Original author: Fishmarketacad

Original translation: Deep Tide TechFlow

Seeing CT's focus on gold today, I have been paying attention to gold for a while, so I decided to share some quick thoughts (which may be wrong).

Why does gold only rise and not fall?

Since the indefinite quantitative easing (QE infinity) and the devaluation of fiat currency in 2020, I have been focusing on precious metals as a way to store value that is independent of the market.

The price of gold has surpassed $4,200, rising 25% in less than two months. Let's explore the reasons behind this phenomenon:

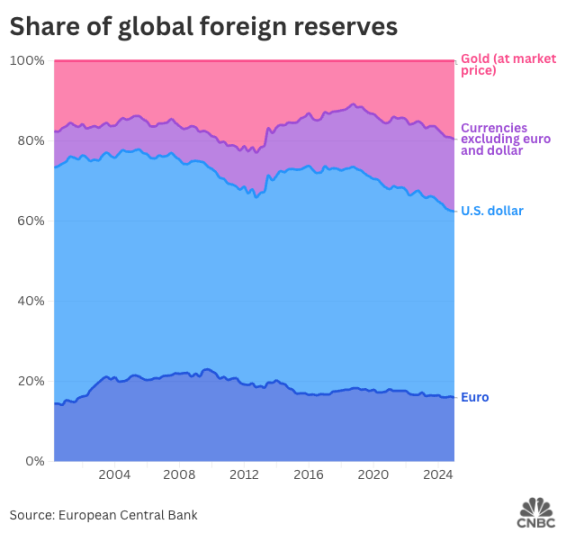

1. De-dollarization / Central banks competing to buy gold

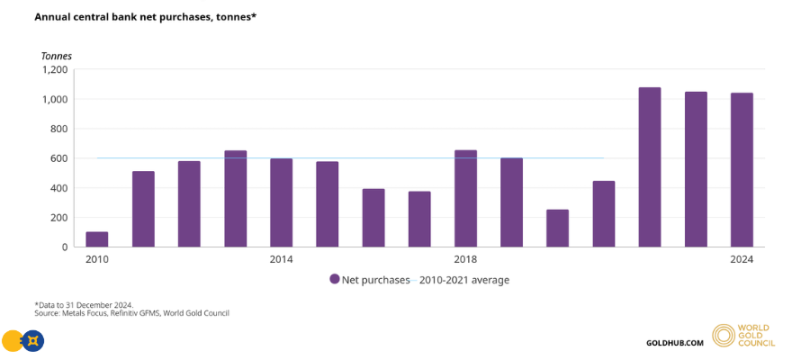

Central banks, especially China, are buying gold at an unprecedented rate. As far as I know, they are expected to purchase over 1,000 tons of gold for the fourth consecutive year, and surveys indicate they plan to continue buying.

Why? The U.S. national debt is expected to reach $37.5 trillion this year, with interest alone exceeding $1 trillion (tax revenue is about $4-5 trillion). There are only two ways to handle such massive debt: default or devalue, and the U.S. never needs to default because they can devalue the debt by printing more money.

2. Stablecoins as a tool for socializing debt

The U.S. devalues its debt through monetary inflation, essentially printing more money to reduce the value of each dollar, thereby shrinking the actual value of the debt. This situation has persisted for decades, and you should be familiar with it.

The new change is that if the U.S. transfers part of this debt to the crypto space, such as stablecoins, it could become very interesting, as cryptocurrencies are more accessible to the world.

Stablecoins are increasingly backed by loans. Stablecoins pegged to the dollar, like USDT and USDC, are currently primarily backed by U.S. Treasury bonds. Initially pure 1:1 instruments have gradually evolved to be over 90% backed by U.S. Treasury bonds.

Therefore, whenever people from other countries hold stablecoins, they are indirectly purchasing U.S. debt. This globalizes America's "inflation tax." The higher the adoption rate of U.S. stablecoins globally — we know this number will reach trillions of dollars — the more the U.S. can export its debt and share its "losses" with the world outside the U.S.

