Written by: Glendon, Techub News

On October 11, an unexpected "black swan" storm swept through the entire cryptocurrency circle. In just 12 hours, the total liquidation amount in the cryptocurrency market approached $20 billion, with over 1.6 million traders being liquidated, among which DEX platforms became the hardest hit.

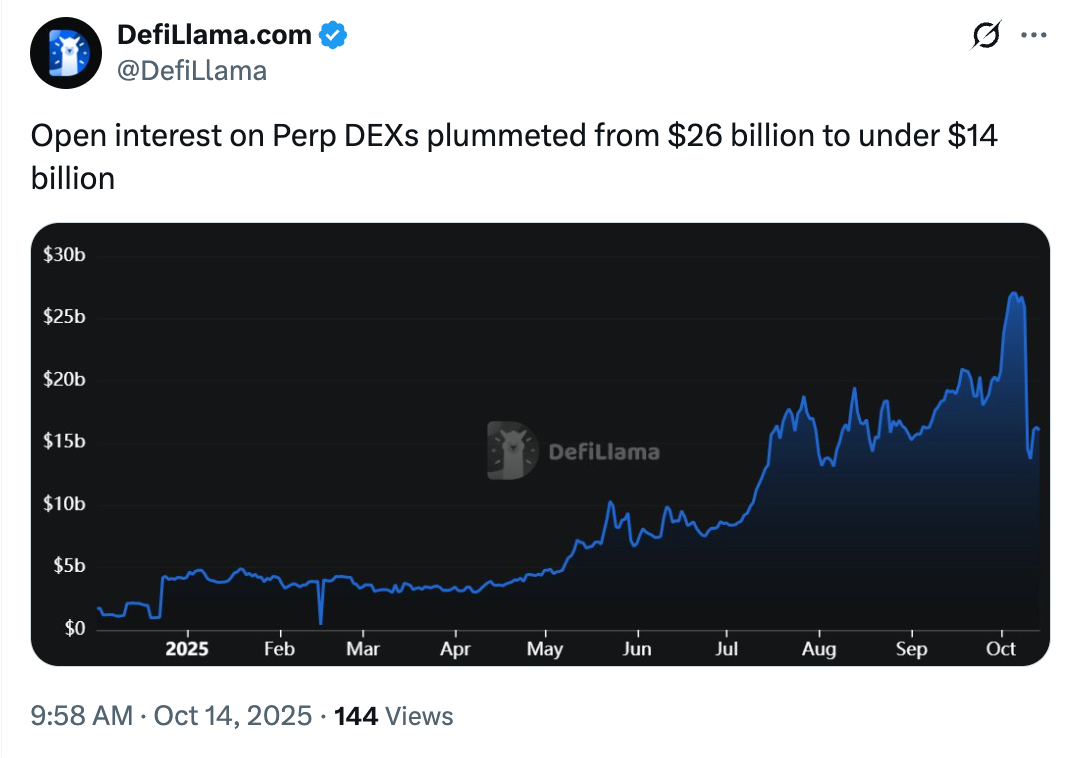

DeFiLlama released data on the X platform, pointing out that just last week, the weekly trading volume of DEX had once exceeded $177 billion, setting a historical record. However, under the impact of this market flash crash, the open contracts of Perp DEX have sharply shrunk from $26 billion to less than $14 billion, nearly halving.

Notably, the Hyperliquid platform suffered a severe blow during this event, with liquidations soaring to over $10.3 billion, far exceeding Bybit (approximately $4.6 billion) and Binance (approximately $2.4 billion). During this period, a HyperLiquid whale, who previously held over 100,000 BTC and sold over $4.23 billion worth of BTC to swap for ETH, drew the attention of industry insiders. Just one hour before Trump announced "100% tariffs on China," Bitcoin was massively shorted, which became one of the "triggers" for the subsequent market crash, leading to a storm of questions regarding "insider trading."

On October 12, on-chain detective Eye tweeted revealing that the "whale who sold over $4.23 billion worth of BTC to swap for ETH" was suspected to be Garrett Jin, the former CEO of BitForex, who was the mastermind behind the $735 million BTC short order on the same platform.

Who is Garrett Jin? He graduated from Boston University with a degree in economics in 2008 and then interned and worked at China Construction Bank until 2011. In 2012, he founded his first company, Da Yo Trading (HK), which operated until 2014. After that, he keenly captured the infinite potential of the cryptocurrency field and immersed himself in it, serving as the Operations Director at Huobi (HTX) until 2015. Then, from 2017 to 2020, Garrett Jin served as the CEO of BitForex.

