Original Author: Eric, Foresight News

In recent days, while organizing the various Web3 prediction markets, I suddenly recalled Augur. After searching for related information, I found that Augur announced a relaunch in March this year, but I had no idea when it had ceased operations.

The reason for this sentiment is that Augur was the subject of my first translation article. The article was published on March 19, 2019, and I distinctly remember the requirement to add my personal understanding to the translation. I also recall that the article I published on the public account used a poster from the movie "The Butterfly Effect" as the cover, because my personal interpretation was that prediction markets have the ability to change the future.

I wonder if that whimsical viewpoint from over six years ago can be considered prophetic. My perspective on the nearly $10 billion valuation of leading Web3 prediction markets remains unchanged: when an event will certainly have a definitive outcome in the future, and the betting on that outcome is mixed with economic interests, the betting itself will possess the ability and motivation to change the final result.

The First DApp and First ICO on Ethereum

Augur is hard to rival in terms of being "early." Since Ethereum is a permissionless network, it's difficult to verify whether Augur is truly the first DApp on Ethereum, but some things can be confirmed. For example, Augur began development on the testnet while Ethereum was still in its testing phase, and Augur can be considered the first project to genuinely attract the attention of an industry that was not yet called "Web3" at the time, leading to a plethora of subsequent ecological projects. Although Augur officially launched in 2018, calling it "the first DApp on Ethereum" should not be an exaggeration.

As for Augur being the first successful ICO on Ethereum, that can be verified. An article published by The Economist in 2018 titled “Blockchains could breathe new life into prediction markets” mentioned that Augur's ICO took place in 2015, specifically in August 2015.

This timing is somewhat absurd: Ethereum's genesis block was created on July 30, 2015, and the ERC-20 standard was not officially proposed until November 2015. This means that when Augur initially sold REP tokens, REP did not conform to the ERC-20 standard.

Regarding which institutional investors participated in Augur's legendary ICO, I have seen many versions, including well-known institutions like Founders Fund, Pantera Capital, Blockchain Capital, 1confirmation, and Multicoin Capital, but I have not found authoritative sources of information.

In this ICO, Augur successfully raised over $5 million. Bitcoin's price in 2015 was only around $300 to $400, and Ethereum's price dropped to about $0.4 in the month of Augur's ICO. Over eight years ago, in a discussion on Reddit titled "What was the first ICO/ERC20 token to run on Ethereum smart contracts?" a user named xETHeREALx stated that at that time, Ethereum had no wallets or GUI interfaces, and transactions had to be conducted via the command line using the Geth client. However, another user named adrianclv quickly corrected this, stating that there was no Geth client at that time, and the Ethereum co-founder used the CPP Ethereum client developed by Gavin Wood.

Continuing the Legacy, but with a Poor Experience

Counting from the ICO, nearly three years later, in July 2018, Augur officially launched.

At the time of its official release, Augur provided a desktop application for PC and a web application. The reason for launching a PC application was that there were relatively few Ethereum nodes at the time, and using an application with a built-in full node might be more efficient. The team behind the Augur ecological project Guesser described the design of the desktop application:

The Augur App is a lightweight Electron application that bundles the Augur UI and Augur Node together and deploys it on your local computer. The Augur UI is a reference client (similar to Geth for Ethereum) used to interact with the core smart contracts of the Augur protocol on the Ethereum blockchain. The Augur Node is a locally running program that scans the Ethereum blockchain for event logs related to Augur, stores them in a database, and provides the corresponding data to the Augur UI.

Although there were other projects at the time, such as the earliest NFT project Crypto Kitties and pure gambling applications like Fomo3D, Augur was still considered "the most attractive" in the industry. In addition to genuinely implementing the functionality of prediction markets on-chain, Augur also developed a decentralized oracle to provide results, which was nearly a year earlier than the official launch of the Chainlink oracle.

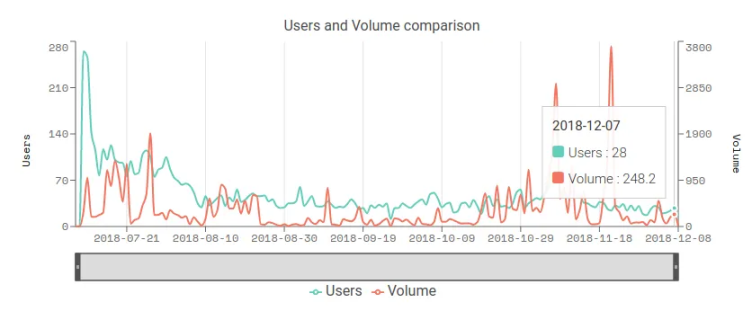

According to DappRadar data, Augur's DAU peaked at 265 users shortly after launch, but by August 8, this number had dropped to 37, and by the end of the year, daily active users were less than 30. As of December 11, 2018, a total of 1,635 markets had been created on Augur, with 11,825 orders and a total of 6,331 completed transactions. During the U.S. midterm elections at the end of 2018, there were days when over 200 transactions were completed. These numbers, which now seem insignificant, were considered quite good at the time.

