Today, I finished my homework early. The sentiment after the U.S. stock market opened on Monday is much better, and I can hardly feel the desolation of the weekend. The overall trend of cryptocurrencies is also acceptable; although it hasn't fully returned to the levels before the U.S. stock market closed on Friday, it's not far off. Users have already emerged from the panic of the weekend's sharp decline. Of course, the main reason is that the trade friction between China and the U.S. has not escalated further, which should be the most important reason.

Today, Beisen Te mentioned in an interview that it is not about actually imposing a 100% tariff on China. The relationship between China and the U.S. is still quite good, and the U.S. holds greater initiative. The implication is that tariffs are merely a means to obtain better negotiation conditions, and indeed, China has not taken significant countermeasures regarding tariffs. Only the Ministry of Commerce and the Ministry of Transport have spoken out, while the Ministry of Foreign Affairs has remained silent.

After the market opened, U.S. stocks performed well, with the Nasdaq rising by 2% and the S&P up by 1.5%. It is estimated that by the end of the week, it could return to the levels before last Friday's decline. Currently, the market's speculation has returned to the U.S. government shutdown and the Federal Reserve's monetary policy. Tonight, the Federal Reserve's PAULSON (not a voting member in 2025) hinted at supporting interest rate cuts in the remaining two meetings in 2025.

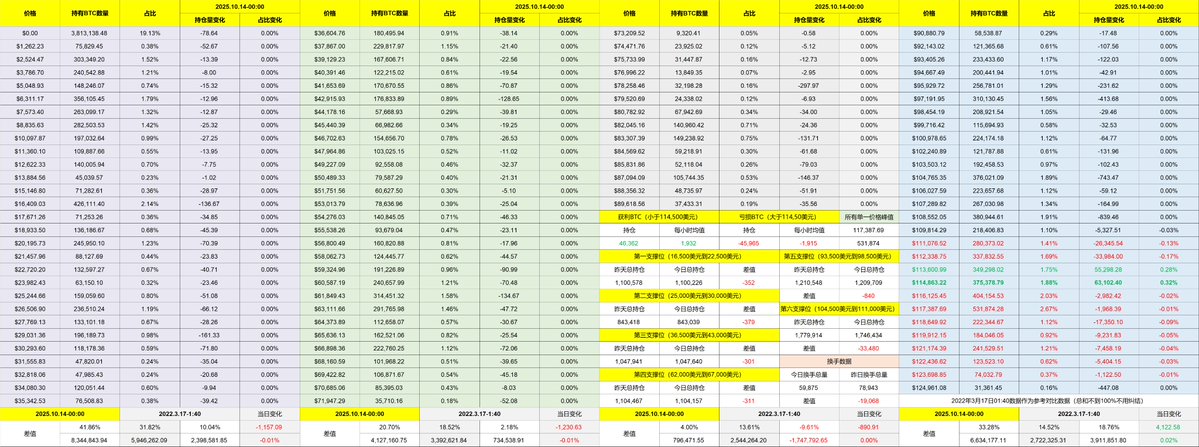

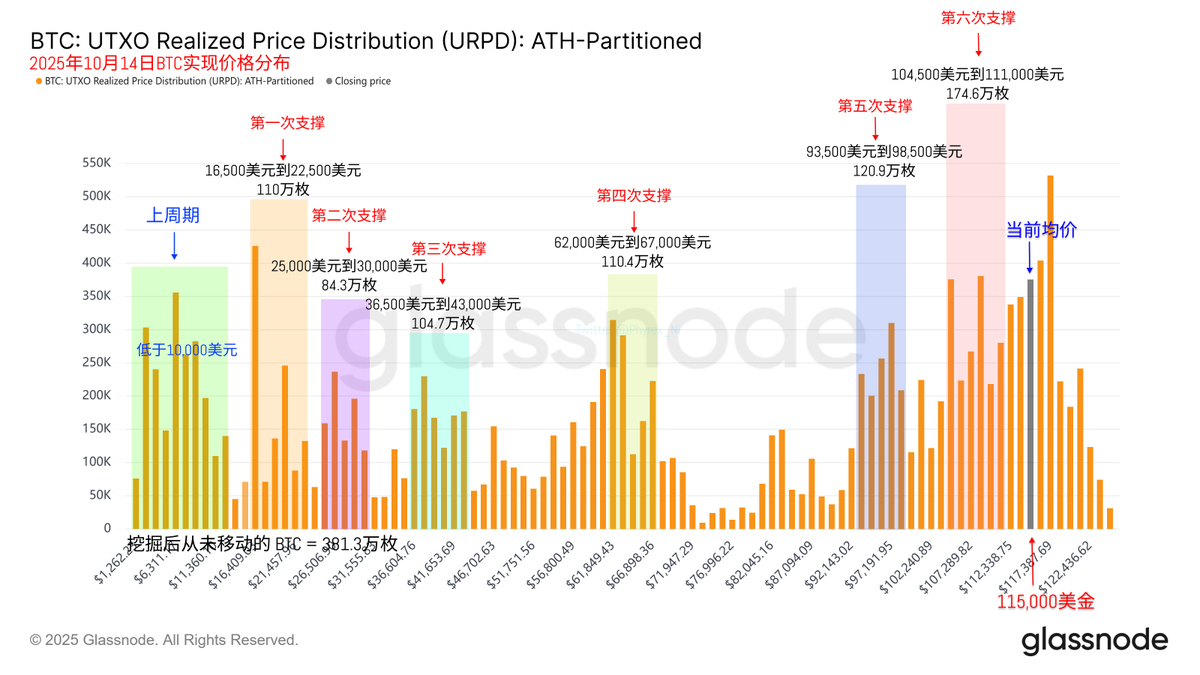

Looking at Bitcoin's data, the turnover rate is not high, maintaining a normal level. Most of the selling is from investors who bought in at the bottom yesterday, along with some high-position investors who are reducing their holdings, likely worried that the bull market is over. However, as mentioned earlier, the performance of U.S. stocks is still decent, and no systemic risks have been observed.

This week, there should be retail data and PPI data, but the likelihood of a government shutdown is now low. Tomorrow, there will be a public speech by Powell, but it is still unknown whether it will involve monetary policy, so it’s worth paying attention to. Everything else seems fine.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。