Author: Liang Yu

Editor: Zhao Yidan

As emerging financial centers attract global capital with their meticulously designed regulatory sandboxes and clear licensing, the world's traditional financial powers have chosen a more ancient and more intimidating weapon to declare sovereignty—law.

The RWA (Real World Assets) regulatory battlefield in the United States appears to be an arena for technological innovation, but in reality, it is a stage for geopolitical financial maneuvering. Its core is not in the parliamentary halls drafting new bills, but in the federal courts filled with litigation documents and settlement agreements; not on the meticulously laid regulatory runway, but in the regulatory minefield gradually clarified through case litigation and enforcement actions.

However, 2025 became a turning point. The GENIUS Act established a federal cornerstone for dollar stablecoins, the CLARITY Act delineated the power boundaries between the SEC and CFTC, and the Anti-CBDC Surveillance National Act completely closed the door on government-led digital currencies—these three fundamental pieces of legislation collectively mark the shift of the United States from passive "regulatory ambiguity" to active "framework building."

The deeper logic is far from nurturing innovation; rather, it forcibly incorporates global financial innovation into its existing legal framework through the duet of "enforcement regulation" and "legislative framing," thereby consolidating financial hegemony centered on the dollar and securities law. This is a unique American-style conspiracy: using the legal framework of the old world to define the financial future of the new century, thus firmly holding the ultimate interpretation and control of the rules in its hands.

Today, the United States is using these three acts as pillars to construct the prototype of its "Digital Financial NATO"—rejecting the global central bank digital currency race, and instead forging privately issued dollar stablecoins into the financial infrastructure of the digital age, laying down entirely new game rules for the tokenization wave of real-world assets.

The RWA Research Institute proudly releases the "Global RWA Compliance Landscape Overview" series of in-depth research reports. The "Global RWA Compliance Landscape Overview Series" aims to study the regulatory legal policies, major regional projects, protocol technology construction, and architectural design of cryptocurrencies in major regulatory countries/regions such as the United States, Hong Kong, Singapore, Dubai in the UAE, Thailand, and Germany, in an effort to provide readers with profound and comprehensive insights.

This is thesecond article** in our series.**

I. Key Laws and Regulations: Adaptation of Digital Assets under Traditional Legal Frameworks

(1) Three Fundamental Acts: Strategic Shift from Regulatory Ambiguity to Framework Building

The GENIUS Act, the CLARITY Act, and the Anti-CBDC Surveillance National Act together form a logical closed loop for the U.S. digital currency regulatory path, marking a significant policy shift from "regulatory ambiguity" to "framework building."

1. The GENIUS Act: Establishing a Federal Regulatory Framework for Stablecoins

The GENIUS Act was signed into law by President Trump on July 18, 2025, making it the first federal law in U.S. history targeting digital assets. According to the fact sheet released by the White House, its core is to establish a layered federal regulatory framework for payment stablecoins, setting different regulatory paths based on whether the issuer is a "regulated depository institution" or a "non-bank issuer." The act stipulates strict reserve requirements, but its text (Sec. 103(b)) explicitly states that reserve assets include "cash, Federal Reserve deposit balances, Treasury bills with maturities of 90 days or less," as well as "assets in deposit accounts insured by federal or state agencies" under certain conditions and limits, which is more specific than the generalization of "short-term U.S. Treasury securities with maturities of 93 days or less." Additionally, the act sets a transition period for existing stablecoin businesses (Sec. 107) and requires relevant regulatory agencies to formulate more detailed implementation rules in the future.

2. The CLARITY Act: Dividing Jurisdiction and Introducing the Concept of "Mature Systems"

The CLARITY Act aims to provide a regulatory blueprint for the digital asset market. One of its core mechanisms is the introduction of the concept of "mature blockchain systems," which provides a path for relevant digital goods to be exempt from SEC regulation. However, this exemption does not take effect automatically. The act's text (Sec. 3(a)) stipulates that this exemption must be negotiated between the SEC and CFTC after the act takes effect, and rules must be established within a period of up to 360 days, clarifying certification standards and procedures before it can take effect for certified systems. Certification standards include various dimensions such as the degree of decentralization, operational history, and issuer control, with the original text stating that "the issuer's holdings are below 20%" being just one of the potential factors for judging "control," rather than the sole decisive formula.

