) and TON (-15.73%) saw significant declines. TVL saw a slight overall decrease, with Aptos experiencing the largest drop (-9.73%). The liquidity of mainstream chains remained stable, while emerging public chains saw increased user activity but limited capital support.

- New project focus: Crown (brl.xyz) is a fintech company based in São Paulo, Brazil, dedicated to modernizing the country's financial system by issuing a stablecoin pegged to the Brazilian real, BRLV. Temple Digital Group is a financial infrastructure company based in New York, focused on creating a privacy-first, compliance-driven digital asset and capital market trading platform on the Canton Network. Legend Trade is a Web3-focused "decentralized marketplace + presale + launchpad" platform where users can participate in trading or investing in tokens at various stages (project presale / IDO / before official trading).

Table of Contents

I. Market Overview

Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-chain Data

Stablecoin Market Capitalization and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. New Industry Dynamics

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

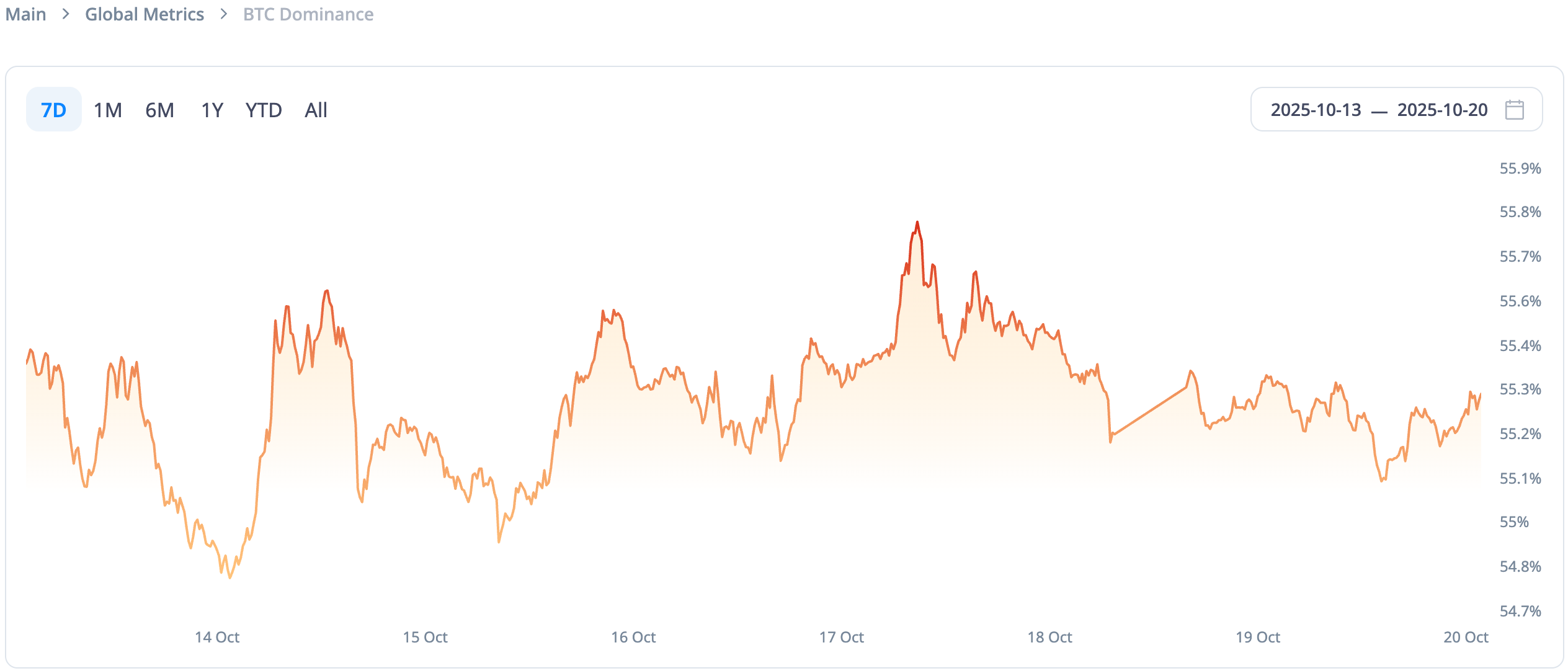

The total market capitalization of cryptocurrencies is $3.89 trillion, down from $4.01 trillion last week, a decrease of 2.9%.

