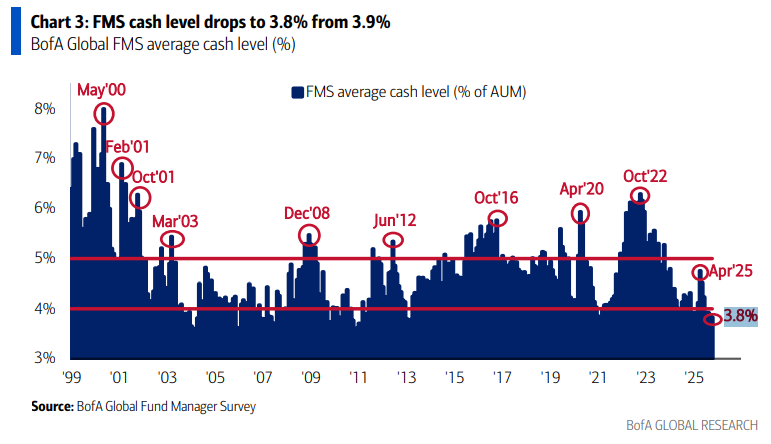

Today, there isn't much content, but I've been reading continuously, and before I knew it, time has flown by. This week, there's a piece of data that I'm quite concerned about, which is that the cash holdings of U.S. fund managers dropped to 3.8% in October, down from 3.9% in September and August. Generally speaking, when this data is above 5%, it indicates a low risk appetite in the market, often corresponding to market bottoms or risk periods.

When this data falls below 4%, it indicates a higher risk appetite, with significant capital flowing into stocks or risk assets. Currently, this figure is at 3.8%, the lowest level in the past 12 years, suggesting that fund managers do not have much cash on hand and are heavily invested. Normally, this is a signal of gradually exiting the market.

This represents a potential short-term market top or a precursor to a pullback. Many might ask, "Aren't you still looking at the bull market for $BTC?" Does this mean it's all over? Not necessarily; this is just a short-term signal. Indeed, from a short-term perspective, fund managers have limited funds, making it difficult to push stock prices higher again.

However, looking at the data from the past 25 years, although there have been multiple instances of falling below 4%, the U.S. stock market has generally been on an upward trend during this period. Therefore, I believe this data reflects more of the "turnover preference of fund managers." When U.S. fund managers start to reduce their holdings, it can indeed lead to some asset declines due to profit-taking, but in the long run, as long as companies perform well and have sufficient cash flow, the market will still buy back in.

The current situation with AI follows this logic. In the short term, there is indeed a high potential for a bubble, but as long as this bubble hasn't burst, the market will continue to bet on it. Moreover, in the long run, the cash-generating ability of AI may evolve from productivity improvements into the "Fourth Industrial Revolution," prompting the market to buy back in, similar to the previous internet bubble.