3. The Anti-CBDC Surveillance National Act: Permanently Banning Central Bank Digital Currencies

The passage of the Anti-CBDC Surveillance National Act reflects a strong sentiment for financial privacy protection in U.S. politics and vigilance against government power expansion. This act sets clear barriers at the legislative level for retail central bank digital currencies (CBDCs). However, considering that U.S. policy styles may change significantly with government transitions, and President Trump’s emphasis on "America First" technological leadership, the long-term stability of the policy direction represented by this act still needs to be tested in future political cycles and specific actions of the administration.

(2) Continuity of Traditional Law's Applicability

The United States has not created an entirely new legal system for RWA like Dubai; instead, it forcibly incorporates this new species into the existing system for interpretation and application, leveraging its deep and robust traditional financial regulatory framework. This is a collision between old codes and new assets.

The Securities Act and the Howey Test: The Damocles Sword Hanging Over RWA Projects

This is the ultimate judgment hanging over almost all RWA projects. The SEC's lawsuit against Ripple Labs (Case No. 20-CV-10832), although primarily involving cryptocurrency (XRP), provides a key precedent for the subsequent judgment of the securities attributes of all tokenized assets (including RWA) through its legal argument regarding "investment contracts," particularly its interpretation of the element of "the efforts of others." Forbes' legal column points out that this case established the principle that even if an asset has utility, its method of issuance may still constitute a securities offering. In practice, the vast majority of RWA tokens with income attributes, such as tokenized government bonds or private credit, are likely to fall under the category of securities, thus subjecting them to the SEC's strict regulation.

(3) Enforcement of Regulation and Market Response: The "Chilling Effect" of Law Enforcement

According to the SEC's enforcement report for the first quarter of fiscal year 2025, the agency initiated over 200 enforcement actions during this period, with a focus on fraud involving digital assets and unregistered securities offerings. Meanwhile, the SEC's Cyber and Emerging Technologies Unit (CETU) is focused on combating blockchain-related fraud and social media-driven "pump and dump" market manipulation. This tough, high-frequency enforcement posture has produced a significant "chilling effect." The international law firm Gibson Dunn noted in its 2025 fintech compliance report that many U.S. RWA project initiators have chosen more conservative and even overly compliant legal structures out of fear of potential enforcement risks, which has somewhat suppressed the pace of innovation.

II. Regulatory Framework and Policy Background: The "Battle of the Gods" Under Multi-Headed Regulation

(1) Three Fundamental Acts: Strategic Shift from Regulatory Ambiguity to Framework Building

The regulatory landscape for RWA in the United States exhibits typical characteristics of "multi-headed regulation," resembling a "battle of the gods"—multiple regulatory agencies with independent powers shape the contours and boundaries of the market through intense competition and negotiation based on their respective missions and authorities.