Data Source: cryptorank

Data as of October 19, 2025

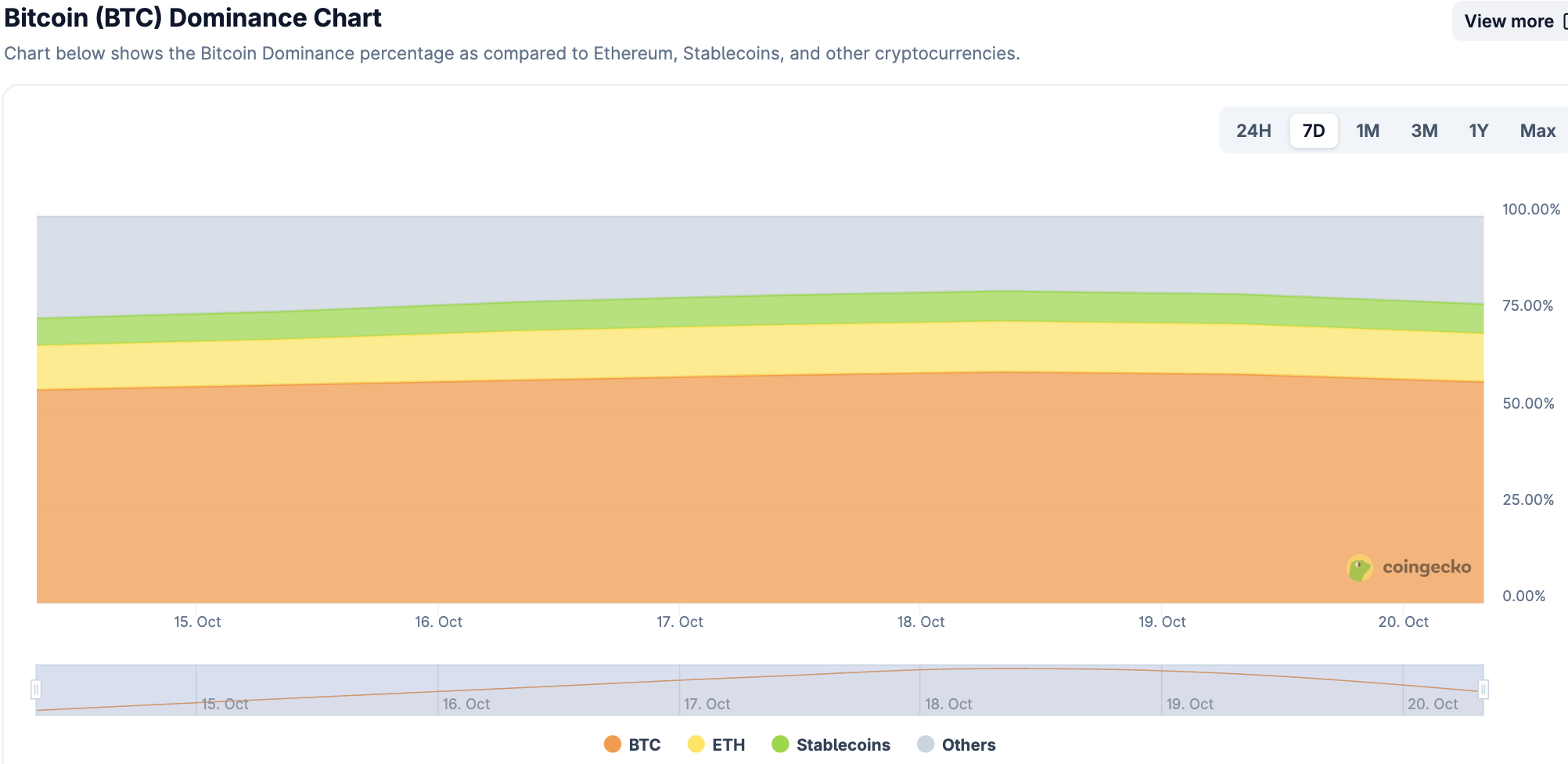

As of the time of writing, the market capitalization of Bitcoin is $215 billion, accounting for 55.3% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $304.4 billion, accounting for 7.83% of the total cryptocurrency market capitalization.

