An epic market flash crash, an algorithmic stablecoin rumored to have "crashed 38%", and a trading giant mired in technical doubts. When the smoke cleared, we were surprised to find that the truth of the story was not simply "the stablecoin failed," but rather a possible extreme stress test of the infrastructure of centralized exchanges. The core issue of this incident points directly to Binance.

1. Event Retrospective: An Illusion of 35% "Depegging"?

On October 11, 2024, the cryptocurrency market encountered a "black swan," with core assets like Bitcoin experiencing a dramatic flash crash. In this chaos, the stablecoin USDe issued by Ethena Labs became the eye of the storm.

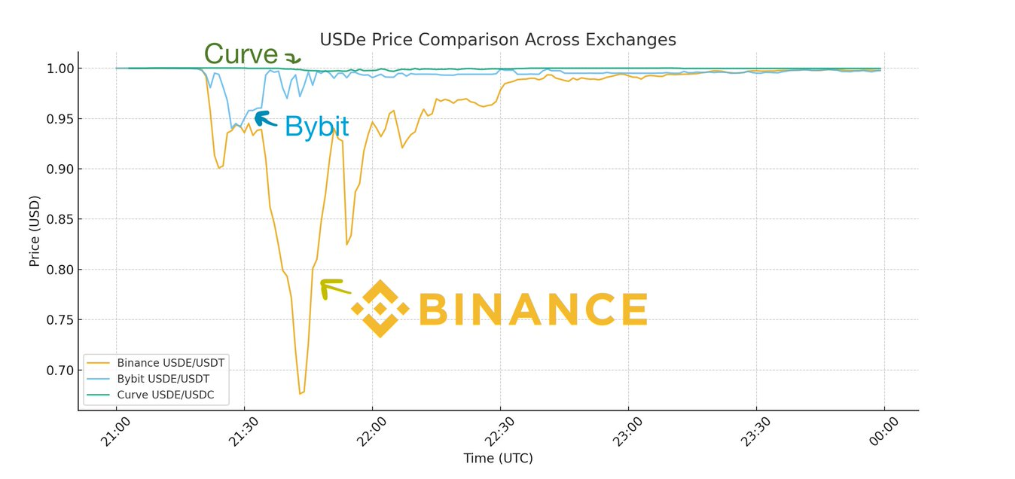

● Rumors of "depegging" spread rapidly: Data showed that the price of USDe on decentralized exchanges like Binance plummeted to as low as $0.65, deviating from the theoretical peg price of $1 by as much as 35%. Market panic spread instantly, with USDe's market capitalization evaporating by over $2 billion in a short time.

● Investors rushed to "extinguish the fire": Faced with a crisis of trust, Haseeb Qazi, managing partner of top venture capital firm Dragonfly and an investor in Ethena, personally stepped in to refute the claims. He pointed out through detailed data analysis a fact overlooked by most: USDe had not truly depegged; it was merely a "localized fire" occurring within the Binance exchange.

Was this a definitive failure or a misinterpreted accident? All clues pointed to Binance.

2. In-Depth Analysis: Fragmented Liquidity and a Failing "Firefighting System"

Why did the price of USDe show such a significant difference across different trading venues at the same time? The answer lies in fragmented liquidity and the paralysis of the market maker arbitrage mechanism.

● Main battlefield remains unscathed: Haseeb's core argument is that the main liquidity pool for USDe is not on Binance, but on the decentralized trading protocol Curve. On Curve, USDe has hundreds of millions of dollars in liquidity depth. Throughout the flash crash, the price of USDe on Curve remained closely tied to $1, with a maximum deviation of only 0.3%. This proves that its core redemption mechanism and market demand remain robust.

● Binance becomes an "island": In contrast, the liquidity pool for USDe on Binance was only tens of millions of dollars. When the market crashed and a massive wave of sell orders flooded in, the weak order book was easily breached. More critically, Binance's API interface frequently failed at that time, and the deposit and withdrawal channels were nearly paralyzed. This meant that even if there was sufficient $1 USDe on Curve, market makers could not engage in cross-market arbitrage by "buying low on Binance and selling at parity on Curve."

