Written by: White55, Mars Finance

A market crash triggered by a misinterpretation of policy, followed by precise operations from institutions buying the dip, has led the cryptocurrency market to complete a new round of strength and weakness exchange on the ruins of liquidated positions.

In the early hours of October 13, Beijing time, Bitcoin quickly rebounded after falling below the $100,000 mark, regaining a high of $115,000, with a 24-hour increase of over 5%. Meanwhile, Ethereum approached $4,200, with a single-day rebound of over 11%.

This reversal occurred against the backdrop of a $2.5 trillion evaporation in the total market value of the global cryptocurrency market on the previous trading day.

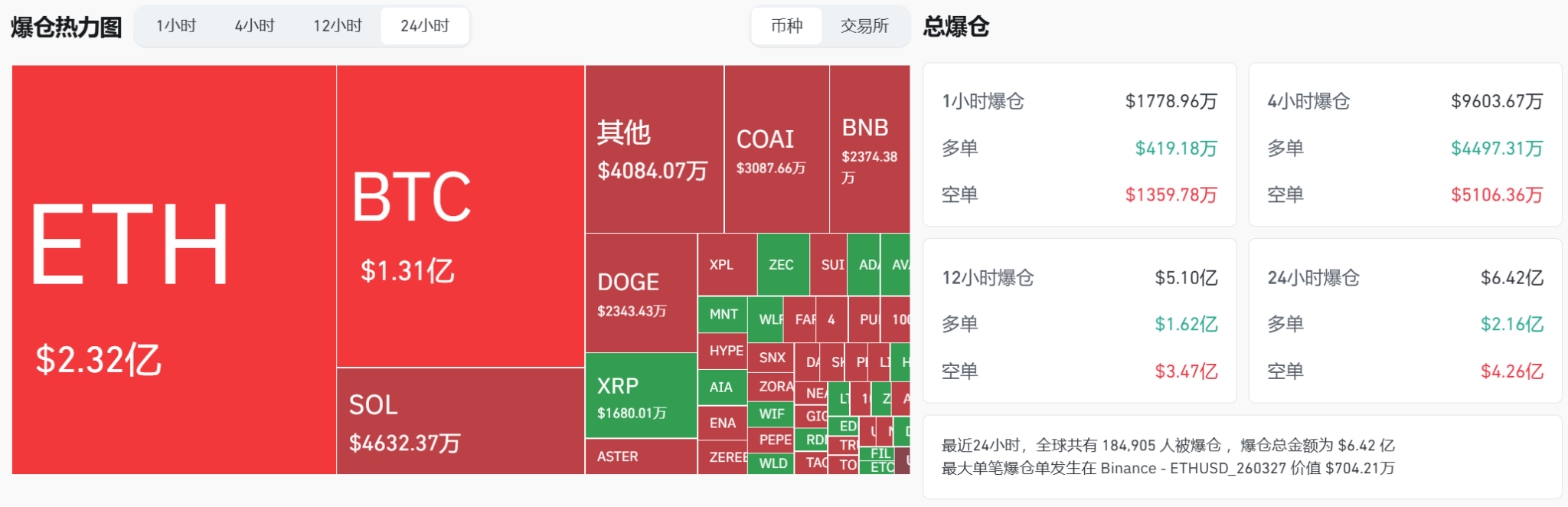

According to CoinGlass data, over 180,000 people were liquidated globally in the last 24 hours, with a total liquidation amount reaching $642 million. In this battle between bulls and bears, the largest single liquidation loss occurred in the ETHUSD trading pair on Binance, valued at $7.0421 million.

