Author: Thejaswini M A

Translation: Block unicorn

Preface

For most of the 20th century, the answer to this question was simple: it was determined by your employer. Companies provided pensions, managed investments, and bore the risks. If the fund performed well, they kept the extra profits; if it performed poorly, they made up the losses. You had no say, but you also had no losses.

Then, the emergence of 401(k) plans shifted the responsibility onto individuals. You choose the investments and bear the risks. But your choices are not entirely free. Employers still act as gatekeepers, offering only a set of "prudent" options. Initially, courts deemed common stocks too risky for retirement accounts. Later, index funds were considered too passive. The definition of prudence has evolved, but the paternalistic approach remains.

On October 15, 2025, Morgan Stanley redefined the boundaries. The company's 16,000 financial advisors can now recommend Bitcoin investments to any client, including those with IRAs and 401(k)s. There are no minimum wealth requirements and no aggressive risk tolerance requirements. Bitcoin quietly joins bonds and blue-chip stocks in the portfolios funding American retirements.

The risks are enormous. Total U.S. retirement assets amount to $45.8 trillion. Even if just 1% of that asset allocation shifts to cryptocurrencies, it means $270 billion flowing into the market. If it's 2%, that's over $500 billion.

What beautiful mathematical principles lie behind this? I have some thoughts to share.

Morgan Stanley Opens a New Era of Cryptocurrency Retirement Investment

Until last October, Morgan Stanley restricted access to cryptocurrencies to clients with over $1.5 million in assets, aggressive risk tolerance, and taxable brokerage accounts. Retirement accounts were completely prohibited.

Now those restrictions are gone.

Advisors will not directly purchase Bitcoin for clients. Instead, they will allocate funds to regulated crypto investment products, primarily Bitcoin ETFs from BlackRock and Fidelity. In the future, once approved, Ethereum and Solana ETFs may also be included.

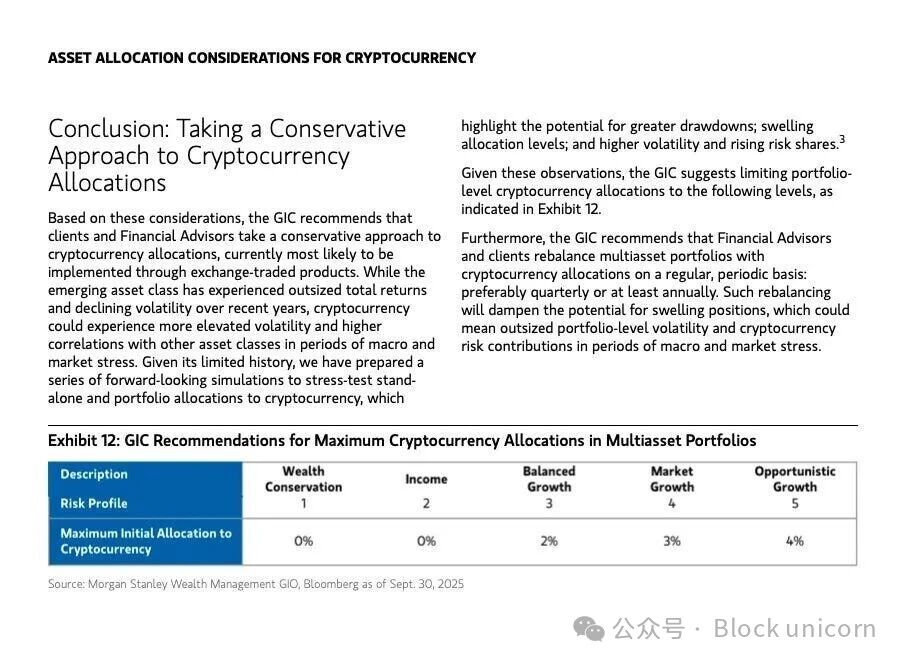

The company's automated portfolio system tracks each client's crypto asset exposure in real-time to prevent over-concentration. Morgan Stanley's Global Investment Committee recommends a 4% allocation for "opportunity growth" portfolios, a 2% allocation for balanced growth portfolios, and 0% for preservation or income strategies.

These limits serve as a legal shield. Under the Employee Retirement Income Security Act (ERISA) of 1974, which governs retirement plans and defines "prudent" investments, companies sponsoring 401(k) plans have a fiduciary duty to act in the best interests of participants. If a company offers imprudent or overly risky investments without proper oversight, participants can sue for losses. To win, plaintiffs must prove that the fiduciary violated their duties by providing inappropriate investments or failing to manage oversight adequately.

Morgan Stanley's 4% cap and real-time risk monitoring are designed to guard against such lawsuits. The company bets that conservative allocation limits and real-time risk monitoring will protect it from accusations of negligence exposing retirees to the volatility of cryptocurrencies. Whether this defense holds when Bitcoin drops 70% remains untested.

Advisors must document crypto recommendations through an internal system. Compliance teams ensure that clients confirm volatility disclaimers and risk tolerance adjustments before investing.