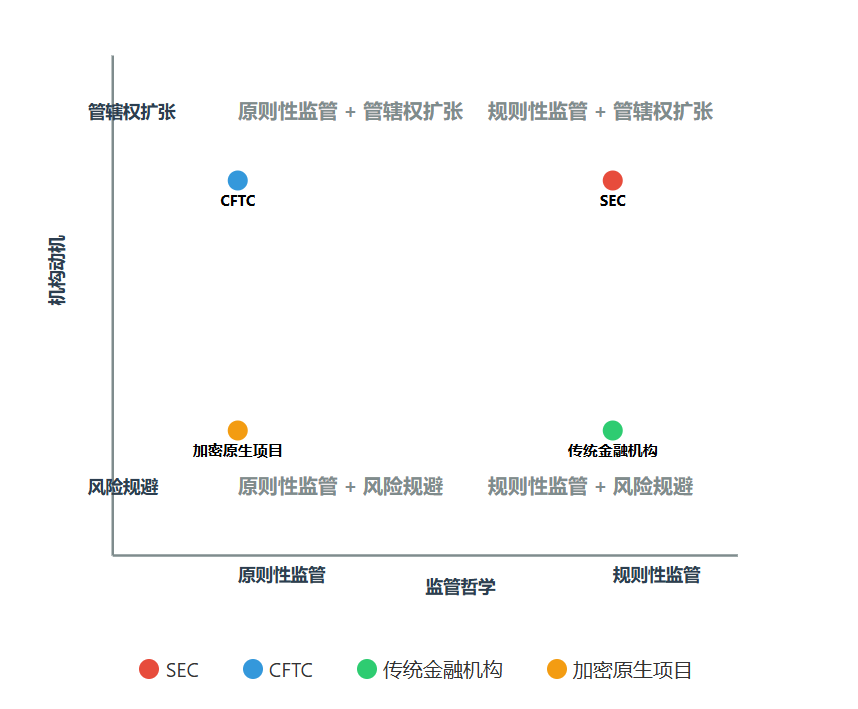

Chart 1: U.S. RWA Regulatory Power Structure and Institutional Game Matrix

(1) Securities and Exchange Commission (SEC): The "Strong Dominator" Where Substance Prevails Over Form

The SEC is the most influential and hardest-line regulatory agency in the RWA field. Its core regulatory logic is "substance over form." Regardless of the technological form in which the asset is packaged, as long as it meets the "Howey Test" standard—i.e., investing money in a common enterprise with a reasonable expectation of profits derived from the efforts of others—it is deemed a security. According to Bloomberg Law analysis, once classified as a security, the issuance and trading of RWA tokens will face strict registration, ongoing disclosure, and compliance with exemption provisions (such as Reg D, Reg S) under the Securities Act of 1933 and the Securities Exchange Act of 1934, which means high compliance costs and legal risks for most projects.

It is noteworthy that according to the SEC's published 2025 fiscal year regulatory agenda, its focus has shifted significantly from broad ESG regulation to promoting technological innovation and capital formation. The agenda explicitly states that it has established a special working group on crypto assets and fintech led by Commissioner Hester Peirce, known for her pro-crypto stance, aimed at systematically addressing the applicability of federal securities laws in the digital asset space. Its tasks include clarifying custody requirements for crypto markets, trading protocol standards, and disclosure norms. This move has been interpreted by the Wall Street Journal as a signal that the SEC, under a strong enforcement facade, is attempting to build internal expertise and conduct more refined regulation.

The SEC is the most influential regulatory agency in the RWA field, yet there are profound internal struggles and philosophical shifts within it.

Gary Gensler's "Enforcement Regulation" Legacy: Former Chairman Gensler was a technological optimist and a strict advocate for investor protection. He firmly believed that most cryptocurrencies, except Bitcoin, are securities and likened stablecoins to "casino chips." His tenure was characterized by "enforcement regulation," clarifying regulatory boundaries through high-intensity lawsuits (such as the case against Ripple Labs). His insistence on this stemmed from deep concerns about fraud and unregistered securities in the market, aiming to ensure that the law applies equally in the face of new technologies.

Paul Atkins' New Direction of "Rule Shaping": In contrast to Gensler's hardline enforcement, new Chairman Paul Atkins' philosophy represents an innovative defense force within the SEC. Its core motivation is to prevent talent and capital outflows caused by regulatory uncertainty. He openly acknowledged that past "enforcement-style regulation" had pushed innovation to places like Dubai and Singapore. His leadership of "Project Crypto" and the promotion of "innovation exemptions" signify the SEC's shift from "passive application" to "active shaping," aiming to establish an "innovation market with the clearest rules" to attract trillions of dollars of traditional assets onto the blockchain.

(2) Commodity Futures Trading Commission (CFTC): The "Parallel Regulator" of Commodity Attributes

CFTC Chairman Rostin Behnam's stance sharply contrasts with that of the SEC, with his core goal being to secure dominant regulatory authority over the "non-security" digital asset market.

Clarifying Commodity Jurisdiction: Behnam emphasized that Bitcoin and Ethereum have been recognized by the courts as "digital commodities," governed by the Commodity Exchange Act. He estimates that 70-80% of tokens currently in the market fall into this category, creating a significant regulatory gap.

Seeking Unified Regulatory Authority and Legislative Promotion: Behnam openly expressed his willingness to accept the proposal to unify the regulatory authority over all digital assets under the CFTC. He actively lobbied Congress, emphasizing that the current regulatory gap exposes U.S. investors to risks and marginalizes the U.S. in global coordination efforts. The regulatory blueprint he advocates emphasizes dual registration, targeted supervision, and a robust compliance framework.