It is worth noting that BitForex was embroiled in a huge controversy for allegedly faking trading volume. In 2023, it was marked by the Japanese Financial Services Agency (FSA) as operating without registration. In February 2024, the private key of the exchange's hot wallet was leaked, and approximately $57 million was quietly withdrawn without any clear explanation. Soon after, the website became inaccessible, all operations ceased, and users had no way to withdraw their funds.

It wasn't until July 2024 that BitForex officially released a "belated" statement, claiming that its team had been detained and investigated by the police in Jiangsu Province, China, which prevented timely notification to users, and promised to reopen KYC-based withdrawal services and restore platform operations. However, as of October 12 this year, the exchange had still not processed all user withdrawal requests. Eye pointed out that the Hong Kong Securities and Futures Commission had previously issued a warning regarding BitForex's suspected fraud, and the exchange had been continuously accused of withholding and misappropriating funds, but these issues remained unresolved.

During the period from 2021 to 2023, Garrett Jin also launched several projects, including the wallet project TanglePay, the cross-chain exchange DEX IotaBee based on "IOTA/Shimmer" (which closed in 2024), and the free Web3 messaging protocol GroupFi (which has since received seed round financing and is still operational).

After the collapse of BitForex, Garrett did not disappear; he founded a new company, XHash, in 2024, claiming to provide non-custodial ETH staking services for institutions. Industry insiders have questioned whether he might use this to transfer old funds into the formal system through "legitimate staking."

So, how did Eye manage to identify the HyperLiquid whale as Garrett Jin? According to his tracking analysis, during August and September, this whale sold over 35,000 Bitcoins through the Hyperliquid/Hyperunit platform using a series of Bitcoin wallet addresses and swapped them for Ethereum. The key breakthrough point was that the address where this whale staked ETH contracts had received funding from a specific wallet, which was traced back to the first funds coming from "ereignis.eth."

