Original | Odaily Planet Daily (@OdailyChina)

Although the epic drop on "10.11" has come to an end and the market is gradually recovering, the record high liquidation in a single day (19.3 billion USD) created by this crash still casts a shadow over the market. Many investors believe that the outspoken Trump should take the blame, while others point fingers at Binance, insisting that the decoupling of USDE, BNSOL, and WBETH prices is the main reason for the further decline in the market.

Binance officially explained the decoupling issue as a temporary technical failure of some platform modules due to the overall market setback. As for the extreme low prices seen in certain spot trading pairs, they were mainly caused by historical limit orders being triggered under one-sided liquidity and issues with UI display accuracy.

Binance has taken responsibility for the platform and compensated users for liquidation losses caused by the decoupling of USDE, BNSOL, and WBETH, with a total amount reaching 283 million USD. Nevertheless, some investors remain unconvinced, arguing that Binance should also be held accountable for the collapse of altcoins and reiterating issues such as "market manipulation," "data black box," and "deliberate disconnection" associated with centralized exchanges.

On October 13, Hyperliquid co-founder Jeff.hl also engaged in a public spat with Binance founder CZ on social media. Jeff.hl was the first to post that all orders, trades, and settlements on Hyperliquid are executed on-chain, providing transparency and verifiability. However, he pointed out that some centralized exchanges (CEX) have serious underreporting issues in their settlement data, specifically naming Binance.

In response, Binance founder CZ quickly addressed all the criticisms in a reply, stating, "While others choose to ignore, hide, shirk responsibility, or attack competitors, key participants in the BSC ecosystem (including Binance, Venus, etc.) have spent hundreds of millions of dollars out of their own pockets to protect users," and he believes this reflects a different value system.

With various opinions in the market, no single solution can satisfy all participants. During this sensitive period, Jeff.hl's public questioning of Binance essentially reflects the different trade-offs made between CEX and DEX regarding "relative fairness" and "absolute transparency."

Performance is no longer the main difference between DEX and CEX

In the past, although DEX was considered the ultimate form of cryptocurrency exchanges, the market share was still dominated by CEX, mainly due to the significant performance gap between DEX and CEX. Issues such as high latency, low market depth, low capital efficiency, and poor trade execution accuracy have always affected traders' experience on DEX. Therefore, even though CEX has been criticized for centralization risks and has faced failures (like the FTX incident), traders ultimately prefer to trade on CEX due to its low latency and high usability.

However, by 2025, these performance issues are no longer the main obstacles hindering DEX from expanding its market. Taking Hyperliquid, which boasts CEX-level performance, as an example, it employs an on-chain Central Limit Order Book (CLOB) model, resulting in a qualitative leap in performance compared to past AMM DEXs, with an average trade confirmation time of just 0.07 seconds, comparable to CEX. While some "niche tokens" on Hyperliquid still face issues of insufficient liquidity and high slippage, for mainstream tokens like BTC and ETH, Hyperliquid's trading slippage has dropped below 0.1%, rivaling that of CEX.

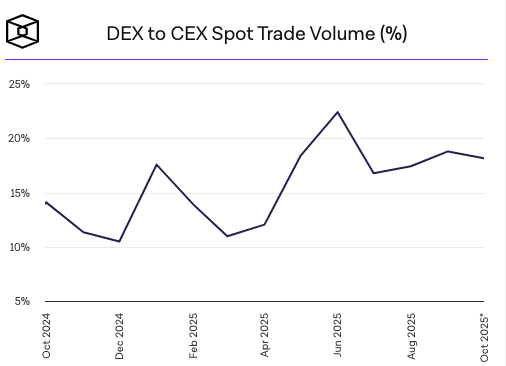

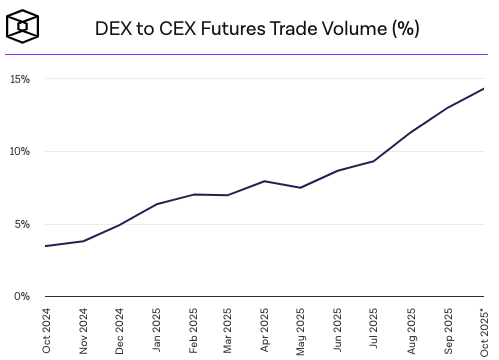

As the performance gap gradually narrows, there is indeed a trend of funds and traders migrating to DEX from 2025 onwards.

According to data from The Block, in the spot market, DEX's market share has shown an overall growth trend compared to CEX, reaching 19% in the third quarter of 2025.

In the perpetual contract market, DEX's market share has grown even more rapidly, from just 4.9% of CEX's contract market at the end of 2024 to 14.33% by October 2025.

In extreme market conditions, today's DEX has also withstood the test. After the "10.11" crash, Hyperliquid officially stated, "Despite the platform traffic and trading volume reaching an all-time high during extreme market conditions, the Hyperliquid blockchain did not experience any downtime or delays."

