Original text from YQ

Translation|Odaily Planet Daily Golem (@web 3golem)_

From October 10 to 11, 2025, leveraged positions worth $19 billion to $40 billion were forcibly liquidated, marking the largest liquidation event in cryptocurrency history. However, this was not solely due to retail investors over-leveraging; many of the liquidated positions were reportedly used for hedging: delta-neutral strategies, conservative 1x leverage setups, and professional market makers' order books.

We found that perpetual contracts convert market risk into operational risk (exchange failures, automatic liquidation mechanisms, oracle manipulation, market maker withdrawal), which can all be triggered simultaneously during extreme market conditions. While perpetual contracts are very effective for directional speculation and professional trading, they are not entirely reliable for hedging.

Traditional Hedging Methods

Delta Neutral Hedging

Hedging refers to establishing offsetting positions to reduce exposure to adverse price fluctuations. A good hedging strategy needs to have four characteristics:

- Path independence: The protection should be effective regardless of whether prices steadily decline or drop sharply;

- Counterparty reliability: The hedging strategy must work when the market is under pressure, not fail when it is most needed;

- Cost predictability: Hedging costs should be transparent and bounded;

- Positive convexity: The protection should strengthen as market conditions worsen, not weaken.

Delta-neutral strategies attempt to create a portfolio with zero price sensitivity. Delta measures how the value of a position changes for every $1 movement in the underlying asset.

Standard configuration: Portfolio Delta = Long position + Short position = (+1) + (-1) = 0

Traders maintain positions, may incur funding fees, and expect to gain protection from price volatility. However, the "10.11" major liquidation proved that this approach has multiple failure modes.

Perpetual Contracts

Perpetual futures are derivative contracts with no expiration date, invented by Alexey Bragin in 2011. Key features include:

- Funding rate: Periodic payments between longs and shorts to anchor the perpetual contract price to the spot price. When the perpetual contract trading price is above the spot price, longs pay shorts, and vice versa;

- No expiration date: Unlike traditional futures, positions in perpetual contracts can theoretically be held indefinitely;

- High leverage: Typically 10x to 100x, claiming high capital efficiency;

- Mark price system: Combines exchange order book prices with external oracle data for margin calculations.

Assuming you have $100,000 in capital, you can use $100,000 as margin (1x leverage) to hedge a $1 million position, leaving $900,000 available. However, in the face of real risk, this efficiency will be negated.

"10.11" Major Liquidation Rendered Contract Hedging Ineffective

After "10.11," both delta-neutral strategies, so-called conservative hedging strategies, and professional institutions faced systemic destruction.

Failure Reason 1: Automatic Liquidation (ADL)

Automatic liquidation (ADL) is the last resort of exchanges. When normal market operations cannot fill the liquidation gap and the insurance fund is exhausted, exchanges will forcibly close profitable positions to absorb losses from bankrupt positions.

Binance's automatic liquidation (ADL) selection formula: ADL ranking = Profit and loss percentage × Effective leverage (for profitable positions)

This system specifically targets the most successful and highly leveraged positions, making profitable hedging positions the priority targets for forced liquidation.

For example, if a trader went long $5 million in BTC spot with 3x leverage before "10.11" while shorting $5 million in BTC contracts around the $120,000 price, and none of the positions had stop-losses set. When "10.11" occurred, their BTC short would be forcibly liquidated by ADL, leaving them holding a naked leveraged long position, ultimately leading to a total loss of 100% ($5 million).

Hyperliquid executed 35,000 ADL events affecting 20,000 users during "10.11." While ADL may have improved the returns for most shorts by forcing liquidations near the market bottom, this was merely coincidental. For trading hedges, forced liquidations are catastrophic.