Data Source: coingeck

Data as of October 19, 2025

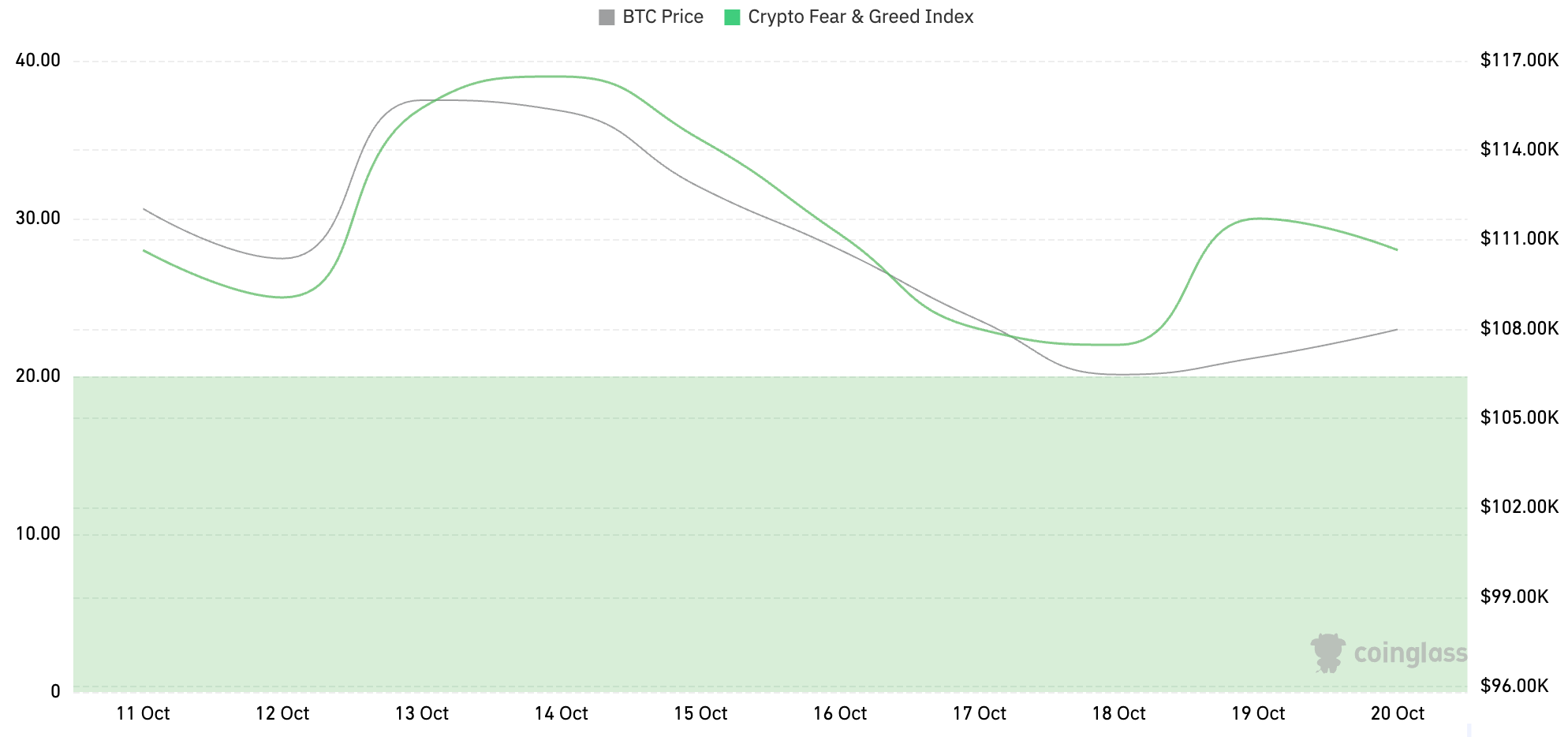

2. Fear Index

The cryptocurrency fear index is 28, indicating fear.

Data Source: coinglass

Data as of October 19, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $61.5 billion, with a net outflow of $1.23 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $14.6 billion, with a net outflow of $311 million this week.

Data Source: sosovalue

Data as of October 19, 2025

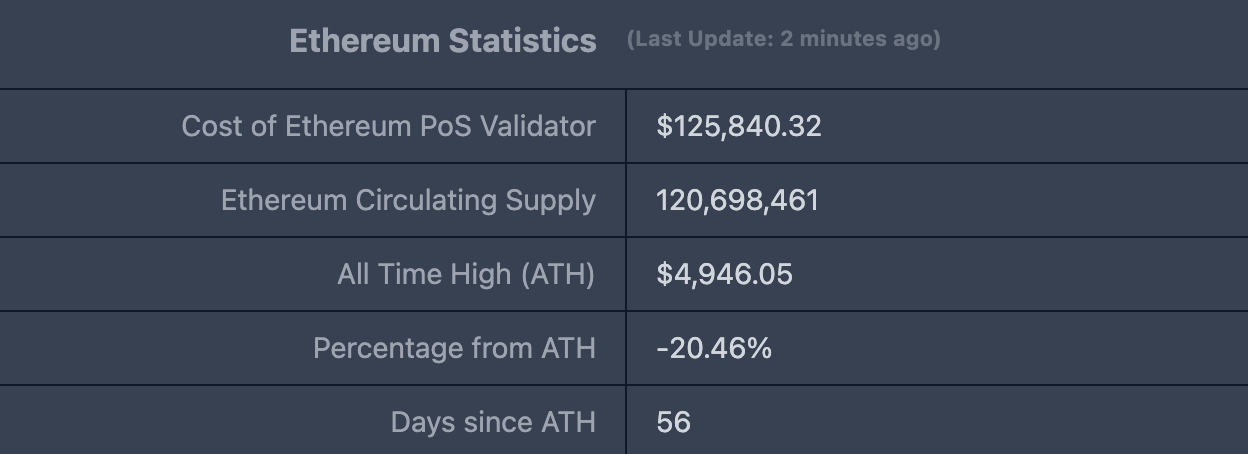

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $3,931.80, all-time high $4,878.26, down approximately 20.46% from the all-time high.