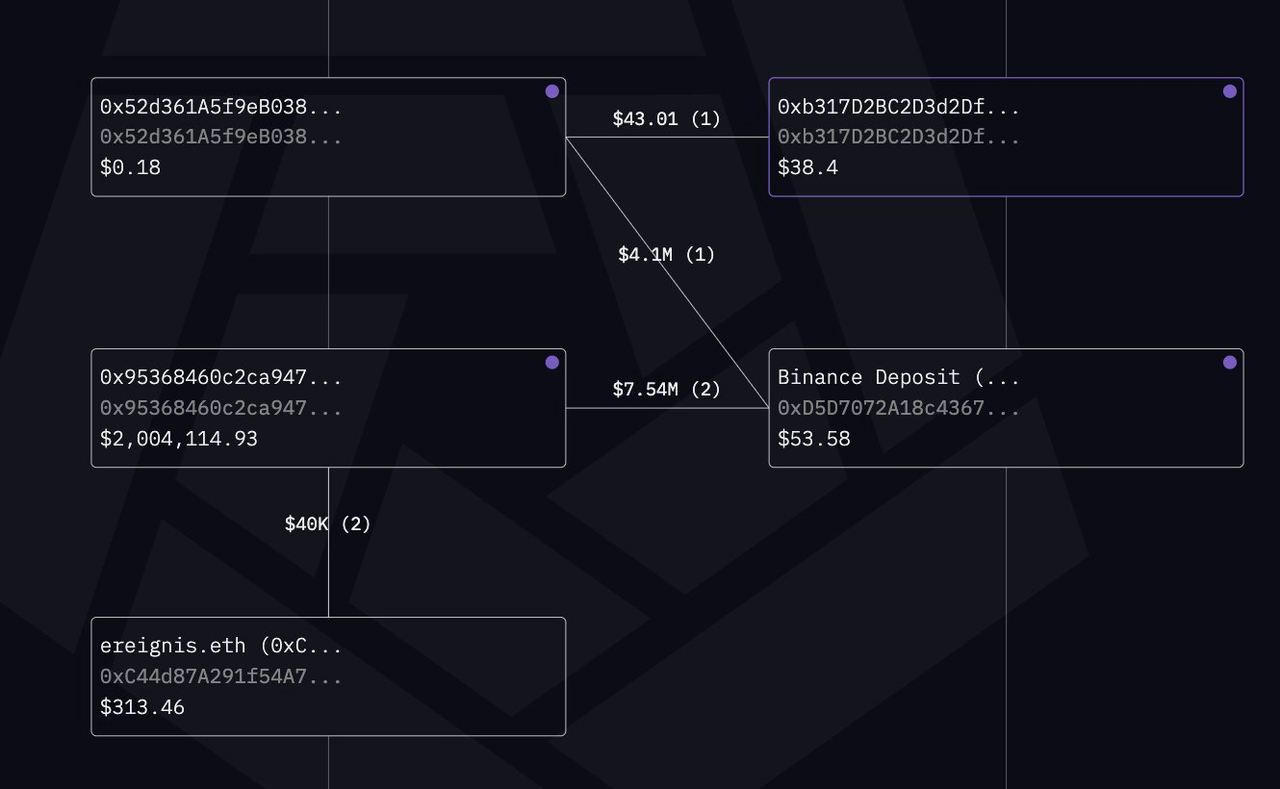

Meanwhile, after in-depth analysis of the $735 million BTC short whale address (starting with 0xb317), Eye discovered that this address received a transaction fee from wallet "0x52d3"; before sending this fee, wallet "0x52d3" deposited $4.1 million USDC into a Binance deposit address "0xD5D7," which had recently received $7.54 million transferred from wallet "0x9536." Notably, wallet "0x9536" had sent $40,000 USDT to "ereignis.eth" two weeks before the shorting began.

Ultimately, after a comprehensive investigation of the "ereignis.eth" address, Eye found that the second ENS domain name associated with that address, "garrettjin.eth," clearly pointed to Garrett Jin, indicating that he might be the mastermind behind the large-scale operations on Hyperliquid/Hyperunit.

According to Eye, as of September 12, Garrett still held a total of 46,295 Bitcoins across multiple addresses (valued at approximately $5.23 billion at the time of writing), with the addresses being:

1C9dhpbtosmxW4L2ctTpPLdKwE2iaEHj7B

bc1qh3g2qyq2akw7ep03nsnmfyy8sgxs92q7jfc2jf

12XqeqZRVkBDgmPLVY4ZC6Y4ruUUEug8Fx

1DjmZD4ph1AQP1PhUGYtrd1G6HjwHFKpa6

1CKJYQPP9xhqjMMYAnzNux3h5wC2vb6Y5M

17MWdxfjPYP2PYhdy885QtihfbW181r1rn

bc1qmqqr5y3r7ud3dnznejsp3sf06fgrtfz4p5mefr

bc1q3vhptfhz48znfsshh9j2xey2nlkjd8qe64uq5p

Subsequently, Eye further stated that "after I posted related tweets, Garrett Jin immediately changed his Telegram privacy settings, hiding previously public photos and phone numbers. He also removed XHash from his personal profile, a series of actions that seem to suggest he is hiding something unspeakable."

Eye's tweet, like a stone creating ripples, quickly attracted the attention of industry insiders, including Binance founder Zhao Changpeng and on-chain detective ZachXBT.

Zhao Changpeng stated that it is still uncertain whether it is true and accurate, hoping someone could verify it. ZachXBT believed, "There are still too many unknown factors in this event; all the posts currently under scrutiny are actually exaggerated versions of immature theories. From what he knows, Garrett Jin (or Exe) seems to have started collaborating with a Chinese whale who previously had ten-digit funds on-chain that had been dormant until recently."

In response, many even suspected that Garrett Jin's funds came from the stolen BitForex user funds.

Faced with overwhelming skepticism, Garrett Jin quickly responded on the X platform: "To clarify, I have no connection with the Trump family or Donald Trump Jr.—this is not insider trading. This fund does not belong to me personally but to my clients. We operate nodes, providing clients with internal insights and strategic support."

At the same time, he explained in detail why he chose to short before the market flash crash: "From a technical analysis perspective, U.S. stocks, A-share tech stocks, and mainstream cryptocurrencies have all shown overbought signals, such as the MACD indicator's top divergence; the crypto market is highly positively correlated with U.S. stocks, and the recent structure of the U.S. stock market is shifting from risk-on to risk-off, so we judged that the crypto market would follow suit; additionally, since September 26, the U.S.-China trade tensions have been escalating, but the market sentiment has been bullish, causing investors to largely overlook this risk; because of this, both A-shares and U.S. stocks had already entered risk-off mode before the crash on October 11. It is important to emphasize that we could not predict when President Trump would take retaliatory measures against China."

This explanation seems satisfactory but did not completely dispel public doubts.