Failure Reason 2: Market Maker Withdrawal

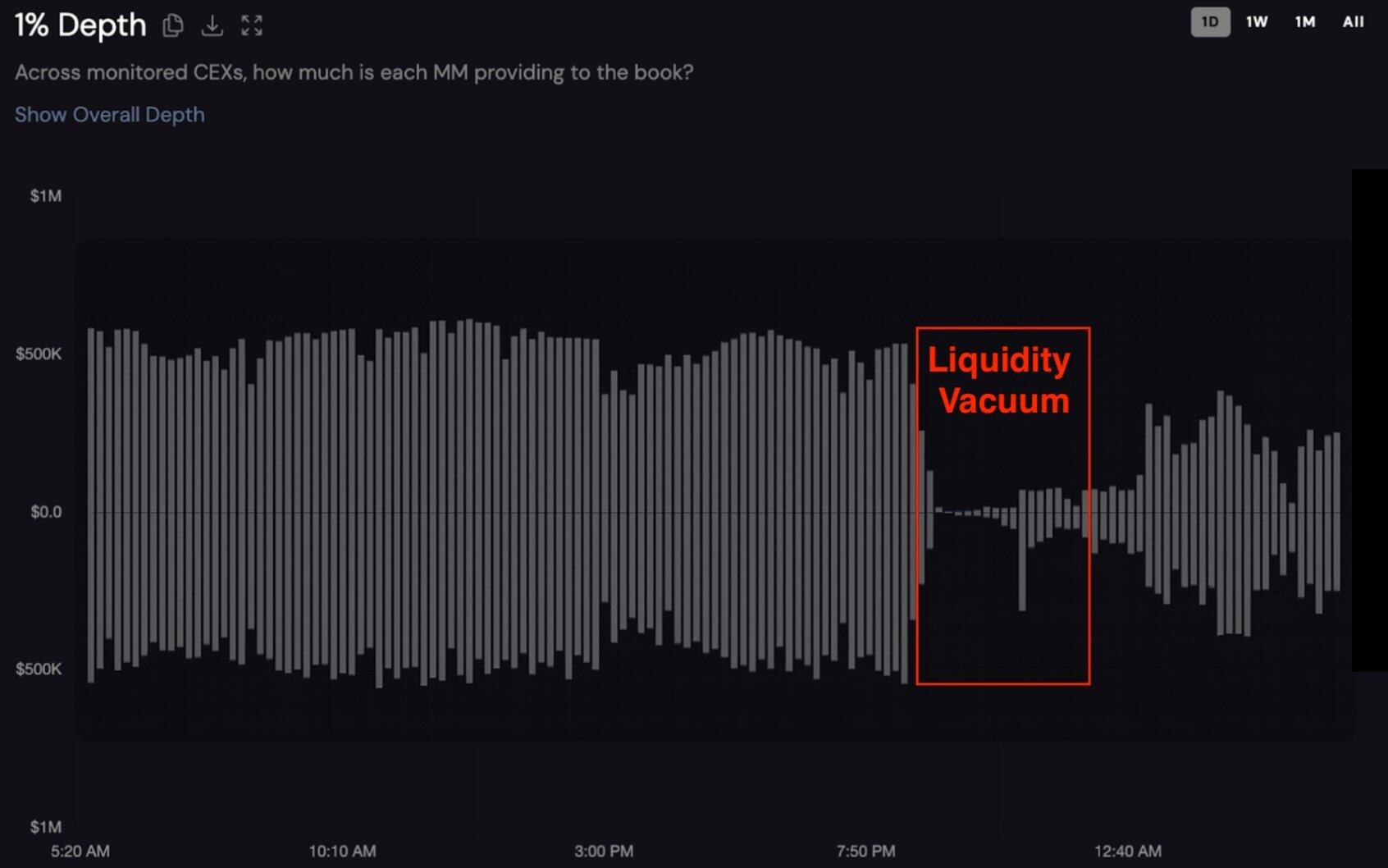

Depth chart of unnamed token_0 on CEX with 1% depth over the past 24 hours. The x-axis below shows the buy price, and above shows the sell price. Data from Coinwatch.

During "10.11," the order book depth for major trading pairs plummeted by 98%, from $1.2 million to $27,000, indicating that professional market makers were withdrawing liquidity in unison. Coinwatch Track data shows that major market makers withdrew all liquidity within 15 minutes, with liquidity depth remaining below 10% of normal levels for over 5 hours, and some market makers took over 8 hours to restore full liquidity.

Market makers typically use perpetual contracts to hedge their inventory, but when ADL comes into play, they are also forced to hold naked long positions in a declining market, leading them to withdraw all liquidity to stop losses. This resulted in a once liquid 24/7 perpetual contract market evaporating precisely when liquidity was most critical.

Failure Reason 3: Oracle Issues and Cross-Margin Mechanism

Many liquidations occurred due to the exchange pricing system using incorrect valuations rather than actual asset depreciation, such as the plummeting prices of wBETH and USDe on CEX.

At the same time, modern exchanges implement cross-margining to improve capital efficiency, with all positions supported by the entire account. When wBETH crashed by 89% due to oracle failure, traders who originally held hedged BTC positions elsewhere found that the collateral for all their positions evaporated simultaneously. The margin supporting BTC hedges was depleted due to losses in wBETH, and a single margin call notification weakened all other positions. Cross-margining also transformed isolated risks into losses for the entire portfolio.