If this is indeed part of the plan, then it circles back to the previously mentioned demand for de-dollarization, making gold a very important safe alternative for storing value.

3. Physical gold shortage

Another important point is that this gold rally is not just driven by a lack of physical gold or derivatives. If you are familiar with the potential short squeeze in perpetual markets when open interest (OI) exceeds token liquidity, this is a similar concept.

In 2025, the open interest in COMEX gold futures typically has hundreds of thousands of contracts (each representing 100 troy ounces), while the total amount of physical gold available for delivery is only a small fraction of that.

This means that at any time, the demand for physical gold far exceeds the deliverable amount. This is also why the delivery time for gold has extended from a few days to several weeks. This indicates a real demand for physical gold (similar to spot demand), which usually does not come from short-term investors, thus forming a structural price bottom.

4. Overall uncertainty

Gold has once again confirmed its status as a safe haven during uncertain times. Current factors such as U.S.-China competition, trade war concerns, domestic turmoil in the U.S., Federal Reserve interest rate cuts, the U.S. economy's reliance on AI infrastructure, and economic uncertainty have led to a global flight from the dollar and an investment in gold.

In my view, the main scenario in which gold would decline is when there is no need for a safe haven. The following conditions must be met, but they are unlikely to occur in the short term:

- High employment rate: The U.S. economic outlook is poor

- Capital flows into risk assets: Stocks are not cheap (though they are not cheap now)

- Political stability: The U.S. needs to be friendly towards China

- Rising interest rates, i.e., increased cost of capital: The current situation is completely the opposite

Due to Trump's unpredictability, these conditions could also change rapidly (or at least the relevant market perceptions), so caution is warranted.

What does this mean for BTC?

Believe it or not, Bitcoin has fallen over 25% against gold so far this year.

I still believe Bitcoin is not yet ready to become "digital gold." Although it shares many similarities with gold, it is gradually getting closer to gold each year (except for the unresolved quantum computing issue).

However, if you try to buy gold, you will find that the premium on physical gold is very high, making it more suitable for buying and holding long-term, which is not very exciting. Therefore, I think retail investors may choose to buy Bitcoin instead of gold, but the purchasing power of retail investors is relatively low compared to central banks.

Bitcoin is now highly correlated with U.S. politics, which hinders other central banks' willingness to buy Bitcoin for de-dollarization. As far as I know, U.S. miners now account for about 38% of Bitcoin's hash power, while U.S. entities (ETFs, listed companies, trusts, and the government) control about 15% of the total Bitcoin supply, and this may continue to grow.

So, I don't know what will happen to Bitcoin relative to gold, but I believe that in the short term (until the end of this year), Bitcoin will continue to weaken relative to gold.

What am I doing?

Please do not follow my actions; this is not investment advice.

Long Bitcoin dominance (BTC DOM): I believe de-dollarization has a greater impact on Bitcoin compared to other altcoins. With the recent "Black Friday" crash, it is clear that Bitcoin is the only asset with real order book liquidity and buying pressure, and Bitcoin dominance currently appears to be on an upward trend. If I see altcoins performing well, I may stop this trade, but usually this happens after Bitcoin reaches a new all-time high, which should further boost Bitcoin dominance.

Long gold: This basically means buying paper gold, selling put options, or buying call options. However, the principle of "not your keys, not your coins" also applies here. I might just be holding a piece of worthless paper, but I have no objections to that for now.

Final thoughts

In short, I believe that due to the structural changes mentioned above, gold remains a good choice, but I would not be surprised by a 20-30% pullback in the short term, which could present a good long-term buying opportunity, provided that the uncertainties mentioned above do not dissipate.

Additionally, gold is about to reach its resistance point relative to the S&P 500 index (SPX) and is approaching a market capitalization of $30 trillion, so these two factors could represent potential local tops, and you may need to wait before entering a FOMO state.

Finally, here is another perspective on gold. As a quick conclusion, I believe gold still has room to rise:

- If the U.S. economy or global stability is uncertain, gold rises

- If the U.S. economy or global stability becomes more unstable, gold rises

- If the U.S. economy or global stability becomes more stable, gold falls

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。