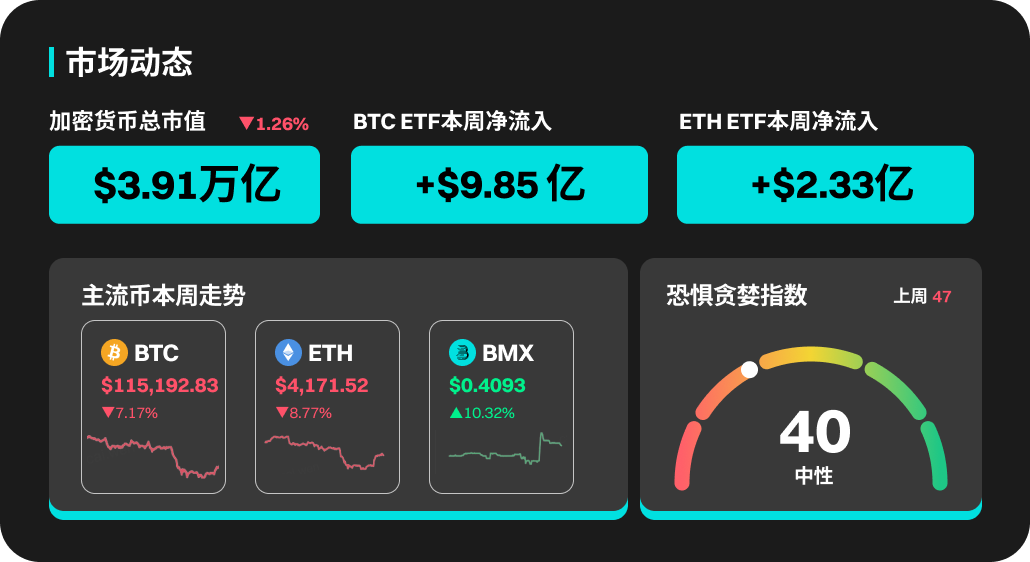

This Week's Cryptocurrency Market Dynamics

Bitcoin's price surged to an all-time high, nearing $126,000, thanks to record inflows into U.S. spot ETFs—$3.2 billion last week and $2.7 billion this week, pushing the two-week total over $5.9 billion. The strong recovery in ETF demand has revitalized market momentum, driving the total cryptocurrency market cap back above $4 trillion and reaching a new high around $4.3 trillion.

Major currencies performed well, while altcoins showed weakness, indicating that capital continues to consolidate around large-cap assets. This trend reflects a structural shift in market composition, increasingly influenced by ETF fund flows, policy developments, and institutional participation. Recent events—including the UK opening cryptocurrency ETPs, Intercontinental Exchange (ICE) investing $2 billion in Polymarket, and upcoming decisions on altcoin ETFs—highlight the deep integration of traditional finance (TradFi) with cryptocurrency.

As these structural changes become evident and the market further enters October's cyclical window, debates intensify over whether the historical four-year cycle of the cryptocurrency market remains intact. Some anticipate a cycle-driven consolidation, while others expect further gains in the cryptocurrency market, supported by dovish Federal Reserve policies and ongoing ETF-led capital inflows.

This Week's Hot Coins

In terms of popular coins, ZEC, SNX, TAO, BNB, and MNT have all performed well. ZEC's price increased by 71.8% this week, with a 24-hour trading volume of 88M. SNX's price rose by 65%, reaching a peak of 294.75 USDT. TAO and BNB increased by 31.2% and 10.8%, respectively, this week.

U.S. Market Overview and Hot News

This week, major asset classes hit new highs, with gold, Bitcoin, and the S&P 500 index performing strongly. The metals sector led the way, particularly gold, which has risen 51.4% year-to-date, showing remarkable performance. Bitcoin and U.S. stocks also maintained good momentum at the beginning of the week, driven by improved risk appetite, but momentum gradually slowed after several days of record-breaking performance. As the weekend approached, market sentiment cooled slightly due to the lack of new policy guidance from the Federal Reserve's meeting minutes and Chairman Powell's speech, leading to some profit-taking in risk assets. Notably, the U.S. Dollar Index (DXY) recorded its first positive growth this week after a recent period of weakness, adding a contrarian color to the cross-asset market.

Japan's new Prime Minister will take office on October 15, with market analysis suggesting he may promote the crypto economy and improve blockchain regulations.

The U.S. SEC's cryptocurrency task force will hold a financial regulation and privacy roundtable on October 17.

The U.S. Treasury is soliciting innovative regulatory ideas for stablecoins under the GENIUS Act, with a deadline of October 17.

The U.S. SEC must make a decision on Grayscale's XRP ETF by October 18.

Hot Sectors and Project Unlocks

Layer2

Against the backdrop of rising risk appetite and high volatility in mainstream assets, the Layer2 sector has become a major beneficiary of capital rotation. According to 7-day data, most leading tokens recorded double-digit gains: OP +33.5%, ARB +22.2%, IMX +24.8%, METIS +22.0%, ZK +24.7%, significantly outperforming BTC's +6.7%. However, there was divergence within the sector: MNT only +2.4%, POL -16.4%, BLAST -22.4%, reflecting that existing capital prefers tracks and targets with clear catalysts or increased ecological activity. On-chain, OP Mainnet's activity surged last week (10/10 refreshed the peak of UOPS in nearly 30 days), resonating with price performance. Overall, capital is rotating from mainstream assets to high β expansion tracks, but attention should be paid to the release/incentive rhythm of individual tokens and cross-chain bridge-related risks.

Cheelee (CHEEL) will unlock approximately 20.81 million tokens at 8:00 AM Beijing time on October 13, accounting for 3.04% of the current circulation, valued at about $22.4 million;

Starknet (STRK) will unlock approximately 127 million tokens at 8:00 AM Beijing time on October 15, accounting for 5.64% of the current circulation, valued at about $14.4 million;

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9:00 PM Beijing time on October 16, accounting for 1.99% of the current circulation, valued at about $28.4 million;

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve substantial risks. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。