XPL/PLASMA: Conservative 1x Leverage Strategy Failure

The collapse of "10.11" highlighted systemic failure. The XPL/PLASMA manipulation incident in August 2025 demonstrated that even a 1x leverage hedge for pre-issued tokens could lead to catastrophic failures under conditions of weak market liquidity.

Hyperliquid was the first to launch pre-issue perpetual contract trading, allowing speculation on tokens before they appeared in the spot market. Plasma's XPL token garnered significant attention, with many traders attempting to hedge their airdrop allocations by shorting XPL perpetual contracts. The logic was that if users expected the XPL token to be worth $10,000, they could short a $10,000 perpetual contract before issuance to lock in that value.

The whale price manipulation incident in August 2025 caused significant losses for users using 1x leverage to hedge. _(Related reading: _Hyperliquid Exposes Whale Manipulation Again: XPL Pre-Launch Rises 200% Leading to Short Liquidation, Harvesting $46 Million)

1x leverage creates a false sense of security for users, who believe that 1x leverage provides safety and requires a 100% reverse movement to trigger liquidation. However, for pre-issued tokens with a maximum leverage of 3x, when a whale can push the price up by 200% by exhausting a thin order book, 1x leverage offers no protection.

A liquidated trader stated, "1x hedge, account destroyed, my XPL allocation lost half." This also reflects a paradox: using a conservative hedging strategy should reduce risk, but the ultimate loss was greater than holding the unhedged underlying asset.

How to Reduce the Risks of Perpetual Contract Hedging?

Despite evidence suggesting that perpetual hedging is flawed, some participants have no choice. Here are some guidelines to reduce (not eliminate) risk.

Capital Requirements

When appropriate risk management is applied, the capital efficiency of perpetual contracts disappears. The required capital formula is:

- Normal volatility: Capital = Position size × 1.4

- October volatility: Capital = Position size × 1.65

- Pre-launch tokens: Capital = Position size × 2.5+

For safe hedging of a $100,000 BTC position, a minimum of $140,000 is needed, but during stress periods, it is advisable to have $165,000, and for pre-launch, over $250,000 is required.

If capital is less than 1.5-2 times the position size, do not attempt perpetual contract hedging, as the risks created will outweigh the risks to be eliminated.

Forced Stop-Loss and Take-Profit

When hedging with perpetual contracts, stop-loss and take-profit must be set before opening a position. During "10.11," many traders hedged but had no exit strategy, believing liquidation was impossible. They thought delta-neutral strategies meant "set it and forget it," but without predetermined exit points, risk exposures included: sudden spikes in volatility (leading to liquidation before reacting), skyrocketing funding rates (resulting in position loss), oracle failures (leading to mispriced collateral), and infrastructure failures (preventing manual intervention).

For each perpetual hedge position, define the following before opening the position:

Stop-loss level:

Conservative: 15-20% adverse movement at entry;

Moderate: 25-30% adverse movement;

Maximum: 40-50% (only for 1x leverage and substantial buffer capital);

For example, if going long 1 BTC at a spot price of $120,000 while shorting 1 BTC perpetual contract at 1x leverage, the stop-loss should be set at $156,000 (30% adverse movement). If the BTC price surges to $156,000, the hedge will automatically close, resulting in a loss of $36,000, but at that point, the spot gains $36,000, and the hedge loses $36,000, netting neutral.

The take-profit for hedging is crucial, as funding rates and opportunity costs accumulate over time.

Multi-Platform Diversification

Do not concentrate perpetual hedging on a single exchange; at least diversify the hedge across 3 or more exchanges (e.g., 40% Binance, 35% Bybit, 25% OKX). Maintain independent collateral pools, use different settlement currencies whenever possible, and do not set cross-platform margin.

Hedging on a single platform means that operational failures of the exchange will destroy the entire hedging trade. During "10.11," Binance experienced oracle failures for wBETH, BNSOL, and USDe; automatic liquidation (ADL) failures in specific areas; and API failures in certain modules.

Leverage Limits

For hedging positions, a maximum leverage of 1x is allowed, no more. For a capital account, hedging $1 million requires $1 million in margin plus 30-50% in buffer capital, totaling $1.3 to $1.5 million. Trading positions with different risk parameters should use separate accounts. Never hedge cross-margin with speculative positions.

If you think 1x leverage seems inefficient in terms of capital, then you are not suited for perpetual hedging. At 10x leverage, a 10% adverse movement can lead to liquidation, while at 1x leverage, movements over 50% may still survive.