ETHBTC: Currently at 0.036430, all-time high 0.1238.

Data Source: ratiogang

Data as of October 19, 2025

5. Decentralized Finance (DeFi)

According to data from DeFiLlama, the total TVL of DeFi this week is $152.2 billion, down from $157.4 billion last week, a decrease of approximately 3.3%.

Data Source: defillama

Data as of October 19, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 62.79%; Solana, accounting for 8.16%; and BNB Chain, accounting for 6.18%.

Data Source: CoinW Research Institute, defillama

Data as of October 19, 2025

6. On-chain Data

Layer 1 Related Data

Mainly analyzing daily trading volume, daily active addresses, and transaction fees for the current major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of October 19, 2025

- Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, all chains experienced varying degrees of decline in daily trading volume, with Ton experiencing the largest drop of 63.14%; Ethereum had the smallest drop of 8.41%, while other chains saw declines of BNB Chain (-50.61%), Sui (-44.13%), Solana (-39.15%), and Aptos (-33.33%). In terms of transaction fees, Ethereum, BNB Chain, and Ton remained stable compared to last week; other chains saw some decline, mainly Solana (-27.06%), Aptos (-18.37%), and Sui (-7.09%).

- Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. This week, BNB Chain remained nearly flat compared to last week, Solana saw a slight increase of 1.95%; Sui and Aptos increased by 19.37% and 20.22%, respectively; Ethereum and Ton decreased by 12.71% and 15.73%. In terms of TVL, all chains saw a decline this week, with Aptos experiencing the largest drop of 9.73%; BNB Chain decreased by 7.42%; other chains saw relatively small declines, including Sui (-3.07%), Ethereum (-2.4%), Ton (-1.82%), and Solana (-1.39%).

