The world is bustling, all for profit; the world is in turmoil, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome all of you to follow and like, and I refuse any market smoke screens!

As the market continues to decline, it has exceeded previous estimates, and there is no need to argue about this; Lao Cui also rushed back to the company overnight, checking data all night, and finally has some clues. Most users are doubting Trump's motives, and there is no need for further speculation. It can only be said that currently, the Federal Reserve and Trump are on the same front. At the beginning of the month, Powell's speech was extremely clear: the valuation of the US stock market is too high, and in the short term, it is cooling down. I still hope that everyone does not isolate the cryptocurrency market; all dollar-linked assets are declining, and the cryptocurrency market is just more volatile, that's all. It is particularly emphasized that gold does not belong to dollar assets. Since decoupling from the dollar, gold has become a stable asset for the whole world. Everyone thinks that gold's value is pushed up due to inflation, but Lao Cui's understanding is that the purchasing power of gold has not changed significantly. It may be affected by short-term news, but the purchasing value will not change much; gold only represents a stable investment market.

By comparing the trend of Bitcoin, the outflow of funds is more about the fluctuations of ancient addresses. For the wallets of the giants, there is still not much fluctuation. The market is like this; the first batch of investors always wants to see returns. Their exit is not entirely a bad thing for us; reshuffling the chips will bring opportunities. The primary factor was concluded yesterday: the impact of tariffs is too great. Yesterday, there was speculation about imposing a 100% tariff, and today it has risen to 130%; the countermeasures came too quickly, all exceeding expected estimates, and they even took action against Goldman Sachs. If this continues, it will almost completely offset the benefits of this year's interest rate cuts. Everyone must pay attention to the tariff aspect, and the investigation into Goldman Sachs is a positive factor for domestic assets, cutting off the outflow of funds. The short-term trend has already reversed; without news stimulus, the entire lower shadow line is likely to solidify, and the previous viewpoint remains unchanged.

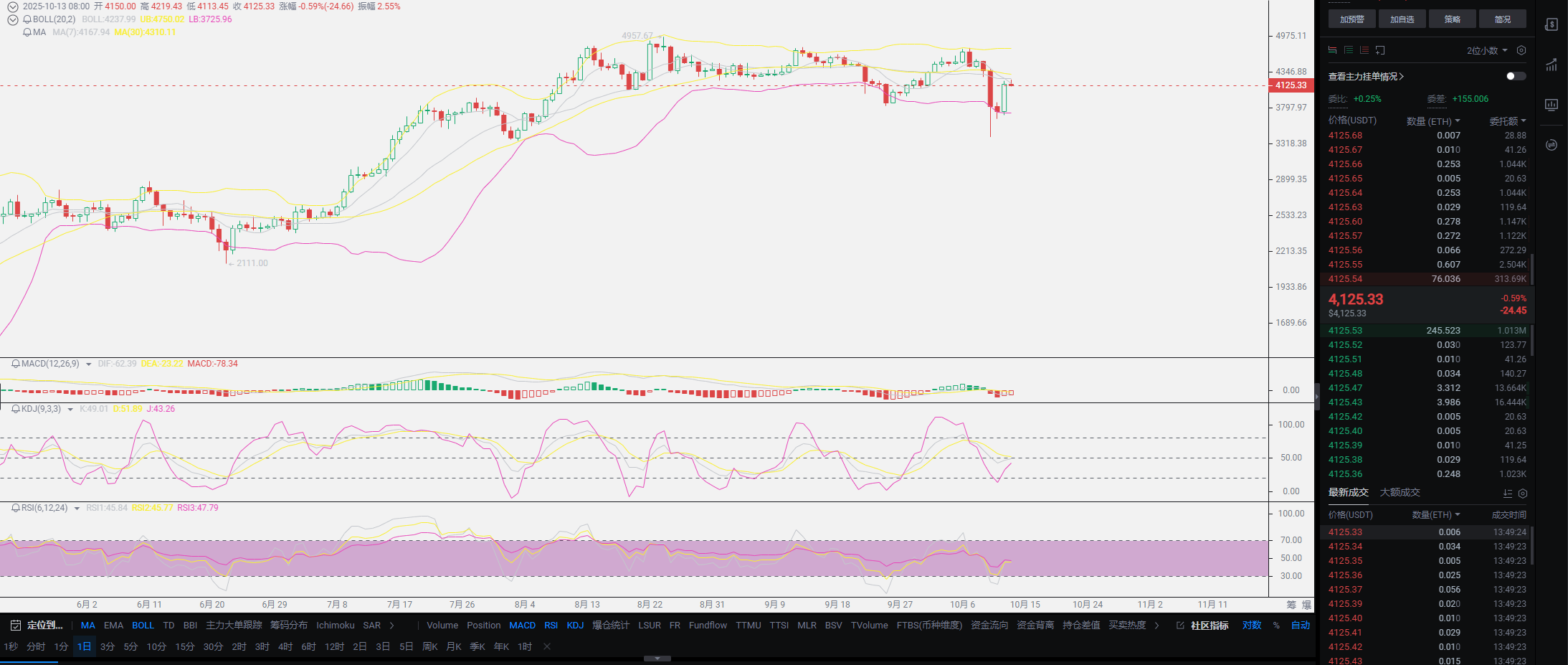

Let me state one point: Lao Cui's viewpoint has always been unchanged, primarily bullish; including this decline, it is definitely beyond my understanding. Just by luck, if Lao Cui had not taken a vacation, he would have definitely entered long positions at this depth of decline. In my personal understanding, luck is also part of strength. Looking solely at Ethereum's trend, if it were driven by Lao Cui's logic, perhaps I would have entered long positions around 4200, waiting for Lao Cui's judgment, which would definitely stop loss around 4000, because Lao Cui's approach is to profit 200 points and stop loss 200 points, which would definitely incur a loss. Many users have complained, so I emphasize that the article is primarily for sharing; everyone's entry and exit are not within Lao Cui's control. Such a crash cannot be controlled by anyone. Trump's statements do not cause substantial harm, but the market makers drive the market trend, and a decline is understandable. This is also beyond Lao Cui's control, and the author has not colluded with Trump, so it cannot be blamed on Lao Cui!