Close Monitoring

The collapse of "10.11" occurred in the early hours (UTC+8), with the total duration from the start of the decline to the peak lasting 90 minutes. During this time, many North American traders were on their way home from work, while European and Asian traders might have been asleep.

This situation is not unique to "10.11." The crash in March 2020 occurred on a Thursday, the crash in May 2021 happened on a Wednesday, and the FTX collapse took place over the weekend. The chain reaction of liquidations is not constrained by business hours, time zones, or sleep schedules.

Without the capability for round-the-clock monitoring, perpetual hedging strategies face unacceptable risks. The 90-minute window of "10.11" was insufficient for most people to:

- Identify the ongoing chain reaction;

- Assess which positions were at risk;

- Access the exchange platform (many APIs timed out);

- Execute protective measures across multiple exchanges;

- Adjust stop-losses or increase margin based on changing conditions;

Traders found their accounts liquidated while commuting, sleeping, or engaged in weekend activities. Some had monitoring alerts set up, but the response was not quick enough; traders checked their phones, saw the alerts, but the exchange app was unresponsive. By the time they opened their computers, positions had already been automatically liquidated or closed.

Professional trading operations require dedicated monitoring teams and shift-based oversight. Minimum infrastructure includes 24/7 manual monitoring, redundant communication systems, distributed geographic coverage, pre-authorized response protocols, and automatic fail-safes.

For individual traders and small firms, the costs of these requirements are prohibitively high. An operation model with three shifts and two people per shift can incur annual labor costs of $300,000 to $500,000, not including technology costs. This cost only makes economic sense for portfolios exceeding $10 million to $20 million. For smaller participants, alternatives are complete automation or simply not using perpetual hedging. Relying solely on "I will check my phone regularly" or "I have set reminders" is insufficient; the "10.11" liquidation demonstrated that even for traders actively monitoring the market, 90 minutes is too rushed for a manual response.

If you cannot meet these monitoring standards through a professional team or robust automation system, the appropriate response is to use custodial services, hire a professional risk management team, or simply abandon perpetual hedging. The "10.11" crash compressed the entire liquidation cycle into 90 minutes, and the next crash may happen even faster. Infrastructure is continuously improving, but the complexity of trading and capital concentration is also increasing. Without ongoing monitoring capabilities, perpetual hedging strategies expose you to catastrophic risks, which are precisely the events that hedging should protect against.

Not Using Contract Hedging is the Best Alternative

Across all analytical dimensions (overall market crash, individual token manipulation, user complexity), the conclusion is consistent: perpetual contracts have failed. At the moment when hedging is most needed, perpetual contracts as a hedging tool have failed; therefore, unless in specific professional fields with ample capital buffers, perpetual contracts are not effective hedging tools.

For 95% of users, the function of perpetual contracts is akin to a speculative tool, not a hedging tool. They are effective when the market is calm and there is no need for hedging, but they fail in pressure environments where hedging is crucial. For all participants in the cryptocurrency market, there are better alternatives than using perpetual contracts.

- VC locking tokens: Consider over-the-counter (OTC) trading or structured products with minimum yield guarantees, gradually realizing gains during the unlocking period, accepting directional risks rather than creating operational risks through contracts.

- Hedge funds: Can adjust positions with tail risk options, Chicago Mercantile Exchange (CME) futures, and unhedged exposures; perpetual contracts are only suitable for tactical arbitrage within 24 hours.

- Yield farmers: Immediately sell part of the tokens after TGE, place tiered limit orders, accept directional exposure, and avoid using pre-perpetual contracts.

- Retail traders: Maintain position sizes to cope with drawdown risks, follow profit-taking principles, and accept the risks of not being able to afford derivative hedging.

- Market makers: Use options-based inventory hedging, physically settled futures, reduce inventory levels, and increase spreads on unhedged risks.

Conclusion

The cryptocurrency industry should stop promoting perpetual contracts as reliable hedging tools for ordinary users. They should be regarded as speculative tools capable of price discovery, directional leveraged trading, professional arbitrage, and market maker inventory management, but with extra caution.

The "10.11" major liquidation fully demonstrated: perpetual contracts convert market risk into operational risk. Operational risks are fully correlated and can trigger simultaneously under market pressure. The best way to hedge in the cryptocurrency space is always to avoid needing to hedge, reduce leverage, allocate assets moderately, and gradually take profits. Diversifying investments across truly different assets, we must accept that some risks cannot be hedged and can only be avoided as much as possible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。