Author: Diogenes

Compiled by: Block unicorn

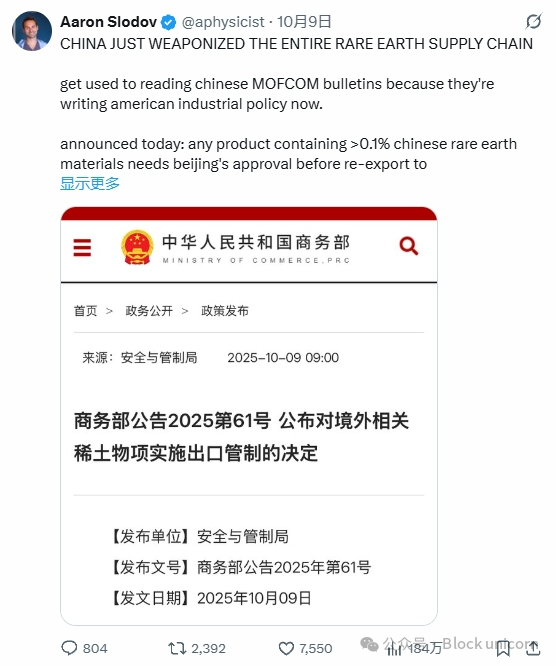

Around 6 AM (Pacific Standard Time) on October 9, news broke that China was tightening export controls on rare earth metals. While this news largely went unnoticed, it sparked significant reactions on right-wing Twitter.

The next day around 1:30 PM, a group of mysterious traders began to short the market on Hyperliquid on a large scale. The price of Bitcoin dropped from $121,000 to $117,000.

At 1:57 PM (Pacific Standard Time), Donald Trump announced via Truth Social a 100% tariff on Chinese goods in response to the rare earth metal statement.

In just 20 minutes, the price of Bitcoin plummeted from $117,000 to $104,000, a drop of about 15%.

Altcoins were hit even harder. Atom nearly dropped to zero. Ethena fell nearly 80% at one point. Sol dropped by 40%.

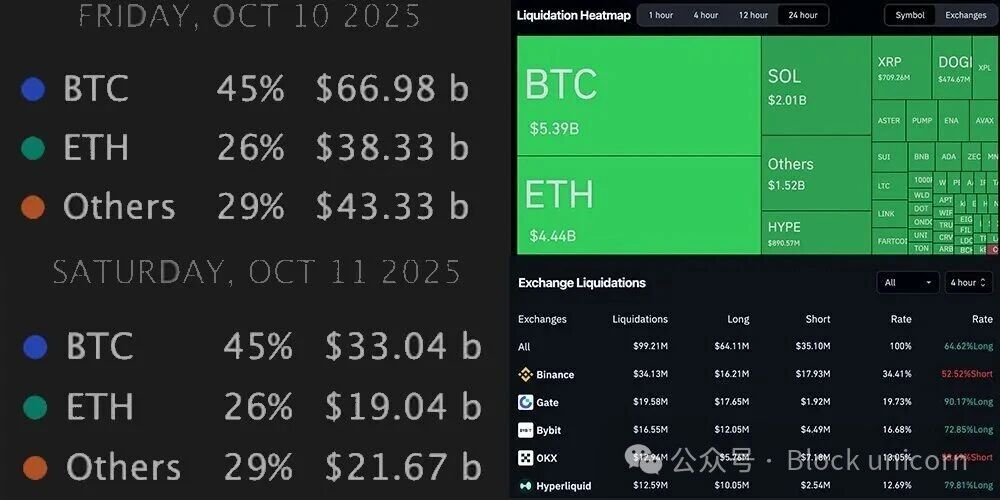

The open contracts on exchanges shrank significantly. At the opening on October 10 (Friday), Bitcoin's open contracts were $67 billion, Ethereum's were $38 billion, and altcoins were $43 billion. By the early morning of the 11th (Saturday), Bitcoin's open contracts had dropped to $33 billion, Ethereum to $19 billion, and altcoins to $31 billion, an overall decline of 50% or more.

Due to such massive liquidations, exchanges were forced to use the "nuclear option": Automatic Deleveraging (ADL). During extreme market volatility, ADL forces traders to close their positions. With a large number of long positions being liquidated, there weren't enough buyers to prevent the exchanges from incurring significant losses. Therefore, ADL was activated, forcing exchange users to fill the gap of losses. This can almost be seen as "involuntary market making"; users who shorted and made significant profits were forced to close their positions.

ADL occurred on almost all centralized exchanges and Hyperliquid. As of the time of writing, the only exchange that did not experience ADL was Lighter. This is also part of the reason why LLP incurred losses while HLP made profits, stemming from different design decisions. If you shorted on Lighter, you would earn significantly more compared to holding the same position on Hyperliquid. This means that liquidity providers (LP) for HLP received better returns than those for LLP, raising the question of whether this trade-off is worth it.

Lighter also experienced several hours of complete downtime. The team stated that a comprehensive post-mortem analysis would be conducted.

Due to extreme price fluctuations, the "gravity" of the economy was also lost. USDe briefly decoupled to $0.62, a drop of 48%.

Numerous market makers and traders complained about websocket and API outages.