Moreover, if you understand how Augur's mechanism works, you would find it miraculous that there were still dozens of users playing and thousands of transactions being completed.

Saying that Augur has a poor experience is not only due to the overall poor experience at the time, including MetaMask, but also because Augur's design had fatal flaws. First, unlike Polymarket, Augur did not design arbitrage opportunities to automatically balance probabilities; instead, it required a one-to-one correspondence between opposing bets. In an era without market makers, you had to find someone with exactly the opposite opinion.

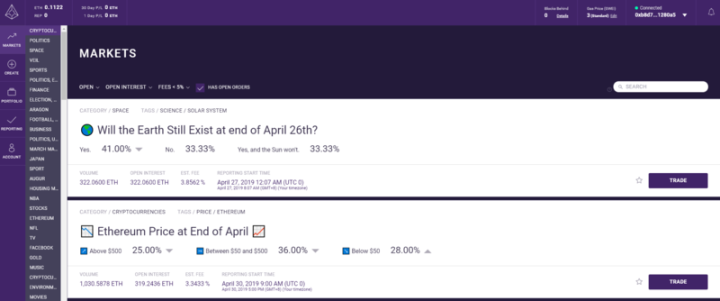

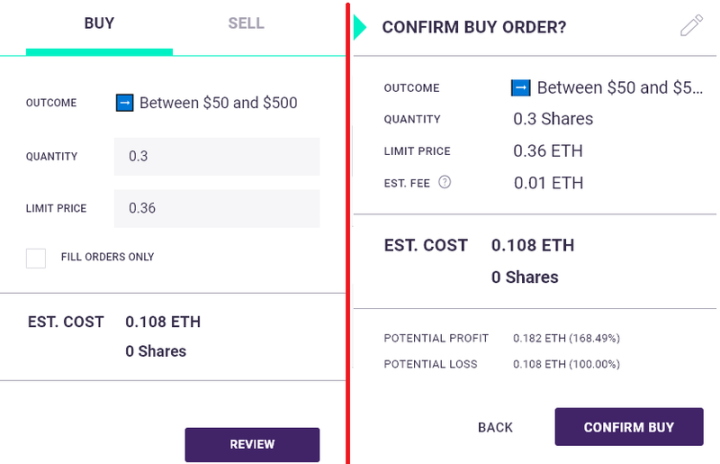

Taking the second market in the trading interface as an example, the theme of this market is the price of ETH before the end of April (2019), with three options: less than $50; between $50 and $500; greater than $500. If we choose the second option to place a bet, you would see a page like this:

Users need to select shares and a limited price (probability). The numbers in the image represent a bet of 0.3 shares, believing there is a 36% probability that the final price will fall between $50 and $500, costing a total of 0.108 ETH. Like Polymarket, Augur also has an order book, but the two order books are completely different.

The lowest selling price shown in the image is 0.3605, which does not mean that someone believes there is a 36.05% chance it will not fall within the $50 to $500 range, but rather that they believe there is a 63.95% chance it will not be in that range. Therefore, when you want to place a reverse bet, you need to calculate the probabilities yourself; otherwise, you may not be able to match orders. The order just placed requires a user who believes or is willing to believe there is a 74% chance it will not be in that range to appear for a successful match, and both parties can earn each other's chips after the final result is revealed.

The sticking point is here: Augur only offers the option of "yes" for each choice; users must choose to go long on "yes" or short on "yes."

Augur's permissionless nature led to many invalid markets. For example, the end date of the aforementioned market might be set for mid-April, and the results provided by the oracle network could support multiple challenges, which caused Augur to have markets that should have settled in the short term dragged on for nearly five months, going through countless disputes before closing. Such a market environment, combined with the need to find "evenly matched" opponents, resulted in only 6,331 transactions out of 11,825 orders being completed.

