In October 2025, the Bitcoin network quietly completed a leap in capability.

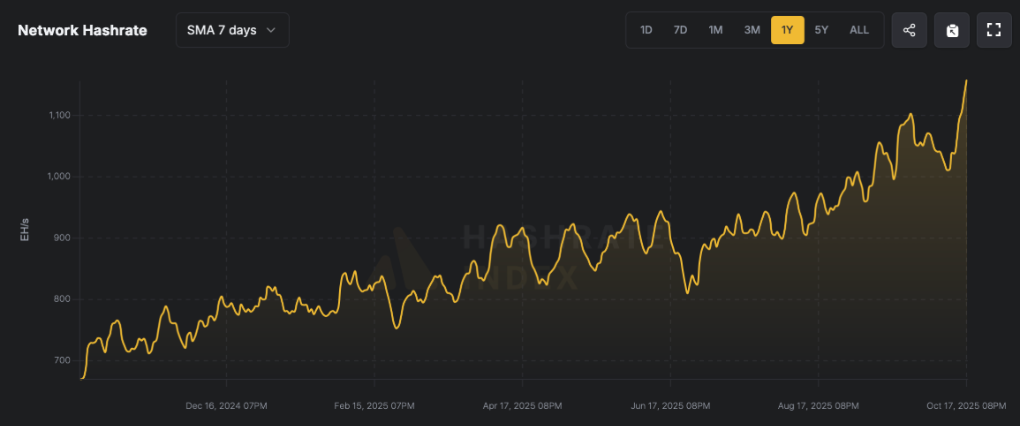

The Bitcoin network once again proved its strong vitality and appeal. As of October 20, 2025, the Bitcoin hash rate soared to a historic high of 1,161 EH/s, breaking all previous records. The subsequent mining difficulty adjustment pushed it to an all-time high of over 150T.

Despite recent fluctuations in Bitcoin's price, which dropped from $121,000 to below $105,000 in October, miners seem undeterred, instead increasing their investments, demonstrating a firm confidence in the long-term value.

1. The 150T Era: The End and Beginning of the Computing Power Race

The peak computing power of 1,161 EH/s signifies much more than a record-breaking number. It represents the establishment of a global, uninterrupted computing power engine. This engine, with computational capabilities thousands of times greater than the total of all global supercomputers, safeguards this distributed ledger, making the cost of attack prohibitively high for any rational entity.

The achievement of this milestone is built on several key pillars:

● Breakthroughs in mining machine technology: By 2025, mining machines with 3-nanometer and more advanced processes have become the absolute mainstay. Their energy efficiency is generally below 20J/TH, meaning that under the same power, their computational output grows exponentially.

● Refined operations of global energy arbitrage: Mining has become a key force in balancing the global energy market. From associated natural gas in the Middle East, wind power in North America, to hydropower in Siberia, previously wasted marginal energy is efficiently capitalized, transforming into irreplaceable digital assets.

● A firm belief in long-term value: Miners are the most steadfast bulls in the Bitcoin world. They invest hundreds of millions based on strong expectations of Bitcoin's value in the coming years. The current level of computing power is the most intuitive physical manifestation of this belief.

However, the most ingenious design of the Bitcoin network—the difficulty adjustment mechanism—immediately responded to this. At the beginning of October, the network difficulty was raised to over 150 T. What does this number mean? Simply put, the amount of computation required to mine a block has increased by over 20 billion times compared to the early days of Bitcoin. It's like a marathon where all participants are constantly accelerating, and the organizers must continuously extend the track to ensure that the winner is always produced in about 10 minutes.

2. Survival Threshold: Differentiation and Game Theory Among Miners

The sudden rise in difficulty is like a high wall that clearly divides the miner community. This differentiation revolves around two key cost concepts:

● First is the general upward shift of the "shutdown price".

For example, a mainstream mining machine from two years ago might have been able to stay operational at a price of $70,000 before the difficulty adjustment. However, once the difficulty surpassed 150T, its output significantly decreased, meaning that to cover unchanged electricity costs, the price might need to approach $80,000 to continue operating. This new survival line pushes many less efficient old-generation mining machines to the brink of elimination.

● More strategically significant is the systematic elevation of the "average production cost across the network".

Those able to remain profitable in the current environment are almost exclusively large mining farms with the latest machines. While the performance of these top-tier devices is indeed outstanding, their acquisition costs and depreciation pressures are unprecedentedly high. Considering equipment, electricity, operational maintenance, and capital costs, industry analysis shows that the average mining cost across the network has surged to a range of $78,000-$85,000.

This high cost line is shaping a new miner landscape:

● Exiters and Migrators: Miners with old machines face an ultimate choice: to exit completely or to relocate their equipment to the last few areas on Earth with low electricity prices? Their exit itself is an efficiency evolution of the network.

● Dominators and Pressured Players: Large publicly listed mining companies dominate the new generation of computing power due to their capital advantages, but they also bear heavy financial pressures—equipment loans and shareholder return requirements force them to continuously produce and sell part of their Bitcoin.

● Strategic Hoarders: A group of the most visionary miners has adopted a completely different strategy. They believe that the current price does not reflect Bitcoin's long-term value. Therefore, they use the profit margins from efficient mining machines to transfer most of the new output into cold wallets for strategic hoarding. For them, on such a high cost basis, the long-term returns from hoarding Bitcoin far outweigh immediate liquidation.