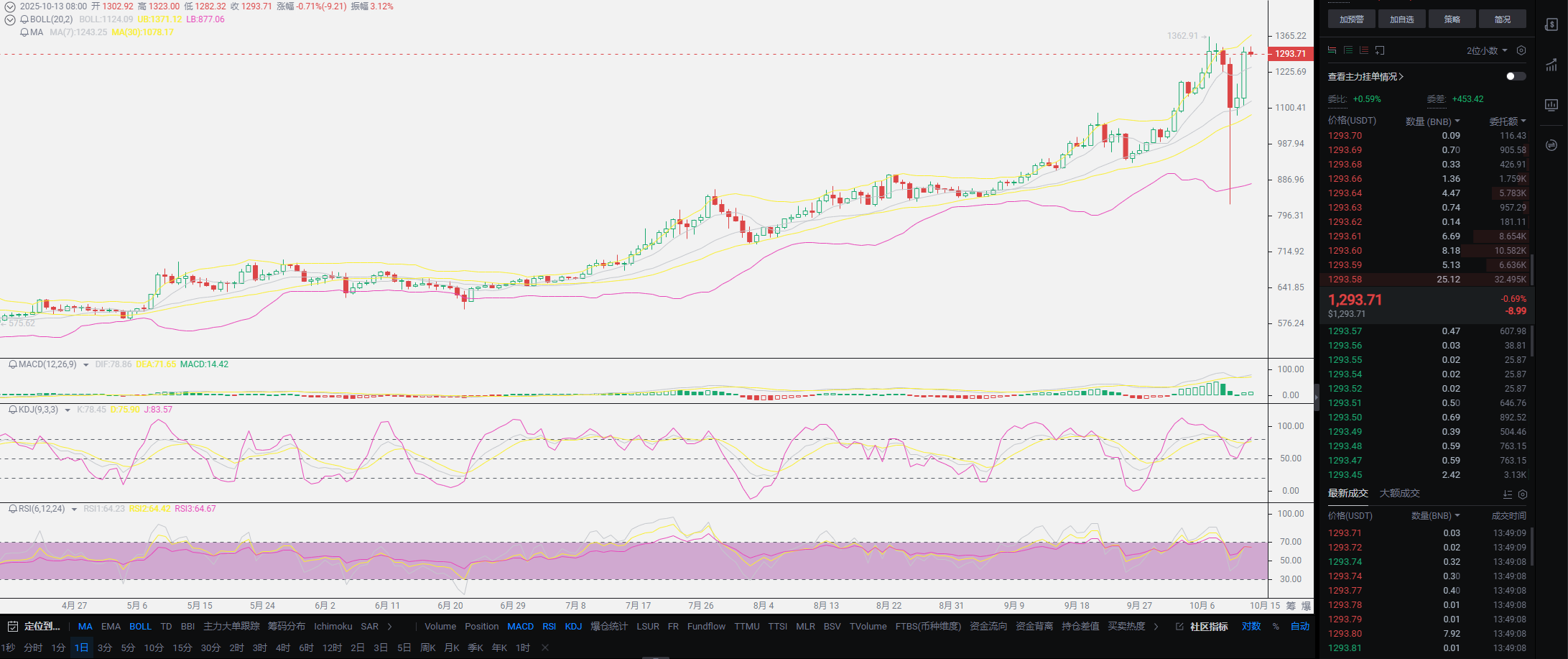

Everyone should not think that Trump's statements are all baseless; substantial data can prove it. Thirty minutes before Trump's speech, a new cryptocurrency trading account appeared, conducting large-scale leveraged shorting of Bitcoin, making over $192 million in profit in just two hours. This data emerged after the market moved; such declines are highly premeditated operations, and Lao Cui is certainly willing to admit it. At the current price, it is worth considering the timing of entry for spot users; SOL below 200, including OKB, are viable options. The BNB indicator also showed a trend today, and it is likely to continue in a bullish form. The only special point about BNB is the Hong Kong license, which means that tariffs have little impact on it. To put it bluntly, the start of tariffs does not have a huge impact on the cryptocurrency market; instead, it will drive on-chain data of cryptocurrencies. The only point of impact is that the funding gap of the giants will flow out of the cryptocurrency market. In the short term, the decline may occur, but in the long term, including high tariffs, the cryptocurrency market may show growth patterns.

Lao Cui summarizes: Overall, the bullish trend cannot be changed, but there is a risk of short-term decline. Trump still holds $870 million in Bitcoin. This week, Lao Cui is looking for a rebound. Currently, the data does not provide Lao Cui with reasons to short. The funding level still stands on the bullish side. For those who want to enter short-term contracts, it is best to focus on Bitcoin. This decline also proves once again that the contract method for small coins is not advisable. Ninety percent of coins have reached a halving rhythm under the influence of this news, which does not belong to the investment category but resembles gambling. Lao Cui will also add some contract positions today to recover spot losses. My ideal prices are to go long around Ethereum 4100 and Bitcoin 113000-114000, with a profit target of 100-200 points for Ethereum and around 2000 points for Bitcoin. BNB has returned to the previous decline position, with good indicators, and perhaps a market recovery will come soon. For those who have not yet entered the spot market, you can consider entering with half positions at this stage, ignoring short-term risks.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。