While Bitcoin ETFs are immediately available, Morgan Stanley's E-Trade platform will launch direct trading of Bitcoin, Ethereum, and Solana in 2026, supported by Zerohash infrastructure.

This remains highly regulated, with strict risk scoring and allocation software. But it effectively turns cryptocurrencies into mainstream investment options accessible through 80% of U.S. retirement accounts managed by Morgan Stanley.

Why Now? The Policy Window Has Just Opened

Three regulatory changes have created conditions for Morgan Stanley's initiative.

First, an executive order signed by President Trump in August directed the Department of Labor (DOL) and the Securities and Exchange Commission (SEC) to re-examine the rules regarding alternative investments in 401(k)s and IRAs. This order effectively rewrote the boundaries of retirement investing, signaling to financial institutions that regulatory backlash is no longer a concern.

Second, the GENIUS Act signed in July established the first comprehensive stablecoin regulation in the U.S. By requiring 1:1 dollar reserves and quarterly audits, the law reduces systemic vulnerabilities and assures institutions that crypto infrastructure now has regulatory legitimacy.

Third, the DOL overturned its cautious stance on cryptocurrencies in retirement plans from 2022. By allowing fiduciaries to assess crypto investments under traditional ERISA standards, the DOL has normalized the inclusion of cryptocurrencies in 401(k)s and IRAs without special exemptions.

These changes collectively create a narrow policy window. Morgan Stanley is the first mainstream wealth management company to seize this opportunity, while competitors like Fidelity and Schwab are slower to act due to ongoing discussions about exposure limits within their internal risk committees.

After Wall Street interpreted the regulatory signals, it concluded that the risk of not offering cryptocurrencies now outweighs the risk of providing them. But there is a deeper trend driving this shift: institutions now refer to it as "currency devaluation trading."

This aligns with the arguments held by gold enthusiasts and Bitcoin supporters for years. Central banks will not stop printing money. Fiat currencies will lose purchasing power. Traditional safe-haven assets like gold are soaring, the dollar index is in a multi-year downtrend, and investors are turning to fixed-supply assets. Once marginal thoughts have now become institutional consensus. Bitcoin is now designed as an anti-devaluation asset: fixed supply, transparent issuance, and trustless verification. When the currency itself is repriced, Bitcoin no longer appears speculative but rather as a means of capital preservation.

Next Steps

Morgan Stanley's decisive move puts pressure on other wealth management companies with retirement businesses. Here’s the current status of major players.

Fidelity launched a no-fee cryptocurrency IRA in 2022 and now offers spot Bitcoin ETFs. As the largest 401(k) provider by asset size, holding over a third of U.S. accounts, Fidelity has expanded to include Ethereum and Solana funds. However, it has yet to integrate cryptocurrencies into the retirement portfolios managed daily by advisors.