For RWAs (such as tokenized commodities, gold, etc.) classified as "commodities," the CFTC has parallel jurisdiction, with its regulatory philosophy focusing more on combating market manipulation and fraud rather than the SEC's comprehensive, preemptive disclosure regulation. In 2025, the CFTC introduced new rules for stablecoins as collateral for derivatives trading (Document No. CFTC-P-2025-001), which is currently in the public comment period. According to Reuters, this initiative has garnered over 72% support among major banks and traders on Wall Street, and is seen as significantly lowering the barriers for traditional financial institutions to participate in the RWA-related derivatives market.

(3) The Binary Opposition of Federal and State: The Split Between the "RWA-Friendly State Alliance" and "Prohibitive States"

Beneath the federal-level game, the unique federal and state dual system in the United States is giving rise to a fragmented regulatory landscape, forming a dichotomy between the "RWA-Friendly State Alliance" and "High Regulatory Cost States."

The Rise of the "RWA-Friendly State Alliance": In the face of federal uncertainty, some states are attracting innovation by providing clear legal infrastructure.

Wyoming: Launched the Frontier stablecoin (FRNT), becoming the first state in the U.S. to issue a production-grade stablecoin, and plans to tokenize assets such as gold and oil.

Delaware: Amended the General Corporation Law to allow the use of blockchain technology to maintain stock ledgers, providing an ideal legal environment for establishing SPVs for RWA projects.

Vermont: Updated the "Virtual Asset Issuance Rulebook" to explicitly include provisions for RWA tokens.

Barriers of "High Regulatory Cost States": In contrast, states like New York have established high compliance barriers through strict BitLicense regulations, effectively excluding many innovative companies.

This state-level differentiation is both a product of federal regulatory failure and provides market participants with a "domestic safe haven" to evade stringent regulations, while simultaneously exacerbating the complexity of national-level regulation.

(4) Legislative Attempts: From Jurisdictional Competition to Framework Building

In response to the long-standing jurisdictional disputes between the SEC and CFTC and the strong calls from the industry, Congress has begun to attempt to construct a more certain unified framework through legislation. Among these, the introduction of the "Financial Innovation and Technology Act of the 21st Century" (FIT 21 Act) is particularly noteworthy, as it aims to clearly delineate the jurisdictional boundaries of the CFTC and SEC in digital asset regulation, providing a clearer compliance path for tokenized commodities. The "broker" provision in the "Infrastructure Investment and Jobs Act" passed in 2021 has already had a profound impact on tax reporting in the RWA field, with the Tax Foundation analyzing that this provision could lead to significant confusion in RWA income reporting.

III. National Strategy: Responding to Global Competition with a "Digital Financial NATO"

The U.S. RWA regulatory strategy is not merely an isolated financial policy adjustment, but a well-considered geopolitical strategic layout. It aims to build a digital financial alliance system centered on dollar stablecoins and framed by U.S. law, in order to respond to challenges from various global regulatory systems.

(1) In Response to the EU's MiCA: From Rule Follower to Rule Shaper

In the face of the EU's MiCA (Markets in Crypto-Assets Regulation), a unified regulatory framework, the U.S. acknowledges that it is temporarily lagging in terms of framework uniformity, but its response strategy reflects a profound shift from passive application to active shaping.

Differences in Regulatory Philosophy: The EU's MiCA provides a horizontal, universal set of rules, attempting to find a place for all crypto assets. In contrast, the U.S. adheres to its tradition of "functional regulation," lacking an independent law specifically targeting RWAs, instead applying existing frameworks such as the Securities Act and the Commodity Act. This leads to frequent overlaps in regulatory authority between the SEC and CFTC, with asset classification (especially the application of the "Howey Test") being fraught with uncertainty, imposing a dual compliance burden on enterprises.

Efforts to Actively Shape—SEC's "Project Crypto": To compensate for the lack of uniformity, the SEC has launched the "Project Crypto" initiative, marking its shift from "passive application" of old laws to "active shaping" of new rules. The core of this initiative is to clarify digital asset classifications, support the integration of "super apps" for trading, publish disclosure and exemption pathways, and establish safe harbor mechanisms. Meanwhile, SEC Chairman Paul Atkins has proposed prioritizing "innovation exemptions" as a legislative focus, which is expected to provide a three-year regulatory sandbox for tokenized securities and on-chain trading platforms, seeking to rebalance between innovation and protection in response to talent and capital outflows.