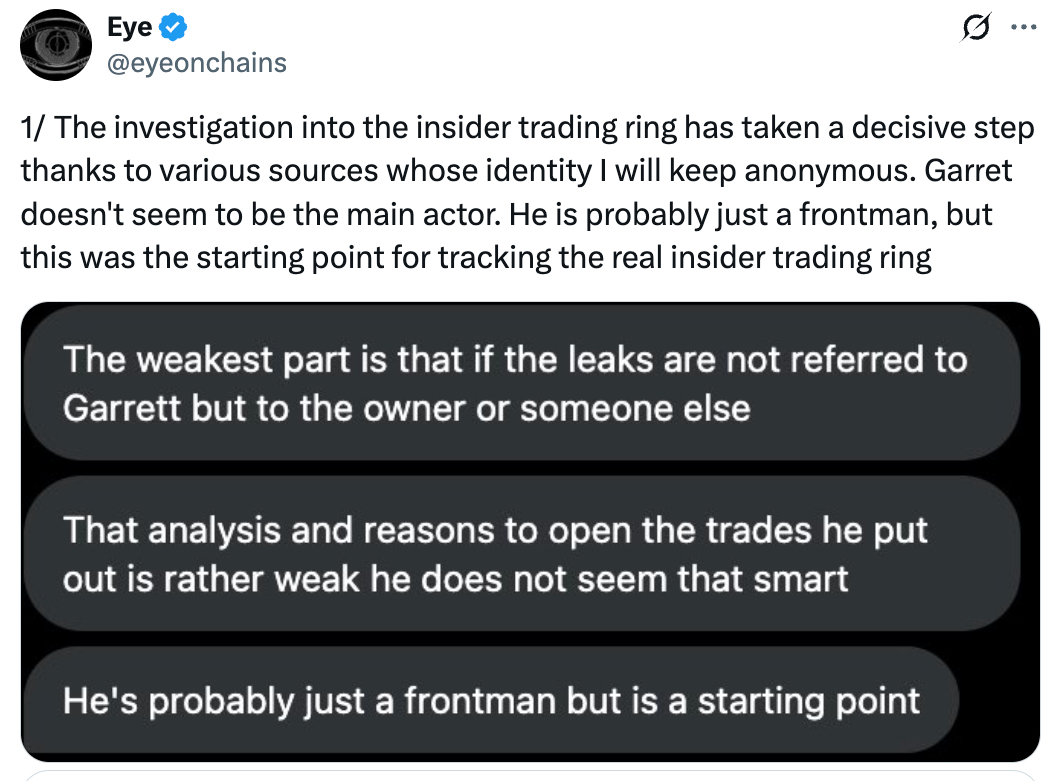

Until today, on-chain detective Eye tweeted again, bringing a significant update: thanks to the help of several anonymous sources, the investigation into the suspected insider trading group has made substantial progress. Sources revealed that Garrett may not be the true mastermind but merely a "decoy," yet he is a key starting point for tracking the real insiders.

He analyzed that if the leaker did not directly disclose information to Garrett Jin but instead passed it to others, it would further confirm the "decoy" hypothesis. The key information provided to him likely originated from a group of insiders who have long been utilizing confidential information from White House rumors and official announcements, which is relayed by aides who can approach the U.S. President to a group of insiders to establish extremely favorable trading positions and maximize trades before significant price fluctuations.

Eye also revealed that the core individuals confirmed to be involved are Zach Witkoff and Chase Herro, co-founders of the Trump family's crypto project World Liberty Financial. It is worth mentioning that Trump's sons may also be involved.

Finally, Eye added: "For personal safety reasons, I will no longer post content on this topic and will leave further research of more information to the public to explore."

As of the time of writing, Garrett Jin has posted multiple tweets attempting to prove his innocence, stating that his team's long-term bullish stance does not contradict short-term hedging operations.

"We are bullish in the long term, but that doesn't mean we won't hedge in the short term. If short positions are condemned when prices fall, should long positions be blamed when prices rise and shorts are liquidated? There aren't that many conspiracy theories in the world. Stop making excuses for your ignorance and unprofessionalism."

He emphasized that clients hold a large amount of cryptocurrency in spot form, and short positions only serve as partial hedges. If liquidity is sufficient, more positions can be established. As it stands, compared to the losses incurred from spot positions, clients are actually in an overall losing state. Currently, the crypto market is highly correlated with the U.S. stock market, and they still hold a bearish outlook. The recent price rebound has mainly been driven by over-leveraged long positions. The crash on October 11 forced most leveraged players out of the market. Before exchanges establish stabilization funds to restore market confidence, the likelihood of a sustained price increase is minimal. Clients may have some biases in their judgments, but they possess deep expertise in risk management.

At this stage of developments, although Eye has provided clear and explicit analysis and conclusions, it is ultimately difficult to provide "decisive" substantive evidence. Meanwhile, Garrett Jin's clarifications can be considered self-consistent. As Eye has toned down his focus on this event, the major "insider trading" cloud surrounding the flash crash on October 11 may ultimately fade away.

Through this flash crash event, crypto investors can also draw some lessons, needing to learn from the experiences of traditional finance rather than relying solely on market narratives and personal emotions to formulate investment strategies. In the current context where the industry is closely linked to the macro market, if the entire industry and investors cannot timely shift their thinking perspectives, similar events may occur again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。