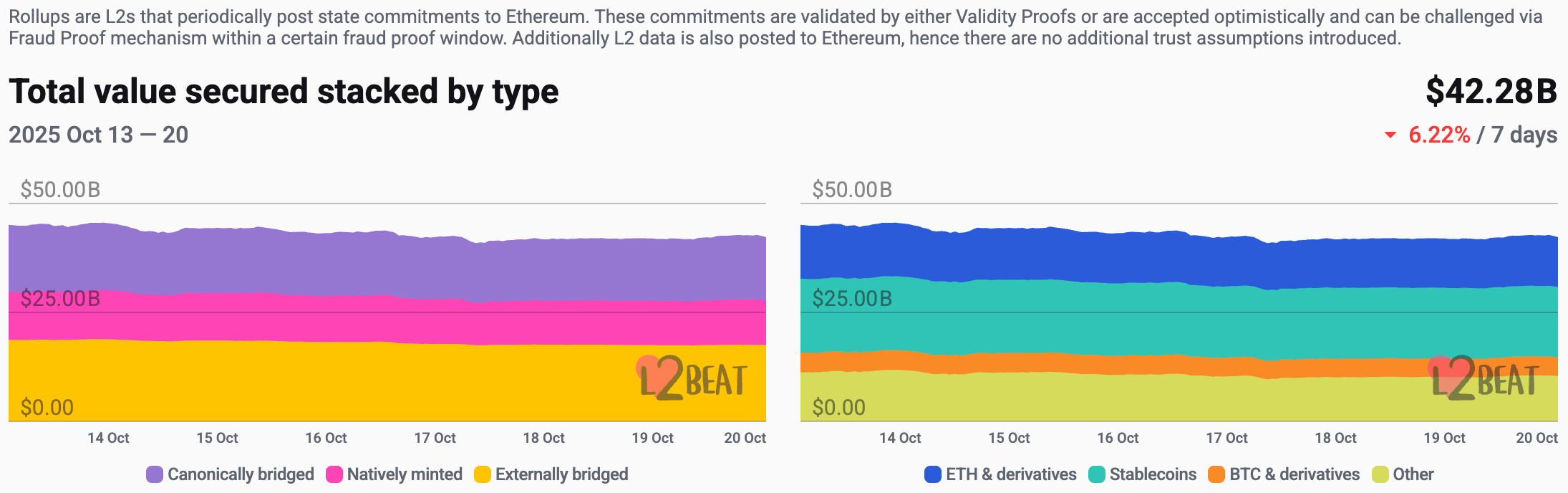

Layer 2 Related Data

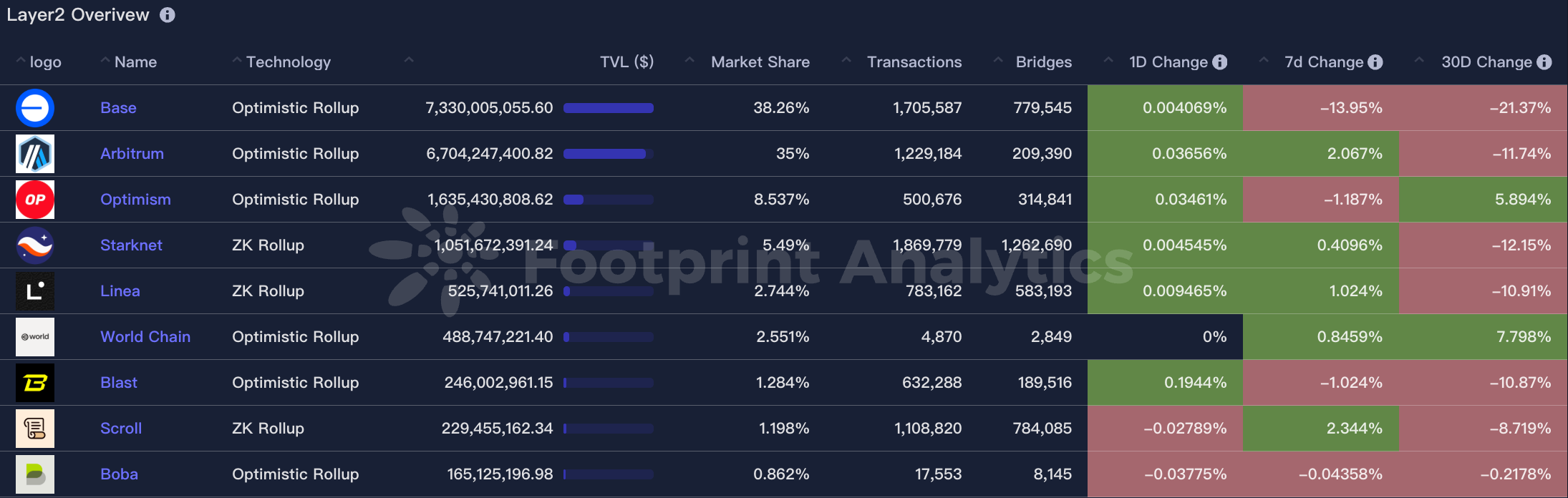

According to L2Beat data, the total TVL of Ethereum Layer 2 is $42.28 billion, down 6% from last week ($44.98 billion).

Data Source: L2Beat

Data as of October 19, 2025

Base and Arbitrum hold the top positions with market shares of 38.26% and 35%, respectively. Base's market share has slightly decreased over the past week, while Arbitrum has seen a slight increase.

