Binance life, finally becoming the first Chinese coin to be listed on Binance perpetual contracts.

As long as you are a Chinese cryptocurrency practitioner, you cannot have missed this term in the past two weeks. Since the birth of this "ticker," it has been both a joke and a vision. CZ himself mentioned that he did not expect a simple reply to trigger a series of subsequent events.

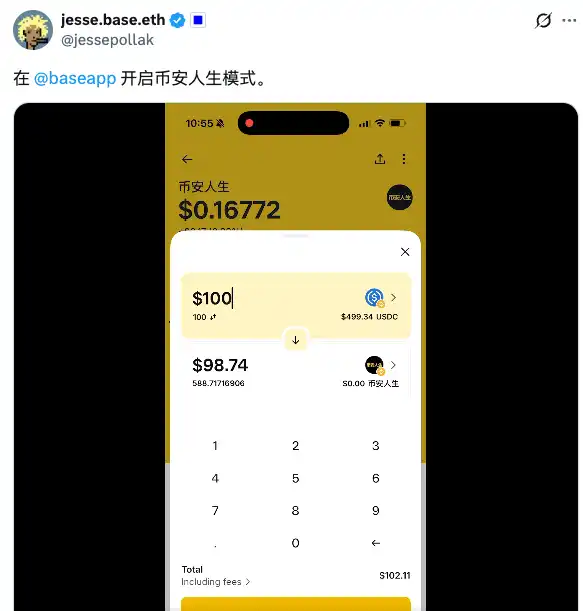

First, it sparked discussions from OKX's CEO Star. Then came the Chinese ticker craze for Tron and Solana, followed by the recent public disclosure of the so-called "listing terms" by the founder of Limitless, leading to confrontations between two chains and trading platforms. Finally, Jesse ended this confrontation with the statement, "Activate Binance life mode on Base."

What this represents may not just be this one ticker, but a deeper cultural shift behind it. This could be the first time that memecoins are not in English, but in Chinese, Japanese, and Korean. What does the meme culture it represents mean?

This time, we found 0xBarrry, a co-founder of WOK Labs, a Polish trader who operates a community of hundreds. What do these foreigners think when they engage with Chinese memes?

Conspiracy community meets Chinese conspiracy coins

This wave appears both mysterious and exciting to ordinary traders.

Polish trader and WOK Labs founder Barry recalled, "I was shocked the first time I saw a Chinese-labeled coin's market cap surpass $20 million. On one hand, I realized that this kind of conspiracy coin still has great potential. By the time it surged to $60 million, or even $100 million, the European group was already in an uproar, with many rushing to recharge on the BSC chain just because the price went up, without understanding the reason."

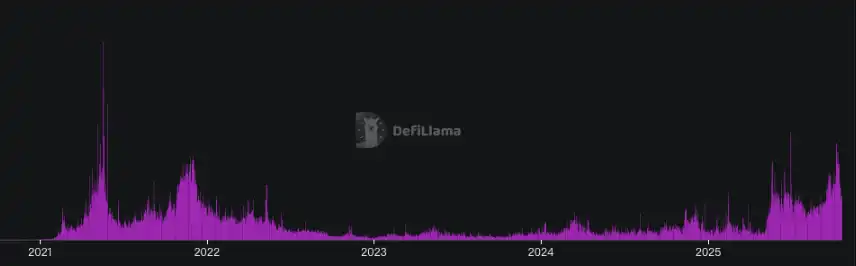

This market sentiment is not an isolated case. On-chain data from Defillama shows that on October 8, the trading volume on the BSC chain surged to $6.05 billion, reaching the peak of the previous mechanism coin craze in 2021, but this time led by Chinese memes.

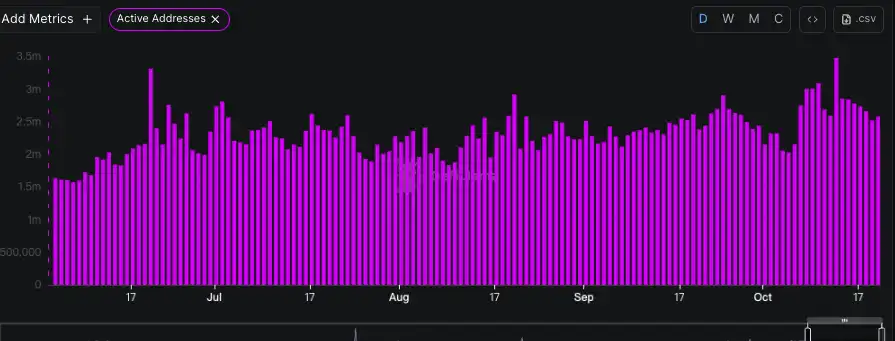

On that day, over 100,000 new traders participated in this round of memecoins frenzy, with nearly 70% making a profit. This indeed attracted many "foreigners" to engage in on-chain activities on BSC, and the number of active addresses increased by nearly 1 million compared to the same period last month.