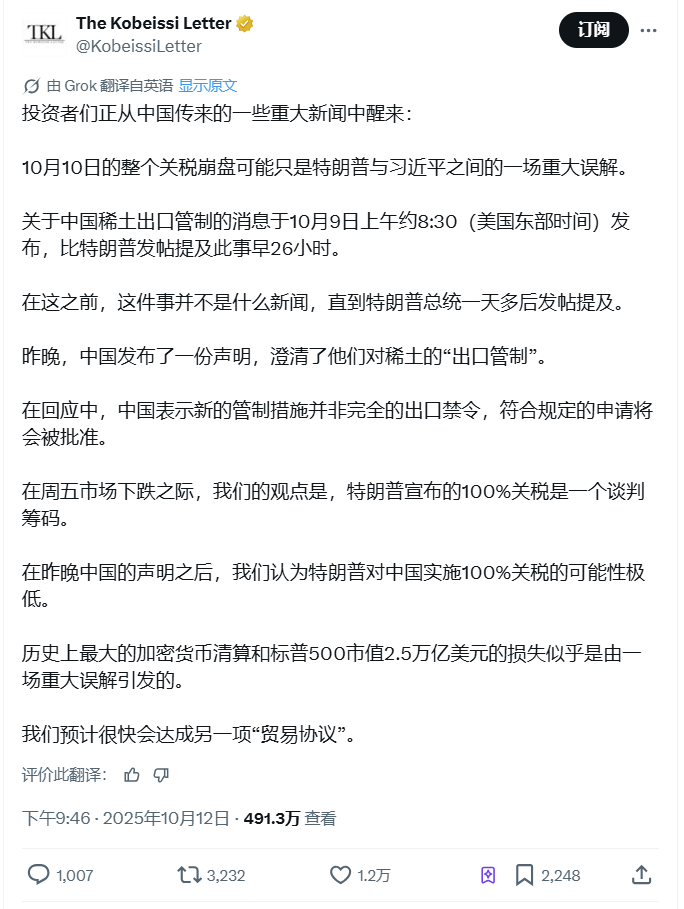

Misinterpretation of Policy and Market Overreaction

The source of this market turmoil can be traced back to October 9. The statement from the Chinese Ministry of Commerce regarding rare earth export controls did not initially provoke an excessive market reaction; however, 26 hours later, Trump's comments on social media completely changed the situation.

Trump threatened to "significantly increase" tariffs on China, which instantly ignited market panic. The S&P 500 index saw a market value evaporation of $2.5 trillion, and the cryptocurrency market subsequently crashed, with Bitcoin plummeting from its historical high of $126,000 to around $100,000. Market analysis firm The Kobeissi Letter pointed out that China's rare earth policy does not constitute a complete ban on exports, as applications that "meet the requirements" will still be approved.

The firm believes that Trump's tariff threat is more of a negotiation strategy, with a very low likelihood of actual implementation. This "Trump tariff drama" model has been summarized by Wall Street as the "TACO" trading strategy, which stands for "Trump Always Chickens Out."

According to GF Securities analysis, since April of this year, global "TACO" trades have occurred multiple times, including the U.S. side's threats of increased tariffs followed by continuous delays, and threats to dismiss Powell but then immediately backtracking.

Leverage Liquidation and Market Structure Reset

In this crash, the cryptocurrency market experienced the most severe deleveraging in history.