Finally, the costs of using Augur were surprisingly high. In addition to gas fees, and the costs for users who were not accustomed to using wallets to trade through fiat channels, since both the result providers (reporters) and market creators in the oracle network needed to stake a certain amount of REP, users also had to pay fees to these two parties.

Although the fees charged by market creators and reporters are relatively low (1-2%), users must pay multiple layers of fees to use the platform, which adds up to a considerable amount. In Augur, these fees range from low to high: reporting fees (0.01%), market creator fees (1-2%), Ethereum gas fees (depending on order size), and fees for converting fiat to ETH (4% for debit card payments on Coinbase, 1.5% for ACH payments). Therefore, the total fees for trading on Augur range from 3.5% to 9% or even higher.

The poor wallet experience, one-to-one matching mechanism, logical flaws, and high costs have made it difficult for Augur to scale, but this does not diminish Augur's nearly "pioneering" influence in the development of Ethereum and DApps. The team that developed Augur back then has some members who have now become key players in the industry.

Internal Conflict, Ex-Partner Claims $150 Million

Augur was launched by the Forecast Foundation, and public information shows that the organization includes co-founder and core developer Jack Peterson, co-founder and chief architect Joey Krug, early marketing and community head Jeremy Gardner, full-stack engineer Stephen Sprinkle responsible for front-end and contract integration, and researcher Austin Williams, who wrote the game theory proof in the Augur white paper appendix.

Among them, Joey Krug has also served as co-CIO of Pantera Capital since June 2017 and is currently a partner at Founders Fund. Stephen Sprinkle left Augur in 2019 to join ConsenSys as a product manager and later became the engineering director at BlockFi; after BlockFi's restructuring in 2022, he moved to Coinbase to continue overseeing institutional products.