Western investors rushed in only when prices soared, with many later "checking Chinese" to realize what was happening. The cultural and traditional trading habit differences also caused many European and American players to suffer losses for the first time.

"In the past, meme investments in Europe often followed American internet culture, characterized by self-deprecating and rebellious humor. Suddenly, the dominating Chinese memes left many Westerners lost," Barry said.

However, due to his early collaboration with Chinese teams to establish WOK Labs, Barry understood the operational dynamics of the Chinese community, including factors like personal relationships and emotional resonance. He began to spread the Chinese narrative within European communities, explaining the differences to more Western traders.

Moreover, the differences in community participation in memecoins are also quite evident. European traders are more likely to participate in conspiracy-type meme projects, relying heavily on the Ethereum ecosystem, often driven by well-known KOLs or teams with significant control. These communities tend to develop more slowly, but suitable KOLs or teams holding a large amount of bottom chips also face significant selling pressure risks, which is why establishing long-term projects in the European region is challenging.

In contrast, Chinese communities are easier to establish. They focus more on emotional storytelling (or leader coins), where project parties and meme communities "tell stories" in WeChat groups to resonate and drive emotions. The emotional push in a "fair" context can theoretically lead to a more lasting community structure.

Especially in this cycle, it has been relatively easy for Chinese players. They only need to buy the IP (or statements from opinion leaders) they think is popular to "print money at will." One retail investor, solely interested in buying Chinese coins, participated in 65 different Chinese meme coins on the BNB chain within 7 days, initially spreading $100–300 widely, then increasing positions in coins with strong momentum, netting about $87,000 in profit by the end of the week.

This high-frequency "net-spreading" strategy reflects the rapid speculative style of "most" retail investors in the Chinese community towards new tracks. Meanwhile, European and American players are gradually abandoning small-cap memecoins around $500,000 and are instead turning to more certain targets starting at $5 million.

Agencies like Barry's, which connect the East and West, bridging markets in China, Korea, Japan, and Europe, are becoming increasingly active, helping Asian projects gain trust in the West and assisting European teams in entering Asia.

He believes that this cultural difference arising from personal experiences may be nurturing new cross-circle collaboration opportunities.

From Dogecoin to Chinese meme coins, from mocking memes to ideological memes

From a broader perspective, the memecoin trend is rooted in the collision of different cultural genes. The ancestor of Western memecoins is Doge, created in 2013 by two programmers as a joke.

Doge was initially a humorous satire of Bitcoin's serious demeanor, but ultimately reached a peak market cap of $88.8 billion in May 2021 due to celebrity effects (like Elon Musk) and sustained community enthusiasm.

The subsequent Pepe coin had a similar experience. As a cultural meme birthed from the 4chan community, it quickly went viral after its launch in early 2023, with its market cap once exceeding $1 billion. The Pepe project completely relied on the heat of internet culture; it had no presale, no team allocation, and no roadmap, with the team stating that the coin "has no intrinsic value and is for entertainment only."

This worldview also dominated many subsequent Solana memecoins, such as Fartcoin and Uselesscoin, which embody nihilism, or Neet, reflecting the Western internet culture's love for "disruption of real-world value" and dark humor, or the trending meme on TikTok, 67. Solana's memes captured investors' imaginations with image memes and rebellious spirit, leading to a long-lasting attention economy era for memecoins. Meanwhile, the lack of "cultural value judgment" in Chinese-dominated regions has led to deviations.

Chinese memecoins, on the other hand, exhibit different characteristics. They are often rooted in resonance and identity projection. For example, tokens like "Humble Xiao He" and "Customer Service Xiao He" humorously mock social realities from the perspective of low-level workers. The "Cultivation" series reflects Chinese netizens' dreamlike fantasies of escaping reality, while "Binance life" directly embodies the dream of getting rich overnight in the crypto market. Of course, their common feature is their connection to official entities.