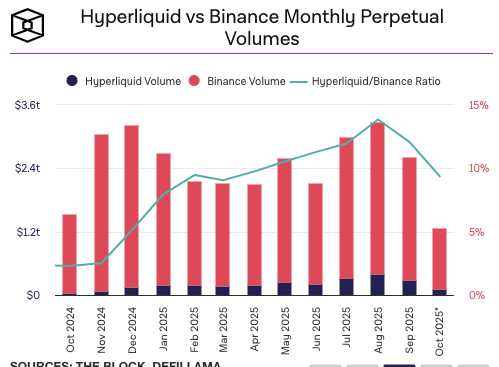

On the same day, however, Binance, the world's largest exchange, faced partial system failures due to technical issues. This does not necessarily indicate that Hyperliquid currently outperforms Binance, as the system pressures faced by both are not the same. On October 11, Hyperliquid's perpetual contract trading volume exceeded 10 billion USD, while Binance's trading volume was more than ten times that. Data from The Block shows that in September, Hyperliquid's contract trading volume was 28.247 billion USD, while Binance's was 2.34 trillion USD, meaning Hyperliquid's contract trading volume was only 12% of Binance's.

The market is always only "relatively fair"

When performance is no longer the main difference between CEX and DEX, will all investors really choose DEX? After the "10.11" crash, although Binance faced criticism from some quarters, trader Vida, born in the 2000s, still publicly stated that large funds should use Binance, reasoning that Binance will always be responsible for its users at any time.

Some investors complained that Vida's statement stems from his being favored by Binance. In extreme market conditions, exchanges tend to compensate and soothe the emotions of large holders and "Binance users," while neglecting retail investors and other market participants affected by the situation. Binance's growth is built on the silent "bodies" of countless others, with the wealthy getting their money back in full while the common people receive a fraction.

However, aside from the conspiracy theories surrounding CEX, fairness in this market is always relative. Even DEX, which champions decentralization and fairness, can "waver" in the face of a crisis of interest. On March 26 of this year, Hyperliquid faced its biggest crisis since its inception when a whale manipulated the price of the meme coin JELLY, causing HLP to take on large short positions and face a risk of going to zero amounting to 240 million USD. However, Hyperliquid chose to handle it in a "pull the plug" manner by delisting the JELLY contract, allowing HLP, which was about to incur losses, to instead profit 700,000 USD.

Hyperliquid's actions also sparked a huge uproar in public opinion, making decentralization and fairness seem like a joke. This was not the first time traders had profited from exploiting Hyperliquid's loopholes; there were also incidents like "whales actively causing liquidations leading to HLP losing 4 million USD" and "XPL consecutive liquidations harvesting 46 million USD," but Hyperliquid did not compensate users who suffered losses in these events.

This made investors realize that Hyperliquid does not adhere to decentralization and fairness; rather, it chose to "do nothing" before the crisis spread to itself. It can be said that every upgrade and improvement of Hyperliquid is also built on the "bodies" of countless others.

The market needs "absolute transparency"

The trading market has never had true fairness. Frankly speaking, if one party makes money, there will always be another party that loses, and neither DEX nor CEX can be responsible for everyone. But even if fairness is relative, transparency can be absolute.

In extreme market conditions, CEX always falls into conspiracy theories, primarily because CEX is inherently a "black box" that can be artificially intervened. Even though regulatory and compliance measures have been upgraded, the lack of transparency continues to breed public distrust in CEX. Investors' understanding of the so-called truth comes entirely from the announcements of the exchanges, which, while authoritative, can easily be questioned to the point of being indefensible. For example, Hyperliquid co-founder Jeff.hl questioned Binance's settlement data for being fabricated, and if Binance wants to prove itself, it would have to "cut open its belly to show how many bowls of noodles it has eaten."

Although Hyperliquid and Binance differ in values, the transparency and verifiability of its on-chain trading data are tangible. The transparent settlement mechanism not only significantly reduces the possibility of platform manipulation of the market but also reassures investors, reducing the birth of conspiracy theories. For instance, during several crises on Hyperliquid, people observed the operations of whales on-chain, with losing investors lamenting, while Hyperliquid remained indifferent to their fates. However, very few would consider this a conspiracy by the platform.

The mechanism cannot be perfect, but a trading mechanism that is transparent, public, and automatically executed within the rules will always reduce more disputes compared to the black box and chaos of centralized exchanges. Even DEXs, if lacking transparency, can face suspicion. For example, the previously popular Prep DEX Aster was questioned for trading volume manipulation and data falsification due to its privacy order feature, leading DeFiLlama to temporarily delist Aster.

As the crypto market has developed to this point, CEX and DEX are no longer mutually exclusive; the boundaries between CEX and DEX are shrinking. The experience of DEX is aligning more closely with that of CEX, while CEX is also expanding its on-chain business through user wallets. Both CEX and DEX have their own risk quadrants: CEX can provide a safety net for users when real issues arise, but investors criticize its significant power; DEX adheres to the principle of "code is law," imposing minimal constraints on user behavior, yet investors still yearn for centralized compensation when problems occur.

From a trend perspective, "transparency and openness" is one of the foundational principles and development trends of Crypto. Even though the value systems of CEX and DEX differ, both should move towards this direction: higher verifiability, clearer boundaries of responsibility, and more robust crisis response mechanisms.

Related Reading

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。