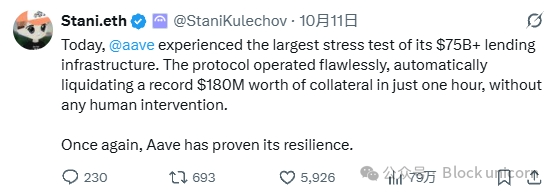

In the decentralized finance (DeFi) space, AAVE handled $180 million in liquidations, setting a new record.

USDT briefly surged to $1.006, indicating that traders were willing to pay a premium of up to 60 basis points for USDT during the uncertainty.

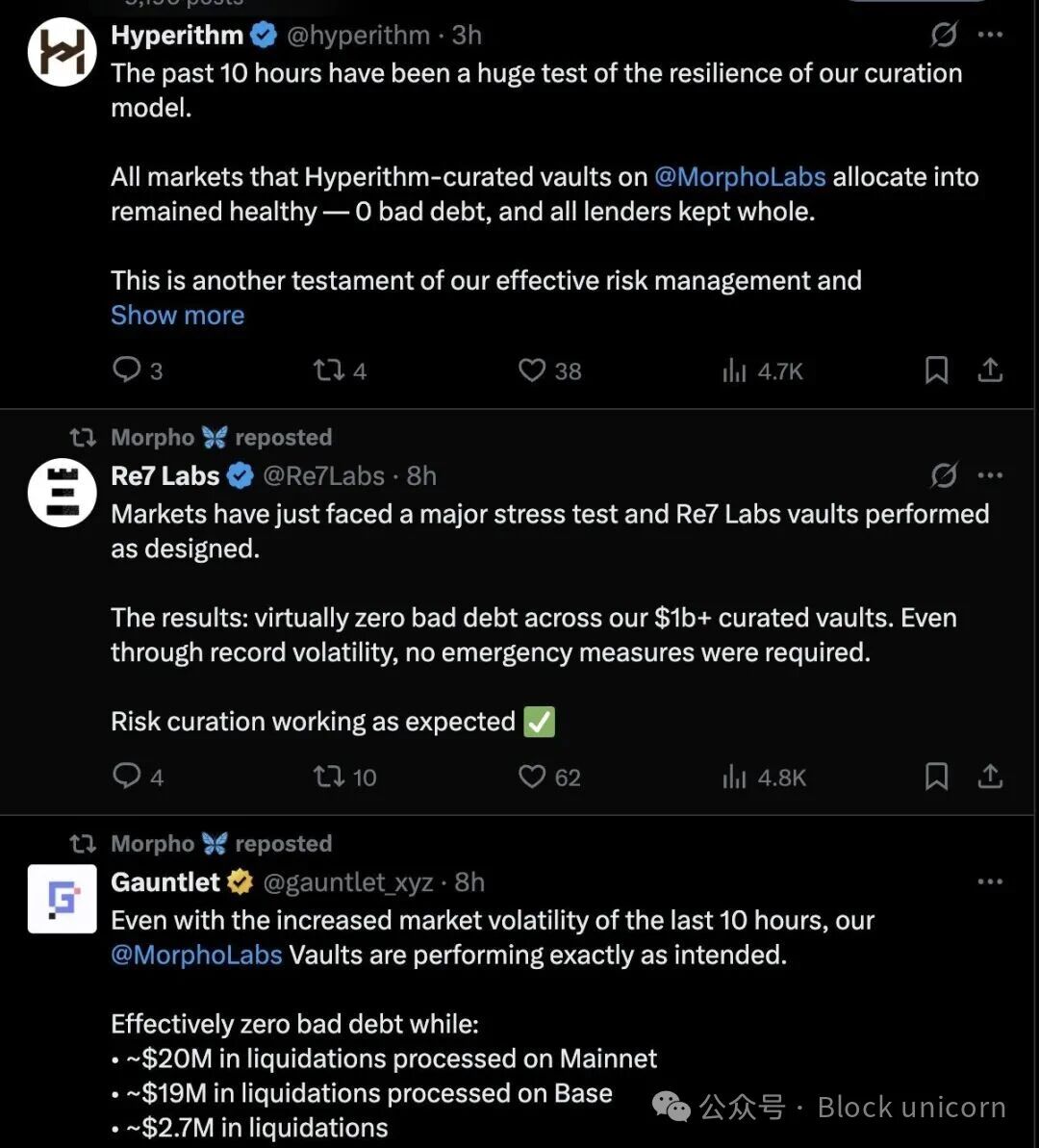

Morpho also experienced similar volatility, with about $100 million in liquidations, and currently seems to have no bad debts.

On-chain prices completely detached from reality. Rabby Wallet and DeBank stopped working, leaving tens of thousands of users unable to send transactions for an extended period.

Some users experienced positive slippage when trading SOL on-chain. Some users were able to buy BNB and wETH at prices never seen before on centralized exchanges (CEX), with CryptoCondom achieving some good trades on BNB using Cowswap.

Rumors of liquidations among some C-level exchanges and small market makers continue to circulate. Over time, some cases may emerge. This will be a critical moment to examine which cryptocurrency businesses can survive. It also serves as a reminder to traders: choosing a trading platform is indeed important, especially during such times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。