Data Source: footprint

Data as of October 19, 2025

7. Stablecoin Market Capitalization and Issuance

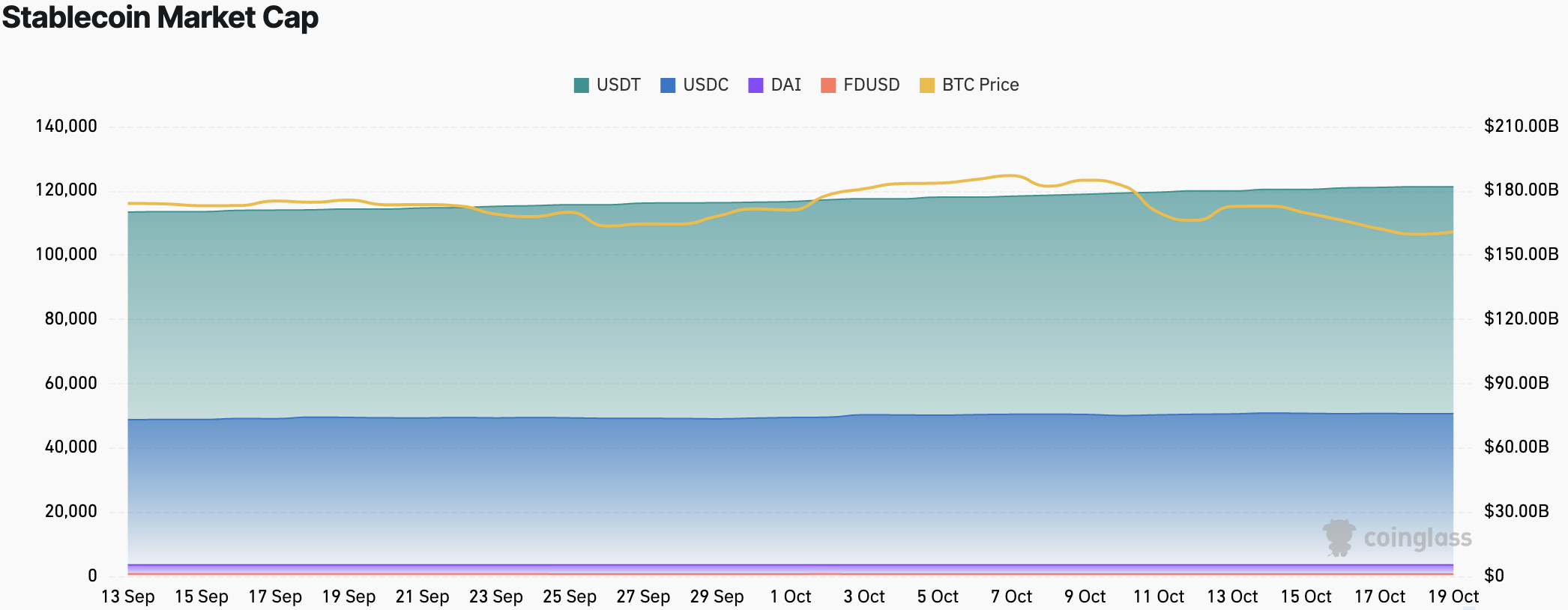

According to Coinglass data, the total market capitalization of stablecoins is $30.44 billion, with USDT having a market capitalization of $18.19 billion, accounting for 59.75% of the total stablecoin market; followed by USDC with a market capitalization of $7.59 billion, accounting for 24.93%; and DAI with a market capitalization of $537 million, accounting for 1.76% of the total stablecoin market.

Data Source: CoinW Research Institute, Coinglass

Data as of October 19, 2025

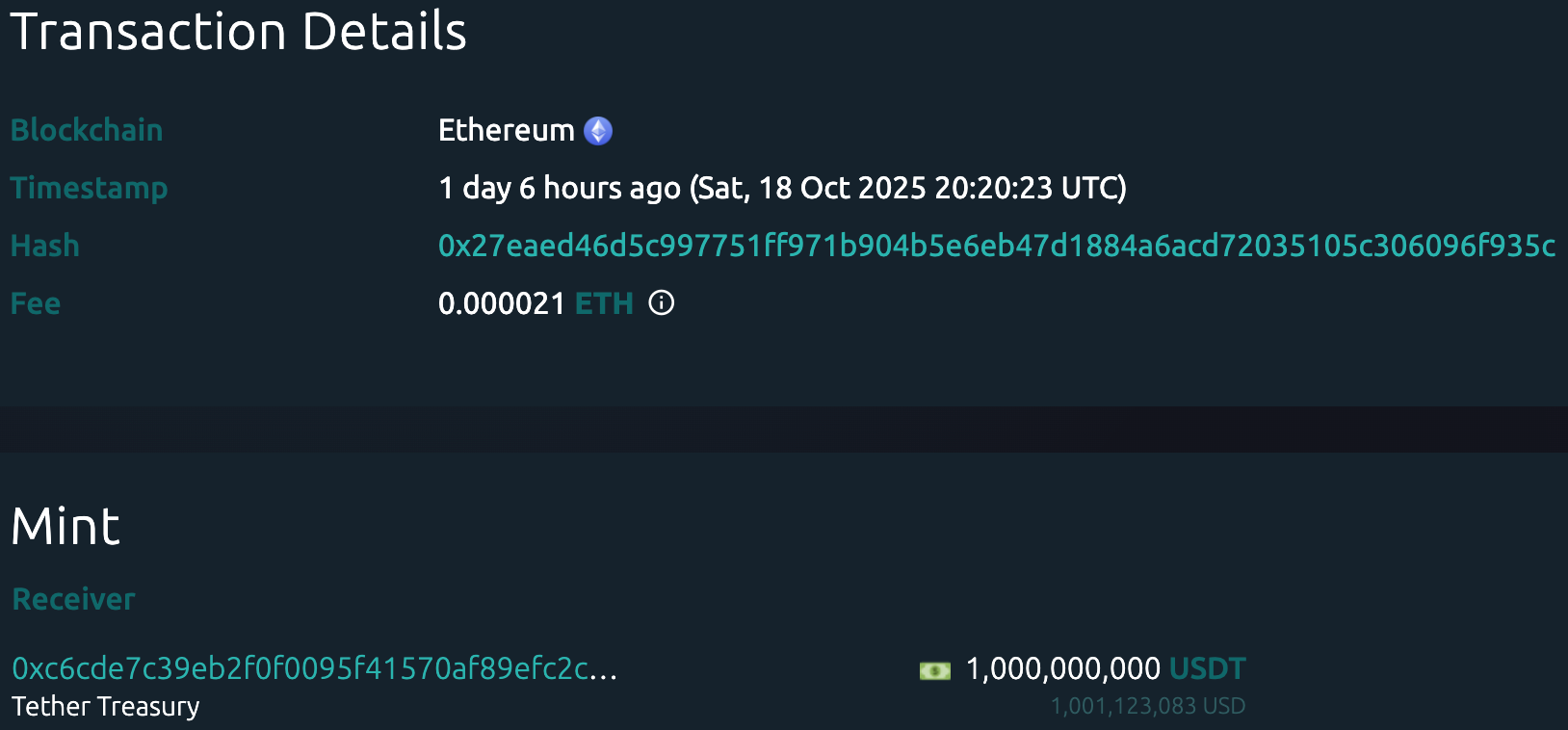

According to Whale Alert data, this week the USDC Treasury issued a total of 2.154 billion USDC, and the Tether Treasury issued a total of 3 billion USDT this week. The total issuance of stablecoins this week was 5.154 billion, an increase of 41.2% compared to last week's total issuance of 3.65 billion.