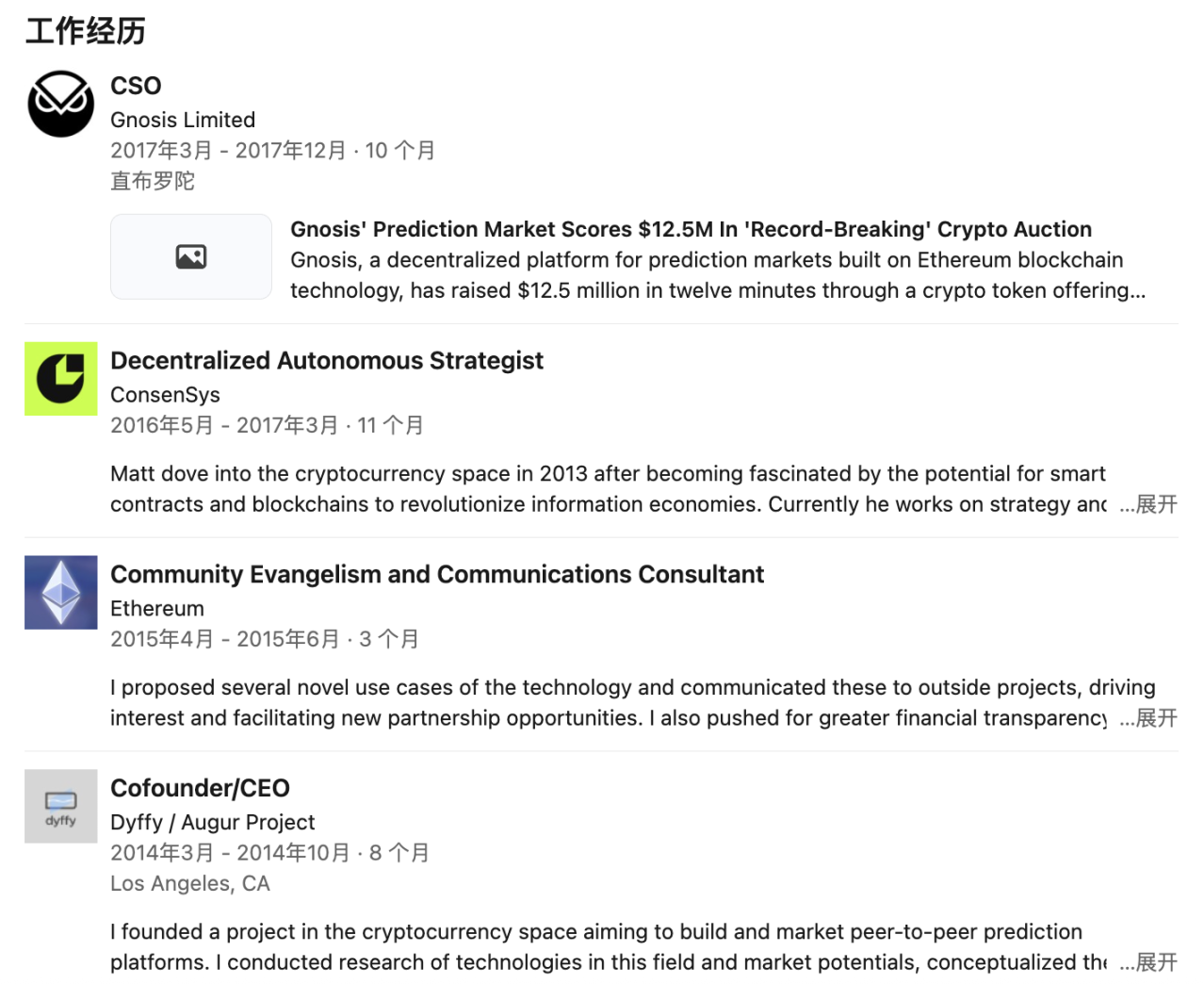

However, according to a lawsuit filed by Matt Liston in 2018, a story before Augur's inception was revealed.

According to a report by BlockBeats in 2018, Matt Liston claimed that he initially registered a company named Dyffy in Delaware and hired Jack Peterson. At that time, Liston proposed the idea of developing a prediction market on the blockchain, but Peterson did not initially support it.

Later, Liston saw the Truthcoin white paper written by Yale economist Paul Sztorc and believed it could serve as a basis for developing a prediction market and issuing tokens. Liston successfully persuaded Joseph Ball Costello to invest and also convinced Peterson to support the idea of on-chain development through Paul Sztorc. With this foundation, Liston hired Joey Krug and Jeremy Gardner, the latter of whom suggested naming the project Augur.

In the following months, the team argued incessantly over technical and business strategy choices, resulting in Matt Liston being ousted in October 2014. Krug replaced Liston as a director, and Peterson became the CEO. In December of the same year, the nonprofit organization Forecast Foundation was established in Oregon, USA.

Matt Liston stated that it might have been a desire to completely sever ties with Dyffy that led Costello to repeatedly urge Liston to accept not taking legal action against Dyffy and to acknowledge that Dyffy had been acquired, exchanging equity for cash or REP tokens. Under continued pressure, Liston was forced to sign an agreement and, due to the so-called "concealment of the specific allocation plan for the ICO," he gave up 5% of his REP share in exchange for $65,000 in cash. Based on Augur's market capitalization at the time of the lawsuit, the tokens he initially gave up are now worth over $20 million.

Regarding Augur, which had a market capitalization of over $450 million at the time, Matt Liston claimed $38 million in general damages and $114 million in punitive damages, totaling $152 million, which exceeded one-third of Augur's market capitalization and became the "highest claim in cryptocurrency history."

However, several defendants from Augur were surprised that Liston suddenly reneged three years after signing the agreement. Additionally, both Jack Peterson and Joey Krug believed that Liston was not a founder of Augur, with Krug stating, "Liston made no contributions to the open-source repositories on GitHub or any other Augur repositories; he cannot be considered a founder of Augur." Reports indicated that doubts about his true identity left Liston struggling with unemployment, and his LinkedIn profile shows no new job records since resigning as Gnosis' chief strategy officer in 2017.

Reports cited insiders stating that the main reason for the internal conflict was Liston's insistence on developing Augur on Ethereum, while the team insisted on developing it on Bitcoin. Interestingly, Augur ultimately launched on Ethereum and became the first successful ICO after the Ethereum mainnet went live. It is worth mentioning that there have been no further public updates on the case since then, and given that Augur managed to last until the end of 2021, this matter either reached a peaceful resolution or faded away.

Three and a Half Years of Silence, A New Start

In March of this year, Augur suddenly announced its return on X, with the last tweet from this account dating back to November 18, 2021.

In 2020, Augur launched an updated v2 version, making adjustments in many areas, including user experience. In July of that year, Forbes referred to it as "a significant leap in the field of decentralized applications." In the article "Ethereum’s First ICO Blazes Trail To A World Without Bosses," Forbes journalist Michael del Castillo stated, "Its functionality is similar to the internet but does not require a trusted third party. If successful, this far-reaching upgrade will not be limited to betting on horse races without bookmakers; it may mark a turning point for the next generation of the internet."