● A vivid metaphor: Haseeb likened Binance at the time to a "burning building with all exits blocked." The "firefighters" outside (market makers and arbitrageurs) could see the huge arbitrage opportunity inside but could not enter to extinguish the fire. The result was that the "fire" inside the exchange (price deviation) continued to spread, while the external "fire" had long been extinguished.

3. Binance's Dual "Crimes": Infrastructure and Risk Model Collapse

If the liquidity issue is a natural disaster, then Binance's design flaws are a clear "man-made disaster." This incident exposed significant shortcomings in two core areas of Binance.

● Crime One: Lack of "Primary Market Maker Relationship" as an Inherent Deficiency

Ethena established primary market maker relationships with exchanges like Bybit, allowing market makers to directly mint and redeem USDe within the exchange, thereby quickly stabilizing price fluctuations.

However, Binance did not establish such a relationship. On Binance, market makers wishing to arbitrage must withdraw funds from Binance, complete Ethena's official arbitrage process on-chain, and then deposit back into Binance.

In cases of extreme market volatility, network congestion, and API failures, this complex process is impossible to execute. This made Binance a "financial island" lacking internal stabilization mechanisms.

● Crime Two: Oracle Flaws Trigger "Chain Liquidation" Tragedy

This is the most controversial point of this incident. Binance's liquidation system, when assessing the value of user collateral, relied solely on the distorted USDe price from Binance's own order book. When the internal USDe price on Binance crashed to $0.8 or even lower, Binance's risk system "foolishly" assumed that all USDe collateral was worth only that price.

As a result, many users who used USDe as collateral had their positions misjudged as insolvent, triggering forced liquidations.

These forced sell-offs further exacerbated the downward pressure on the market, creating a death spiral of chain liquidations. Ironically, Binance later admitted that this was a failure of its system and announced full compensation for users who were mistakenly liquidated, totaling approximately $283 million. This move was tantamount to acknowledging the failure of its risk control model.

4. Insights and Warnings: When "Stability" Relies on the "Continuity" of Exchanges

The USDe incident leaves the industry with more than just a war of words; it serves as a heavy warning.

● For exchanges: Infrastructure is the cornerstone of trust

As the industry leader, Binance's system stability affects the entire market. This incident indicates that competition among exchanges is no longer just about the number of listed coins and transaction fees, but more fundamentally about the robustness of infrastructure, the rigor of oracle design, and the intelligence of risk models. Any failure in one link can trigger a chain disaster. For Binance and its BNB ecosystem, this incident represents a loss of trust.

● For project teams and investors: Reassess the definition of "stability"

For algorithmic stablecoin projects like Ethena, this incident is a severe test but also provides a counterexample. It proves that a project designed with sufficient collateral and a sound arbitrage mechanism can maintain stability in mainstream channels. However, investors must also clearly recognize that the "stability" of any asset depends on the health of its trading environment. When you store assets in an exchange with weak infrastructure and fragmented liquidity, you expose yourself to additional risks.

● A mirror of history: True depegging and price misalignment

As Haseeb compared, when USDC depegged due to a banking crisis in 2023, it was because it was impossible to buy it at $1 in all trading venues, and the redemption mechanism was completely suspended. That was a true credit crisis and systemic depegging. In contrast, the USDe incident resembles a localized price misalignment triggered by specific exchange technical failures. Recognizing this essential difference is crucial for understanding the truth of the market.

Conclusion: The True "Black Swan" May Never Have Been Far Away

The flash crash on October 11 was an external shock, while the illusion of USDe's "depegging" on Binance exposed a potential and more dangerous "black swan" within the industry—the fragility of key infrastructure in centralized exchanges.

When the APIs, oracles, and liquidation systems of exchanges are overwhelmed in extreme market conditions, they transform from stabilizers of the market into amplifiers of risk. This time it was USDe and Binance; next time, who will it be? For every market participant, it is time to incorporate "exchange infrastructure risk" into their core risk assessment framework.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。