Data Source: Whale Alert

Data as of October 19, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

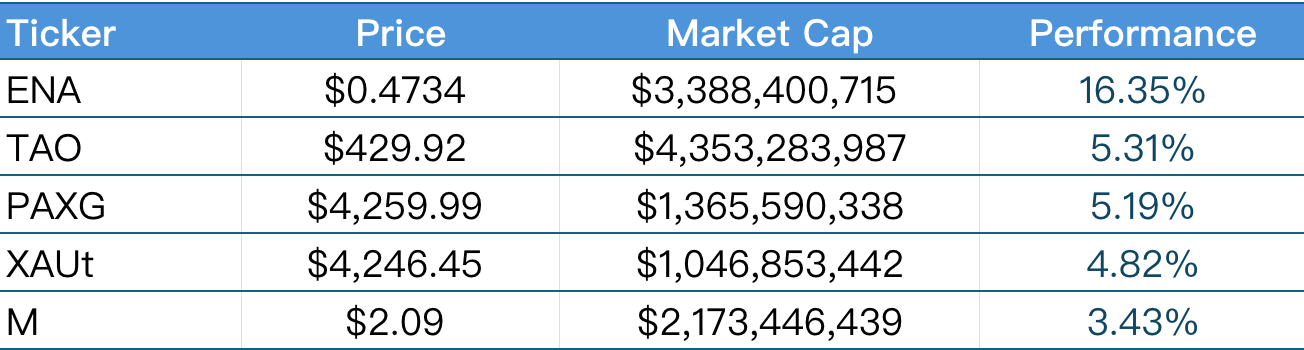

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of October 19, 2025

The top five meme coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of October 19, 2025

2. New Project Insights

- Crown (brl.xyz) is a fintech company based in São Paulo, Brazil, dedicated to modernizing the country's financial system by issuing a stablecoin pegged to the Brazilian real, BRLV. This coin is fully backed by Brazilian government bonds and aims to provide secure and compliant digital settlement and liquidity solutions for institutional users. Crown recently completed a $8.1 million seed round of financing, led by Framework Ventures, with participation from Coinbase Ventures, Valor Capital, Paxos, and others. The project ensures asset security through a "bankruptcy isolation" structure and complies with Brazil's upcoming stablecoin regulatory policies, positioning itself to connect the sovereign debt market with on-chain financial infrastructure.

- Temple Digital Group is a financial infrastructure company based in New York, focused on creating a privacy-first, compliance-driven digital asset and capital market trading platform on the Canton Network. Temple's products combine traditional electronic trading systems (such as centralized limit order books, automated order routing, and liquidity for all traders) with blockchain technology (instant settlement, asset tokenization, non-custodial wallets, etc.), enabling institutions, enterprises, and individual users to participate in global digital asset trading under privacy and compliance.

- Legend Trade is a Web3-focused "decentralized marketplace + presale + launchpad" platform where users can participate in trading or investing in tokens at various stages (project presale / IDO / before official trading). Its features include tradable tokens that have not yet been officially issued, transparent mechanisms during the presale phase, a bonding curve-based pricing mechanism, and decentralized OTC allocation, allowing early participants to engage with projects with less friction while reducing trust and security risks.

III. New Industry Dynamics

1. Major Industry Events This Week

- On October 14, 2025, South Korea's leading shared charging platform Piggycell officially completed its token generation event (TGE) for its token $PIGGY on the BNB Chain and began trading on several mainstream centralized exchanges (CEX). Piggycell is South Korea's largest shared charging network, with over 14,000 sites, 100,000 devices, and 4 million paying users. Its business model combines real-world charging data with blockchain technology to build a transparent and verifiable on-chain economic system.

- On October 14, 2025, the Lab (LAB) project completed its token generation event (TGE), releasing approximately 3% of the total supply of LAB tokens in the first batch. Lab is an ecological project focused on decentralized finance and on-chain experimental tools, aiming to provide developers and users with a secure and efficient smart contract and experimental environment.

- On October 15, 2025, the Plasma chain decentralized exchange Lithos held its token generation event (TGE), distributing LITH and governance token veLITH to the community through liquidity mining. This dual-token model supports platform governance and utility, laying the foundation for liquidity building and DeFi product development in the Plasma ecosystem.

