Written by: YQ

Translated by: AididiaoJP, Foresight News

The cryptocurrency market crash from October 10 to 11 resulted in $19.3 billion in liquidations, marking the largest event of its kind in history.

While the market attributed this drop to panic triggered by tariff news, a deeper examination of the data reveals a disturbing truth. Was this a coordinated attack targeting Binance and USDe holders? Let’s take a look at the data.

Suspicious Patterns: Why Did These Assets Decouple?

The most perplexing aspect of this crash centered on three specific assets that experienced catastrophic price drops, but only on the Binance exchange:

- USDe: Dropped to $0.6567 on Binance, while remaining above $0.90 on-chain

- wBETH: Plummeted to $430 on Binance (down 88.7% from ETH value)

- BNSOL: Dropped to $34.9 on Binance, while other exchanges showed minimal volatility

This specific breakdown on the exchange immediately raised alarms in the market and quickly led to widespread panic.

Timing Issues

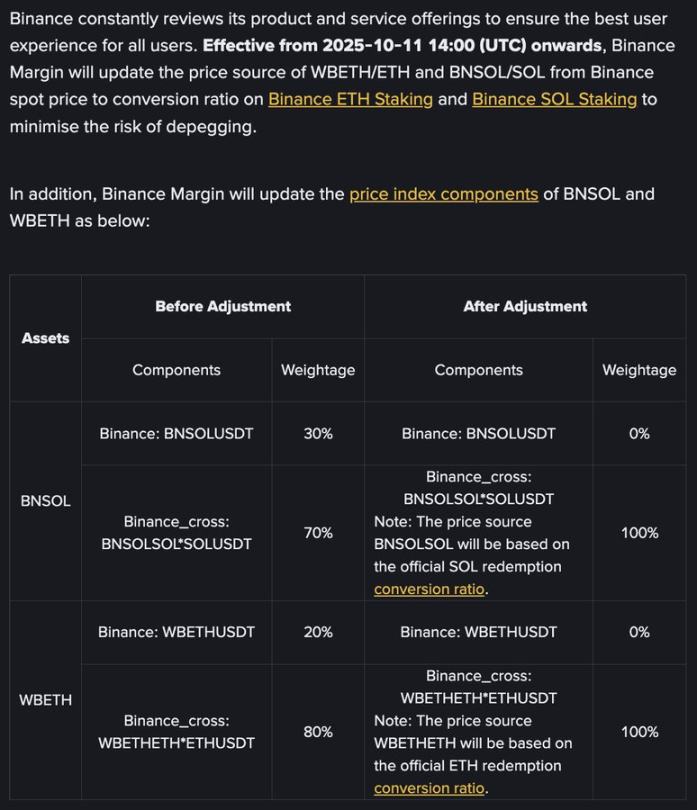

Things became particularly interesting on October 6, when Binance announced an update to the pricing mechanism for these three assets, set to take effect on October 14.

The crash occurred on October 10 to 11, right within this vulnerability window.

Among thousands of trading pairs, only those that had announced updates experienced such extreme decoupling. Is this a coincidence? The probability seems negligible.

Testing the Attack Hypothesis

If this was indeed a coordinated attack, the timeline suggests that this strike was meticulously planned:

- 5:00 AM: Market begins to decline following tariff news, normal behavior

- 5:20 AM: Altcoin liquidations accelerate sharply, possibly targeting market maker positions

- 5:43 AM: USDe, wBETH, and BNSOL simultaneously crash on Binance

- 6:30 AM: Market structure completely collapses

5:00 AM (UTC+8): Initial market volatility begins

- Bitcoin starts to drop from $119,000

- Trading volume remains within normal parameters

- Market makers maintain standard spreads

5:20 AM: First liquidation cascade

- Altcoin liquidations accelerate sharply

- Volume surges: reaching 10 times normal trading activity

- Market maker withdrawal patterns emerge

5:43 AM: Key decoupling event

- USDe: $1.00 → $0.6567 (-34.33%)