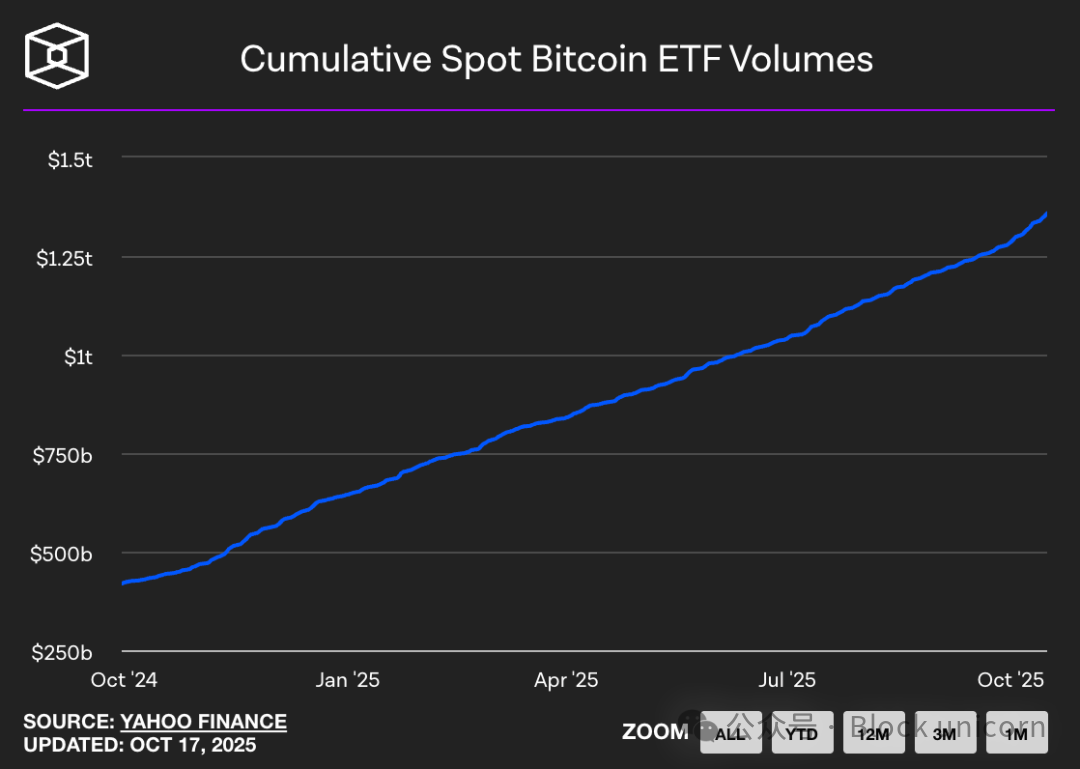

BlackRock's Bitcoin ETF (IBIT) holds $84 billion in assets, capturing 57% of the Bitcoin ETF market share. It is the fastest-growing ETF in history, potentially reaching $100 billion in 450 days. BlackRock's advantage lies in product dominance rather than distribution channels.

Charles Schwab plans to launch cryptocurrency spot trading in 2026, targeting Gen Z investors, who account for 33% of new accounts and are under 28 years old. Schwab aims to roll out a full suite of products in early 2026, but retirement account access is not yet available.

Vanguard, managing $10 trillion in assets, is exploring access to third-party crypto ETFs after years of resisting crypto assets. Under pressure from clients and the new CEO of BlackRock, Vanguard's policy has shifted to be more open to cryptocurrencies. However, among major players, Vanguard remains the most cautious.

Goldman Sachs focuses on tokenized money market funds through its GS DAP platform in partnership with BNY Mellon, providing on-chain fund record services. The company is building tokenized asset infrastructure rather than pursuing retail crypto exposure.

The broader banking industry is also taking action. JPMorgan is expanding its JPM Coin for cross-border settlements and servicing crypto funds. Citigroup plans to launch digital asset custody services in 2026 and is involved in the G7 stablecoin alliance. Bank of America, Deutsche Bank, UBS, and Barclays are all participating in multinational stablecoin research groups.

A noteworthy new player is Erebor Bank, founded by billionaire Palmer Luckey and Joe Lonsdale, both supporters of Trump, based in Columbus, Ohio. Erebor received conditional approval from the Office of the Comptroller of the Currency (OCC) in October. This bank, focused on technology and cryptocurrencies, aims to serve emerging companies in fields like artificial intelligence and digital assets. Its approval marks a regulatory opening for institutions specializing in cryptocurrency banking.

Traditional institutions are racing to integrate cryptocurrencies into existing wealth management infrastructures, while new players are building crypto-native tracks from scratch.

While Morgan Stanley's move brings cryptocurrencies into individual retirement accounts, state pension funds have quietly accumulated Bitcoin for over a year.

Wisconsin and Michigan have disclosed holdings in BlackRock's IBIT and ARK Bitcoin ETFs, totaling nearly $400 million.

The risk appetites of the general public and Wall Street institutional investors are accelerating towards convergence. Pension funds operate under fiduciary duties, meaning their managers must demonstrate that each allocation is prudent and in the best interests of beneficiaries. If they are willing to invest in Bitcoin, it is because they believe the diversification benefits and asymmetric upside outweigh the volatility risks.

Now, through Morgan Stanley, retirement accounts are joining this trend, highlighting a large but covert reallocation of long-term savings towards digital assets. Conservative strategies will limit exposure to 5% of the portfolio, while aggressive allocations may reach up to 35%, depending on risk tolerance.

Bitwise analysts estimate that a 1-2% shift of the $45.8 trillion in retirement assets to cryptocurrencies could result in inflows of $450 billion to $900 billion, potentially pushing Bitcoin to $200,000. The first wave of funds may arrive this fall, coinciding with the Federal Reserve's potential interest rate cuts.

But if cryptocurrencies drop 70%, that would mean a $300 billion loss for retirees, potentially impacting consumer spending and eroding trust in retirement advisors.

What happens when others follow suit?

Deutsche Bank analysts predict that by 2030, central banks may hold significant amounts of Bitcoin and gold due to institutional adoption and a weakening dollar. Gold has surpassed the $4,000 per ounce mark, while Bitcoin's trading price is slightly below its historical high.

The dollar's share of global reserves has fallen from 60% in 2000 to 41% in 2025. This decline has driven record inflows into gold and Bitcoin ETFs, reaching $5 billion and $4.7 billion in June alone.

JPMorgan analysts estimate that by 2027, the growth of the stablecoin market could translate into an additional $1.4 trillion demand for dollars, although this depends on overseas investment interest. The interplay between Bitcoin's rise, stablecoin adoption, and dollar hegemony is still unfolding.

However, it is evident that retirement portfolios are being rebuilt through Bitcoin ETFs, whether regulators, advisors, or retirees fully understand the implications.

If Fidelity, Schwab, and Vanguard follow in Morgan Stanley's footsteps, the industry will effectively decide that cryptocurrencies are no longer alternative assets. They have become core assets.

This concludes today's discussion; see you in our next article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。