Overall, the U.S. is attempting to catch up with the uniformity and certainty provided by MiCA by offering clearer exemption pathways and sandbox mechanisms under traditional securities law, but its underlying logic remains to enhance the interpretive power and applicability of its legal system to participate in competition.

(2) In Response to the UK's "Same Risk, Same Regulation": Recognition of Principles and Real-World Dilemmas

The principle of "same business, same risk, same rules" advocated by the UK and financial centers influenced by it, such as Hong Kong, theoretically aligns with the U.S. concept of "functional regulation." However, in practice, the U.S. faces dilemmas due to the lagging legal framework.

Application of Principles and Dilemmas: The U.S. theoretically supports a principle based on the substance of business for RWA regulation, but in practice, the vast majority of RWA tokens are classified as securities due to their compliance with "Howey Test" characteristics, requiring adherence to the complex registration and disclosure processes of the Securities Act of 1933. Although blockchain technology itself possesses strong audit and traceability capabilities, the hesitation of regulatory agencies and insistence on investor protection rules have led the U.S. to lag behind the UK, EU, and Singapore in pilot projects that transfer securities trading to blockchain.

Resistance from Traditional Financial Institutions: Wall Street giants, such as the Securities Industry and Financial Markets Association (SIFMA), strongly argue that even if securities are presented in blockchain form, core investor protection requirements must not change. They point out that many emerging tokenized stock products are marketed as "stock-like," but the actual shareholder rights and information disclosure provided are far inferior to traditional stocks, resembling high-risk derivatives more closely, raising deep concerns about regulatory arbitrage and insufficient investor protection.

(3) In Response to China's Digital Renminbi: Stablecoins as Geopolitical Strategic Tools

Although the U.S. RWA strategy does not directly name China's digital renminbi, its clear regulation of stablecoins serves to maintain the core strategy of dollar hegemony, which is an indirect yet powerful response to the transformation of the global monetary system.

Strategic Positioning of Stablecoins and the GENIUS Act: The U.S. has elevated stablecoin regulation to a geopolitical strategic height. Through the GENIUS Act (the "U.S. Stablecoin National Innovation Guidance Act"), the U.S. has established a federal regulatory framework for stablecoins for the first time, requiring that stablecoins must be fully backed 1:1 by high liquidity assets such as dollar deposits and U.S. Treasury securities. This provision creates a closed loop of "issue coins to buy bonds," deeply tying the credit of stablecoins to the sovereign credit of the dollar.

Digital Extension to Maintain Dollar Hegemony: The rapid growth of stablecoins (such as USDT and USDC) provides "on-chain currency" for RWA trading. The U.S. government, through the GENIUS Act, grants credit endorsement to compliant dollar stablecoins, effectively creating a digital extension system for the dollar, allowing it to penetrate deeper into global capital flows and the fintech landscape, achieving the dollarization effect of digital currencies. This is a key part of the U.S. maintaining its control over the global financial system in the face of challenges to dollar hegemony.

The U.S. RWA regulatory strategy is functional, incremental, and strongly strategic in intent. It addresses infrastructure issues through the GENIUS Act, explores compliance pathways through "Project Crypto" and "innovation exemptions," with the ultimate goal of constructing a digital financial ecosystem centered on dollar stablecoins as the settlement currency and U.S. law as the dispute resolution mechanism, namely a "Digital Financial NATO," to respond to competition from different models in the EU, UK, and China.

IV. Industry Practices and Market Responses: Dancing Within the Chains of Compliance

Despite the severe regulatory environment and high uncertainty, the U.S. market has still fostered the world's most prosperous and deep RWA ecosystem, thanks to its unparalleled financial foundation, technical talent, and market scale. Market participants are navigating a survival path filled with wisdom and compromise under the constraints of compliance.

(1) Tokenized U.S. Treasury Bonds: Market Explosion and Legal Concerns Coexist

According to the "RWA Status Report" released by on-chain data analysis firm Messari in October 2025, as of the third quarter of 2025, the total scale of tokenized U.S. Treasury bonds has reached $7 billion to $8 billion, dominating the on-chain RWA market with an average daily trading volume exceeding $1 billion, regarded as the "king of liquidity" on-chain. This explosive growth is primarily driven by the Federal Reserve maintaining benchmark interest rates at over 5%, a twenty-year high, prompting traditional financial institutions and crypto-native treasuries to shift large amounts of idle funds into on-chain U.S. Treasury bond products in search of nearly risk-free high returns.