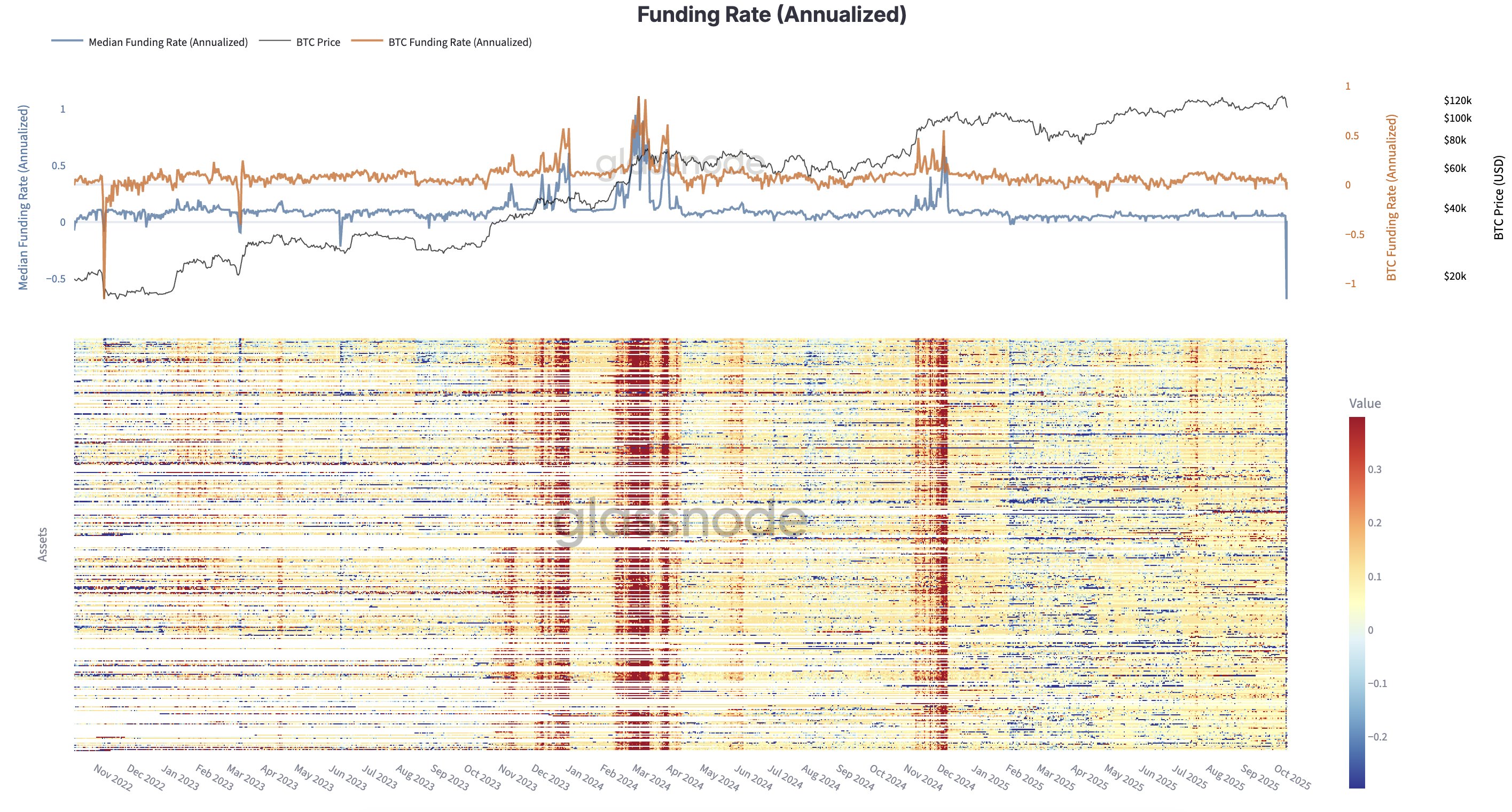

Glassnode data shows that the funding rate across the entire cryptocurrency market has fallen to its lowest level since the 2022 bear market, indicating that speculative excess has been systematically cleared out. Excessive leverage was a key factor amplifying this market volatility.

The vulnerability of high-leverage contracts in price fluctuations was fully exposed. A large number of retail investors went long with high leverage around $120,000, and when Bitcoin dropped to $102,000 (a 15% decline), their margin was insufficient to cover the losses, leading to account liquidations.

Although this market structure reset brings short-term pain, it lays the foundation for a healthy market rebound.

Matrix on Target's weekly report noted that since December 2024, discussions on social media regarding altcoins have decreased by over 40%, while discussions related to Bitcoin remain high, reflecting ongoing market interest in Bitcoin as a macro hedge asset.

Institutional Buying the Dip and Trump's Bitcoin Interests

Amid market panic, institutional investors are quietly positioning themselves.

Cryptocurrency analysis platform Lookonchain pointed out that the largest corporate Ethereum financial company, BitMine Immersion Technologies, purchased over 128,700 Ethereum after the crash, valued at $480 million.

BitMine's Executive Chairman Tom Lee stated, "Any price drop without real structural changes is a great buying opportunity."

Similarly, MicroStrategy's Executive Chairman Michael Saylor hinted that his company may have bought the dip, posting a chart of the company's Bitcoin holdings on social media with the title "Don't Stop Believin'."

Notably, Trump himself has become an important stakeholder in the Bitcoin market.

According to Forbes, by holding shares in Trump Media & Technology Group (TMTG), Trump indirectly holds approximately $870 million worth of Bitcoin, placing him among the world's largest Bitcoin investors.

TMTG purchased $2 billion worth of Bitcoin in July this year, and since the company's investment in Bitcoin, the price has risen by about 6%. This interest connection may explain why the Trump administration has taken a friendly stance towards the cryptocurrency industry, including promoting a cryptocurrency strategic reserve plan.