- On October 14, 2025, the cross-chain protocol Enso (ENSO) held its token generation event (TGE) and simultaneously launched an airdrop, issuing approximately 20.59% of the total ENSO tokens for the first time. Enso is a Layer-0 network designed to connect multiple blockchains, simplifying the development and deployment of decentralized applications, supporting multi-chain workflows, and promoting the integration of Web2 and Web3 applications.

- On October 14, 2025, the Layer-1 blockchain project Monad officially launched its token airdrop activity. This airdrop targets a broad range of cryptocurrency community users, including active on-chain users, developers, and community members, with approximately 230,000 wallets qualifying for the MON token. Users can verify their eligibility and claim tokens through claim.monad.xyz, with the claim window open until November 3, 2025. Monad has not yet announced a specific date for its token generation event (TGE). It is expected that the TGE will coincide with the mainnet launch, with specific timing to be announced later.

2. Major Upcoming Events Next Week

- The token generation event (TGE) for Meteora will be held on October 23, 2025, on the Solana chain. This TGE will distribute 10% of the allocated 48% token supply, establishing initial liquidity through a liquidity allocator by the community. Early participants can exchange USDC for $MET and earn rewards. Jupiter stakers will automatically receive 3%, while the remaining 7% will be distributed on a first-come, first-served basis. The entire mechanism aims to incentivize users to provide liquidity, reduce selling pressure, and promote the healthy development of the Meteora ecosystem.

- On October 13, 2025, the IPRWA protocol project Aria within the Story ecosystem announced the establishment of the Aria Foundation and revealed that its platform token $ARIAIP will soon undergo a token generation event (TGE), with specific details to be announced later. Aria is dedicated to providing on-chain governance and liquidity solutions for intellectual property assets and has supported the on-chain transfer of royalties for well-known artists, including Justin Bieber, BLACKPINK, and BTS, issuing IP-backed asset tokens $APL.

- Novastro announced the postponement of its originally scheduled token generation event (TGE) on October 15, in response to last week's market volatility. The TGE will still take place within this month. Novastro is an RWAfi layer protocol that provides on-chain yield and liquidity for real-world assets through smart SPV tokenization and AI-optimized asset strategies, while also supporting the on-chain transfer of well-known artists' IP and the tokenization of physical assets.

3. Important Investments and Financing from Last Week

- a16z Crypto (the crypto division of Andreessen Horowitz) announced a $50 million investment in Jito Labs, a liquid staking protocol in the Solana ecosystem. Jito is a leading liquid staking platform on Solana that allows users to stake SOL and receive a derivative token, JitoSOL, which can be used in DeFi. It also optimizes MEV revenue distribution and transaction ordering through its innovative Block Assembly Marketplace (BAM) mechanism, enhancing network efficiency and fairness. (October 16, 2025)

- Decentralized energy company Daylight Energy announced the completion of a $75 million financing round (including $15 million in equity financing + $60 million in project development financing), led by Framework Ventures, with participation from a16z Crypto, Lerer Hippeau, M13, Coinbase Ventures, and others, with Turtle Hill Capital leading the project financing. The company is working to build a decentralized energy network that integrates "chain + physical energy infrastructure." Through its DeFi protocol called DayFi, it aims to tokenize electricity assets, allowing investors to participate in the revenue from energy infrastructure while enabling household users to access solar and storage services via subscriptions, sharing network revenue and supporting the grid. (October 16, 2025)

- Kraken announced the acquisition of the Small Exchange (DCM), a designated contract market regulated by the U.S. CFTC, for $100 million, laying a compliance foundation for its upcoming full suite of derivatives business in the U.S. Through this transaction, Kraken will design and create futures and options products under the CFTC's regulatory framework, integrating spot, margin, and clearing systems to build a high-performance, unified onshore cryptocurrency trading platform. The Small Exchange itself, as an authorized DCM, provides Kraken with direct access to the regulated U.S. derivatives market. (October 16, 2025)

- Tria (tria.so) completed $12 million in pre-seed and strategic financing, with participants including P2Ventures, Aptos, its own community, and teams or executives from Polygon, the Ethereum Foundation, Wintermute, Sentient, 0G, Concrete, Eigen, among others, with Polychain and Polygon serving as advisors for this round. Tria aims to create a self-custodial digital bank for humans and AI entities, allowing users to transact, consume, and earn within a single balance without the need for bridging, gas fees, or custodians. (October 14, 2025)

IV. Reference Links

Helius Jito: https://www.jito.network/

Daylight: https://www.daylight.world/

The Small Exchange: https://smallexchange.com/

Tria: https://www.tria.so/

Crown: https://brl.xyz/

Temple: https://templedigitalgroup.com/

Legend Trade: https://legend.trade/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。