VanEck Lido Staked Ethereum ETF Could Redefine ETH Staking Access

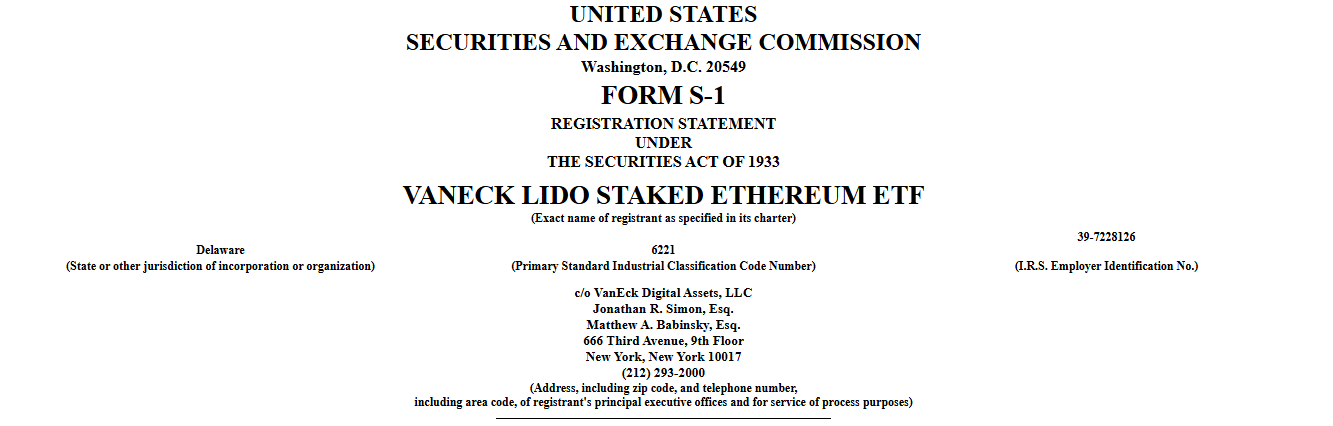

A new development from VanEck has caught the crypto market’s attention. The well-known asset manager has filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a Lido Staked Ethereum ETF, a fund that would give investors exposure to stETH – the token representing staked Ether on Lido Finance.

Source: SEC_Official

If VanEck Lido Staked Ethereum ETF gets approved, it could open a new door for institutions to earn staking rewards through a regulated product, something that hasn’t been available in the U.S. market before. But for now, it is just a filing, not an approval.

A New Kind of Ethereum ETF

Unlike a regular ETH-ETF, this one would hold stETH, a token that represents staked ETH and automatically gains rewards over time. In simple terms, it’s like holding Ethereum that earns interest through staking.

VanEck says the goal is to make it easier for investors to access staking rewards without the technical hassle of running validators or managing wallets. All the stETH would be kept with the regulated custodian.

Current Performance of Ethereum and Lido

Ethereum has been trading steadily in recent sessions, hovering around $3,800–$$3,900 range currently at $3,910. Despite the recent market crash, it continues to show strength near key support levels .

Despite the new integration, Lido’s token, $LDO, has been staggering, trading around $0.8875, with a 3–4% down today, hoping for a rise with renewed interest in staking-related news.

Meanwhile, the stETH-ETF discount, the small difference between the value of both tokens, has remained narrow, as the token labelling at $3,902, signalling strong market confidence in this system. If this ETF progresses, could it drive high demand for stETH? If yes then how? Let’s understand the key points.

Why Does it Matters for the Market?

Ethereum remains the backbone of the decentralized finance world, and Lido plays a major role, holding over $30 billion worth of ETH staked through its protocol. If a stETF ETF launches, it could make staking exposure available to large institutions, fund managers, and even retail investors through standard brokerage accounts, no wallets or private keys needed.

Such a move might also increase ETH liquidity and attract new capital into the ecosystem. However, the SEC’s approval isn’t guaranteed, it takes months to review as it has done with previous crypto ETF filings and many in current.

What’s Next: Booster Dose For Assets?

News like that mostly affects the assets' performance, whether to give them a high jump or a sharp dip, depending on the market view. If optimism builds in this case, ETH could test the $4,900 zone again, while LDO might see a short-term boost in volume.

Data shows Ether staking participation continues to rise with nearly 28% of the total ETF supply now locked in staking contracts. So, could this be the start of a new wave for institutional Ether products, similar to how Bitcoin ETFs changed the game earlier this year?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。