This structural change has led to the complexity of miner behavior. On one hand, the overall miner reserves showed a growth trend in October, indicating a dominant hoarding mentality; on the other hand, mid-October also saw a phase of large-scale selling triggered by profit pressures. This indicates that the miner community is not monolithic; its behavior is differentiated and dynamic, but overall, high costs suppress the desire for indiscriminate selling.

3. Value Cornerstone: Pricing Logic in a High-Cost Era

Against the backdrop of both computing power and difficulty reaching new highs, the pricing logic of Bitcoin is undergoing a fundamental transformation.

1. The cost abyss has become the foundation of value

● The $78,000-$85,000 average production cost across the network forms the most solid "safety net" for Bitcoin prices. This price range represents the minimum economic incentive required to maintain the current security of the network. If market prices remain below this range for an extended period, many miners will find it unprofitable and shut down, leading to a decrease in computing power and a reduction in difficulty, as the network automatically seeks a new, lower-cost equilibrium.

● Although this process is painful, it ensures the long-term resilience of the system. Therefore, this continuously rising production cost provides a dynamic yet clear value floor for Bitcoin prices.

2. Computing power is a "lagging confirmation" of confidence

It is important to clarify that the growth of computing power is a confirmation of past confidence, not a prediction of future prices. The current 1,161 EH/s is the result of miners investing heavily after seeing the approval of Bitcoin ETFs, accelerated institutional adoption, and changes in the macro environment as established facts. Therefore, today’s new high in computing power serves more as a solid footnote for the value discovery that has already occurred.

3. The Game of New Heights

With production costs so high, the market is searching for the next catalyst for value discovery. High costs provide bottom support, but to open up new upward space, stronger narratives from the demand side are needed, such as:

● More mainstream financial institutions allocating Bitcoin as a legitimate asset class.

● Breakthrough developments in the Bitcoin Layer 2 ecosystem, evolving from "digital gold" to "settlement network."

● Increased global macroeconomic uncertainty, reinforcing its attributes as a safe-haven asset.

4. Challenges Behind the Growth of Computing Power

The rapid growth of computing power is not without concerns. As the hash rate continues to rise, the profit pressure faced by miners is intensifying.

AiCoin data shows that despite the record-breaking hash rate, Bitcoin miners' income is decreasing—the hash price has dropped by 15.61% in the past 30 days.

● A month ago, on September 18, the hash price—i.e., the price obtainable for one petahash (PH/s) per second—was $54.71. As of October 18, this price had fallen to $46.17 per petahash.

More computing power does not always mean more profit.

● At the same time, the network mining difficulty has also surged. On October 16, the average block time was slow, hovering around 10 minutes and 21 seconds.

● By October 18, the average block time shortened to 9 minutes and 29 seconds, reshaping the predictions for the next difficulty adjustment expected on October 29, 2025.

● At that time, predictions indicated an increase of 3.39%—but as of October 18, that estimate had risen to 5.43%.

5. Potential Impact on Bitcoin Prices

What impact does the continued growth of Bitcoin's computing power have on market prices?

● Analysis shows that in the short term, the growth of computing power may provide price support, but the medium to long-term impact is more complex. It is commonly believed that changes in Bitcoin's hash rate affect BTC prices. However, this is not entirely true.

● The real dynamic is that changes in BTC's market value influence the hash rate, not the other way around.

Therefore, except in certain specific situations, it is unrealistic to use hash rate trends to predict price movements. If miners are forced to sell large amounts of BTC at low prices to quickly convert to fiat currency to pay for electricity, it may increase selling pressure.

● However, data shows that since October 12, selling pressure has actually decreased. This indicates that miners have not yet begun to sell their BTC reserves on a large scale.

● From historical data, the increase in hash rate often coincides with significant rises in Bitcoin prices.

For example, in March 2025, the hash rate of the Bitcoin network reached a new historical high, while Bitcoin's price rose from $65,000 to $72,000 during the same period. This correlation indicates a strong bullish sentiment between miners and investors, who view the increase in network security as a positive signal for Bitcoin's value proposition.

Indicators

Current Value (2025.10)

Historical Comparison

Price Impact

Hash Rate

1,161-1,241 EH/s

ATH +20% (vs. 2024)

Positive lead, supports rebound

Difficulty

146.72 T

+15% QoQ

Short-term profit compression, volatility ↑

Hash Price

$47-49/TH/s

-8% WoW

Neutral, alert if < $40

BTC Price

~$108,833

+25% YTD

Bull market continues, but high volatility

Source: Compiled by AiCoin

6. Conclusion: Between the Shadows and Light of Computing Power

Looking ahead, the Bitcoin mining industry may exhibit two major trends: first, the global competition for computing power will continue to intensify, and second, miner efficiency will become a key decisive factor.

As the hash rate reaches new highs, the Bitcoin network's resistance to attacks has also significantly strengthened. This indicates an increased confidence in the network's robustness, which may positively impact Bitcoin's market price. The increase in hash rate may bring greater stability and resistance to attacks.

At the same time, miners may face industry consolidation. As network conditions tighten, smaller operations may face greater pressure than industrial-scale miners. If market dynamics do not change quickly, the consolidation of the entire industry may accelerate, benefiting those companies that have already optimized for costs, energy acquisition, and long-term strategies.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。