This represents a cultural difference under a certain mindset. For Chinese people, this is called "widening the path," while for most European and American players, such names mean their upper limits are controlled by whether the "system" is willing to pump.

However, the explosion of Chinese memecoins represented by "Binance life" is directly attributed to this emotional resonance. Its slogan compares Binance life to the previously popular "Apple life." This innovative narrative is clearly different from the satire of Dogecoin, appealing more to loyalty and sentiment.

When this impression is understood by enough people, this ticker becomes bound within the system. When it is mocked, the official "has to pump," which may be the thought of many who can still hold this coin after a washout.

This round of meme frenzy is not entirely driven by retail investors spontaneously; it is also the result of careful cultivation by the Binance ecosystem. From a joke by He Yi, CZ's reply, to a series of official interactions from Fourmeme, and the launch of Binance's MemeRush platform, the gradual release of positive news, the timing of high market cap memecoins' breakout, mid-term liquidity, and later sustainability have brought the originally chaotic memecoin issuance into the official system, making the frenzy more organized and keeping the market's attention focused on the BSC chain for a long time.

The enthusiasm has spread from a single project to the entire BSC ecosystem, further driving the public's "next order might make them millionaires" Degen mentality. This "upward ladder" expectation is also why, at the beginning of this round of market, when multiple popular projects emerged, we did not feel a significant liquidity siphoning effect between the plates.

This has become a significant ladder-like wealth effect under the joint action of the official and the community. This path validates the structured listing expectations behind Chinese meme coins and the market consensus being at a level that just a few months ago we could hardly have imagined.

In contrast, Western meme coins are more about luck-driven community revelry or conspiracy group promotion. The BSC ecosystem, under the multiple influences of founders, platform ecosystems, and communities, has transformed this revelry into a blatant "wealth creation movement."

The public relations battle between trading platforms, the listing fee dispute, and the "China-US" thaw

At the same time, this incident has triggered intense public relations confrontations between trading platforms. On October 11, 2025, Jesse first tweeted calling for everyone to boycott centralized trading platforms with listing fees of 2% to 9%.

Three days later, on October 14, CJ Hetherington, founder of the prediction market project Limitless Labs backed by Coinbase, revealed on X that he discovered during negotiations with trading platforms that to launch on Binance, project parties need to stake 2 million BNB and pay high fees, including an 8% airdrop and marketing allocation of the total tokens, as well as a $250,000 deposit.

He compared the differences between Binance and Coinbase, believing that Coinbase places more emphasis on the intrinsic value of projects, while Binance is more like a "listing fee" platform. Upon hearing this, Binance quickly published an article denying the claims, stating that the accusations were "completely untrue and defamatory," emphasizing that "Binance never charges listing fees," and threatened legal action against CJ for leaking internal conversations.

Subsequently, Binance released a more restrained statement, admitting that the initial response was overly aggressive but reaffirming that it does not charge any listing fees.

As this debate intensified, Coinbase also responded swiftly. Jesse Pollak, head of the Base blockchain, publicly stated on social media, "There should be 0 fees for projects to go live on trading platforms."