Macroeconomic Environment and Shift in Capital Flows

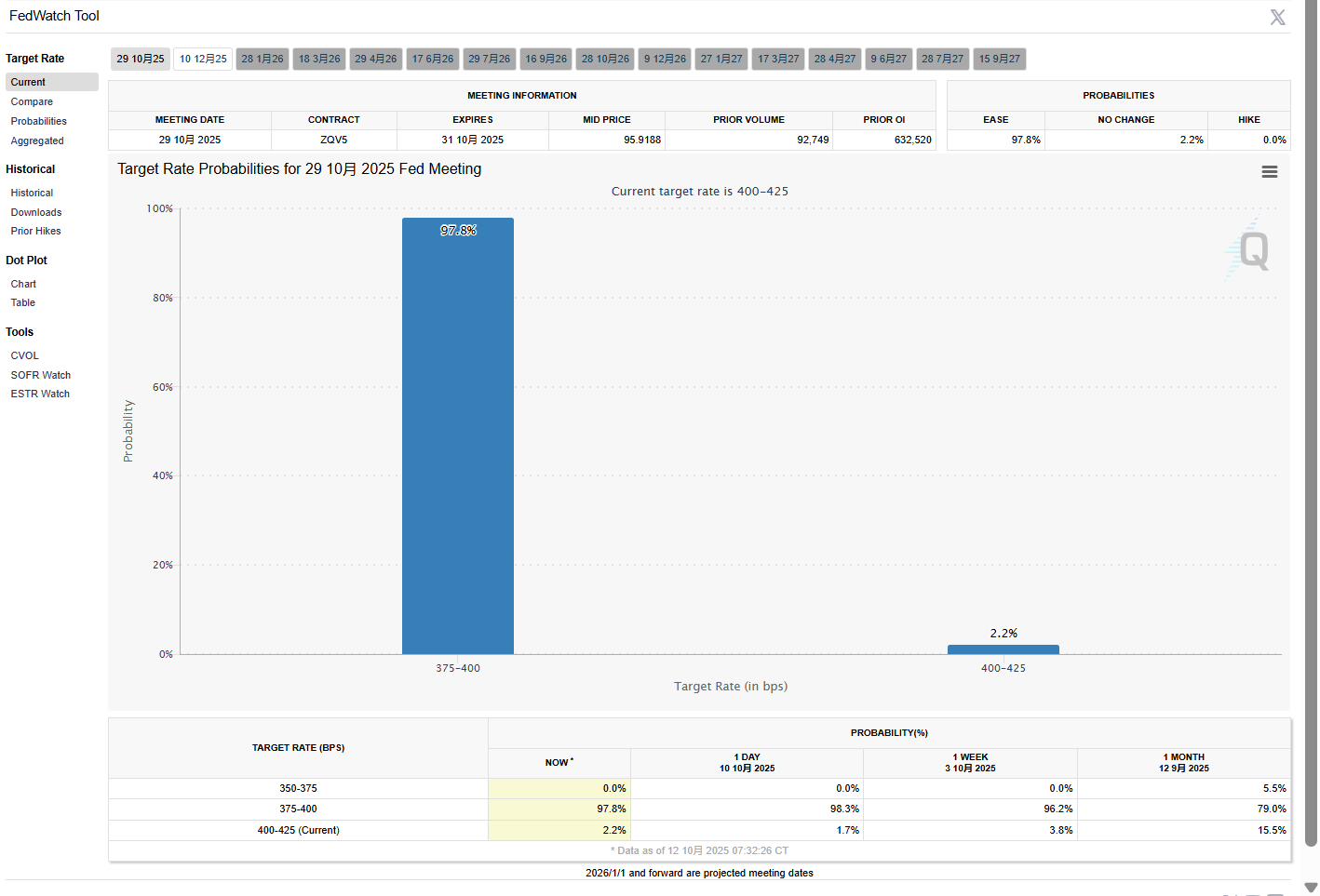

The Federal Reserve's shift in monetary policy has become an important support for the market.

According to CME's "FedWatch" data, the probability of the Federal Reserve cutting interest rates by 25 basis points in October is as high as 97.8%, and the probability of a cumulative 50 basis point cut in December reaches 96.7%. This expectation of liquidity easing provides a favorable environment for risk assets.

