ETF Inflows Surge as Fidelity Crypto Purchase Signals Whale Confidence

Fidelity-Investment (a financial service giant) has made a massive move by purchasing $132.7 million worth of Bitcoin and $154.6 million worth of Ethereum, signaling strong institutional confidence. Fidelity Crypto Purchase came just four days after a $19 billion market-wipeout , where leveraged traders were forced out.

Source: X

According to official ETF data, on October 14, Fidelity’s Ethereum ETF bought 36,460 ETH, worth $154.6 million. Simultaneously, the Fidelity's Bitcoin ETF (FBTC) saw the largest daily net inflow of $133 million among all U.S. spot ETFs that day. Rather than retreating, Fidelity stepped in exactly when liquidity was deepest and prices were 10% off the highs. That’s classic whale behavior.

ETF Market Flows Point to Institutional Confidence

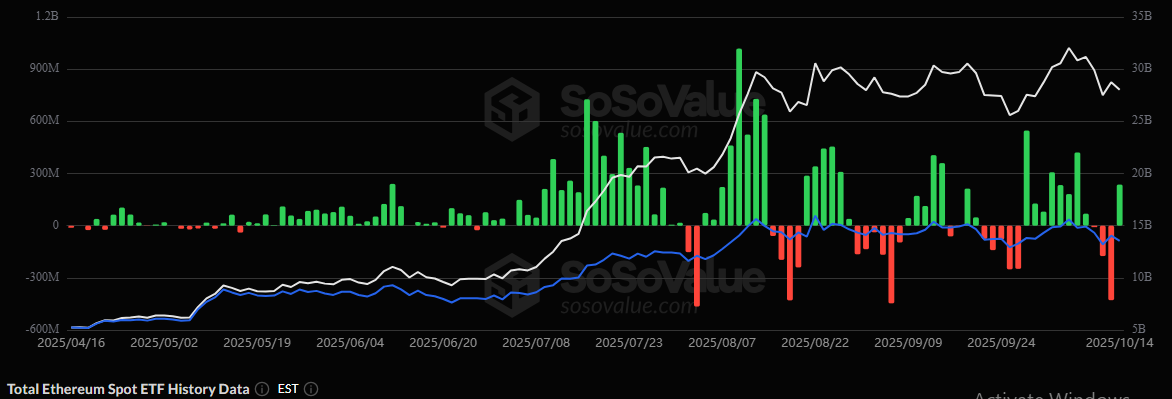

Although direct spot trading is yet to get on line, the ETF-market is quietly stepping in. The market-data of ETF flows reflected this shift in momentum:

-

Bitcoin Spot ETFs recorded $102.58M in total net inflows, led by Fidelity’s FBTC. Bitwise BITB followed with $7.99M. Interestingly, BlackRock’s IBIT saw a $30.79M outflow, its first in two weeks, likely a tactical rebalancing.

Source: SoSoValue

-

Ethereum Spot ETFs experienced a $236M inflow day, with no outflows from any issuer, a rare, bullish signal of synchronized institutional demand.

Source: SoSoValue

ETF assets now account for 6.82% ($153.55B) of Bitcoin’s and 5.64% ($62.55B) of Ethereum’s total market-caps. These figures quietly show how deeply traditional finance is integrating with crypto’s core assets.

Fidelity Isn’t Alone in Dip Buying

While some traders blamed market makers for a coordinated sell-off, and organic deleveraging, this market reset created an ideal entry point, and whales like Fidelity took it. But the financing firm is not alone here:

-

Strategy Inc. added 220 BTC for $27.2M at $123,561 per BTC, raising its total to 640,250 BTC worth $47.38B (avg. $74,000 per BTC).

-

Meanwhile, BitMine Immersion bought 202,037 ETH worth $827M, boosting its treasury to 3,032,188 ETH, about 2.5% of circulating supply.

-

SOL Strategies Inc. has also purchased 88,433 SOL at $193.93 each, including 79,000 locked tokens from the Solana Foundation.

These large-scale Bitcoin, Ethereum, and Solana buys underline deep institutional appetite during consolidation phases. On the other hand, BlackRock ’s smaller outflow hints at portfolio tuning, not bearish sentiment.

Strategic Accumulation Meets Market Mechanics

Looking back at similar scenarios, this move carries both technical and strategic weight. The liquidation removed unstable long positions, reducing funding pressure across derivatives. At the same time, ETF inflows provided spot demand, anchoring prices around clean support zones.

While the recent market debuts have to suffer most, major-assets buyers of the dip got a golden door. For Bitcoin, trading near $112K, a push toward $120K–$126K could deliver a 7–12.5% upside for dip buyers. For Ethereum, currently at $4,122, it could offer 19–20% gain if leveled to its previous range ($4,600–$4,900).

As an observer of multiple cycles, this feels less like a speculative pump, and more like the quiet accumulation phase before the next decisive market leg.

Disclaimer

This article is for informational purposes only and not financial advice. Cryptocurrency investments are risky and volatile. Always do your own research.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。