- wBETH: 3,813 USDT → begins catastrophic decline

- BNSOL: approximately 200 USDT → accelerates collapse

5:50 AM: Maximum dislocation

- wBETH reaches $430.65 USDT (down 88.7% from parity)

- BNSOL bottoms out at $34.9 USDT (down 82.5%)

- Buy-side liquidity completely disappears

6:30 AM: Market structure collapse complete

- Total liquidation exceeds $10 billion

- Market makers completely withdraw

- Binance-specific price anomalies reach their peak

USDE/USDT crashed at 5:43 AM Singapore time.

WBETH/USDT crashed at 5:44 AM Singapore time.

The 23-minute gap between the widespread liquidation and the specific asset crashes suggests a sequential execution rather than random panic.

BNSOL/USDT crashed at 5:44 AM Singapore time.

USDe Factors

Several factors made USDe particularly vulnerable if someone wanted to exploit it:

- Implicit leverage: Binance's 12% yield program encouraged circular borrowing, creating positions with leverage up to 10 times

- Collateral concentration: Many traders reportedly used USDe as margin collateral

- Thin order book: Despite being a "stablecoin," USDe's liquidity was exceptionally weak

When USDe crashed to $0.6567, it not only caused direct losses but may have triggered a chain reaction throughout the ecosystem.

Market Maker Perspective

A theory circulating among traders is that the initial altcoin liquidation at 5:20 AM specifically targeted market makers. If true, this would explain the subsequent liquidity vacuum. When market makers are forced to exit, they withdraw from all order books simultaneously, leaving the market defenseless.

Evidence? Altcoin prices on Binance were significantly lower than on other exchanges, a pattern consistent with major market maker liquidations.

Tracking Fund Flows

If this was a coordinated action, then someone profited immensely:

- Potential short profits: $300 million to $400 million

- Accumulating assets at low prices: $400 million to $600 million opportunity

- Cross-exchange arbitrage: $100 million to $200 million

Potential value capture: $800 million to $1.2 billion

These are not normal trading profits; they are robbery-level returns.

Other Explanations

Fairly speaking, several factors could explain these events without coordination:

- Cascading effects: Once liquidations begin, they can naturally spiral upward

- Concentrated risk: Too many traders using similar strategies

- Infrastructure stress: Systems failing under unprecedented trading volumes

- Panic psychology: Fear creates a self-fulfilling prophecy

However, the precision of which assets crashed and where they crashed makes these explanations seem far-fetched.

Suspicious Aspects

Several factors distinguish this crash from a typical market crash:

- Venue specificity: Price crashes were almost entirely confined to Binance

- Asset selection: Only pre-announced vulnerable assets were severely affected

- Timing precision: Occurred within the exact vulnerability window

- Sequential nature: Market makers were eliminated before the main targets were attacked

- Profit pattern: Consistent with pre-planned strategies

Potential Implications if True

If this was indeed a coordinated attack, it represents a new evolution in cryptocurrency market manipulation. The attackers did not hack the system or steal keys; instead, they weaponized the market structure itself.

This would mean:

- Every exchange announcement becomes a potential vulnerability

- Transparency may paradoxically reduce security

- Market structure needs fundamental redesign

- Current risk models are inadequate

Disturbing Possibilities

While we cannot definitively prove the existence of coordination, the evidence raises reasonable suspicion. Its precision, timing, venue specificity, and profit pattern align too perfectly with what a coordinated attack would look like.

Whether through shrewd opportunism or deliberate planning, someone turned Binance's transparency into a vulnerability and extracted nearly a billion dollars in the process.

The cryptocurrency industry now faces a disturbing question: In our interconnected, 24/7 markets, has transparency itself become a weapon that savvy participants can wield?

Until we have clear answers, traders should assume that similar vulnerabilities exist across all exchanges. The events of October 10 to 11 may involve multiple factors, but one thing is certain: it was not a random event.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。