Morning Analysis: From the 1-hour chart, Bitcoin tested the resistance around 115800 twice yesterday but failed to break through. This position has formed a W-shaped pattern in the short term, and there is significant bearish selling pressure above.

Although the daily chart is leaning bearish, yesterday's candlestick closed with a long lower shadow compared to the upper shadow, indicating that as long as the closing price stabilizes above 114800 in the short term, the upward trend may still hold. However, currently, Bitcoin's rebound lacks sufficient volume and there is a lack of active bullish capital, resulting in an overall weak state. The short-term support to watch during the day is 114000, with strong support at 112800.

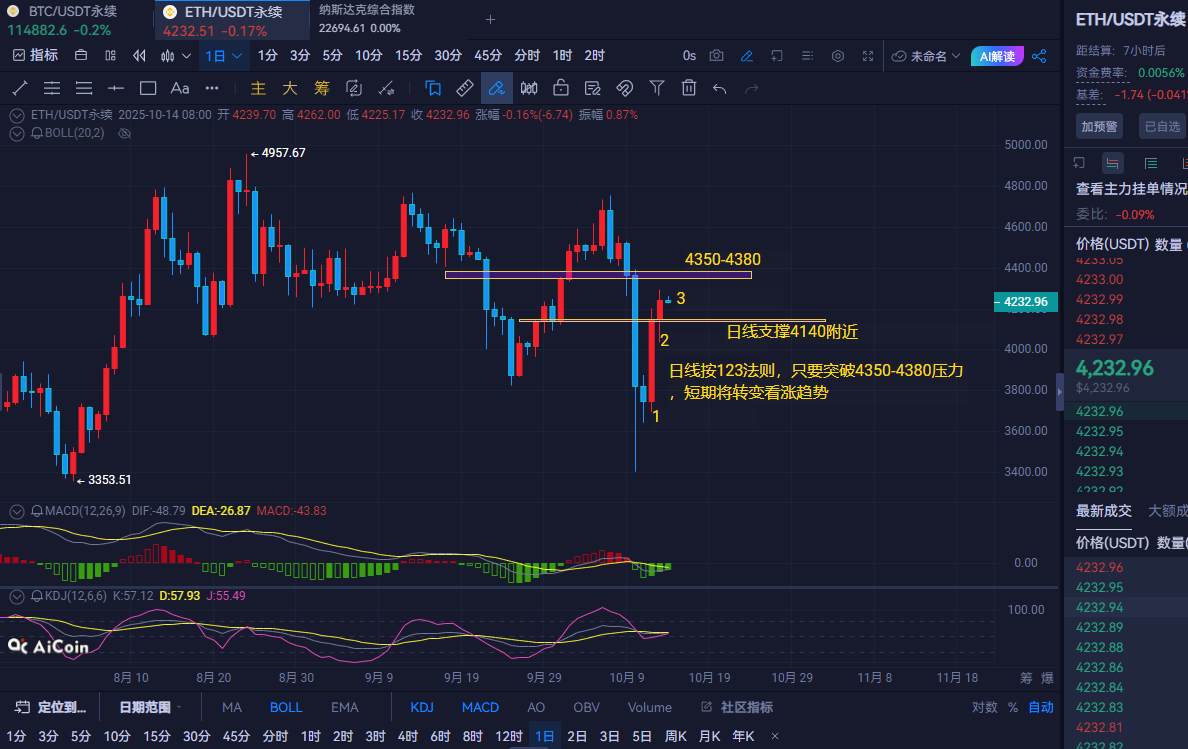

Ethereum's price recently rebounded quickly from the low of around 3740 on October 11 to the high of around 4290 on October 13, forming a strong V-shaped reversal. On the daily chart, a small bearish candlestick was formed on October 14, indicating high-level fluctuations and showing a temporary balance between bullish and bearish forces. According to the 123 rule, the key resistance in the short term is 4350-4380, with short-term support at 4140 and 4080. Although the MACD technical indicator is still below the zero line, the fast line is gradually moving upward, and the green bars are shortening, indicating a weakening of bearish momentum and signs of bullish attempts to take over the trend.

Trading Suggestions: For Bitcoin, consider buying on a pullback near 114000-113600, with a stop loss at 113000 and a target of around 115300-115800. If it breaks through, look for 116500-117000; if it doesn't break, consider shorting.

For Ethereum, consider buying on a pullback near 4160-4130, with a stop loss at 4080 and a target of around 4250-4280. If it breaks through, look for around 4350; if it doesn't break, consider shorting.

This strategy is for reference only; please invest cautiously and secure profits. (For real-time updates, follow the public account: Ethereum Kai)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。