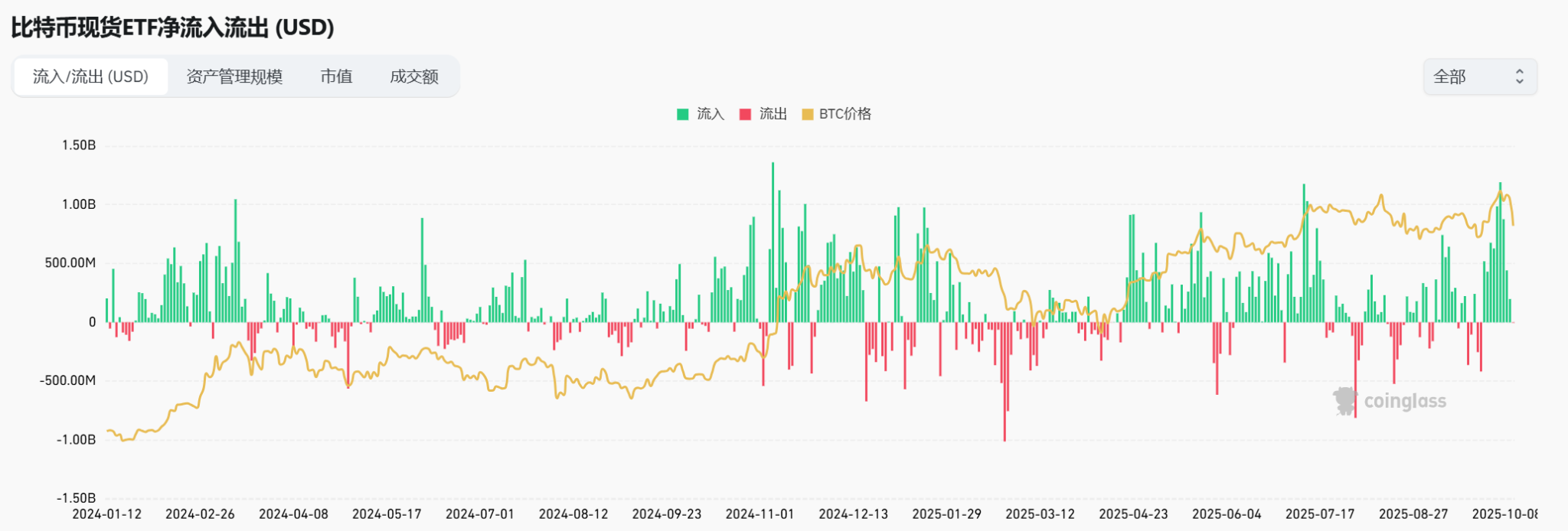

The flow of funds in traditional financial markets is also showing new trends.

Since September, nearly 200 billion yuan has flowed into the ETF market, with net subscriptions for equity ETFs totaling 121.613 billion yuan. This demand for capital allocation in the context of "asset scarcity" also brings potential buying power to the cryptocurrency market.

The synchronous rise of gold and Bitcoin is also noteworthy.

Spot gold surged to $4,060 per ounce on October 13, setting a new historical high. This simultaneous fluctuation of traditional safe-haven assets and emerging digital assets indicates that the current market liquidity environment is driving a revaluation of various asset values.

Geoff Kendrick, Global Head of Digital Asset Research at Standard Chartered Bank, pointed out: "Unlike the last government shutdown in 2018-2019, when Bitcoin had a weak correlation with traditional risk assets, its position is now completely different." This increased correlation with traditional financial markets makes Bitcoin more susceptible to macro factors.

Market Outlook and Strategy Adjustments

Analysts generally present an optimistic outlook for future market trends.

Tom Lee, co-founder of Fundstrat, expects Bitcoin to rise to $200,000-$250,000 by the end of the year, while Geoff Kendrick of Standard Chartered Bank reiterated his target of $200,000 for Bitcoin by year-end.

Technical analysis also supports the rebound judgment. Bitcoin around $109,000 is seen as a key support level, coinciding with the miner shutdown price, and historically similar positions often trigger strong rebounds.

The delta skew (put - call) in the options market has risen to 12%, exceeding the extreme panic threshold of 10%, and historically, this level has averaged a 40% rebound in the following month. However, the market still faces many uncertainties.

The Federal Reserve's policy may shift unexpectedly; if inflation rebounds and leads to a pause in rate cuts, cryptocurrencies may face a risk of a second dip.

At the same time, strong regulation of stablecoins by various countries may trigger a liquidity crisis, which is also a potential risk point. For investors, controlling leverage has become the primary principle in the current market. Analysis suggests avoiding leverage above 20 times, focusing on spot trading to avoid liquidation risks in a single-day 10% volatility. Additionally, a reasonable asset allocation should keep high-risk assets (BTC/ETH) below 10% and retain 15%-20% cash for bottom-fishing opportunities.

As Bitcoin stabilizes above $115,000, the total market value of cryptocurrencies has also rebounded above $4 trillion. The structure of market participants is quietly changing: retail leverage has been cleaned out, while institutional investors and whale accounts are seizing the opportunity to increase their holdings. The increasingly complex interest relationship between the Trump administration and the cryptocurrency market, along with the Federal Reserve's upcoming interest rate decisions, will continue to shape a new market landscape. This time, the market's evolution from "retail speculation" to "institutional allocation" may bring more profound changes to the digital currency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。