Although Augur did see individual markets with participation exceeding $10 million during the 2020 U.S. presidential election, the brilliance of DeFi overshadowed it, and Augur ultimately faltered at the peak of the explosive bull market in 2021. Perhaps the breakout of Polymarket brought prediction markets back into focus after nearly a decade, prompting the new team behind Augur to choose to restart this year.

The relaunch of Augur will be managed by two teams: the Lituus Foundation will handle token and operational matters and develop the oracle, while Dark Florists will be responsible for implementing specific prediction markets. The Lituus Foundation claims to be composed of long-term community members of Augur, but there is currently no information available about its members.

Dark Florists is a well-known Ethereum development team. Among its main members, Killari cracked a solution for indistinguishable obfuscation (a cryptographic scheme designed to convert programs into "black boxes" that can be freely shared and executed while completely hiding their internal workings) developed jointly by the Ethereum Foundation, Phantom.zone, and 0xPARC at the 2024 Devcon, earning a $10,000 bounty. Micah Zoltu is known for discovering a significant vulnerability in MakerDAO in 2019 and is also a developer of EIP-3074 and EIP-2718.

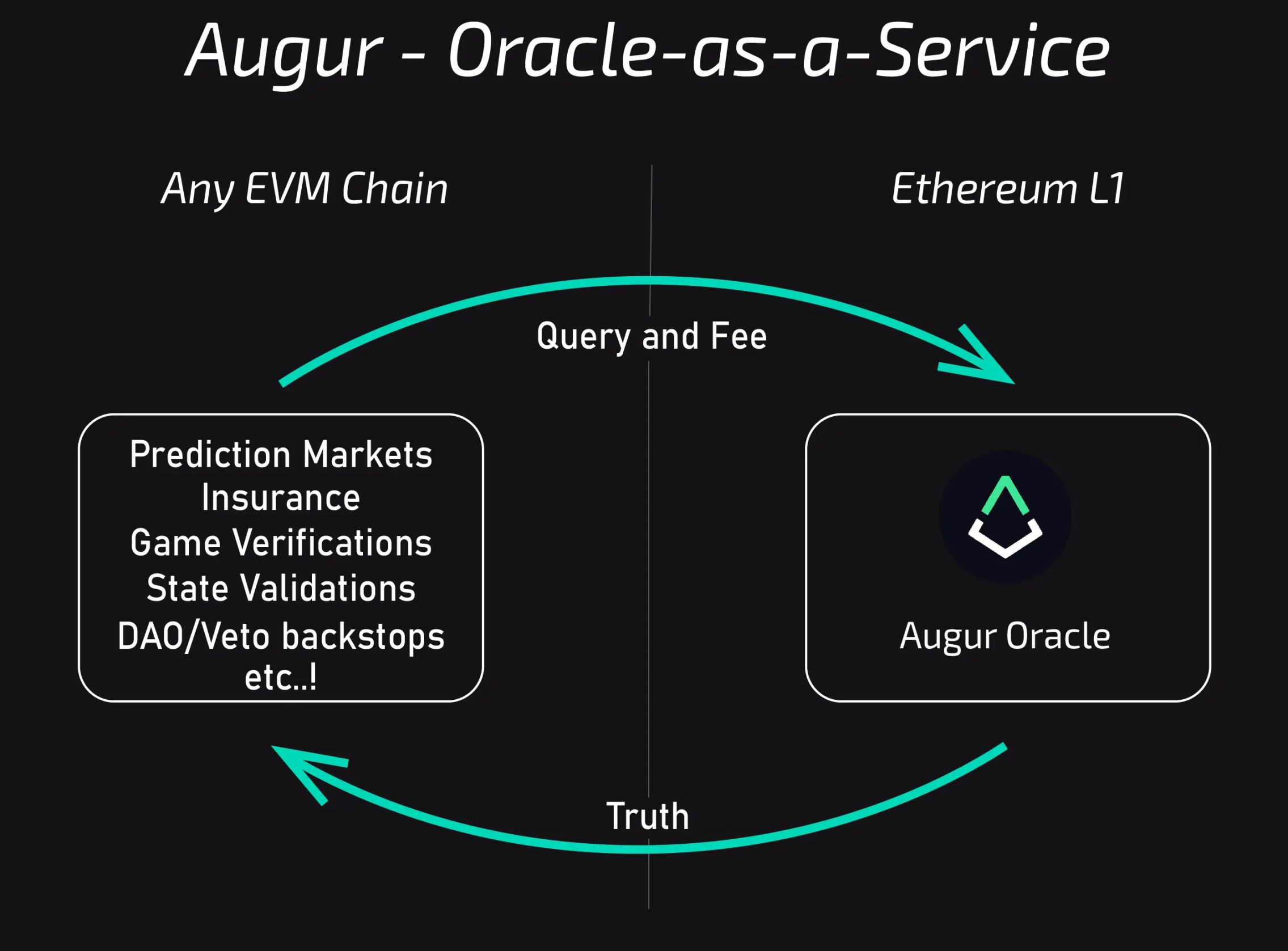

This team hopes to launch a "new Augur" that is not merely a commercial platform but, in the words of the Lituus Foundation, a cross-chain decentralized truth machine. The Lituus Foundation aims to separate and modularize the oracle from Augur's prediction markets, allowing all applications to utilize the Augur oracle.

Augur was originally designed as a purely decentralized application, not relying on multi-signatures, management keys, or backup mechanisms. Even its tokenomics design incorporated original game theory to ensure the platform operates through interest-based competition (this aspect was not explained in the previous text; interested readers can refer to the original white paper and the v2 update). The new Augur will continue to uphold this spirit. The information we currently have indicates that the new oracle will likely be deployed on L2, and the initial prediction markets will be developed based on AMM.

As of now, the Lituus Foundation has released two progress reports. In the first quarter after announcing the relaunch, Lituus increased its REP holdings from 250,000 to 550,000 and deployed $100,000 in liquidity on Uniswap v3 while planning to launch on CEX. In the subsequent second quarter, four significant developments occurred:

- Launched a website;

- Research on the oracle will develop along two complementary lines, one focusing on consumer prediction markets and the other on enterprise-level oracle use cases;

- Micah Zoltu initiated a crowdfunding campaign to intentionally promote an algorithmic fork of REP to test Augur's core security model;

- The foundation's buyback scale expanded to 1 million REP.

The algorithmic fork is a very interesting design, and the details are quite complex. Here, I will provide a simple explanation:

In the design of Augur, "outcomes" do not have fixed answers. Augur allows for disputes over outcomes to be initiated by staking REP to vote, and when the dispute reaches a threshold (2.5% of the total staked REP), the system splits into two parallel universes, each corresponding to an outcome. REP holders must choose the universe they endorse and migrate their REP to that universe. After a dispute begins, if the staked REP does not reach the threshold within a given time, participants supporting the initial outcome will be rewarded.

Micah Zoltu initiated crowdfunding to raise funds to invest in outcomes that are clearly incorrect in disputes, thereby "sacrificing" a portion of REP to test the feasibility of this mechanism. However, due to this test, the plan to go live on CEX was forced to be interrupted and will need to be discussed again only after this dispute is fully resolved.

Conclusion

"Feng Tang is easy to grow old, but Li Guang is hard to be sealed."

Ethereum co-founder Vitalik mentioned in his article "From prediction markets to info finance" published last November that he was once a loyal user and supporter of Augur. As the first ICO project on Ethereum, Augur's design seems overly advanced even today.

This advancement does not solely stem from the mechanism but rather from the overly utopian prerequisites for implementation. What were our discussions about prediction markets back then?

- Farmers could establish prediction markets for harvest season weather as a hedge against the potential impact of climate on yields;

- Using prediction markets to establish bug bounties and smart contract insurance;

- Conducting incentivized public opinion polling markets and introducing conditional markets to guide policy-making (detailed reading can be found in the Ethereum Foundation's 2014 article);

- Creating trading pairs on Uniswap between RealT (real estate tokens) and tokenized positions betting on falling property prices to allow hedged positions to earn trading fees;

……

Current prediction markets are filled with trading and arbitrage, which is one approach, and it currently seems to be the only correct approach. We often complain that Web3 lacks innovation in recent years, but looking back at the thoughts of OGs from ten years ago, do we really have no room for innovation?

Web3 is like a massive Polymarket; we used to be busy establishing new markets, enjoying ourselves. At one point, we suddenly began to market-make in the order book, using bots to find opportunities with probabilities that do not equal 1 within milliseconds, and also arbitraging by placing take-profit and stop-loss orders before the market closes. It seems that suddenly everyone lost the courage to establish a new market and bet on a bigger future.

In an article I translated six years ago, I mentioned the "3P theory," which stands for Predicting the future, Preparing for the future, and Persuading the future. At that time, I wrote a passage that I had forgotten: decentralized prediction markets lay all possible parallel timelines before you, and everyone has the right to choose the future door they want to step into. The more people participate in the choice, the more likely it is to guide time toward a further future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。