Selected News

BNB continues to rise, breaking through $1375, with a 24-hour increase of 17.2%

Binance Alpha will launch the exclusive TGE for Lab (LAB) on October 14

ZeroBase releases ZBT token economics: 8% for airdrop, total supply of 1 billion tokens

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

[BNB]

BNB has gained significant attention on Twitter due to its strong performance and resilience amid market fluctuations. Core discussions focus on its robust ecosystem, bolstered by community support and strategic actions taken by Binance and its affiliates to protect users. The infrastructure of BNB Chain and the launch of new projects like Aster have also fueled its growth. Additionally, comparisons with past market cycles indicate further upside potential, with BNB seen as a safe and promising investment. Overall, market sentiment towards BNB is positive, with most users expressing confidence in its future prospects.

[MONAD]

Today's discussions about MONAD mainly revolve around its mainnet launch and airdrop event scheduled for October 14. The community is both excited and cautious, with users reminded to be vigilant against scams. The development of the ecosystem has sparked widespread interest, with over $100 million raised by teams building projects on MONAD. Airdrops are a hot topic, with market speculation about their impact on prices and potential gains for MONAD cardholders. Additionally, discussions highlight the platform's Ethereum Virtual Machine (EVM) compatibility and its potential for high-speed, low-fee transactions. Overall, market sentiment is positive, with most expressing optimism about MONAD's future.

[ENA]

Today's discussions about ENA primarily focus on the recent cryptocurrency market crash and its impact on Ethena's stablecoin USDe. Although there were initial concerns about decoupling, subsequent clarifications indicated that the issue was specific to the Binance platform, stemming from internal pricing flaws rather than a failure of USDe's mechanism. Ethena's stability mechanism has performed strongly, maintaining its peg to the dollar on major trading platforms like Curve. This incident underscores the importance of a robust oracle system and market infrastructure, with Ethena praised for its resilience and transparency during the crisis. Discussions also touch on the broader implications for decentralized finance (DeFi) and the need for improved risk management strategies.

[POLYMARKET]

Polymarket has garnered significant attention today, primarily due to Tom Brady mentioning the platform on national television, sparking widespread discussion. The platform is recognized for its cultural relevance and intuitive user experience, with comparisons made to other prediction markets like Kalshi. Additionally, the New York Stock Exchange's recent $2 billion investment in Polymarket has elevated its industry standing, making its founders billionaires. The platform's role in accurately predicting events (such as Nobel Peace Prize winners) has also been emphasized, showcasing its potential to replace traditional experts in various fields.

[TAO]

TAO has emerged as the biggest winner in cryptocurrency discussions, as Grayscale submitted a Form 10 filing for its Bittensor trust fund, signaling potential access for institutional investors and paving the way for ETF approval. This news has significantly boosted TAO's price, with many tweets highlighting its resilience and further growth potential. Discussions focus on the bullish sentiment surrounding TAO, its recovery from recent declines, and the upcoming halving event in 2026, which could further increase its value.

Featured Articles

Following the announcement by Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, on October 7 to invest $2 billion in the prediction market platform Polymarket at an estimated valuation of $9 billion, another prediction market giant, Kalshi, announced the completion of a $300 million financing round, reaching a valuation of $5 billion just three days later. Meanwhile, Polymarket founder Shayne Coplan has previously retweeted or liked posts about the platform potentially launching a token, and this time he listed a series of mainstream crypto asset symbols followed by the $POLY ticker on social media, which can be seen as an implicit indication of token issuance. This series of news has triggered FOMO among community members. As the news develops, the prediction market sector has once again become a hot topic of discussion.

Discussions about the black swan crash event on October 11 continue, with the community questioning the identity of the whale who accurately shorted over $1.1 billion in positions ahead of time. On-chain detectives suggest that the address may belong to former BitForex CEO Garrett Jin. Today at noon, Garrett Jin responded to market rumors for the first time with three posts on his personal X account, clarifying that he has no connection to the Trump family or "Little Trump," and emphasized that his previous actions were not insider trading, and the funds used were not his personal assets but belonged to his clients.

On-chain Data

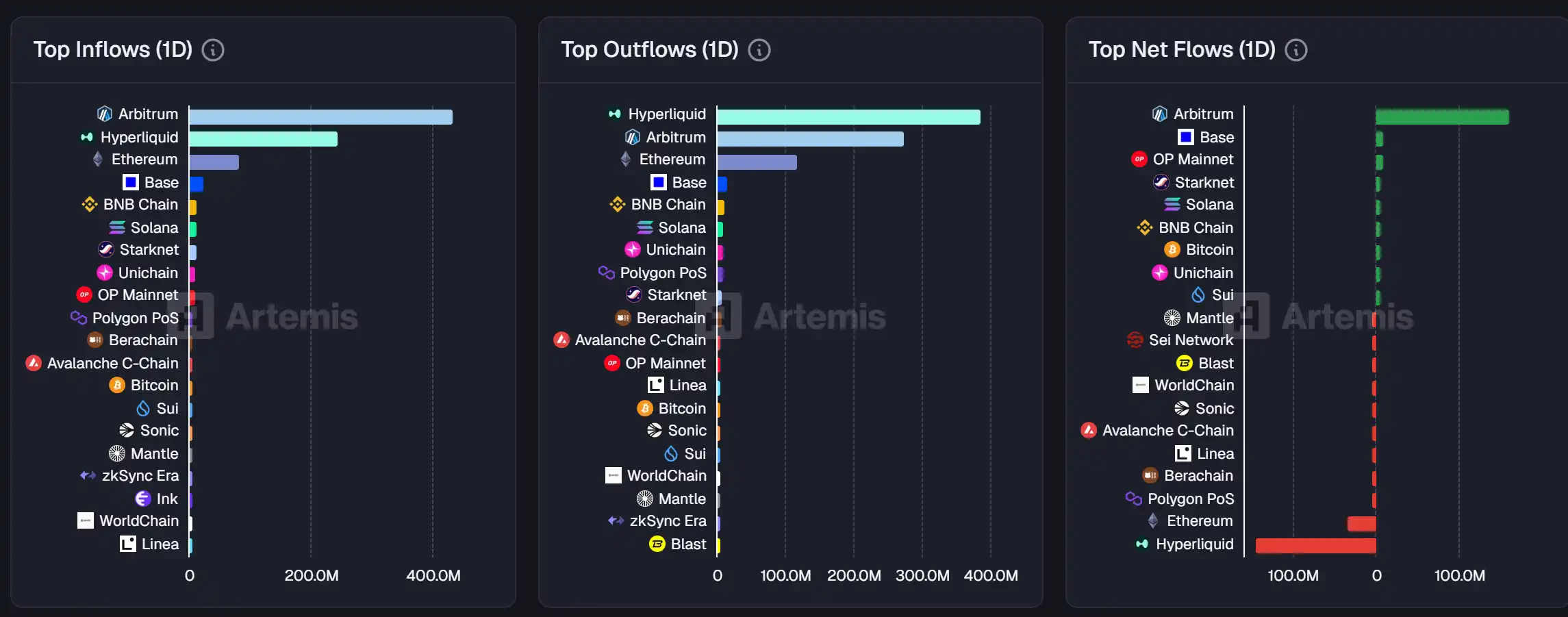

On-chain fund flow situation on October 13

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。