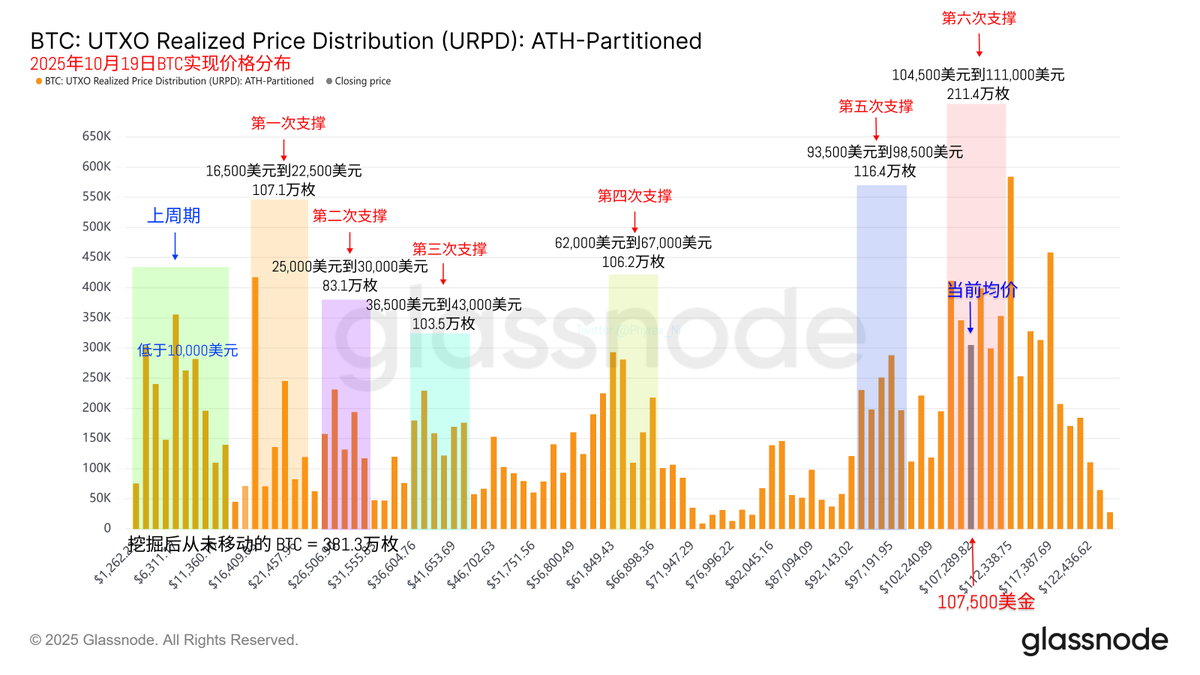

As for $BTC, the narrative is different. The logic of Bitcoin has detached from traditional fund managers, and institutional and political drivers are still continuing to ferment. Although BTC does not have performance metrics, a significant amount of "trust" has led long-term holders to lock up a large amount of liquidity, reducing the disposable retail BTC in the market, which enhances BTC's properties akin to gold.

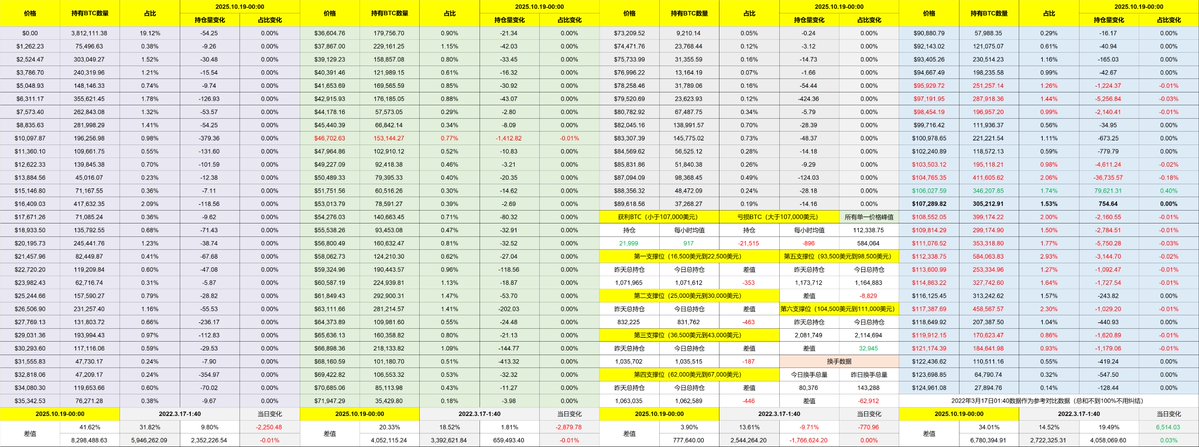

Looking back at Bitcoin's data, the turnover rate has almost halved. Although this is partly due to the weekend, it also indicates that investor pessimism is beginning to ease. After a day of consolidation on Sunday, the market will start to re-engage on Monday. Currently, the dominant influence is still the impact of the stalemate, but with the House of Representatives going into recess next week, the market has already priced this in, and as long as there are no unexpected issues between China and the U.S., it should be manageable.

There's not much else to say. If next week fund managers show signs of selling that lead to a decline in U.S. stocks and subsequently drag Bitcoin down, I will prepare to buy the dip in the spot market.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。