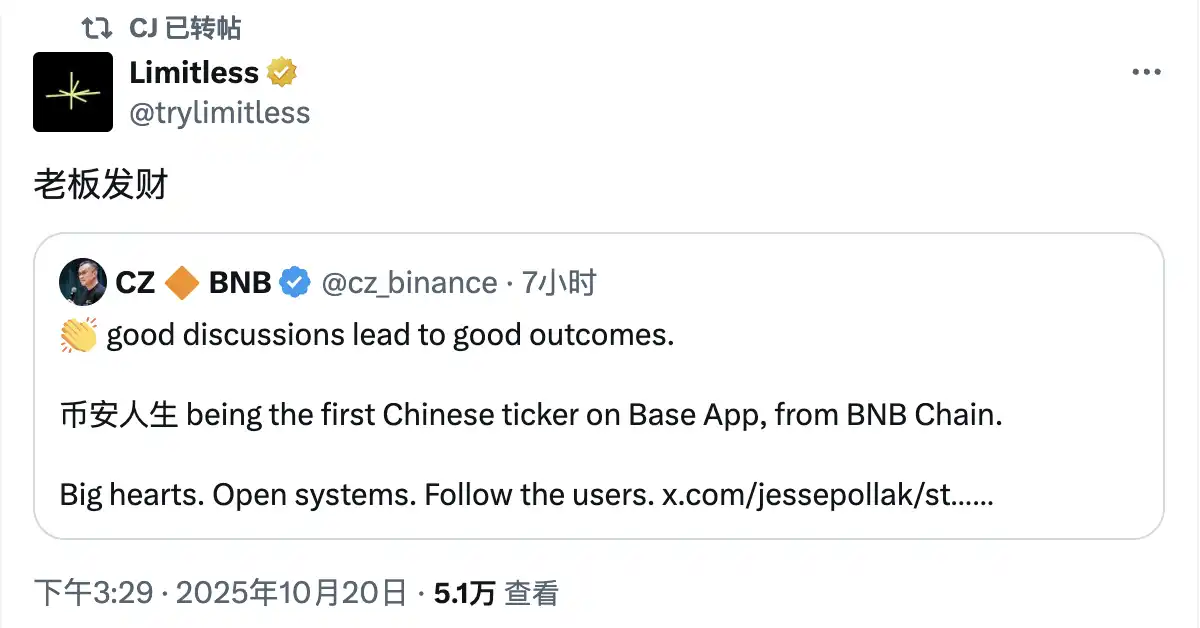

However, it was at this moment that public opinion began to shift. Coinbase, seemingly out of "spite," officially announced that it would include BNB in its future supported token list, marking the first time it announced support for tokens issued on a direct competitor's mainnet. In response, Binance founder CZ welcomed this on social media and encouraged Coinbase to list more BSC chain projects.

CJ, who originally "exposed" the terms, also began to show goodwill, while Jesse Pollak's attitude underwent a direct 180-degree turn. He first posted a demonstration video of the Base App on X, which even used "Binance life" as an example token in the demonstration. Pollak humorously remarked in Chinese, "Activate Binance life mode on the Base App," and replied under CZ's tweet, "Binance life + Base life = the strongest combination." This series of actions was interpreted by the industry as a breakthrough between the Chinese and American crypto camps, and it also brought a long-lost little golden dog to the Base chain.

It can be said that when the trading volume and attention brought by the Asian market reach a certain scale, Western trading platforms have to actively approach the Chinese community, intertwining competition among trading platforms with cultural narratives.

Cognitive and Reactive Differences Between Eastern and Western Communities

Mainstream media in Europe and America have paid close attention to this event, while many Western retail investors expressed in groups, "We don't understand the price increase." Most rushed to buy in only after the price took off. Even in communities like Barry's, which have deep exchanges with the Chinese system, encountering the issue of "knowing the meaning but not the significance" when predicting a memecoin with internal cultural implications is common. This indicates that for overseas investors, Chinese elements have become a new barrier to entry.

Some members of the European and American communities developed a tool for translating Chinese to English for Dogecoin.

This wave also emphasizes the notion that "language is opportunity." For the crypto world, the cultural emotional information behind different languages is itself a layer of valuable resources. This is "the first time that European and American investors need to understand Chinese culture to participate in this feast."

A recent popular video series of foreigners learning Chinese to buy memecoins.

However, Barry believes, "I think the wave of Chinese memes is nearing its end. The longer this cycle lasts, the more severe the PTSD it brings to traders. We can see that these memecoins have started to evolve towards smaller market caps and faster rotations." At the same time, he also said, "English and Chinese have become the two main components of the meme market, and this situation will not change quickly. China has a larger market and is more easily driven by emotions. The European market tends to lag behind. I believe English tickers may return, but they will become more integrated with Asian culture. Due to the inspiration derived from this round of Chinese memes, they will adopt more Chinese humor, symbolism, and aesthetics."

In the future, to capture the next wave of memecoin opportunities, it will not be enough to rely solely on chance; a deep understanding of the languages and cultures of different regional communities will be necessary. AI may currently help with cross-linguistic communication, such as by automatically generating Chinese meme images and translating social dynamics to accelerate information dissemination, but AI ultimately struggles to replace a deep understanding of cultural contexts.

We may see a more polarized crypto world, with more "golden dogs" featuring Chinese tickers emerging from Base, Solana, and others. There is a new trend of integration and mutual learning between Western and Eastern communities, but there may also emerge separate ecological zones, and within these cultural differences may lie new opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。