The OnChain U.S. Government Money Market Fund issued by Franklin Templeton's Benji Investments platform has surpassed $1.5 billion in scale by issuing tokenized shares on the Ethereum blockchain, becoming the first money market fund to operate entirely on a public chain with SEC approval, providing a full-chain compliance model for traditional asset management giants. Meanwhile, the OUSG product from crypto-native institution Ondo Finance innovatively integrates U.S. Treasury bond yields with DeFi protocols, allowing users to stake tokens to borrow stablecoins, with annualized yields stabilizing between 4.8% and 5.2%. According to its official website, this product has attracted over $2 billion in funds.

However, its "risk-free" label is facing severe legal scrutiny. An analysis in a client memorandum released by international law firm Allen & Overy in September 2025 pointed out that the mainstream "SPV + Custody" model in the market currently represents equity or debt rights in the SPV, rather than direct ownership of the underlying U.S. Treasury bonds. The memorandum emphasizes that the core risk lies in whether token holders can successfully "pierce" the SPV and exercise recourse to the underlying assets in extreme situations such as bankruptcy or judicial disputes, which will heavily depend on the specific terms of the SPV's organizational documents, custody agreements, applicable bankruptcy laws, and the final interpretation by the courts. Therefore, the so-called "bankruptcy isolation" may have untested loopholes in legal practice, rather than being an absolute guarantee.

(2) Compliance Exploration by Traditional Financial Institutions and Crypto-Native Projects

Between 2024 and 2025, traditional asset management giants such as BlackRock and State Street launched their respective RWA products. According to estimates by the Financial Times, these institutions collectively brought over $12 billion in incremental funds to the market. Their entry has significantly accelerated the maturation of compliance and credit infrastructure, such as KYC tokens, whitelists, and Chainlink oracles. A white paper released by Chainlink Labs shows that using its oracles and verification systems, the time for qualified investors to complete the entire on-chain process from identity verification to purchasing private credit tokens has been reduced from three days to an astonishing 15 minutes.

On the other hand, mainstream DeFi lending protocols like Aave and Compound have begun to incorporate specific, vetted RWAs (such as tokenized corporate bonds) into their collateral pools, allowing users to use these assets as collateral to borrow stablecoins like USDC, with collateralization rates of up to 70%. This "traditional assets + DeFi Lego" model has transformed RWAs from static tokens into composable, yield-generating financial building blocks. Users can use tokenized U.S. Treasury bonds as a "risk-free base position" and allocate part of their funds to high-yield private credit RWAs, achieving an overall annualized return of over 8%.

(4) Robinhood Proposal: Industry Attempt to Build a Dedicated Trading Framework

In May 2025, online brokerage Robinhood submitted a 42-page "Real World Asset Regulatory Framework Proposal" to the U.S. SEC. According to a copy of the proposal obtained by The Block, its core content includes three major innovations: establishing the legal equivalence of asset tokens and underlying assets; constructing a new trading venue called the "Real World Asset Exchange (RRE)" that employs a hybrid architecture of off-chain order matching and on-chain final settlement; and mandating the integration of third-party compliance tools such as Jumio and Chainalysis for round-the-clock monitoring. If approved, this proposal would provide an unprecedented pathway for traditional financial institutions to participate in on-chain asset trading on a large scale and in compliance, marking a key attempt to evolve RWA trading venues from decentralized protocols to regulated trading platforms.

Chart 2: Comparison of Compliance Strategies, Legal Structures, and Risks of Major RWA Projects in the U.S. Market

V. Future Development and Core Challenges: Moving Forward Amid Uncertainty

The future of RWA regulation in the U.S. will gradually take shape under the pull of political will, institutional games, market innovation, and judicial decisions. Its path is anything but linear and is full of variables.

(1) Future Policy Predictions and Institutional Participation Trends

The executive order "Strengthening America's Leadership in Digital Financial Technology" issued by the Trump administration in early 2025 explicitly stated the need to establish a "safe and growth-friendly regulatory framework" to unleash the innovative potential of the crypto industry. This policy direction has already been reflected at the legislative level. According to Politico, the Senate Banking Committee is accelerating the revision of the "Responsible Financial Innovation Act," with the proportion of supporting senators reaching 58%, aiming to provide long-term policy certainty for the market.

At the same time, the U.S. Federal Reserve has also launched an "RWA Regulatory Sandbox" and a tokenized Treasury bond pilot program. According to a press release on the Federal Reserve's official website, these pilots aim to observe settlement risks, monetary policy impacts, and financial stability effects of RWAs in a controlled environment, accumulating empirical data for subsequent regulatory details.

(2) Fundamental Paradoxes and Systemic Risks

The Paradox of Innovation and Protection: Will the strict securities laws aimed at protecting investors, in practice, stifle innovation and drive markets and talent overseas? A 2025 research report from the Carter Center pointed out that the "enforcement" nature of U.S. regulation, while clear in individual cases, overall brings long-term legal uncertainty, potentially leading to "winning battles but losing the war" in the global RWA competition.

Ambiguity of Legal Ownership: This is the most prominent legal "original sin" in the current U.S. RWA market. The complex, multi-layered legal structure (such as SPVs) between token holders and underlying assets poses significant challenges for direct recourse and piercing in extreme situations (such as the bankruptcy of a custodian bank). This is akin to the "legal gap" issue revealed in the Dubai section, but under the U.S. common law system, it may ultimately require a Supreme Court-level case to clarify thoroughly.

Cross-Border Regulatory Coordination and Jurisdictional Conflicts: The inherent contradiction between the global circulation nature of RWAs and the strong extraterritorial jurisdiction of U.S. regulation (such as the SEC's overseas enforcement actions) creates complexities. An RWA project issued in the U.S. but targeting global investors will face a complicated compliance environment. The Bank for International Settlements (BIS) warned in its 2025 quarterly report that the differences in regulatory attitudes and methods between the U.S. and other major jurisdictions (such as the EU's MiCA framework and the UK's "same risk, same regulation" principle) are exacerbating the fragmentation of the global RWA market and increasing the risk of cross-border enforcement conflicts.

Liquidity Mismatch Risks: An investigative report by The Wall Street Journal in July 2025 revealed that a well-known cross-border trade receivables RWA project had promised users the ability to redeem at any time, despite the underlying assets being receivables with a 180-day term. This led to a surge of $300 million in redemption requests in June 2025 due to market panic, far exceeding its cash reserves, ultimately triggering a liquidation mechanism and causing the token price to plummet by 40% in a single day. This liquidity mismatch, caused by the immediacy of on-chain transactions and the natural time lag of offline cash flows, poses a significant hidden danger for many high-yield RWA products and is a substantial test of regulatory wisdom.

Can Hegemony Continue?

The U.S. RWA ecosystem is a path forged through the intense collision of its powerful traditional financial legal system and emerging technological innovations. It lacks the sophistication and certainty of Dubai's "regulatory productization," yet is filled with the pragmatism, gamesmanship, and risk-taking characteristic of Wall Street.

Its model, centered on "enforcement regulation," while bringing short-term market pain and legal uncertainty, may ultimately establish a very high standard for market entry, thereby firmly locking the pricing power, rule-making authority, and highest judicial interpretation rights of RWAs within the realm of dollar assets and Wall Street. The GENIUS Act anchors stablecoins to dollar hegemony, and tokenized U.S. Treasury bonds become the on-chain "risk-free benchmark," all of which highlight this profound strategic intent.

However, this path is also riddled with deep cracks. The ambiguity of legal ownership, conflicts in cross-border regulation, and risks of liquidity mismatch are all unresolved paradoxes within its system. The ultimate success or failure of the U.S. RWA experiment will not only depend on the enforceability of its rules but also on its ability to find a dynamic and inclusive balance in the paradox of defending financial security while embracing technological innovation.

In this global RWA competition, the U.S. is attempting to win the future dominance of digital finance using its most familiar means—law, market, and the dollar. But will its "enforcement regulation" sword ultimately clear a path for the global market, creating a road that can be followed, or will it sever the budding innovations at home, handing opportunities to others? The final direction of this double-edged sword will be key to determining whether the U.S. can maintain its financial hegemony in the digital age.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。